Consumer packaging solutions provider Graphic Packaging Holding (NYSE:GPK) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 5.7% year on year to $2.22 billion. Its non-GAAP profit of $0.64 per share was also 7.2% below analysts’ consensus estimates.

Is now the time to buy Graphic Packaging Holding? Find out by accessing our full research report, it’s free.

Graphic Packaging Holding (GPK) Q3 CY2024 Highlights:

- Revenue: $2.22 billion vs analyst estimates of $2.28 billion (2.8% miss)

- Adjusted EPS: $0.64 vs analyst expectations of $0.69 (7.2% miss)

- EBITDA: $433 million vs analyst estimates of $442.6 million (2.2% miss)

- Management lowered its full-year Adjusted EPS guidance to $2.55 at the midpoint, a 7.3% decrease

- EBITDA guidance for the full year is $1.71 billion at the midpoint, below analyst estimates of $1.74 billion

- Gross Margin (GAAP): 22.7%, in line with the same quarter last year

- Operating Margin: 12.5%, in line with the same quarter last year

- EBITDA Margin: 19.5%, down from 22.1% in the same quarter last year

- Free Cash Flow was -$118 million, down from $208 million in the same quarter last year

- Market Capitalization: $9.11 billion

Michael Doss, the Company's President and CEO said, "In the third quarter, we saw our packaging volumes turn positive, after Europe's return to growth in the second quarter. Third quarter also saw the launch of new paperboard cup and container innovations for major Foodservice customers and the first-ever round BoardioTM paperboard canister for a leading collagen-protein brand. Our innovations are delivering real value for our customers and for consumers.

Company Overview

Founded in 1991, Graphic Packaging (NYSE:GPK) is a provider of paper-based packaging solutions for a wide range of products.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

Sales Growth

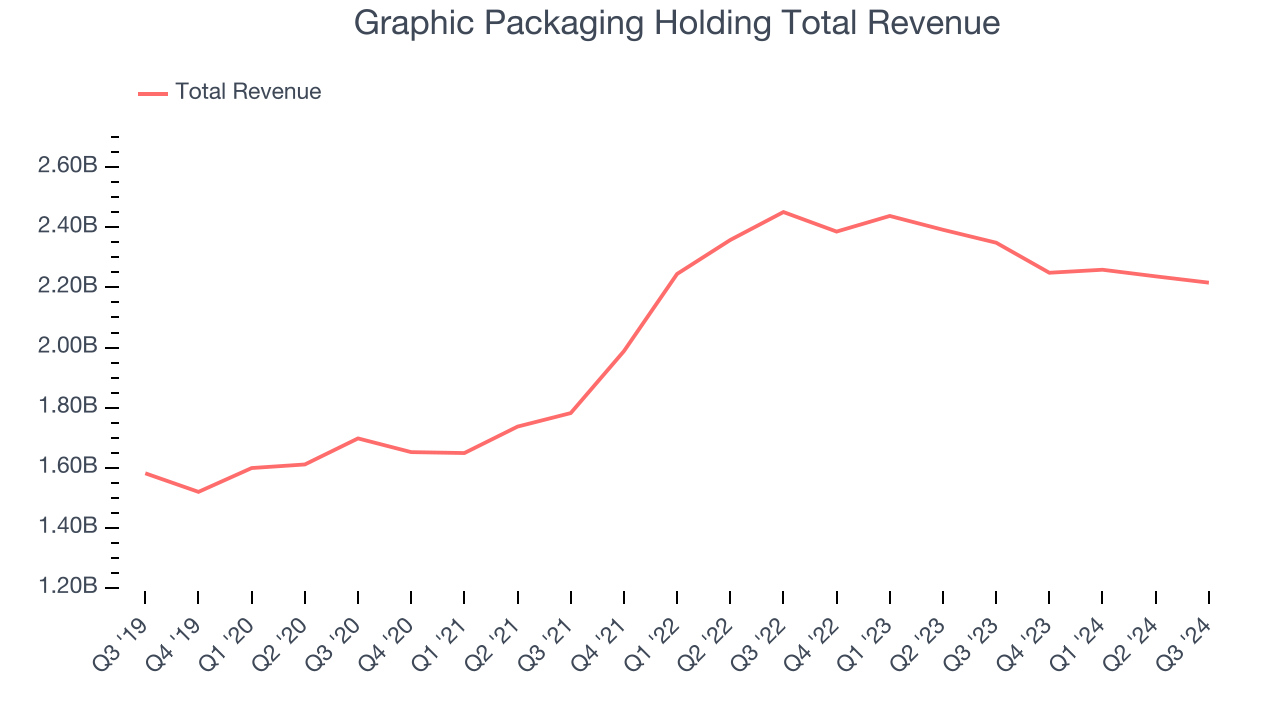

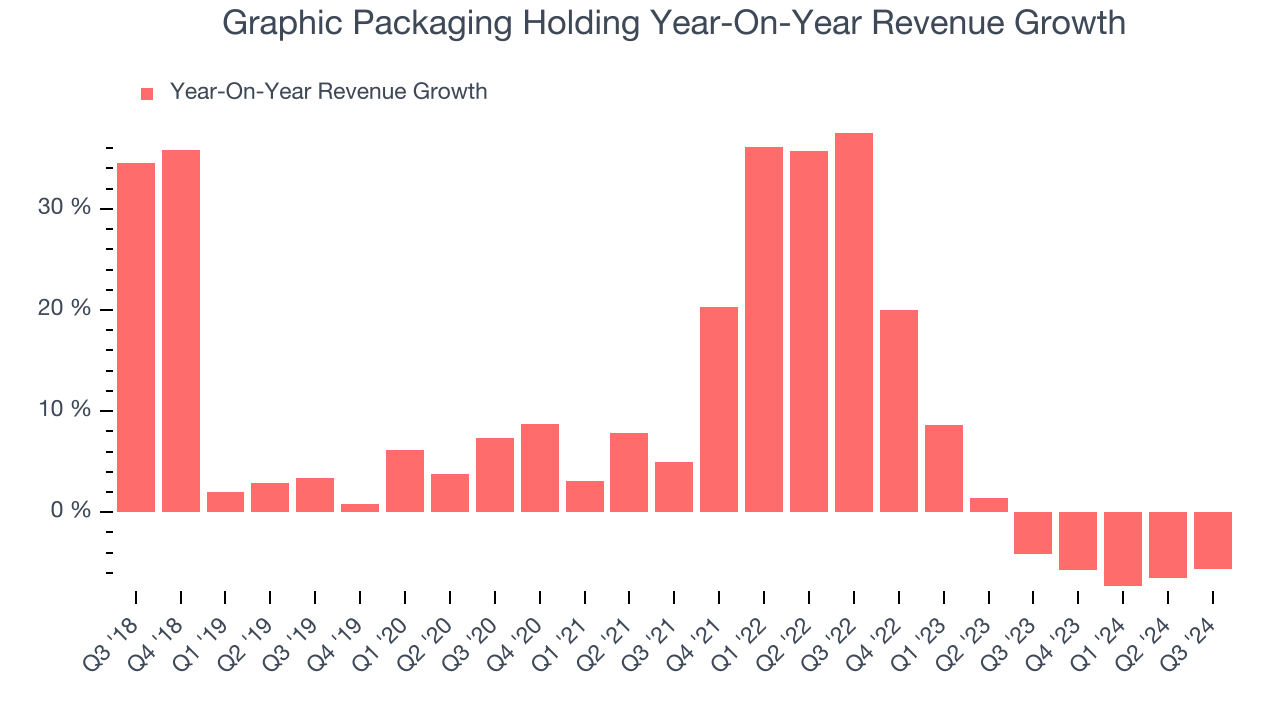

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, Graphic Packaging Holding’s sales grew at a decent 7.8% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Graphic Packaging Holding’s recent history shows its demand slowed as its revenue was flat over the last two years. We also note many other Industrial Packaging businesses have faced declining sales because of cyclical headwinds. While Graphic Packaging Holding’s growth wasn’t the best, it did perform better than its peers.

This quarter, Graphic Packaging Holding missed Wall Street’s estimates and reported a rather uninspiring 5.7% year-on-year revenue decline, generating $2.22 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months. Although this projection illustrates the market believes its newer products and services will spur better performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

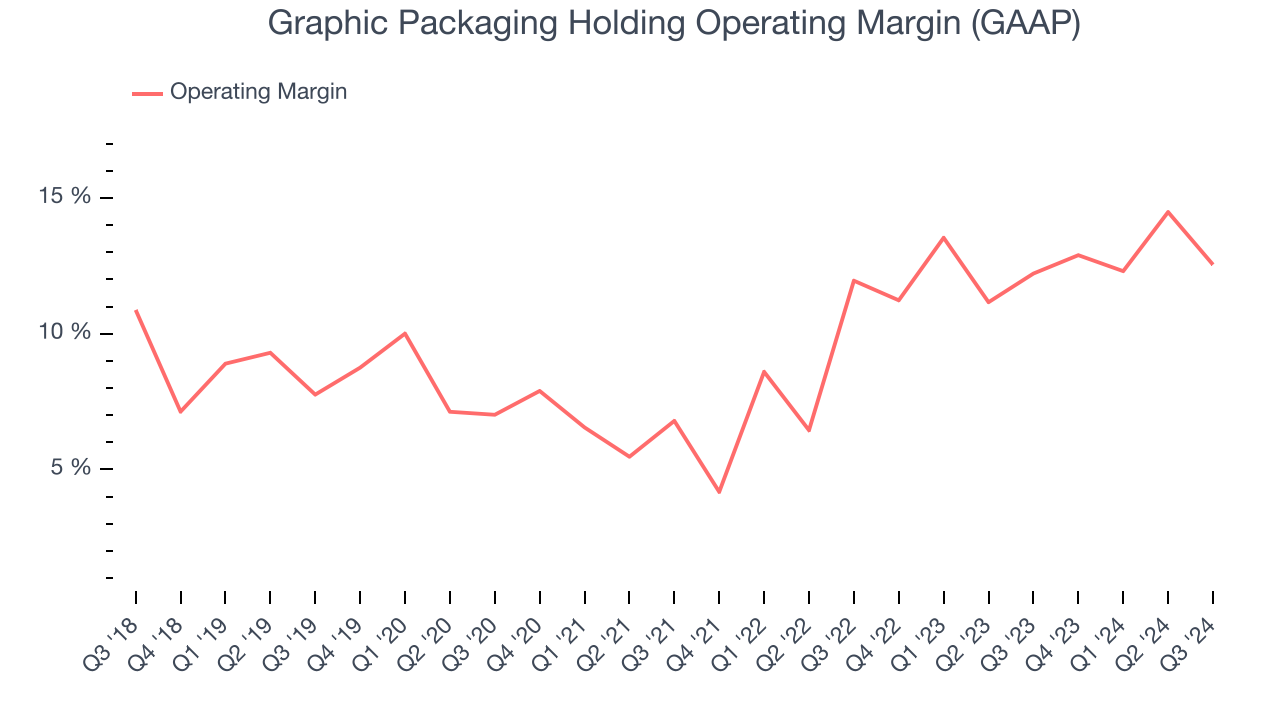

Graphic Packaging Holding has done a decent job managing its cost base over the last five years. The company produced an average operating margin of 9.9%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Graphic Packaging Holding’s annual operating margin rose by 4.9 percentage points over the last five years, showing its efficiency has improved.

This quarter, Graphic Packaging Holding generated an operating profit margin of 12.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

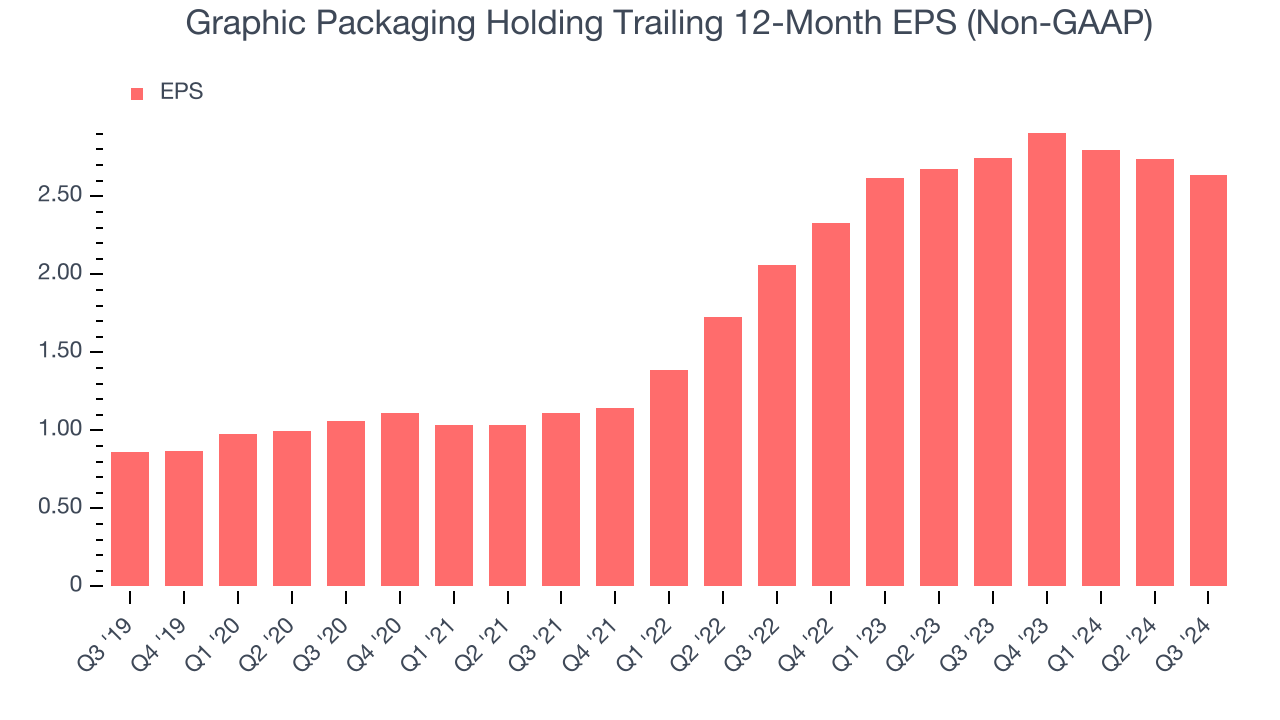

Graphic Packaging Holding’s EPS grew at an astounding 25% compounded annual growth rate over the last five years, higher than its 7.8% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into Graphic Packaging Holding’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Graphic Packaging Holding’s operating margin was flat this quarter but expanded by 4.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Graphic Packaging Holding, its two-year annual EPS growth of 13.3% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, Graphic Packaging Holding reported EPS at $0.64, down from $0.74 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Graphic Packaging Holding’s full-year EPS of $2.64 to grow by 7.2%.

Key Takeaways from Graphic Packaging Holding’s Q3 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $30.34 immediately after reporting.

Graphic Packaging Holding didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.