Clothing and accessories retailer The Gap (NYSE:GPS) reported Q3 FY2023 results exceeding Wall Street analysts' expectations, with revenue down 6.7% year on year to $3.77 billion. Turning to EPS, Gap made a GAAP profit of $0.58 per share, down from its profit of $0.77 per share in the same quarter last year.

Is now the time to buy Gap? Find out by accessing our full research report, it's free.

Gap (GPS) Q3 FY2023 Highlights:

- Revenue: $3.77 billion vs analyst estimates of $3.61 billion (4.4% beat)

- EPS: $0.58 vs analyst estimates of $0.21 (170% beat)

- Free Cash Flow of $113 million is up from -$689 million in the same quarter last year

- Gross Margin (GAAP): 41.3%, up from 37.4% in the same quarter last year

- Same-Store Sales were down 2% year on year

- Store Locations: 3,533 at quarter end, increasing by 153 over the last 12 months

"Gap Inc. delivered a solid performance in the third quarter. We were pleased to see market share gains as well as improvements in both gross margins and operating margins, demonstrating our ability to drive operating and financial discipline. This rigor has put the company on stronger financial footing and is enabling us to focus on reinvigorating our portfolio of brands, strengthening our operating platform, and reviving our culture for success," said Gap Inc. President and Chief Executive Officer, Richard Dickson.

Operating under The Gap, Old Navy, Banana Republic, and Athleta brands, The Gap (NYSE:GPS) is an apparel and accessories retailer that sells its own brand of casual clothing to men, women, and children.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Gap is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

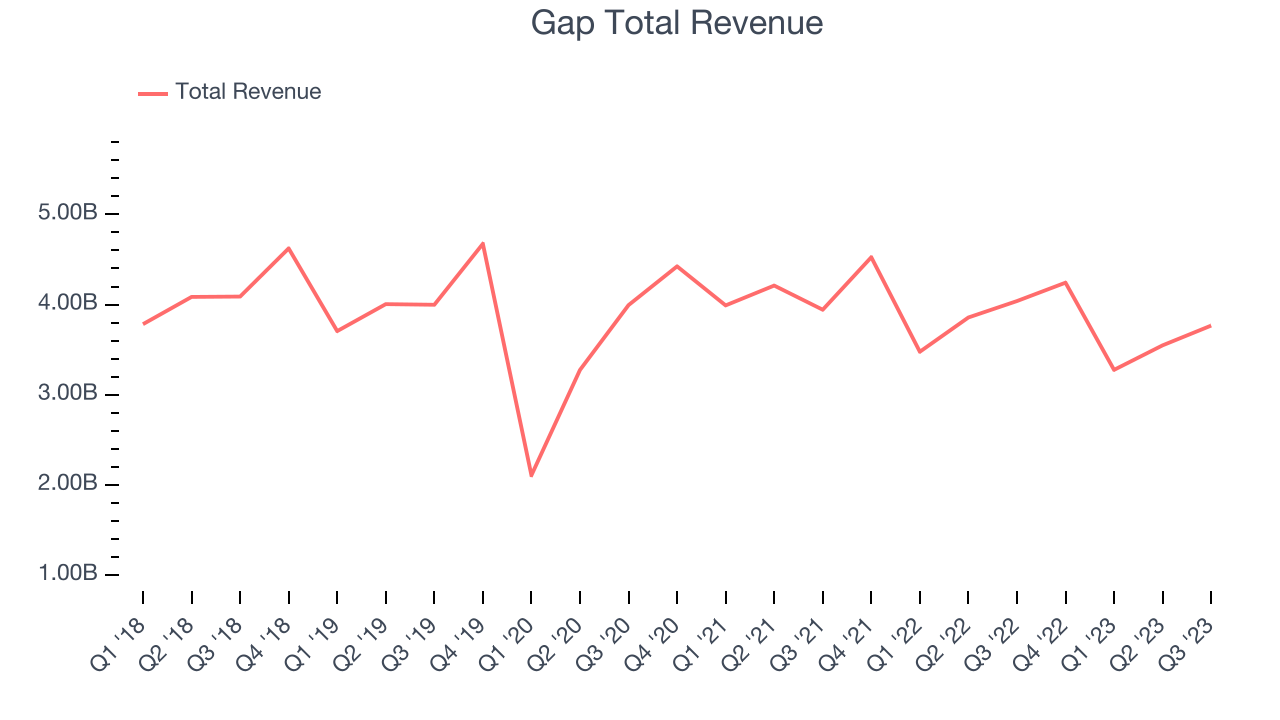

As you can see below, the company's revenue has declined over the last four years, dropping 2.4% annually as its store count and sales at existing, established stores have both shrunk.

This quarter, Gap's revenue fell 6.7% year on year to $3.77 billion but beat Wall Street's estimates by 4.4%. Looking ahead, analysts expect revenue to remain relatively flat over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Number of Stores

A retailer's store count often determines on how much revenue it can generate.

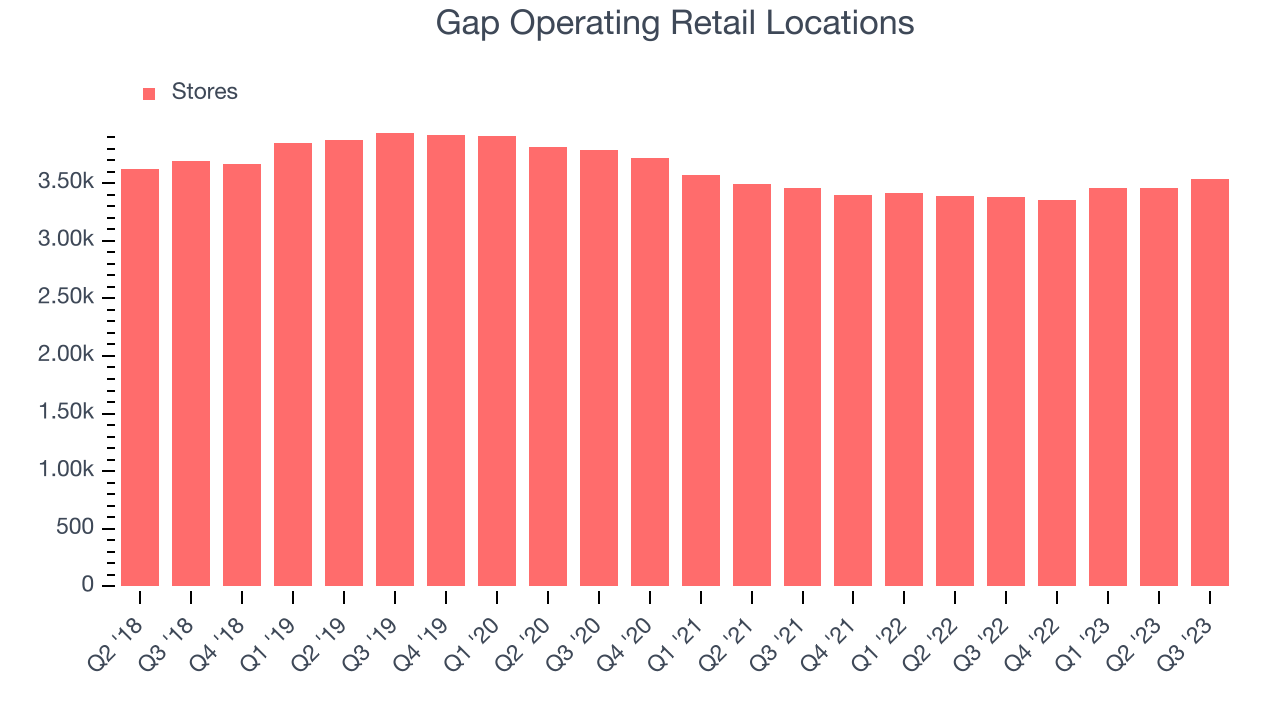

When a retailer like Gap is shuttering stores, it usually means that brick-and-mortar demand is less than supply, and the company is responding by closing underperforming locations and possibly shifting sales online. Gap's store count increased by 153 locations, or 4.5%, over the last 12 months to 3,533 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally closed its stores over the last two years, averaging a 1.5% annual decline in its physical footprint. A smaller store base means that the company must rely on higher foot traffic and sales per customer at its remaining stores as well as e-commerce sales to fuel revenue growth.

Same-Store Sales

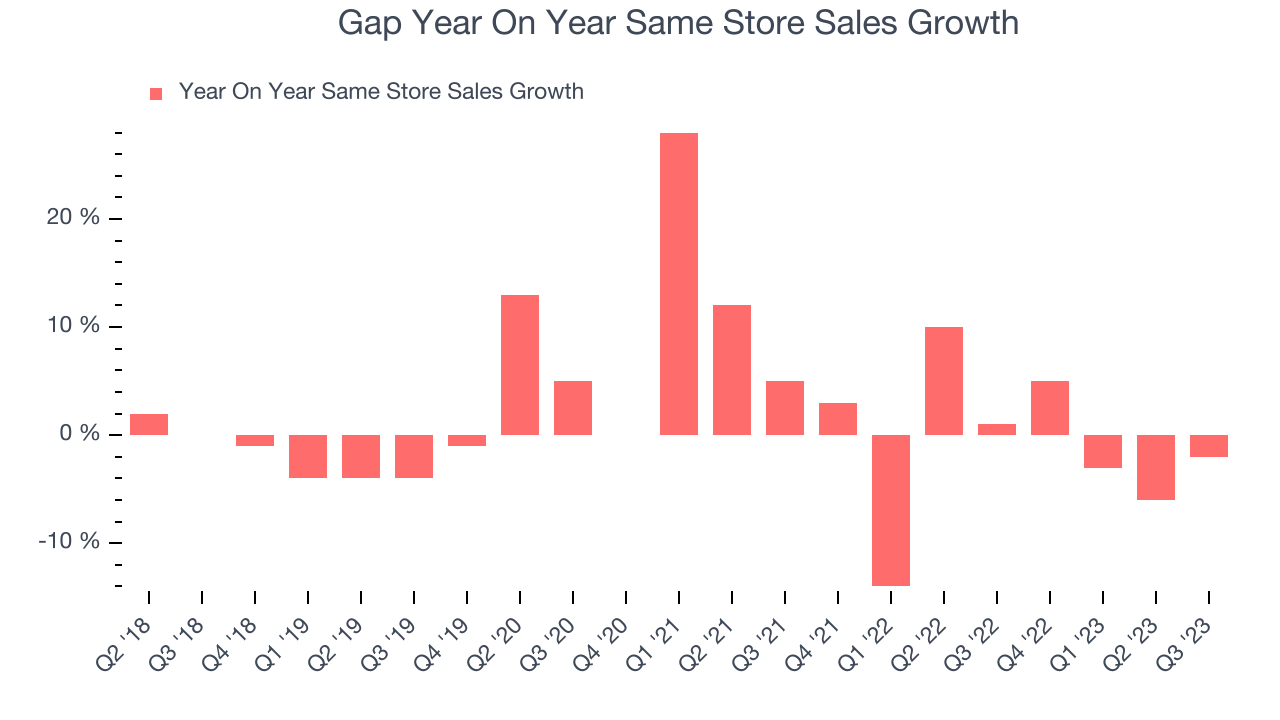

Gap's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 0.8% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Gap's same-store sales fell 2% year on year. This decline was a reversal from the 1% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Gap's Q3 Results

With a market capitalization of $5.20 billion, Gap is among smaller companies, but its $1.35 billion cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

Although its revenue and EPS declined, we were still impressed by how significantly Gap blew past analysts' expectations this quarter. These beats were driven by better-than-expected same-store sales performance (analysts forecasted a 7% decline and Gap posted a 2% decline). We were also excited its gross margin and free cash flow outperformed Wall Street's estimates - many were expecting Gap to post negative free cash flow. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 8% after reporting and currently trades at $14.75 per share.

Gap may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.