Insurance industry-focused software maker Guidewire (NYSE:GWRE) reported results in line with analysts' expectations in Q2 FY2024, with revenue up 3.6% year on year to $240.9 million. On the other hand, next quarter's revenue guidance of $231 million was less impressive, coming in 1.6% below analysts' estimates. It made a non-GAAP profit of $0.46 per share, improving from its loss of $0.21 per share in the same quarter last year.

Guidewire (GWRE) Q2 FY2024 Highlights:

- Revenue: $240.9 million vs analyst estimates of $241.8 million (small miss)

- EPS (non-GAAP): $0.46 vs analyst estimates of $0.23 ($0.23 beat)

- Revenue Guidance for Q3 2024 is $231 million at the midpoint, below analyst estimates of $234.9 million

- The company dropped its revenue guidance for the full year from $981 million to $962 million at the midpoint, a 1.9% decrease

- Free Cash Flow of $63.89 million is up from -$76.77 million in the previous quarter

- Gross Margin (GAAP): 59.1%, up from 53.1% in the same quarter last year

- Market Capitalization: $9.44 billion

Founded by two individuals involved in the development of leading procurement software Ariba, Guidewire (NYSE:GWRE) offers insurance companies a software-as-a-service platform to help sell their products and manage their workflows.

The company’s suite of products is designed to help insurers manage all mission critical aspects of their business, from policy administration and underwriting to claims management and billing. For example, Guidewire's claims management system can automate many of the manual and paper-based processes involved in handling claims, reducing the time and resources required to process them. This can improve the customer experience by providing faster and more accurate payouts (who doesn't like that?), while also reducing insurer costs from inaccuracies.

The insurance industry is complex, and insurers face lots of challenges in managing their operations. Traditional, paper-based processes can lead to human error, can result in lost efficiency as information eventually needs to be entered digitally, and can mean lack of data capture for bigger-picture insights. Guidewire's products are designed to help insurers address these challenges by providing a platform that can streamline processes, improve data capture, and reduce costs.

Guidewire principally generates revenue by selling licenses to its software and by providing services such as implementation, training, and support to ensure customer success. As expected, the company’s customers include insurers of all sizes, from small regional companies to large global corporations.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Competitors in insurance-focused vertical software include Duck Creek (NASDAQ:DCT) and private company EIS Group as well as horizontal software platforms such as SAP (NYSE:SAP) and salesforce.com (NYSE:CRM).Sales Growth

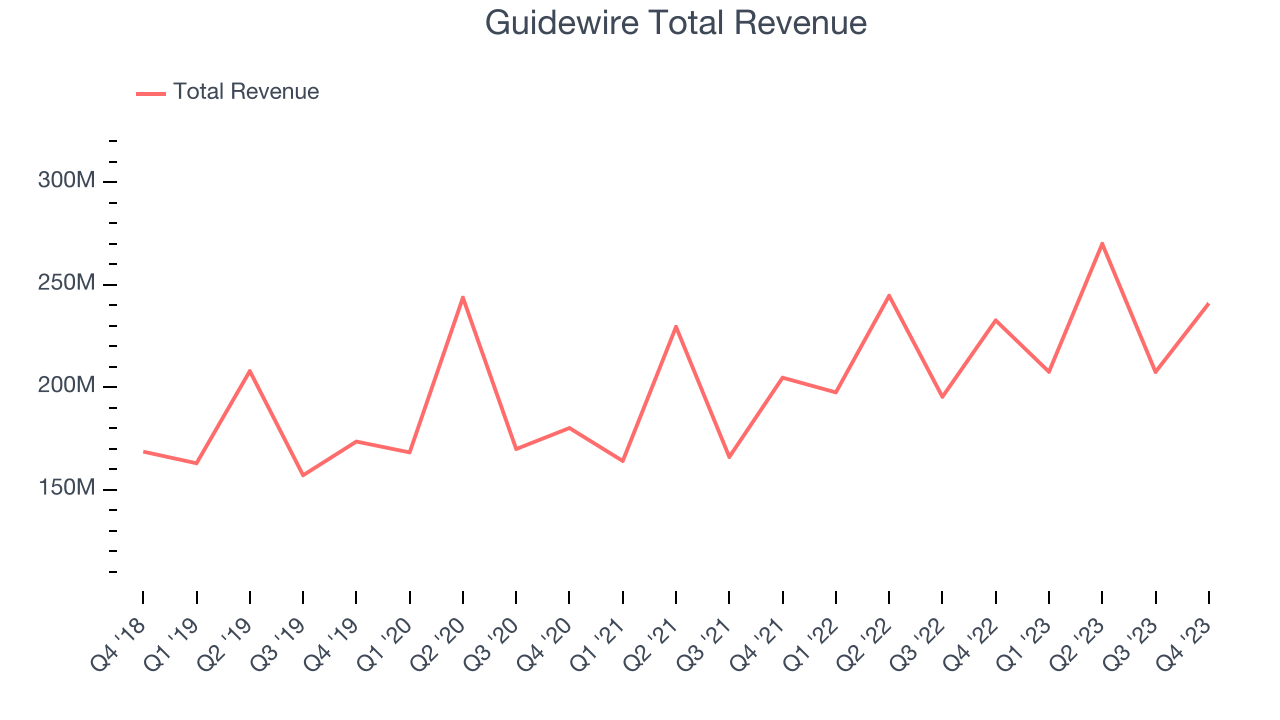

As you can see below, Guidewire's revenue growth has been unremarkable over the last two years, growing from $204.6 million in Q2 FY2022 to $240.9 million this quarter.

Guidewire's quarterly revenue was only up 3.6% year on year, which might disappoint some shareholders. However, its revenue increased $33.49 million quarter on quarter, a strong improvement from the $62.55 million decrease in Q1 2024. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that Guidewire is expecting revenue to grow 11.3% year on year to $231 million, improving on the 5.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 13% over the next 12 months before the earnings results announcement.

Profitability

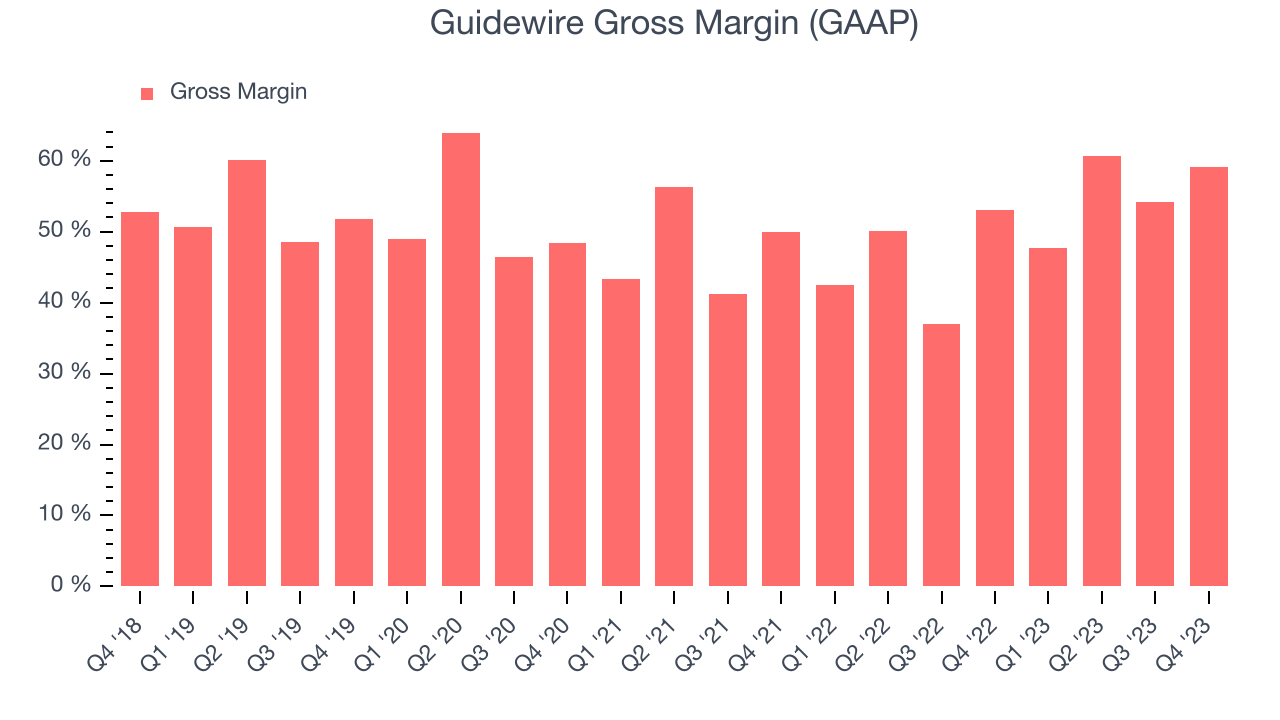

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Guidewire's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 59.1% in Q2.

That means that for every $1 in revenue the company had $0.59 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, Guidewire's gross margin is still poor for a SaaS business. It's vital that the company continues to improve this key metric.

Cash Is King

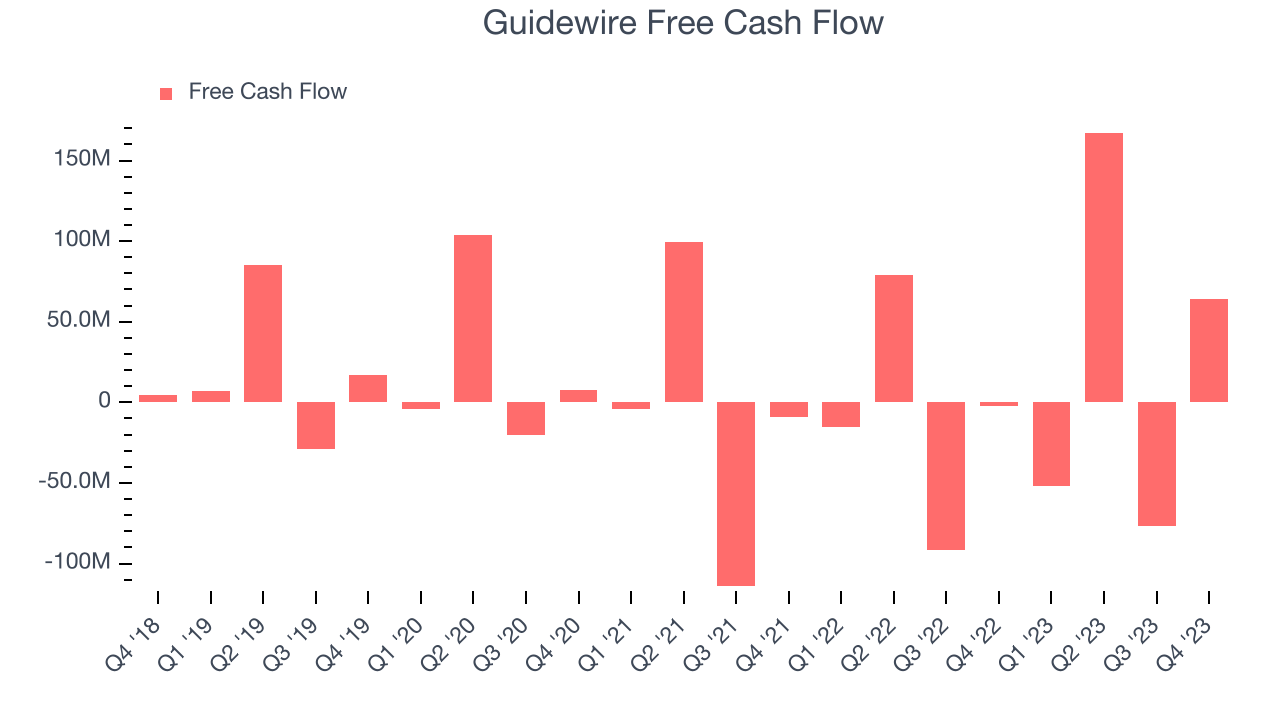

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Guidewire's free cash flow came in at $63.89 million in Q2, turning positive over the last year.

Guidewire has generated $102.4 million in free cash flow over the last 12 months, or 11.1% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Guidewire's Q2 Results

It was good to see Guidewire's positive free cash flow. We were also glad its gross margin improved. On the other hand, its full-year revenue guidance was below expectations. Overall, the results could have been better. The company is down 5.7% on the results and currently trades at $110.2 per share.

Is Now The Time?

When considering an investment in Guidewire, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Guidewire, we'll be cheering from the sidelines. Its revenue growth has been slow, and analysts don't see anything changing. On top of that, its customer acquisition is less efficient than many comparable companies, and its gross margins show its business model is much less lucrative than the best software businesses.

Given its price-to-sales ratio based on the next 12 months is 9.3x, Guidewire is priced with expectations of a long-term growth, and there's no doubt it's a bit of a market darling, at least for some. While we have no doubt one can find things to like about the company, we think there might be better opportunities in the market and at the moment don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $115.60 per share right before these results (compared to the current share price of $110.20).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.