Clothing company Hanesbrands (NYSE:HBI) fell short of analysts' expectations in Q1 CY2024, with revenue down 16.8% year on year to $1.16 billion. On the other hand, the company expects next quarter's revenue to be around $1.36 billion, in line with analysts' estimates. It made a non-GAAP loss of $0.02 per share, improving from its loss of $0.06 per share in the same quarter last year.

Hanesbrands (HBI) Q1 CY2024 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.17 billion (1.6% miss)

- EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.08 ($0.06 beat)

- Revenue Guidance for Q2 CY2024 is $1.36 billion at the midpoint, roughly in line with what analysts were expecting

- EPS (non-GAAP) Guidance for Q2 CY2024 is $0.09 at the midpoint, above analyst estimates of $0.09

- The company reconfirmed its revenue guidance for the full year of $5.41 billion at the midpoint

- Gross Margin (GAAP): 39.9%, up from 32.7% in the same quarter last year

- Free Cash Flow of $5.91 million, down 97.8% from the previous quarter

- Market Capitalization: $1.57 billion

A classic American staple founded in 1901, Hanesbrands (NYSE: HBI) is a clothing company known for its array of basic apparel including innerwear and activewear.

Over time, the company has grown into a conglomerate in the apparel industry, and its portfolio now includes recognizable names such as Hanes, Champion, Playtex, Bali, L'eggs, Just My Size, and Maidenform. These brands cover a diverse range of products including t-shirts, bras, shapewear, underwear, socks, hosiery, and activewear.

Hanesbrands's materials and fabrics have historically been key for its brand reputation. This includes developments for enhanced comfort and fit, such as tagless t-shirts and underwear, ComfortBlend and X-Temp fabrics, and the Comfort Flex Fit bra designs.

Hanesbrands operates on a large scale with a global footprint. Most of the company's manufacturing facilities are self-owned, allowing it to control its supply chain and ensure quality. Its global distribution network spans more than 40 countries, with products sold in thousands of retail stores worldwide, including mass merchants, department stores, and specialty retailers, as well as through various online channels.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Hanesbrands's primary competitors include Fruit of the Loom (owned by Berkshire Hathaway NYSE:BRK.A), Gildan Activewear (NYSE:GIL), PVH (NYSE:PVH, owner of Calvin Klein and Tommy Hilfiger), Delta Apparel (AMEX:DLA), and Under Armour (NYSE:UAA).Sales Growth

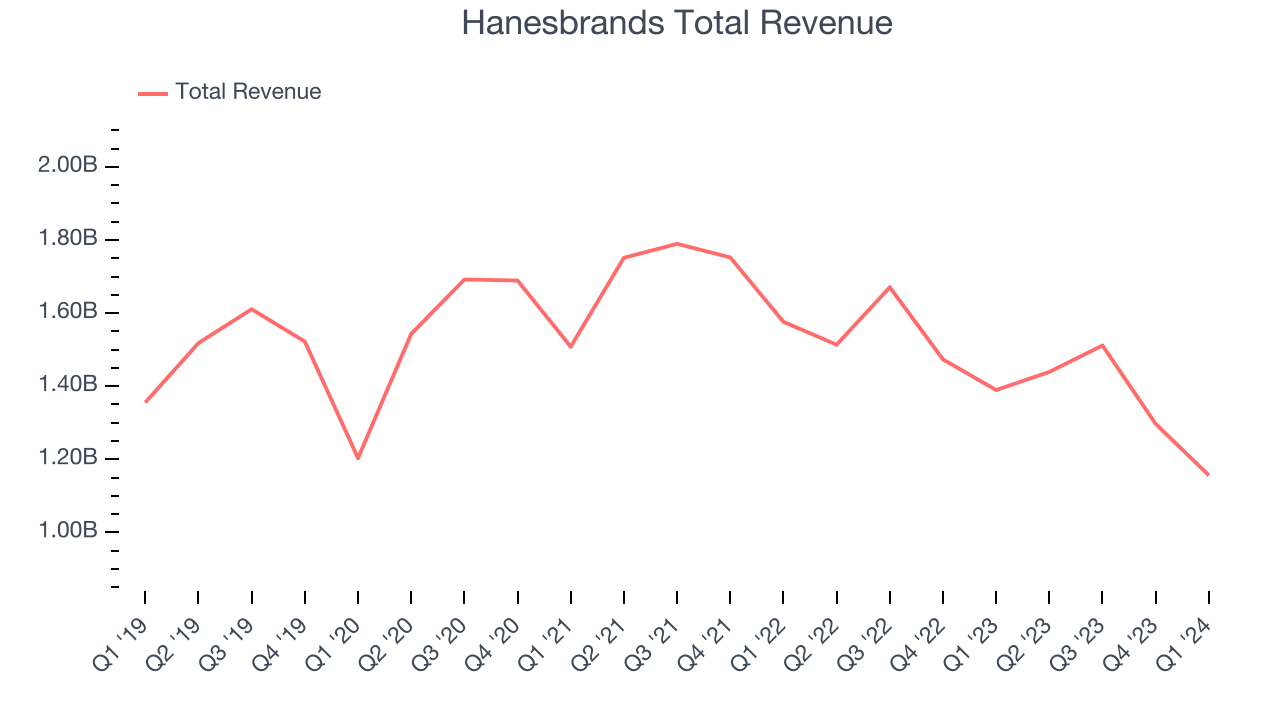

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Hanesbrands's revenue declined over the last five years, dropping 4.2% annually.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Hanesbrands's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 11.3% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Hanesbrands's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 11.3% over the last two years.

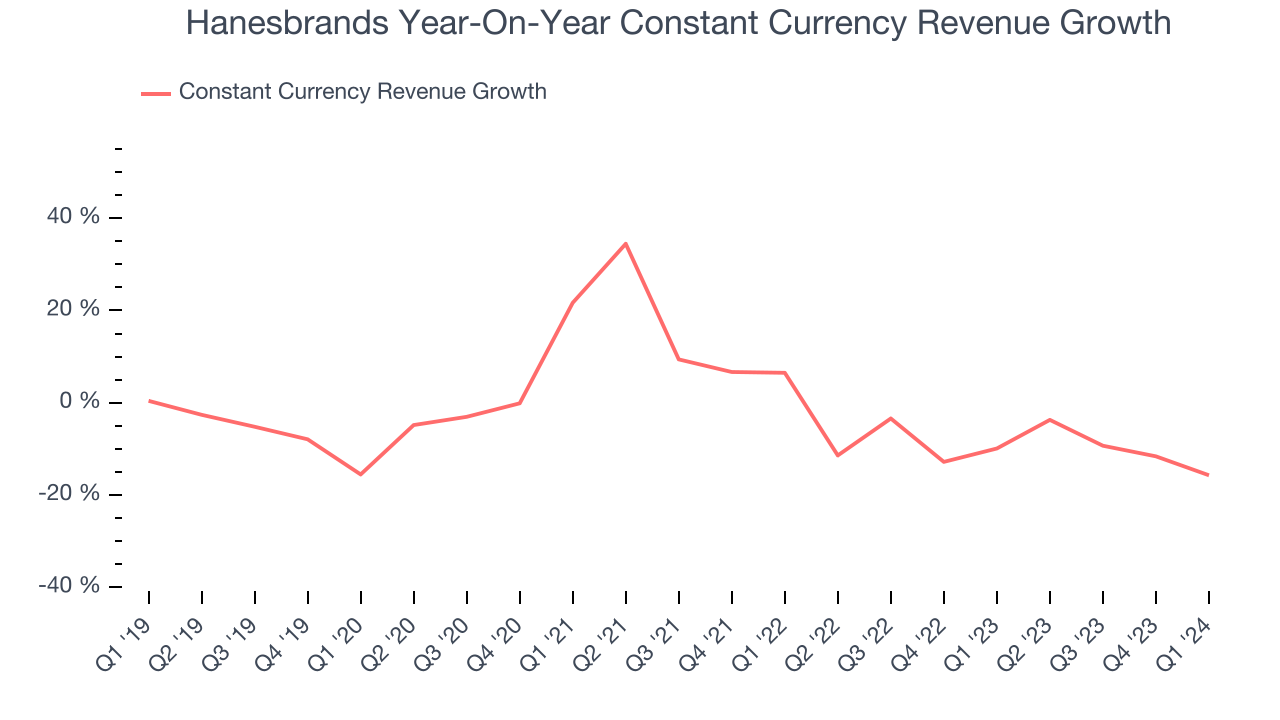

Hanesbrands also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 9.7% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see that foreign exchange rates have been a headwind for Hanesbrands.

This quarter, Hanesbrands missed Wall Street's estimates and reported a rather uninspiring 16.8% year-on-year revenue decline, generating $1.16 billion of revenue. The company is guiding for a 5.8% year-on-year revenue decline next quarter to $1.36 billion, a deceleration from the 4.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Operating Margin

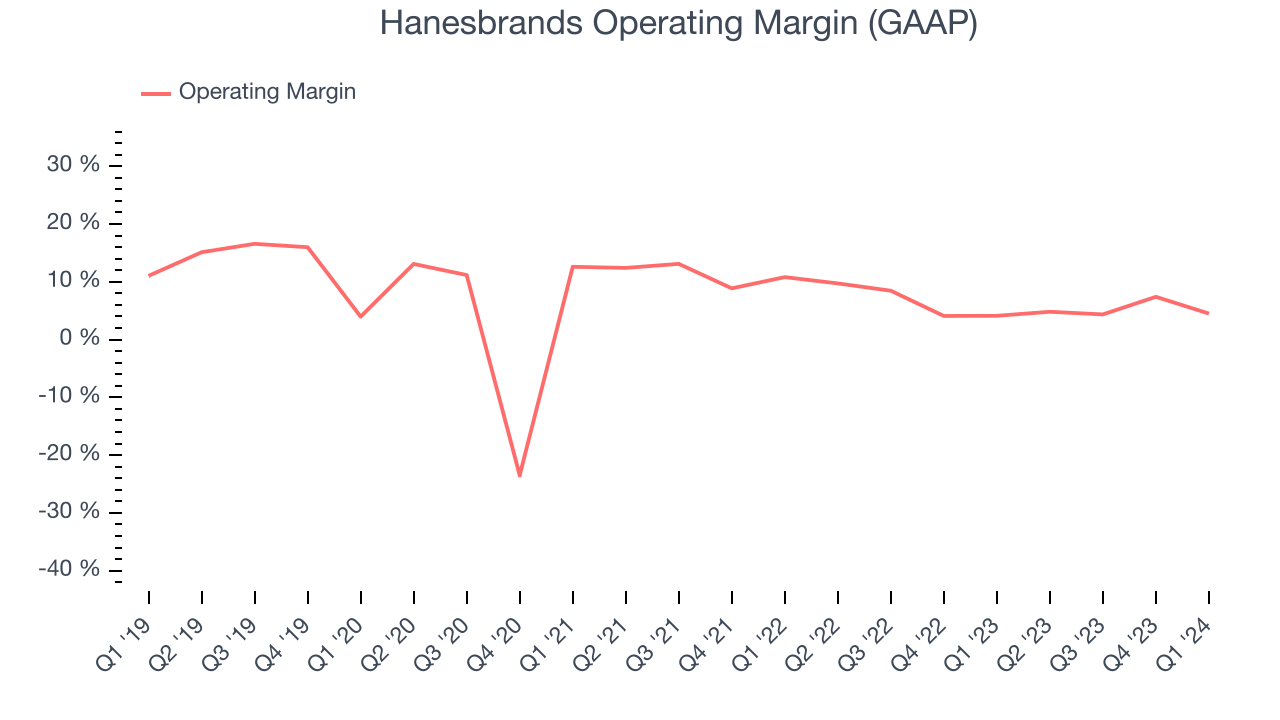

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hanesbrands was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer discretionary business, producing an average operating margin of 6%.

In Q1, Hanesbrands generated an operating profit margin of 4.5%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Hanesbrands to become more profitable. Analysts are expecting the company’s LTM operating margin of 5.2% to rise to 9.2%.EPS

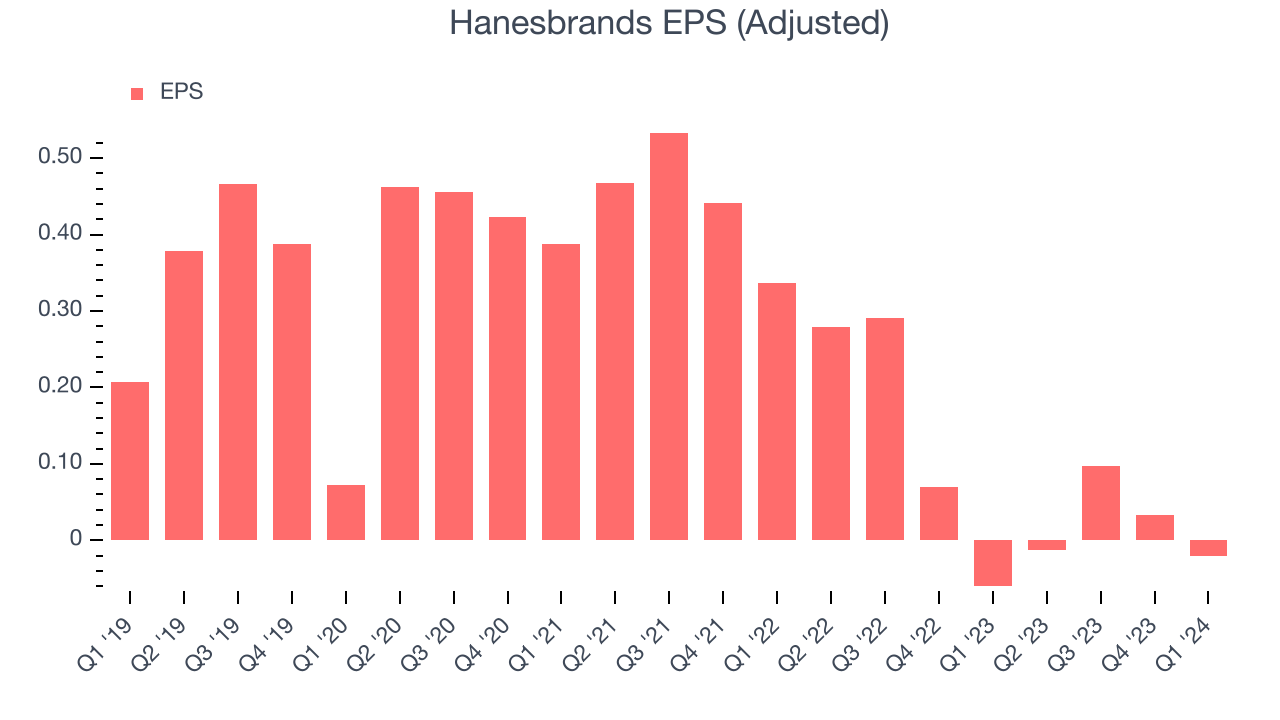

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Hanesbrands's EPS dropped 501%, translating into 43.2% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, Hanesbrands reported EPS at negative $0.02, up from negative $0.06 in the same quarter last year. This print beat analysts' estimates by 74.2%. Over the next 12 months, Wall Street expects Hanesbrands to perform poorly. Analysts are projecting its LTM EPS of $0.10 to shrink to break even.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

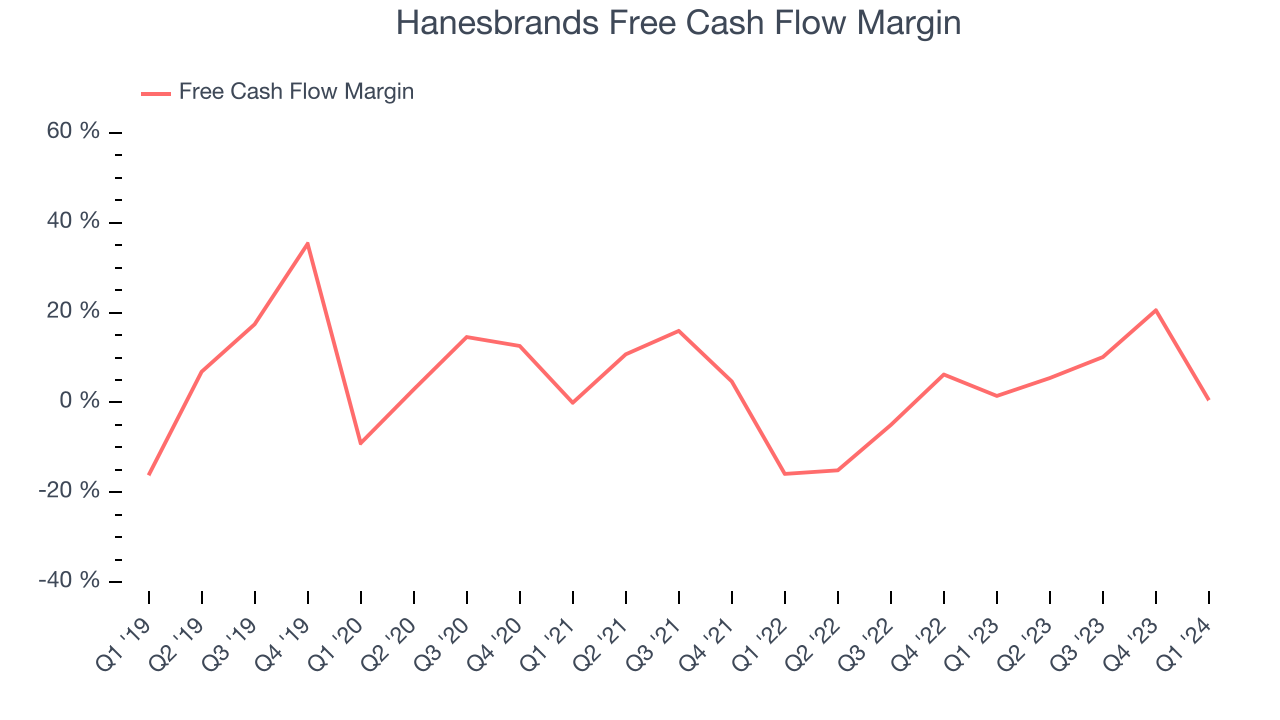

Over the last two years, Hanesbrands has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 2.6%, subpar for a consumer discretionary business.

Hanesbrands broke even from a free cash flow perspective in Q1. This quarter's result was in line with its margin in same period last year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

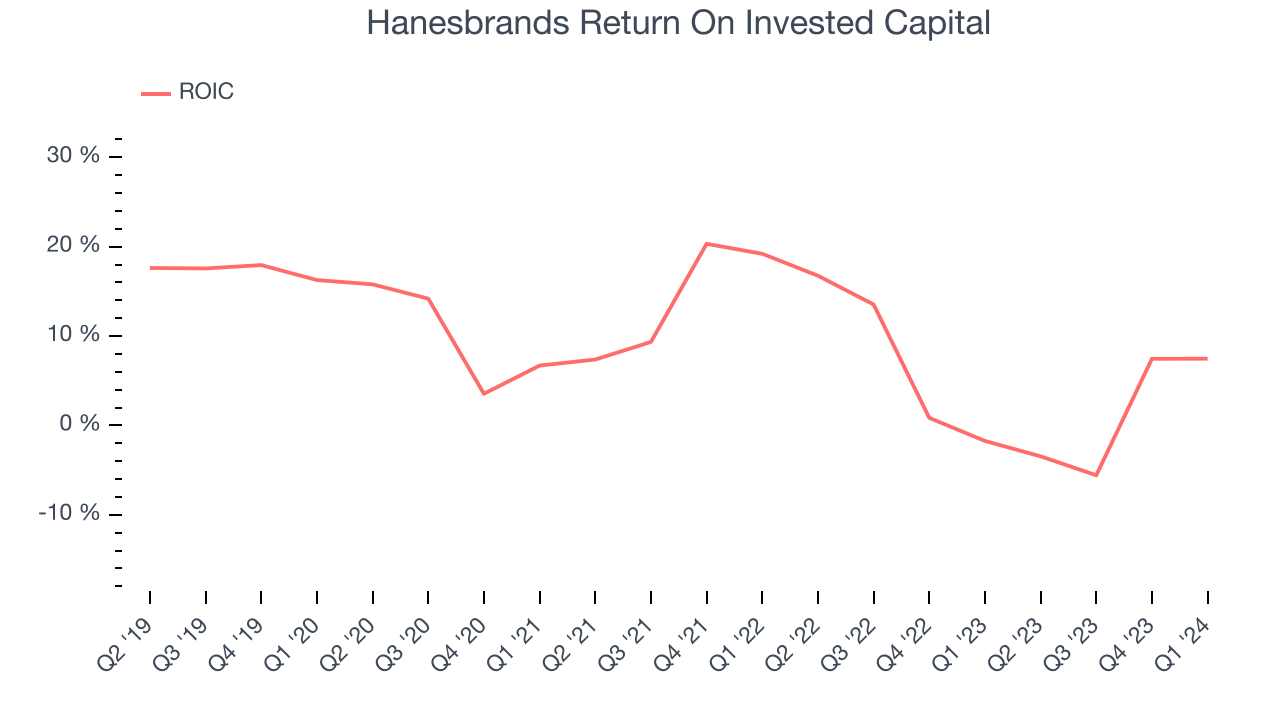

Hanesbrands's five-year average return on invested capital was 9.6%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Hanesbrands's ROIC averaged 8.6 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Hanesbrands reported $191.2 million of cash and $3.71 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $1.07 billion of EBITDA over the last 12 months, we view Hanesbrands's 3.3x net-debt-to-EBITDA ratio as safe. We also see its $284.6 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Hanesbrands's Q1 Results

We were impressed by how significantly Hanesbrands blew past analysts' EPS expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its constant currency revenue fell short of Wall Street's estimates. Overall, this quarter's results still seemed fairly positive and shareholders should feel optimistic. The stock is up 6.1% after reporting and currently trades at $4.72 per share.

Is Now The Time?

Hanesbrands may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Hanesbrands, we'll be cheering from the sidelines. Its revenue has declined over the last five years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its constant currency sales performance has been disappointing. On top of that, its declining EPS over the last five years makes it hard to trust.

Hanesbrands's price-to-earnings ratio based on the next 12 months is 9.9x. While there are some things to like about Hanesbrands and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $5.66 per share right before these results (compared to the current share price of $4.72).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.