Timeshare vacation company Hilton Grand Vacations (NYSE:HGV) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 23.8% year on year to $1.16 billion. It made a non-GAAP profit of $0.95 per share, improving from its profit of $0.64 per share in the same quarter last year.

Hilton Grand Vacations (HGV) Q1 CY2024 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.12 billion (2.8% beat)

- Adjusted EBITDA: $273 million vs analyst estimates of $253.8 million (7.6% beat)

- EPS (non-GAAP): $0.95 vs analyst estimates of $0.74 (28.6% beat)

- Reiterated adjusted EBITDA guidance for 2024 of $1.23 billion at the midpoint (in line)

- Gross Margin (GAAP): 41.5%, up from 35.9% in the same quarter last year

- Free Cash Flow was -$19 million, down from $255 million in the previous quarter

- Members: 718,000

- Market Capitalization: $4.55 billion

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE:HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations develops, markets, and operates high-quality vacation resorts in prime destinations worldwide. These resorts are located in highly sought-after vacation spots, including urban centers like New York City, beachfront areas in Hawaii and Florida, and scenic destinations like Colorado and Scotland. HGV’s portfolio holds more than 55 resort properties, offering a range of accommodations, from studios to multi-bedroom units.

The core of HGV's business is its timeshare model, where customers purchase a share of a property that entitles them to spend a set amount of time there annually. This model is bolstered by the Hilton Grand Vacations Club, a points-based membership system that allows member to use their points to book stays at various HGV resorts and thousands of hotels in the Hilton Worldwide network.

To maintain market relevance, the company invests in new facilities and services to enhance the vacation experience. This includes well-appointed accommodations, on-site dining and leisure activities, and customer service. HGV also incorporates digital technology to streamline the booking and customer service processes for greater convenience.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Hilton Grand Vacations's primary competitors include Marriott Vacations Worldwide (NYSE:VAC), Wyndham Destinations (NYSE:WYND), Bluegreen Vacations (NYSE:BXG), Hyatt Residence Club (owned by Hyatt Hotels NYSE:H) and Diamond Resorts (owned by Apollo NYSE:APO).Sales Growth

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Hilton Grand Vacations's annualized revenue growth rate of 15.1% over the last five years was decent for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Hilton Grand Vacations's annualized revenue growth of 20.8% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Hilton Grand Vacations's annualized revenue growth of 20.8% over the last two years is above its five-year trend, suggesting some bright spots.

We can dig even further into the company's revenue dynamics by analyzing its number of members, which reached 718,000 in the latest quarter. Over the last two years, Hilton Grand Vacations's members averaged 14.8% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company's monetization of its consumers has risen.

This quarter, Hilton Grand Vacations reported remarkable year-on-year revenue growth of 23.8%, and its $1.16 billion of revenue topped Wall Street estimates by 2.8%. Looking ahead, Wall Street expects sales to grow 21.9% over the next 12 months, a deceleration from this quarter.

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hilton Grand Vacations has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 19%.In Q1, Hilton Grand Vacations generated an operating profit margin of 37.6%, up 23.7 percentage points year on year.

Over the next 12 months, Wall Street expects Hilton Grand Vacations to become less profitable. Analysts are expecting the company’s LTM operating margin of 21.9% to decline to 17.4%.EPS

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Hilton Grand Vacations's EPS dropped 7.3%, translating into 1.4% annualized declines. Thankfully, Hilton Grand Vacations has bucked its trend as of late, growing its EPS over the last three years. We'll see if the company's growth is sustainable.

In Q1, Hilton Grand Vacations reported EPS at $0.95, up from $0.64 in the same quarter last year. This print beat analysts' estimates by 28.6%. Over the next 12 months, Wall Street expects Hilton Grand Vacations to grow its earnings. Analysts are projecting its LTM EPS of $3.11 to climb by 40% to $4.36.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Hilton Grand Vacations has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 11.2%, slightly better than the broader consumer discretionary sector.

Hilton Grand Vacations burned through $19 million of cash in Q1, equivalent to a negative 1.6% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter.

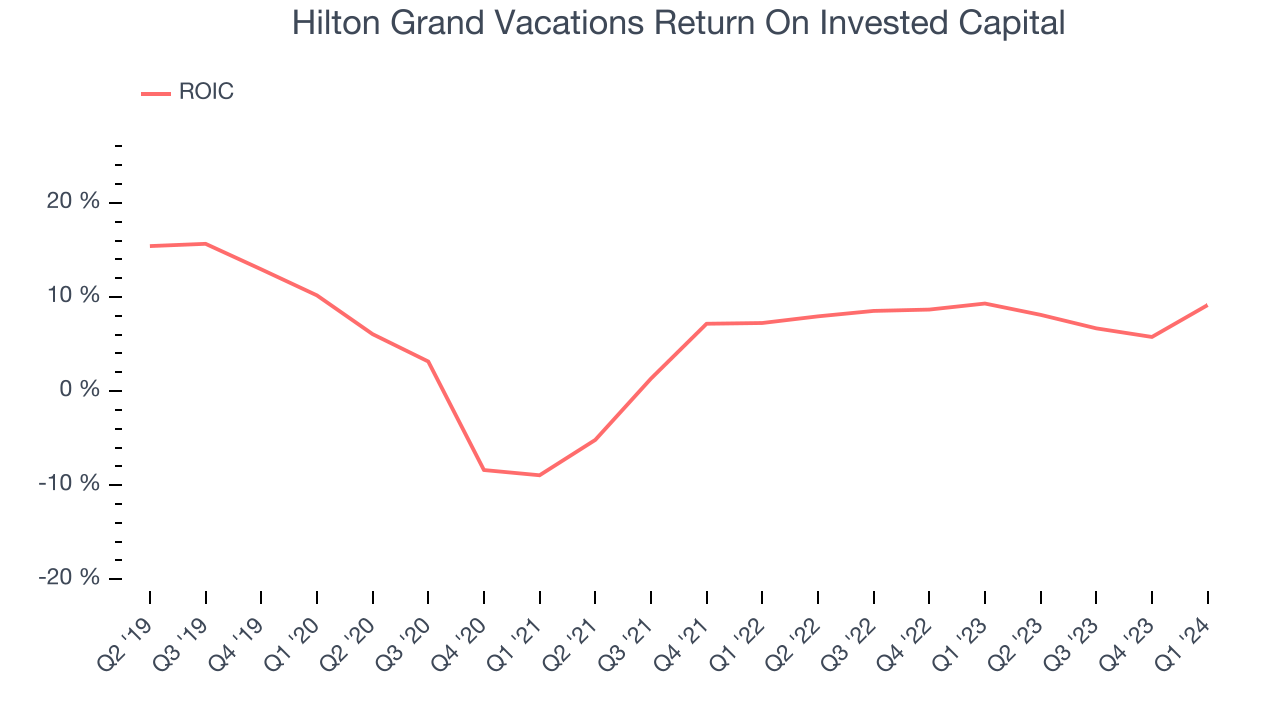

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Hilton Grand Vacations's five-year average return on invested capital was 5.4%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Hilton Grand Vacations's ROIC averaged 8.6 percentage point increases. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Hilton Grand Vacations's $6.78 billion of debt exceeds the $355 million of cash on its balance sheet. Furthermore, its 6x net-debt-to-EBITDA ratio (based on its EBITDA of $1.06 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Hilton Grand Vacations could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Hilton Grand Vacations can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Hilton Grand Vacations's Q1 Results

We were impressed by how significantly Hilton Grand Vacations blew past analysts' operating margin expectations this quarter. We were also glad its number of members outperformed Wall Street's estimates. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is flat after reporting and currently trades at $43.41 per share.

Is Now The Time?

Hilton Grand Vacations may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Hilton Grand Vacations isn't a bad business. First off, its revenue growth has been decent over the last five years, and growth is expected to increase in the short term. And while its relatively low ROIC suggests it has historically struggled to find compelling business opportunities, its projected EPS for the next year implies the company's fundamentals will improve.

Hilton Grand Vacations's price-to-earnings ratio based on the next 12 months is 10.0x. All that said, the state of its balance sheet makes us somewhat uncomfortable. We recommend investors interested in the company wait until it reduces its leverage or increases its profits before getting involved.

Wall Street analysts covering the company had a one-year price target of $57.13 per share right before these results (compared to the current share price of $43.41).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.