Motion control and electronic systems manufacturer Helios Technologies (NYSE:HLIO) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 3.4% year on year to $194.5 million. The company’s full-year revenue guidance of $802.5 million at the midpoint came in 2.6% below analysts’ estimates. Its non-GAAP profit of $0.59 per share was 8.5% above analysts’ consensus estimates.

Is now the time to buy Helios? Find out by accessing our full research report, it’s free.

Helios (HLIO) Q3 CY2024 Highlights:

- Revenue: $194.5 million vs analyst estimates of $196.4 million (in line)

- Adjusted EPS: $0.59 vs analyst estimates of $0.54 (8.5% beat)

- EBITDA: $40.6 million vs analyst estimates of $40.39 million (small beat)

- The company dropped its revenue guidance for the full year to $802.5 million at the midpoint from $832.5 million, a 3.6% decrease

- Management lowered its full-year Adjusted EPS guidance to $2.15 at the midpoint, a 8.5% decrease

- EBITDA guidance for the full year is $155 million at the midpoint, below analyst estimates of $165.5 million

- Gross Margin (GAAP): 31.1%, up from 29.6% in the same quarter last year

- Operating Margin: 11.4%, up from 6.9% in the same quarter last year

- EBITDA Margin: 20.9%, up from 17.7% in the same quarter last year

- Free Cash Flow Margin: 14.8%, up from 2.9% in the same quarter last year

- Organic Revenue fell 4% year on year (-10% in the same quarter last year)

- Market Capitalization: $1.63 billion

“The Helios team delivered solid results in line with our outlook for the quarter while we provided exceptional products, services and solutions to our customers, and drove operational efficiencies with strong cash management. These efforts contributed to the measurable margin expansion in the quarter. Our focus on inventory management helped us reach an inventory level we have not achieved since January 2023. This consistent reduction in inventory, operational efficiencies, and strong cash generation enabled us to reduce debt for the fifth consecutive quarter while we continued to improve our net debt leverage ratio. I believe we are a better, even more financially disciplined business than we were a year ago and expect that to be more evident as market conditions improve,” said Sean Bagan, Interim President, Chief Executive Officer, and Chief Financial Officer of Helios.

Company Overview

Founded on the principle of treating others as one wants to be treated, Helios (NYSE:HLIO) designs, manufactures, and sells motion and electronic control components for various sectors.

Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

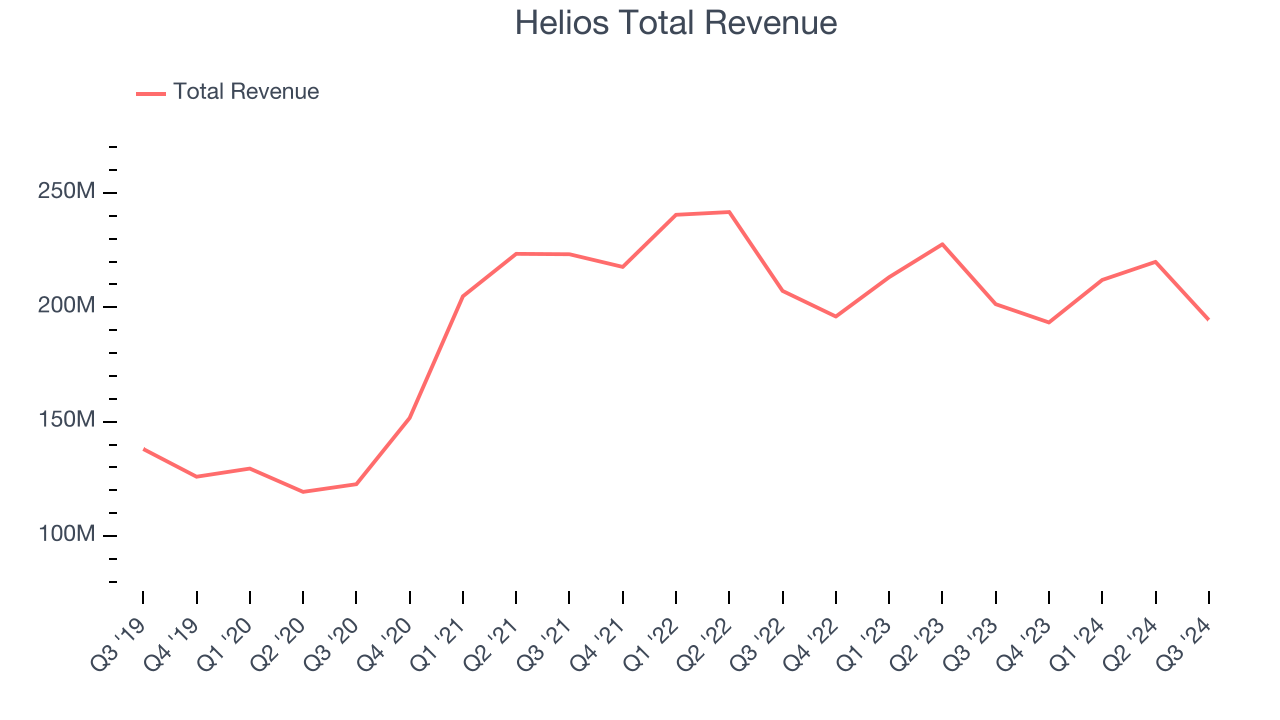

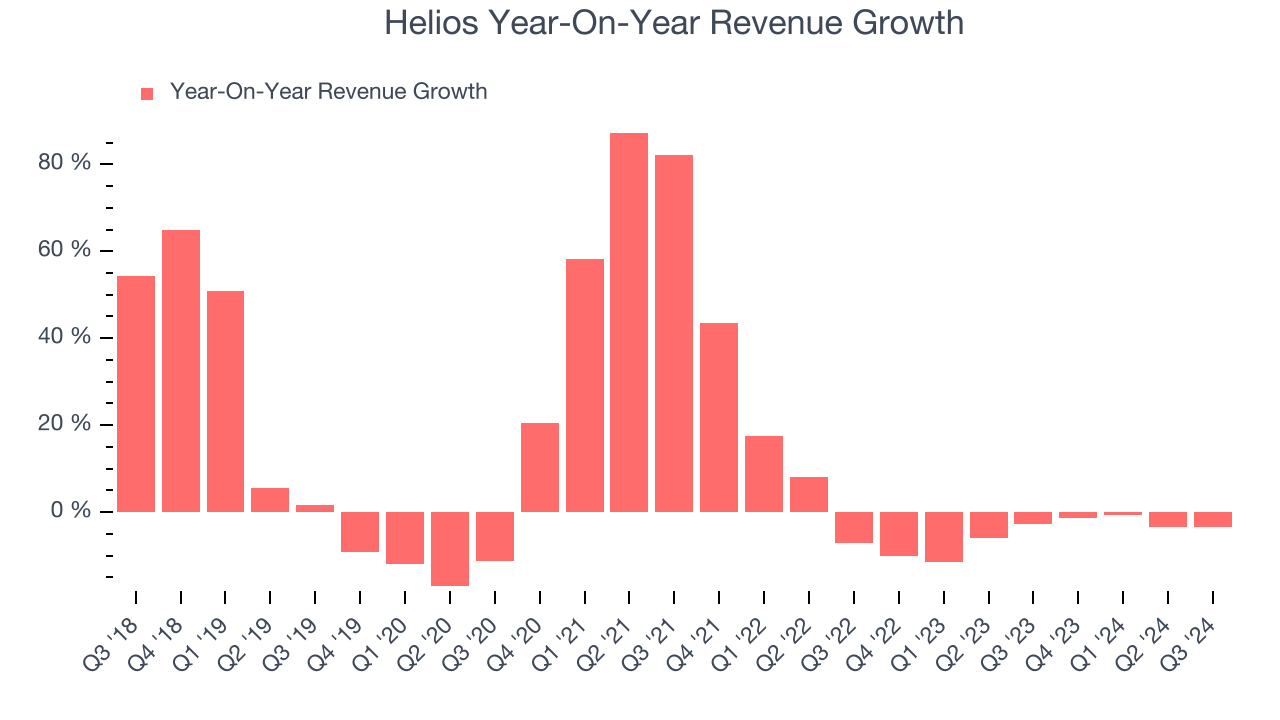

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Helios’s 7.6% annualized revenue growth over the last five years was decent. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Helios’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.9% over the last two years.

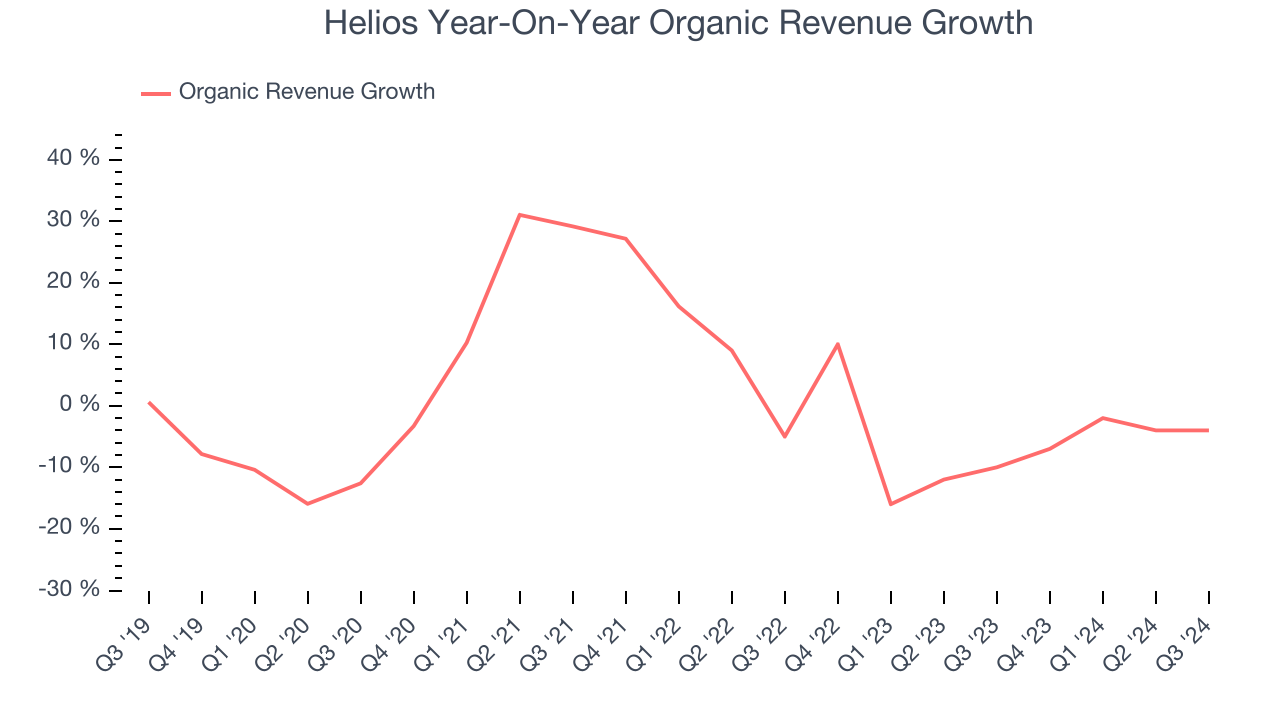

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Helios’s organic revenue averaged 5.6% year-on-year declines. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not M&A) drove most of its performance.

This quarter, Helios reported a rather uninspiring 3.4% year-on-year revenue decline to $194.5 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, an improvement versus the last two years. Although this projection shows the market believes its newer products and services will catalyze better performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

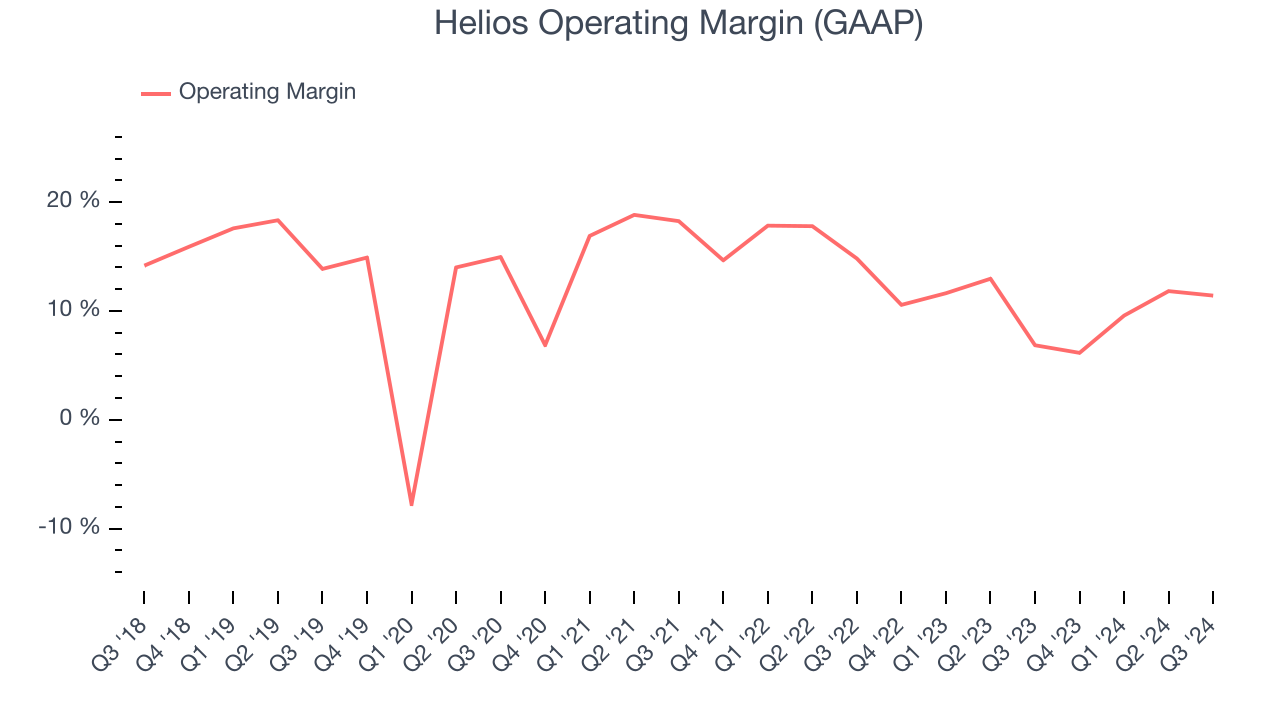

Operating Margin

Helios has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.7%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Helios’s annual operating margin rose by 1 percentage points over the last five years, showing its efficiency has improved.

This quarter, Helios generated an operating profit margin of 11.4%, up 4.6 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

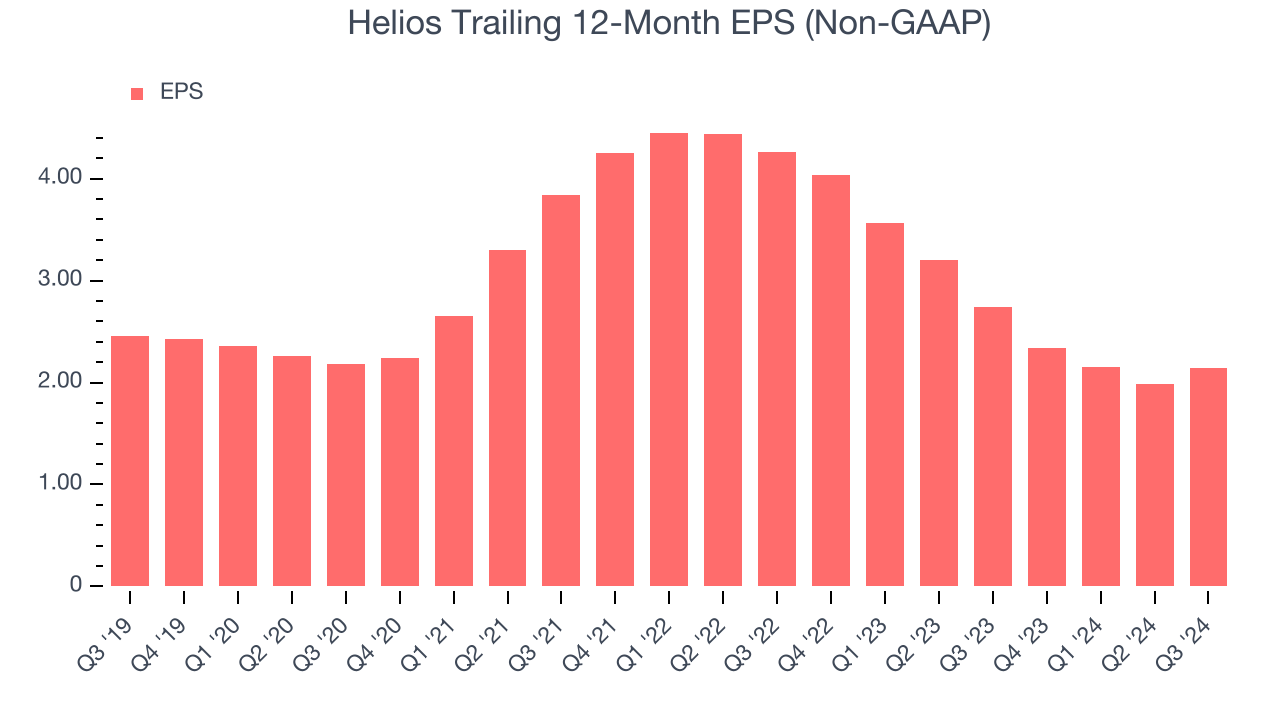

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

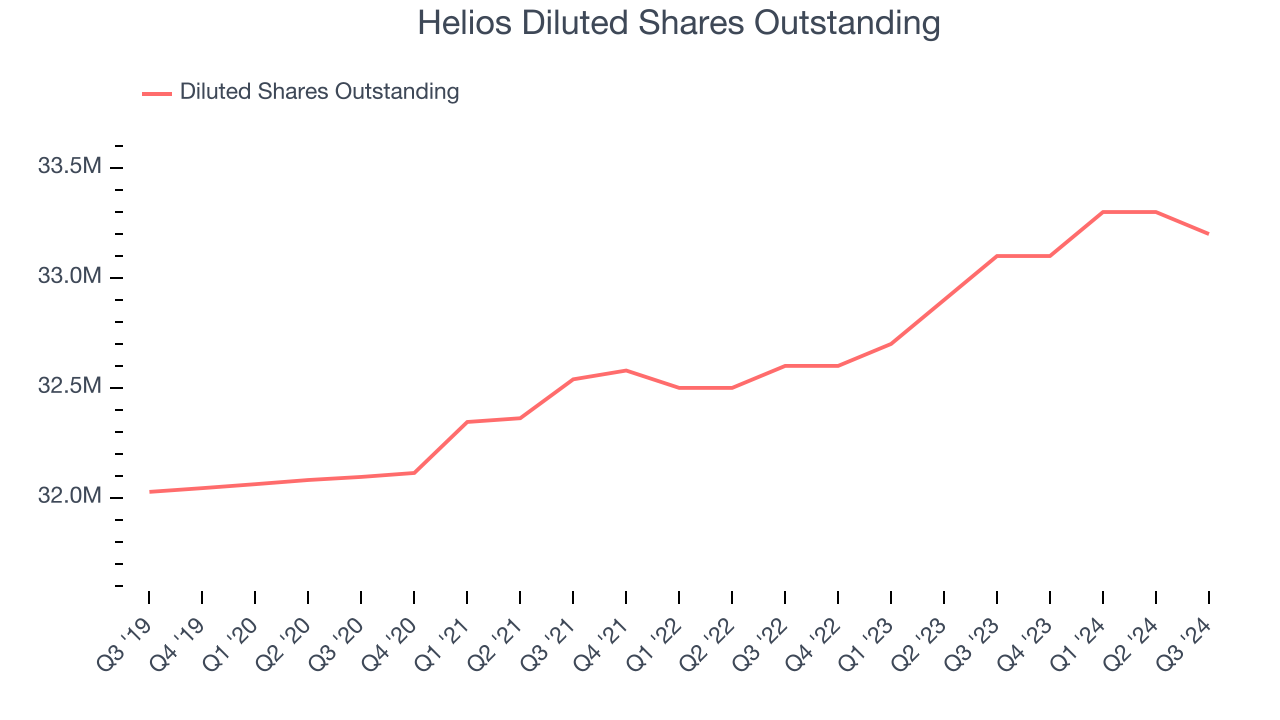

Sadly for Helios, its EPS declined by 2.7% annually over the last five years while its revenue grew by 7.6%. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

We can take a deeper look into Helios’s earnings to better understand the drivers of its performance. A five-year view shows Helios has diluted its shareholders, growing its share count by 3.7%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Helios, its two-year annual EPS declines of 29.2% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Helios reported EPS at $0.59, up from $0.44 in the same quarter last year. This print beat analysts’ estimates by 8.5%. Over the next 12 months, Wall Street expects Helios’s full-year EPS of $2.14 to grow by 31.7%.

Key Takeaways from Helios’s Q3 Results

It was good to see Helios beat analysts’ EPS expectations this quarter. On the other hand, its EBITDA forecast for the full year missed and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $49.07 immediately following the results.

So should you invest in Helios right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.