American motorcycle manufacturing company Harley-Davidson (NYSE:HOG) reported Q1 CY2024 results topping analysts' expectations, with revenue down 3.3% year on year to $1.73 billion. It made a GAAP profit of $1.72 per share, down from its profit of $2.04 per share in the same quarter last year.

Harley-Davidson (HOG) Q1 CY2024 Highlights:

- Revenue: $1.73 billion (Consensus not comparable)

- Operating income: $263 million vs analyst estimates of $264 million (slight miss)

- EPS: $1.72 vs analyst estimates of $1.52 (12.9% beat)

- Gross Margin (GAAP): 26.4%, down from 34.4% in the same quarter last year

- Free Cash Flow of $57.64 million is up from -$20.38 million in the previous quarter

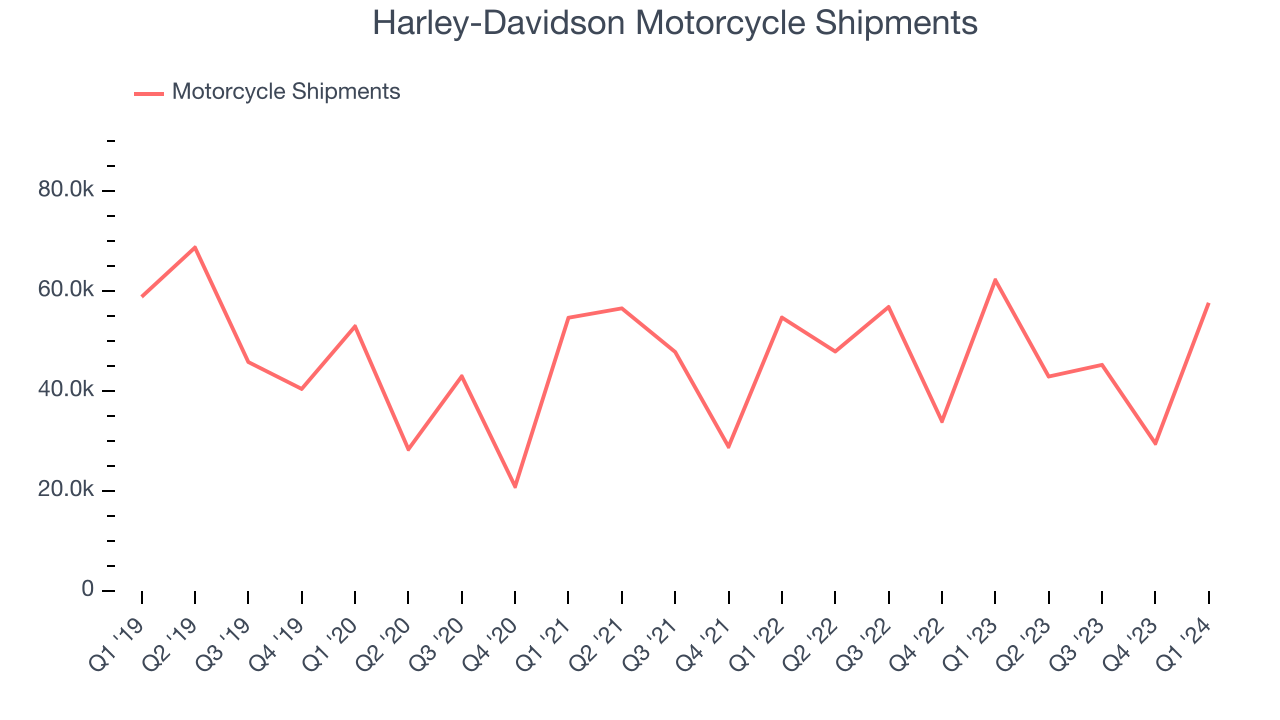

- Motorcycle Shipments: 57,700

- Market Capitalization: $5.31 billion

Founded in 1903, Harley-Davidson (NYSE:HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson was established to fulfill the need for a powerful and reliable motorcycle. Its creation was driven by the founders' passion for mechanics and the freedom of the road, leading to the production of motorcycles that would become symbols of American culture and craftsmanship.

Harley-Davidson manufactures and sells an array of heavyweight motorcycles, along with motorcycle parts, accessories, and general merchandise. The company's products are known for their distinctive design, sound, and performance, catering to a global community of enthusiasts seeking the Harley-Davidson riding experience. Additionally, Harley-Davidson offers motorcycle financing services, enhancing accessibility for buyers.

The company's revenue model is multifaceted, encompassing the sale of motorcycles, parts, and accessories, alongside offering financial services such as loans and insurance for buyers. Harley-Davidson also earns from licensing its brand to a variety of merchandise. Its distribution strategy relies on a global network of independent dealerships which also provide maintenance services, further enhancing revenue.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the recreational vehicle industry include Polaris (NYSE:PII), Honda (NYSE:HMC), and Arcimoto (NASDAQ:FUV).Sales Growth

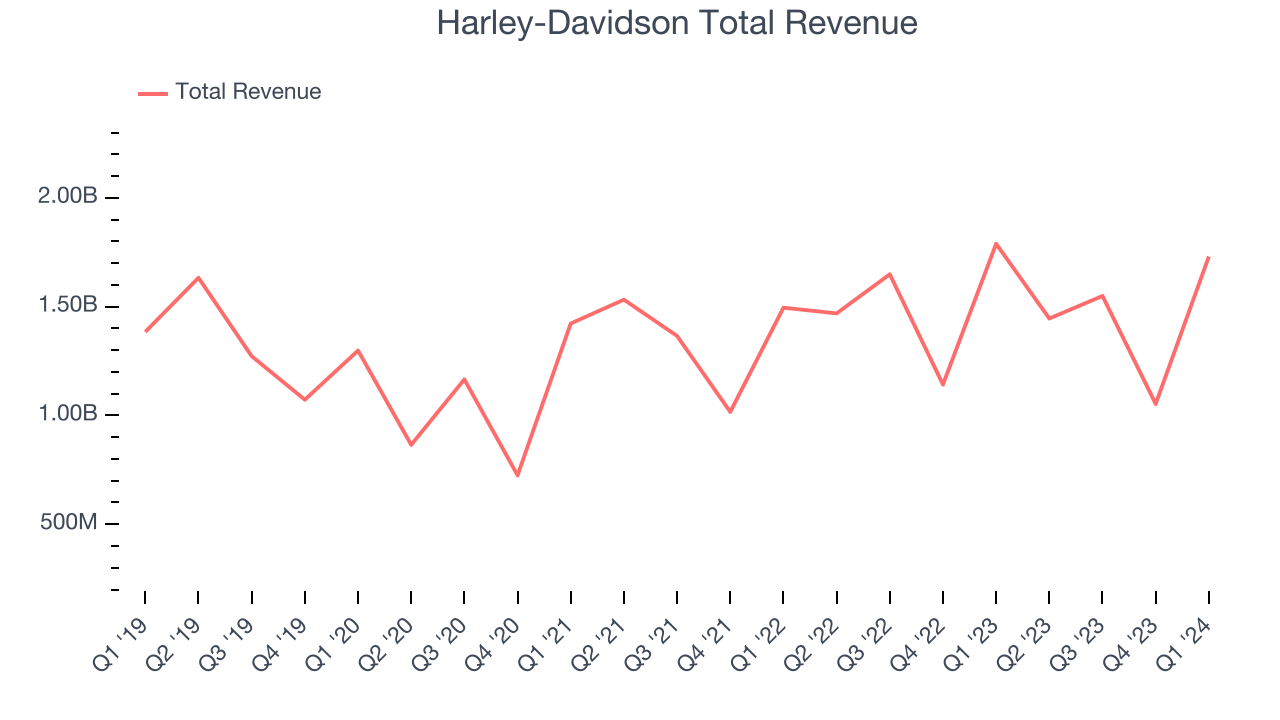

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Harley-Davidson's revenue was flat over the last five years.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Harley-Davidson's annualized revenue growth of 3.4% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Harley-Davidson's annualized revenue growth of 3.4% over the last two years is above its five-year trend, suggesting some bright spots.

We can better understand the company's revenue dynamics by analyzing its number of motorcycle shipments, which reached 57,700 in the latest quarter. Over the last two years, Harley-Davidson's motorcycle shipments averaged 2% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company's monetization of its consumers has risen.

This quarter, Harley-Davidson's revenue fell 3.3% year on year to $1.73 billion but beat Wall Street's estimates by 28.4%. Looking ahead, Wall Street expects revenue to decline 19.5% over the next 12 months, a deceleration from this quarter.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

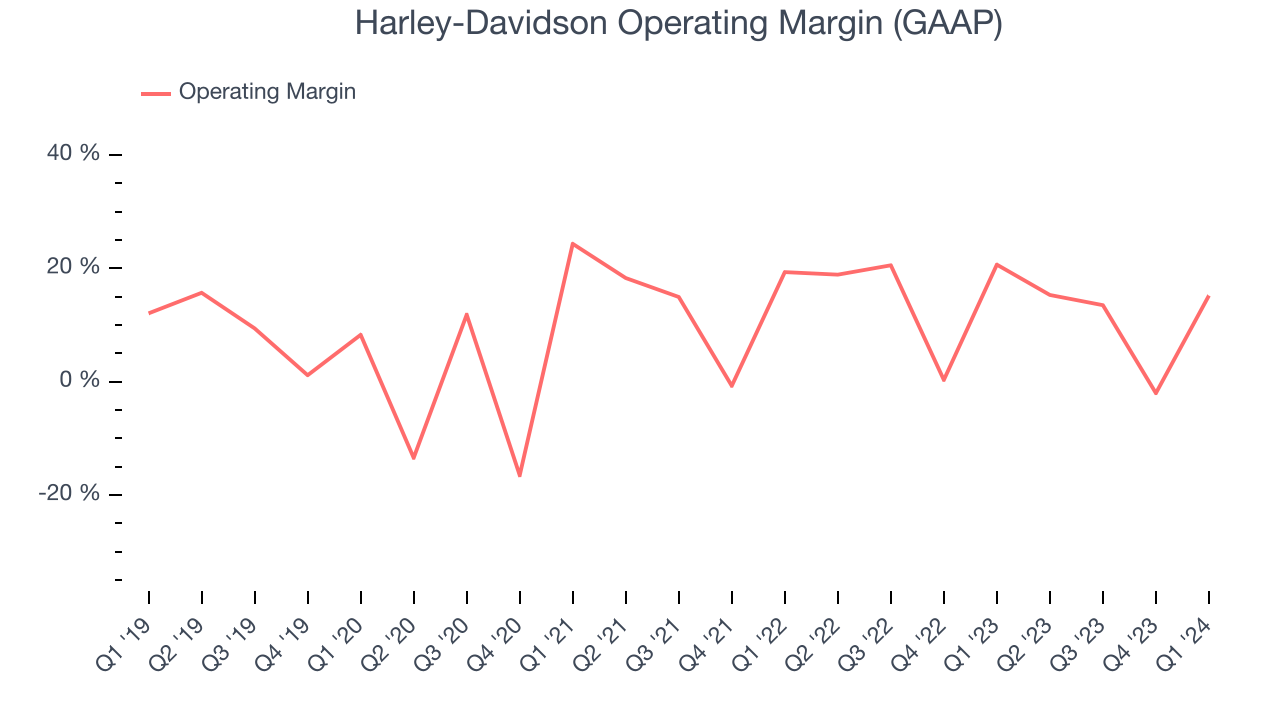

Harley-Davidson has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer discretionary business, producing an average operating margin of 14.1%.

In Q1, Harley-Davidson generated an operating profit margin of 15.2%, down 5.5 percentage points year on year.

Over the next 12 months, Wall Street expects Harley-Davidson to become more profitable. Analysts are expecting the company’s LTM operating margin of 11.6% to rise to 15.7%.EPS

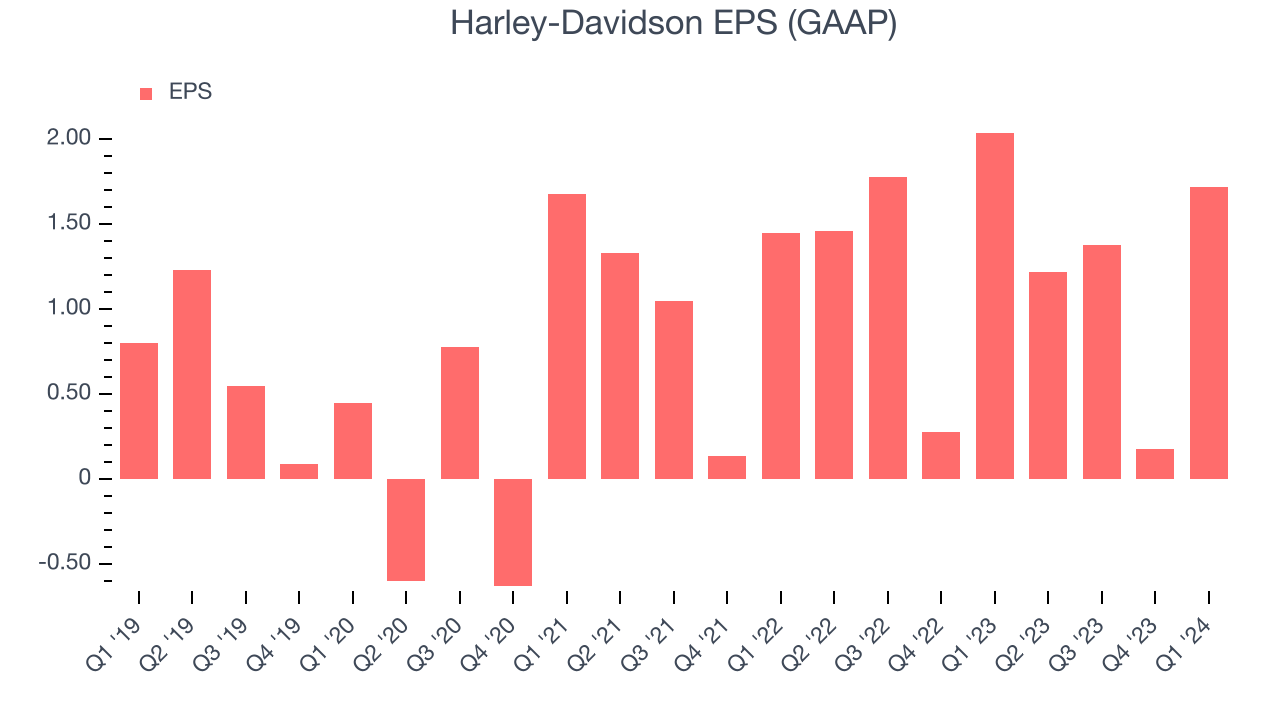

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Harley-Davidson's EPS grew 53.5%, translating into an unimpressive 8.9% compounded annual growth rate. This performance, however, is materially higher than its flat revenue over the same period. Let's dig into why.

While we mentioned earlier that Harley-Davidson's operating margin declined this quarter, a five-year view shows its margin has expanded 3.1 percentage points while its share count has shrunk 14.4%. Improving profitability and share buybacks are positive signs as they juice EPS growth relative to revenue growth.In Q1, Harley-Davidson reported EPS at $1.72, down from $2.04 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 12.9%. Over the next 12 months, Wall Street expects Harley-Davidson to perform poorly. Analysts are projecting its LTM EPS of $4.50 to shrink by 1.8% to $4.42.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

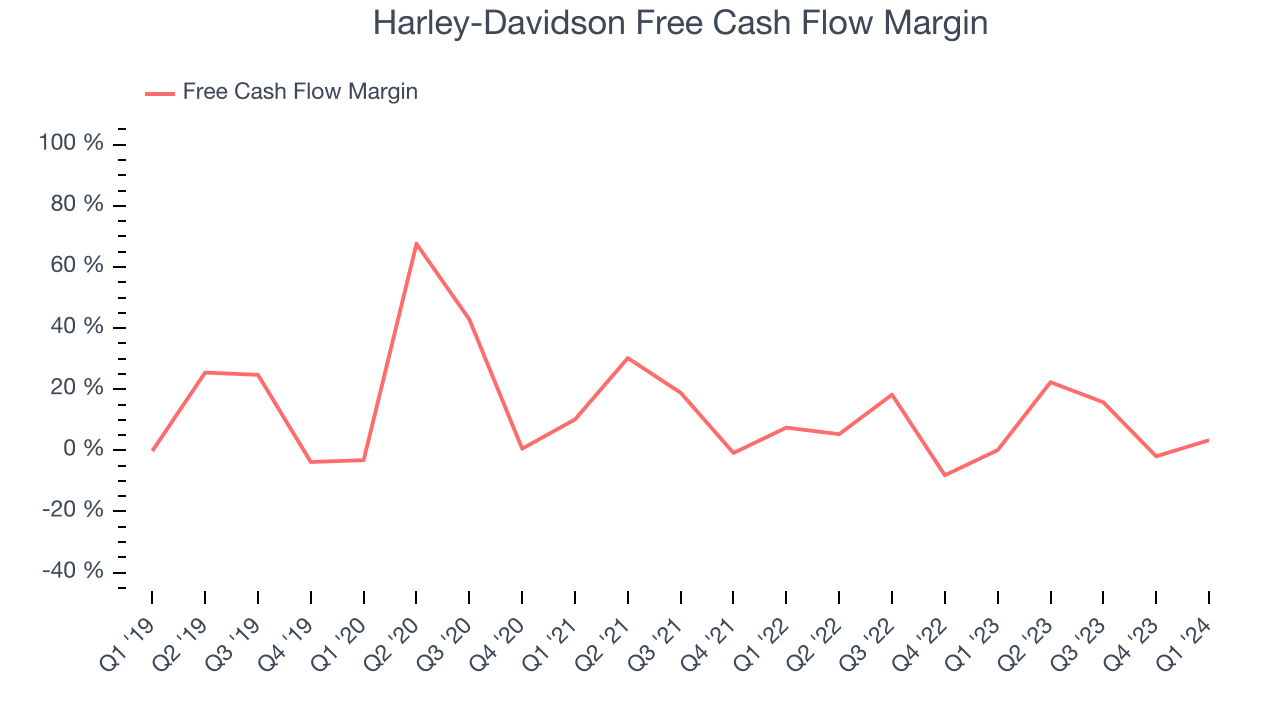

Over the last two years, Harley-Davidson has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 7.5%, subpar for a consumer discretionary business.

Harley-Davidson's free cash flow came in at $57.64 million in Q1, equivalent to a 3.3% margin and up 3,588% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

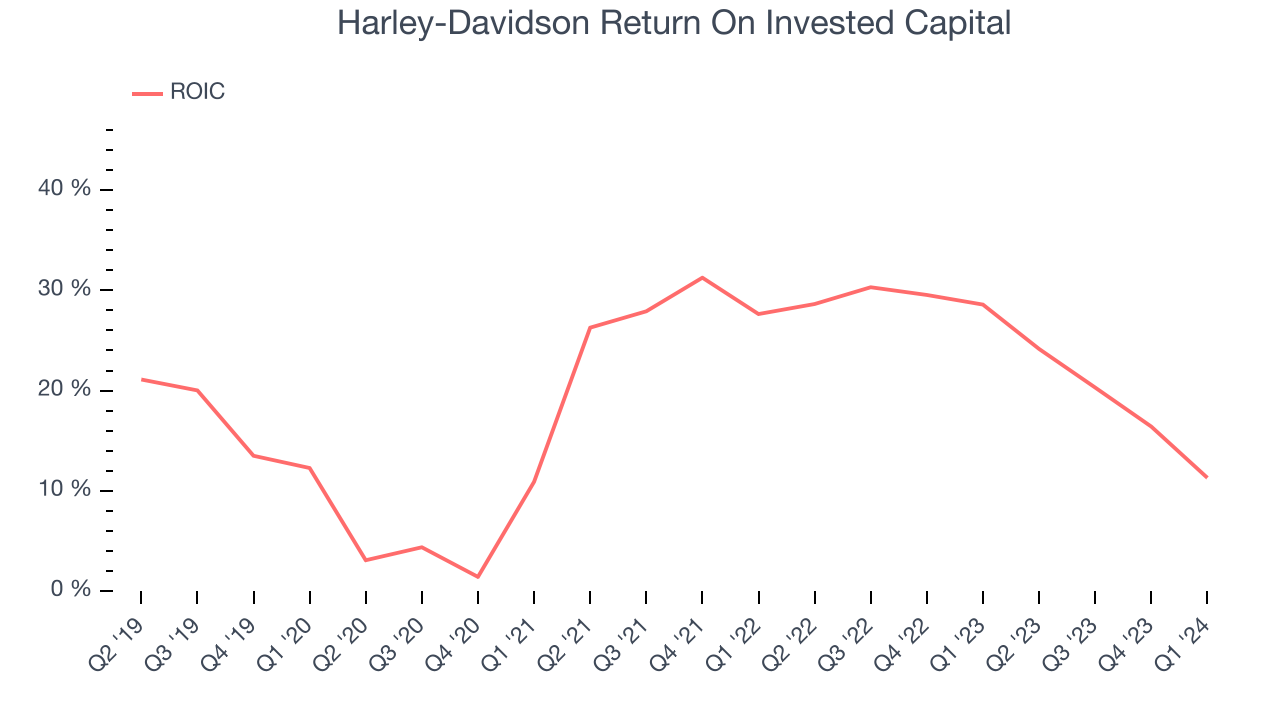

Although Harley-Davidson hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a solid job investing in profitable business initiatives. Its five-year average return on invested capital was 18.1%, higher than most consumer discretionary companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Harley-Davidson's ROIC averaged 8.4 percentage point increases. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Key Takeaways from Harley-Davidson's Q1 Results

Operating profit missed and both gross and operating margin in the core segment that sells motorcycles and parts declined meaningfully year over year. The results could have been better. The stock is down after reporting and currently trades at $39.11 per share.

Is Now The Time?

Harley-Davidson may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Harley-Davidson, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years, and analysts expect growth to deteriorate from here. And while its solid ROIC suggests it has grown profitably in the past, the downside is its number of motorcycle shipments has been disappointing. On top of that, its projected EPS for the next year is lacking.

Harley-Davidson's price-to-earnings ratio based on the next 12 months is 9.0x. While there are some things to like about Harley-Davidson and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $45.21 per share right before these results (compared to the current share price of $39.11).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.