Residential real estate services company Anywhere Real Estate (NYSE:HOUS) missed analysts' expectations in Q1 CY2024, with revenue down 0.4% year on year to $1.13 billion. It made a GAAP loss of $0.91 per share, improving from its loss of $1.26 per share in the same quarter last year.

Anywhere Real Estate (HOUS) Q1 CY2024 Highlights:

- Revenue: $1.13 billion vs analyst estimates of $1.15 billion (1.8% miss)

- EPS: -$0.91 vs analyst expectations of -$0.69 (31.4% miss)

- Gross Margin (GAAP): 35.5%, down from 36.1% in the same quarter last year

- Free Cash Flow was -$145 million compared to -$13 million in the previous quarter

- Market Capitalization: $601 million

Formerly known as Realogy Holdings, Anywhere Real Estate (NYSE:HOUS) is a residential real estate company with a network of brokerages, franchises, and settlement services.

Anywhere Real Estate's business model is multifaceted, encompassing various segments in the real estate industry. The company operates through several business units, each focusing on different aspects of real estate transactions. These units include Real Estate Franchise Services, Company-Owned Real Estate Brokerage Services, Relocation Services, and Title and Settlement Services.

The company's portfolio of real estate brands is robust and includes some of the most recognized names in the industry, like Century 21, Coldwell Banker, Sotheby’s International Realty, and Better Homes and Gardens Real Estate. These brands aim to provide clients with market expertise in residential real estate.

Apart from its franchise and brokerage operations, Anywhere Real Estate’s Relocation Services are designed to assist companies in moving employees, while its Title and Settlement Services segment facilitates the closing and funding of real estate transactions.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Anywhere Real Estate’s primary competitors include RE/MAX Holdings (NYSE:RMAX), Berkshire Hathaway HomeServices (owned by Berkshire Hathaway NYSE:BRK.A), Compass (NYSE:COMP), eXp Realty (owned by eXp World Holdings NASDAQ:EXPI) and private company Keller Williams Realty.Sales Growth

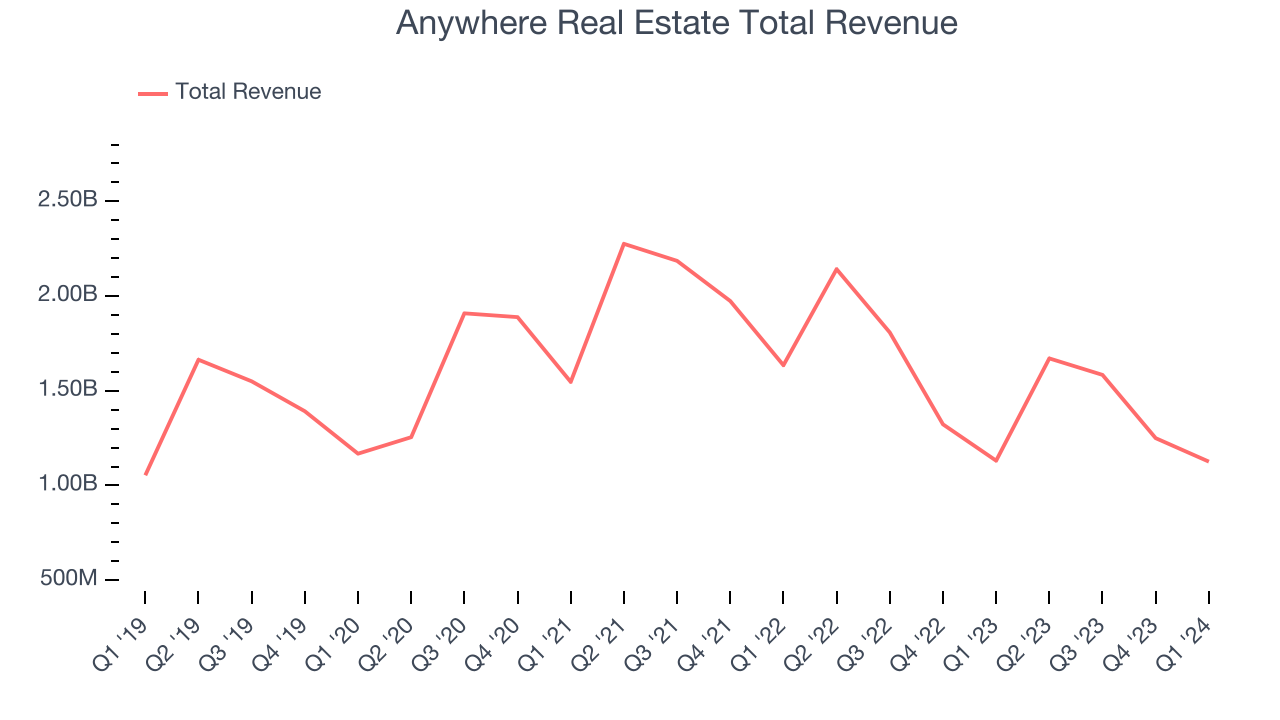

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Anywhere Real Estate's revenue was flat over the last five years.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Anywhere Real Estate's recent history shows a reversal from its five-year trend as its revenue has shown annualized declines of 16.5% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Anywhere Real Estate's recent history shows a reversal from its five-year trend as its revenue has shown annualized declines of 16.5% over the last two years.

This quarter, Anywhere Real Estate missed Wall Street's estimates and reported a rather uninspiring 0.4% year-on-year revenue decline, generating $1.13 billion of revenue.

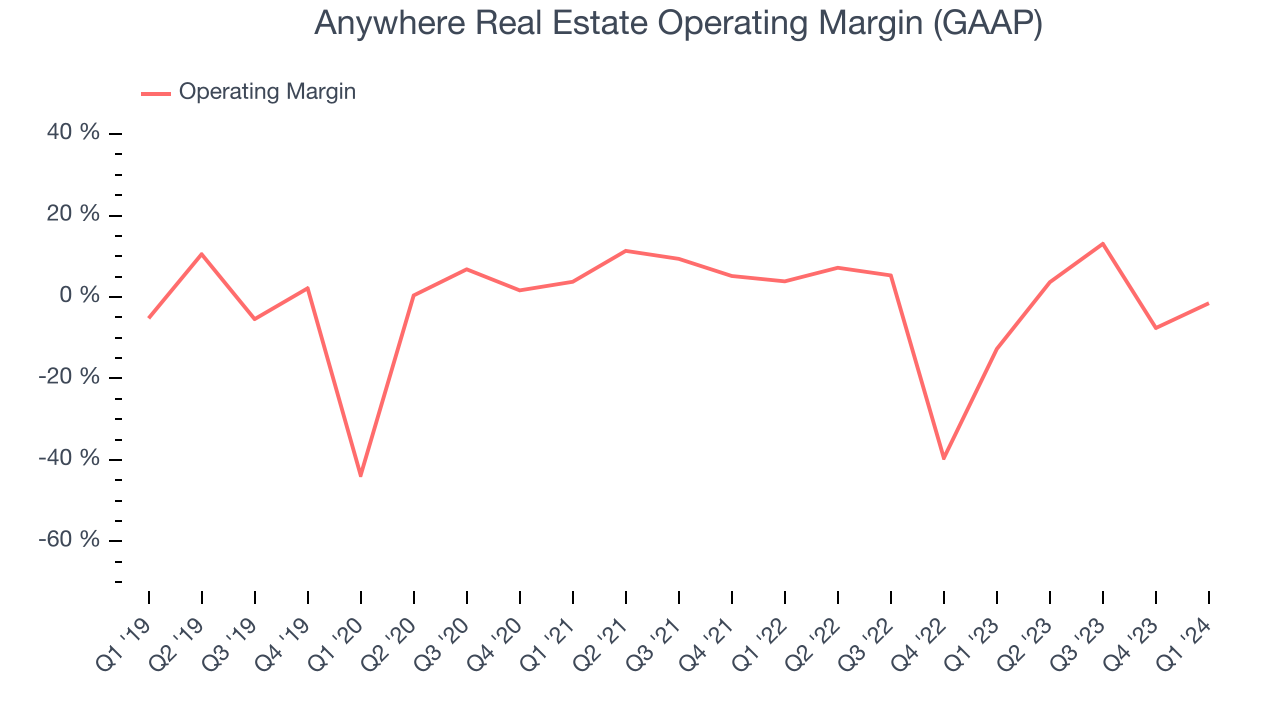

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Anywhere Real Estate's high expenses have contributed to an average operating margin of negative 2.2%.

In Q1, Anywhere Real Estate generated an operating profit margin of negative 1.5%, up 11.2 percentage points year on year.

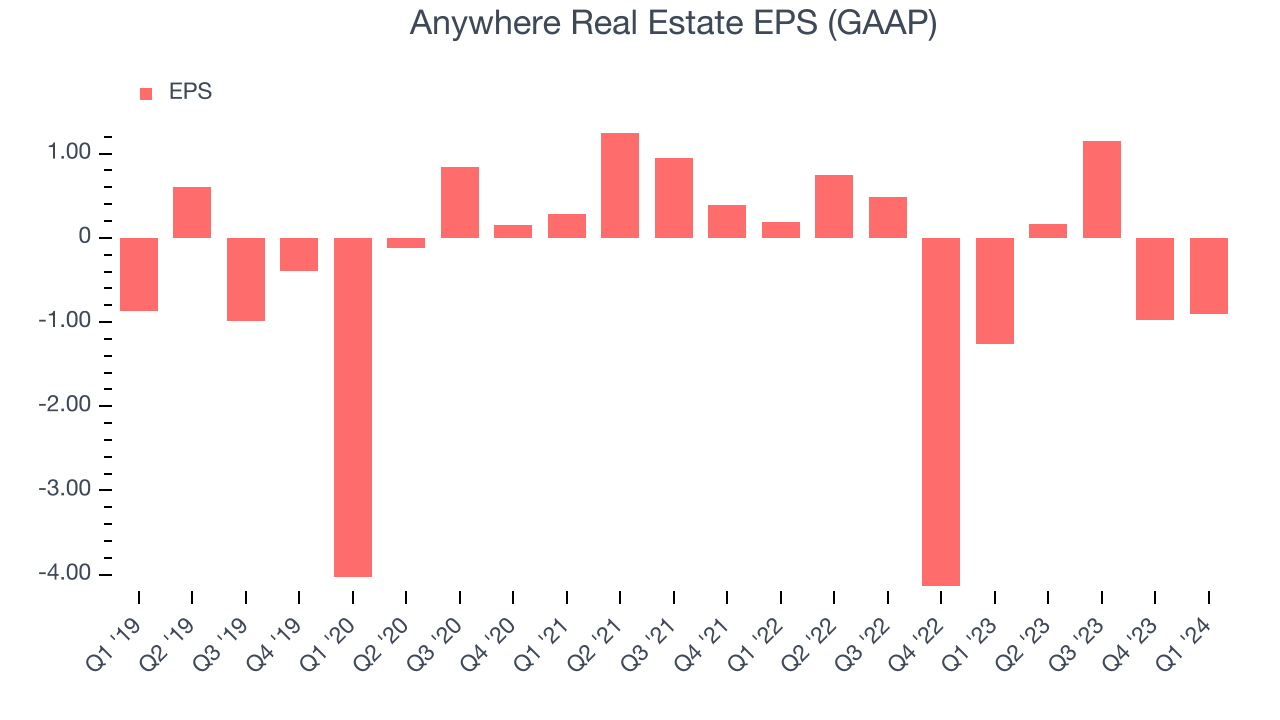

EPS

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Anywhere Real Estate's EPS dropped 177%, translating into 22.6% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, Anywhere Real Estate reported EPS at negative $0.91, up from negative $1.26 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Anywhere Real Estate's LTM EPS of negative $0.56 to reach break even.

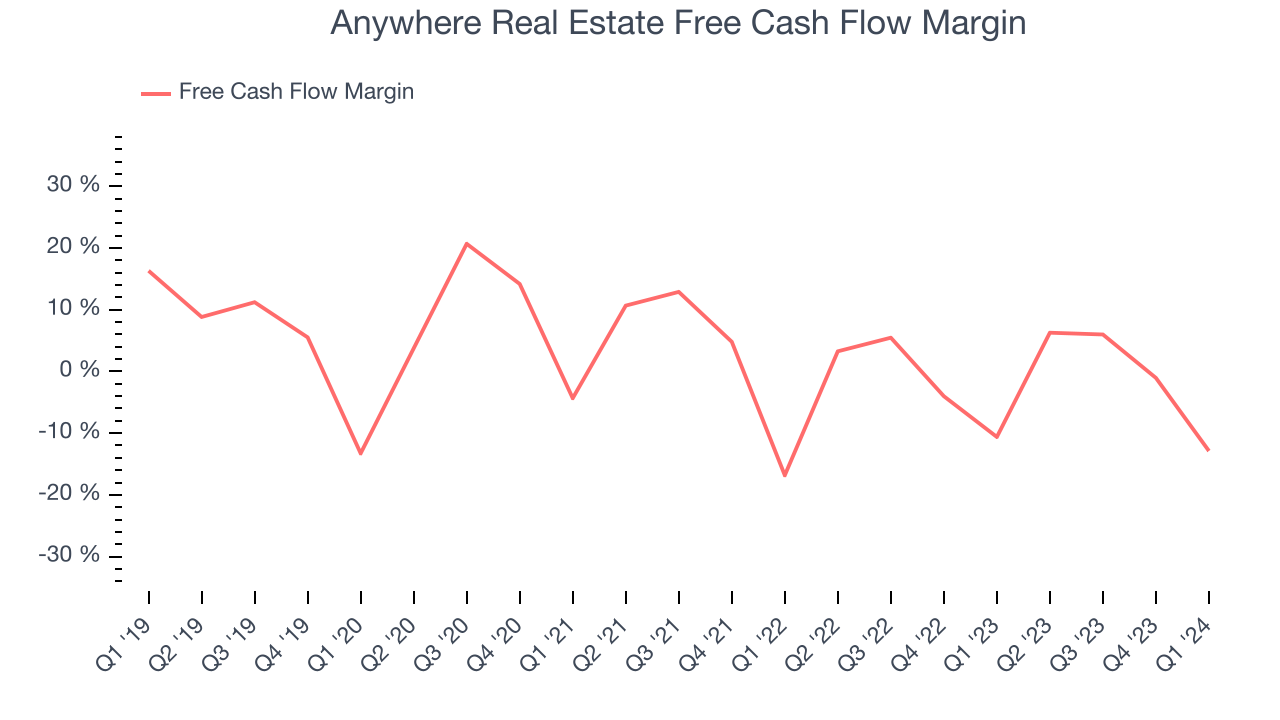

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Anywhere Real Estate broke even from a free cash flow perspective, subpar for a consumer discretionary business.

Anywhere Real Estate burned through $145 million of cash in Q1, equivalent to a negative 12.9% margin, reducing its cash burn by 20.8% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Anywhere Real Estate's five-year average return on invested capital was 1.1%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Anywhere Real Estate's ROIC has stayed the same over the last few years. If the company wants to become an investable business, it will need to increase its returns.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Anywhere Real Estate's $3.13 billion of debt exceeds the $111 million of cash on its balance sheet. Furthermore, its 20x net-debt-to-EBITDA ratio (based on its EBITDA of $151 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Anywhere Real Estate could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Anywhere Real Estate can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Anywhere Real Estate's Q1 Results

Anywhere Real Estate missed analysts' revenue, EBITDA, and EPS estimates this quarter as its housing unit sales were down 4% year on year. Its average prices, however, were up 7%, allowing it to post closed transaction growth for the first time in two years. The luxury segment outperformed as the company's Sotheby's International Realty brand saw closed transaction values up 7% year on year, split evenly between unit and price growth.

Looking ahead, the company expects moderately positive free cash flow for the full year (excluding a one-time ~$112.5 million expense), beating Wall Street's expectations. Overall, this was a mediocre quarter for Anywhere Real Estate, but the market is likely happy it generated closed transaction growth. The stock is up 4.8% after reporting and currently trades at $5.68 per share.

Is Now The Time?

Anywhere Real Estate may have had a decent quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Anywhere Real Estate, we'll be cheering from the sidelines. First off, its revenue has declined over the last five years. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its number of transacted dollars has been disappointing. On top of that, its declining EPS over the last five years makes it hard to trust.

Anywhere Real Estate's price-to-earnings ratio based on the next 12 months is 18.1x. While we've no doubt one can find things to like about Anywhere Real Estate, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $6.50 per share right before these results (compared to the current share price of $5.68).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.