Packaged foods company Hormel (NYSE:HRL) missed analysts' expectations in Q4 FY2023, with revenue down 2.6% year on year to $3.20 billion. On the other hand, the company's full-year revenue guidance of $12.35 billion at the midpoint came in slightly above analysts' estimates. It made a GAAP profit of $0.36 per share, down from its profit of $0.51 per share in the same quarter last year.

Is now the time to buy Hormel Foods? Find out by accessing our full research report, it's free.

Hormel Foods (HRL) Q4 FY2023 Highlights:

- Revenue: $3.20 billion vs analyst estimates of $3.27 billion (2.1% miss)

- EPS: $0.36 vs analyst expectations of $0.44 (18.6% miss)

- Management's revenue guidance for the upcoming financial year 2024 is $12.35 billion at the midpoint, in line with analyst expectations and implying 2% growth (vs -2.8% in FY2023)

- Free Cash Flow of $217.4 million, similar to the previous quarter

- Gross Margin (GAAP): 16.1%, down from 17.3% in the same quarter last year

- Sales Volumes were down 0.4% year on year

Best known for its SPAM brand, Hormel (NYSE:HRL) is a packaged foods company with products that span meat, poultry, shelf-stable foods, and spreads.

Packaged Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Hormel Foods is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

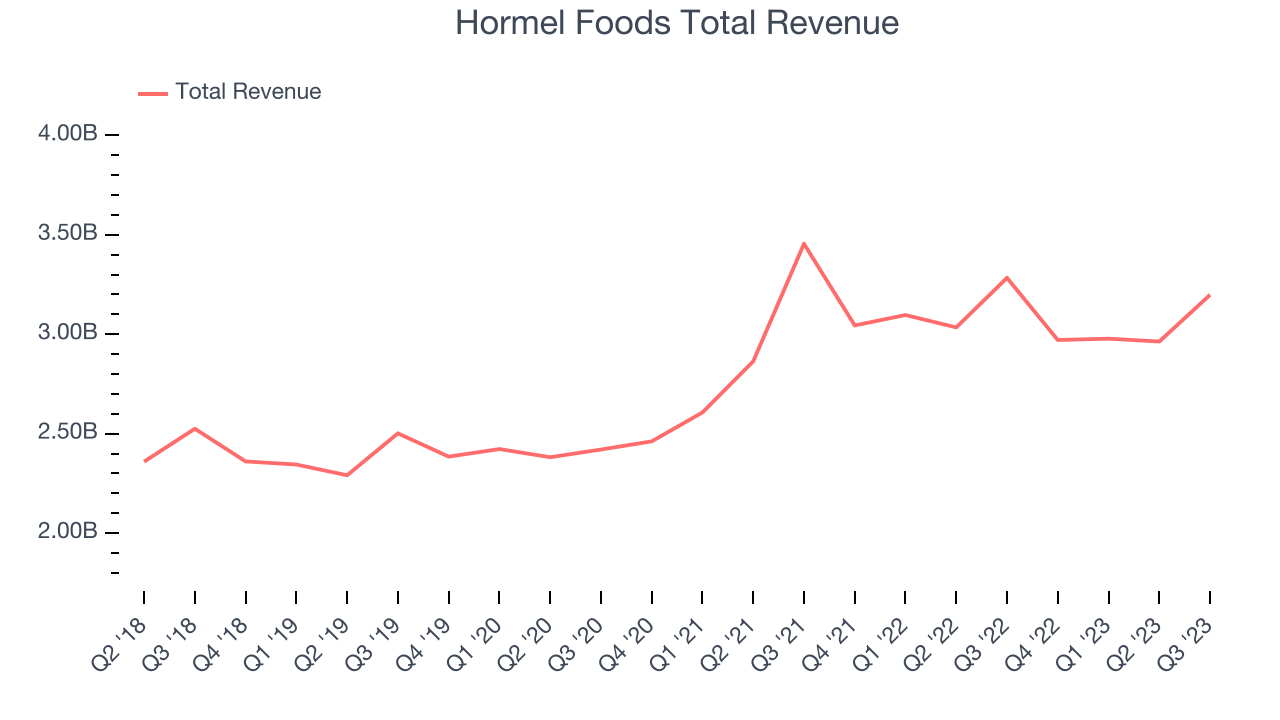

As you can see below, the company's annualized revenue growth rate of 8% over the last three years was decent for a consumer staples business.

This quarter, Hormel Foods reported a rather uninspiring 2.6% year-on-year revenue decline, missing Wall Street's estimates. Looking ahead, analysts expect sales to grow 1.5% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Volume Growth

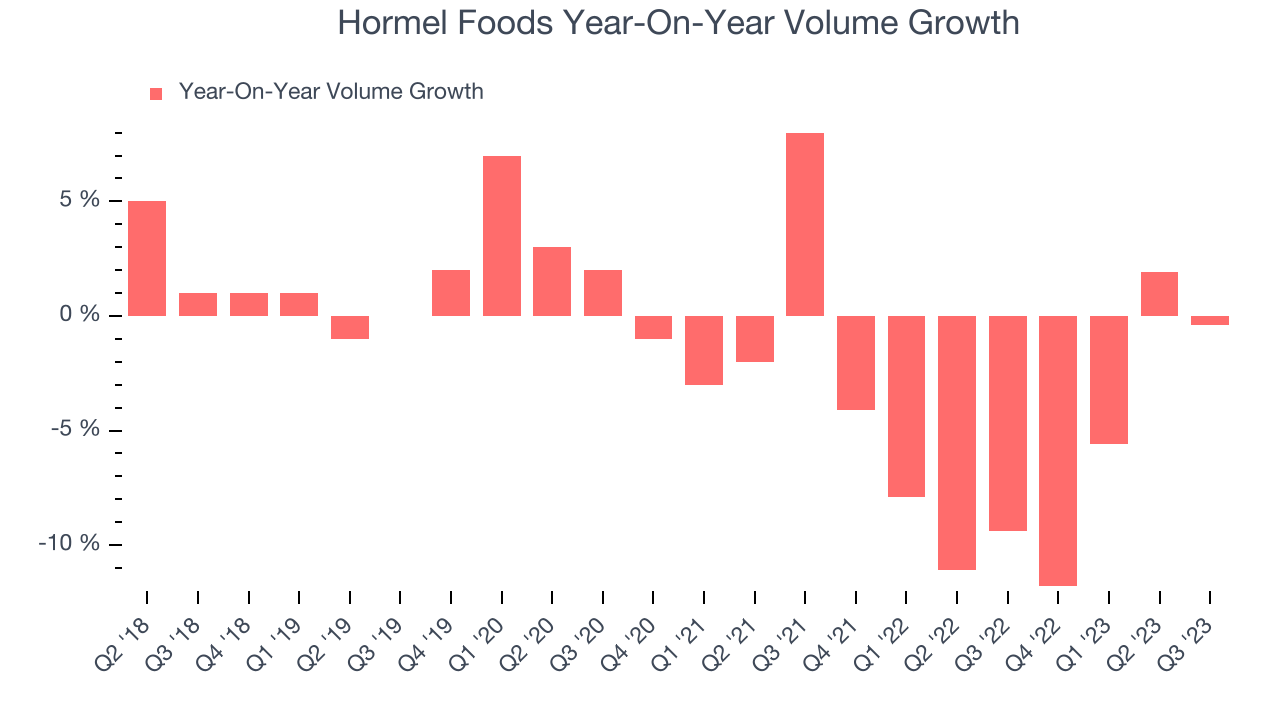

Hormel Foods's average quarterly sales volumes have shrunk by 6.1% over the last two years. This decrease isn't ideal because the quantity demanded for consumer staples products is typically stable.

In Hormel Foods's Q4 2023, year on year sales volumes were flat. This result was a well-appreciated turnaround from the 9.4% year-on-year decline it posted 12 months ago, showing the company is heading in the right direction.

Key Takeaways from Hormel Foods's Q4 Results

Sporting a market capitalization of $17.46 billion, more than $753.2 million in cash on hand, and positive free cash flow over the last 12 months, we believe that Hormel Foods is attractively positioned to invest in growth.

It was encouraging to see Hormel Foods provide full-year revenue guidance that slightly topped analysts' expectations. That stood out as a positive in these results. On the other hand, its revenue missed, driven by lower-than-expected sales volumes, while its operating margin and EPS also fell short of Wall Street's forecasts. Overall, this was a mediocre quarter for Hormel Foods. The stock is flat after reporting and currently trades at $32.19 per share.

Hormel Foods may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.