Sales and marketing software maker HubSpot (NYSE:HUBS) reported results ahead of analyst expectations in the Q4 FY2022 quarter, with revenue up 27.2% year on year to $469.7 million. Guidance for next quarter's revenue was $474 million at the midpoint, which is 1.07% above the analyst consensus. HubSpot made a GAAP loss of $15.6 million, improving on its loss of $16.4 million, in the same quarter last year.

Is now the time to buy HubSpot? Access our full analysis of the earnings results here, it's free.

HubSpot (HUBS) Q4 FY2022 Highlights:

- Revenue: $469.7 million vs analyst estimates of $446 million (5.3% beat)

- EPS (non-GAAP): $1.11 vs analyst estimates of $0.82 (34.6% beat)

- Revenue guidance for Q1 2023 is $474 million at the midpoint, above analyst estimates of $469 million

- Management's revenue guidance for upcoming financial year 2023 is $2.06 billion at the midpoint, in line with analyst expectations and predicting 18.7% growth (vs 33.6% in FY2022)

- Free cash flow of $70.9 million, up 99.6% from previous quarter

- Customers: 167,386, up from 158,905 in previous quarter

- Gross Margin (GAAP): 82.9%, up from 80.6% same quarter last year

“I’m proud of the way our team stepped up to the challenging macroeconomic conditions that emerged in 2022. We executed well and helped our customers navigate choppy waters,” said Yamini Rangan, Chief Executive Officer at HubSpot.

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software as a service platform that helps small and medium-size businesses sell, market themselves, and get found on the internet.

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality, coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrate data analytics with sales and marketing functions.

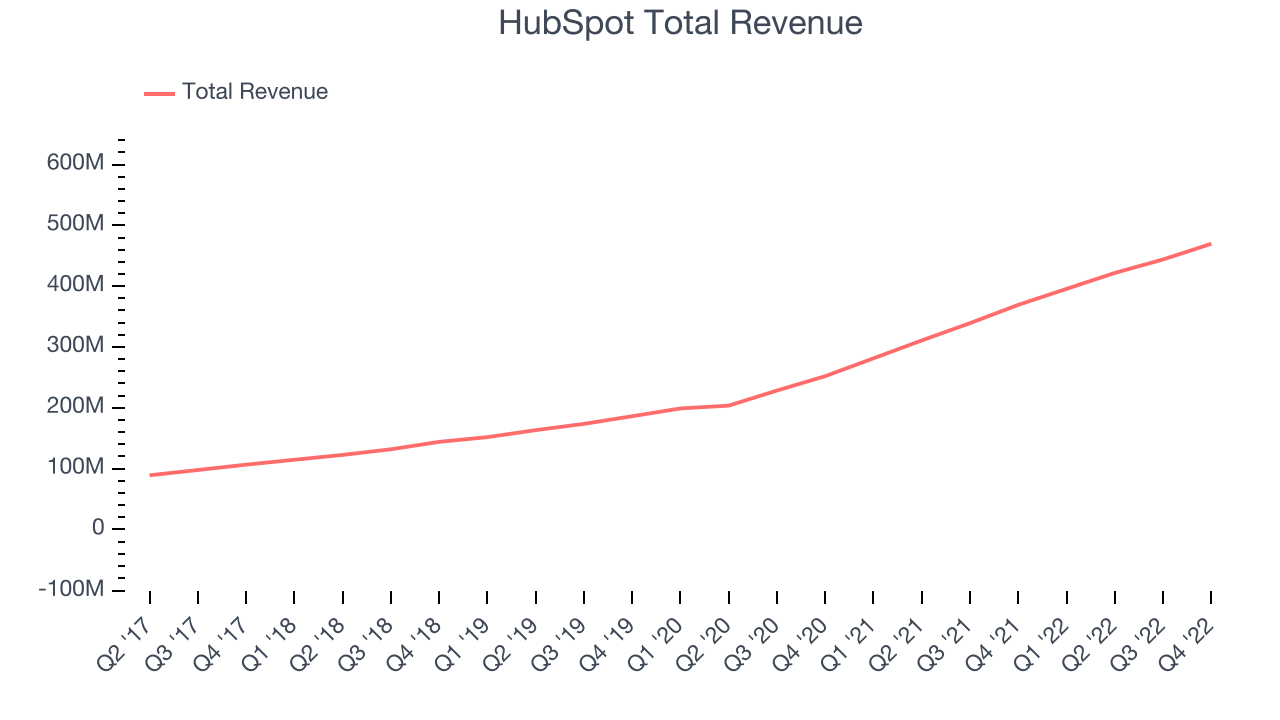

Sales Growth

As you can see below, HubSpot's revenue growth has been impressive over the last two years, growing from quarterly revenue of $252.1 million in Q4 FY2020, to $469.7 million.

This quarter, HubSpot's quarterly revenue was once again up a very solid 27.2% year on year. On top of that, revenue increased $25.7 million quarter on quarter, a solid improvement on the $22.2 million increase in Q3 2022. Happily, that's a slight acceleration of growth.

Guidance for the next quarter indicates HubSpot is expecting revenue to grow 19.8% year on year to $474 million, slowing down from the 40.6% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $2.06 billion at the midpoint, growing 18.7% compared to 33.1% increase in FY2022.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

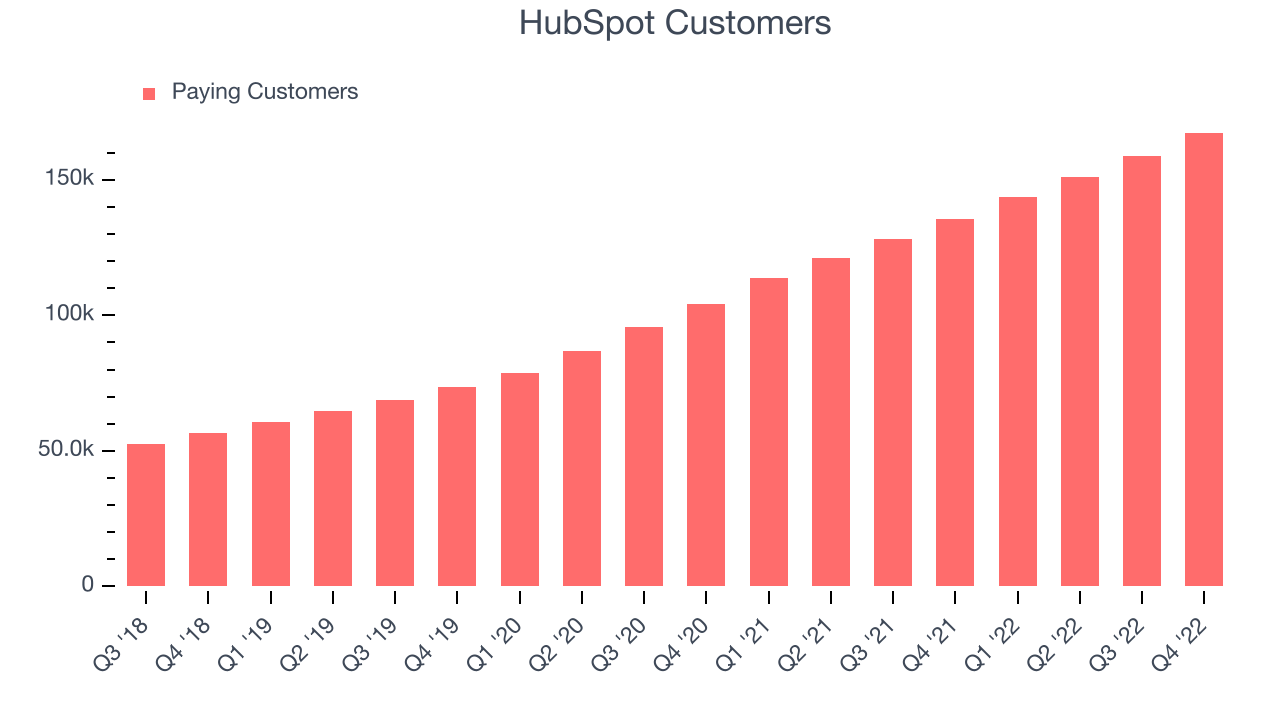

Customer Growth

You can see below that HubSpot reported 167,386 customers at the end of the quarter, an increase of 8,481 on last quarter. That's in line with the customer growth we have seen over the last couple of quarters, suggesting that the company can maintain its current sales momentum.

Key Takeaways from HubSpot's Q4 Results

With a market capitalization of $17.9 billion, more than $1.41 billion in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

We liked to see that HubSpot beat analysts’ revenue expectations pretty strongly this quarter and guide ahead for revenue next quarter. We were also glad to see the improvement in already robust gross margins as well as continued strong free cash flow generation. Zooming out, we think this was positive quarter from HubSpot. The company is up 11.9% on the results and currently trades at $406 per share.

Should you invest in HubSpot right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.