Sales and marketing software maker Hubspot (NYSE:HUBS) reported Q1 FY2021 results that beat analyst expectations, with revenue up 41.4% year on year to $281 million. Hubspot made a GAAP loss of $23.1 million, down on its loss of $17.7 million, in the same quarter last year.

Hubspot (NYSE:HUBS) Q1 FY2021 Highlights:

- Revenue: $281 million vs analyst estimates of $264 million (6.61% beat)

- EPS (non-GAAP): $0.31 vs analyst estimates of $0.29 (6.01% beat)

- Revenue guidance for Q2 2021 is $295 million at the midpoint, above analyst estimates of $278 million

- The company lifted revenue guidance for the full year, from $1.16 billion to $1.24 billion at the midpoint, a 6.6% increase

- Free cash flow of $61.1 million, up 33.5% from previous quarter

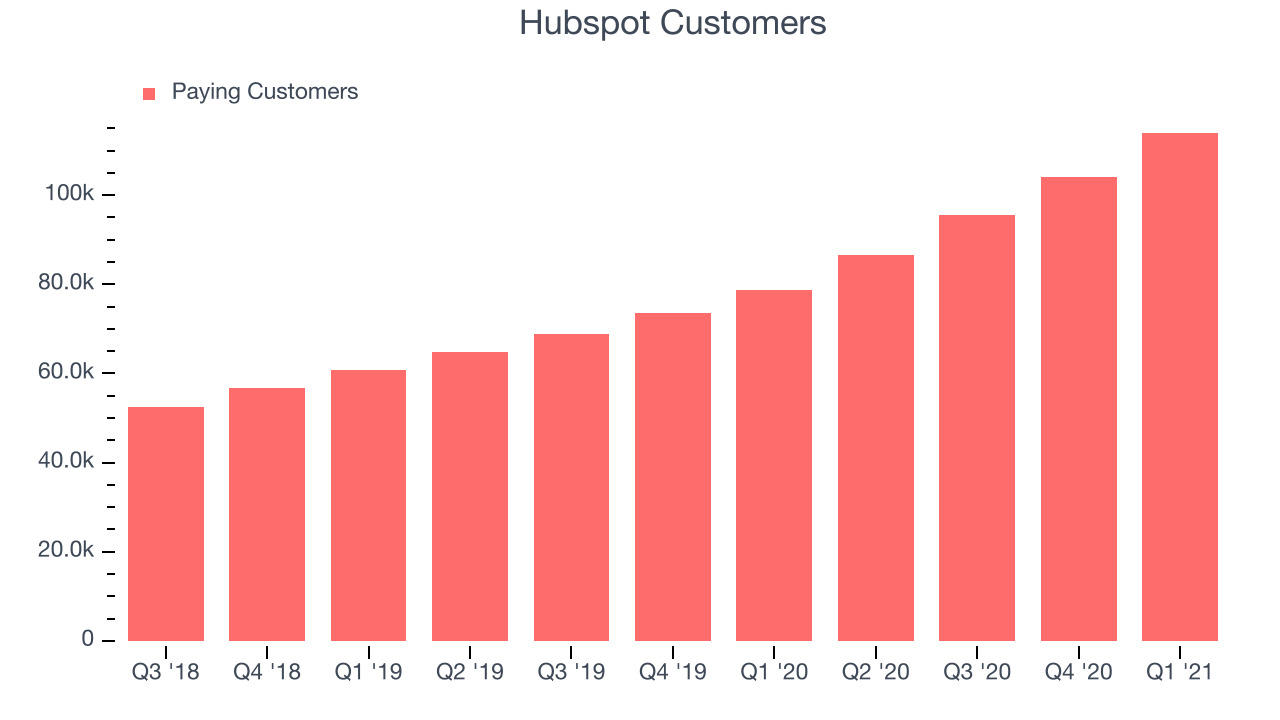

- Customers: 113,925, up from 103,994 in previous quarter

- Gross Margin (GAAP): 80.5%, in line with previous quarter

"We entered 2021 strong with the launch of Operations Hub and another quarter of tremendous growth across the business," said Yamini Rangan, Chief Customer Officer at HubSpot. "We believe there's still a massive opportunity ahead as companies continue to adapt to doing business in a digital-first world. With our powerful and easy-to-use CRM platform, we are well positioned to help our customers through that transition."

How To Be Found

Started in 2006 by two MIT grad students, Hubspot (NYSE:HUBS) is a software as a service platform that helps small and medium size businesses sell, market themselves and get found on the internet. The platform integrates with a company’s website and database and provides easy to use tools to capture visitor’s information, automate email marketing and create content marketing and sales campaigns. Companies using Hubspot are able to analyze their customers' behaviour and optimize the marketing based on who the customers are and what they need.

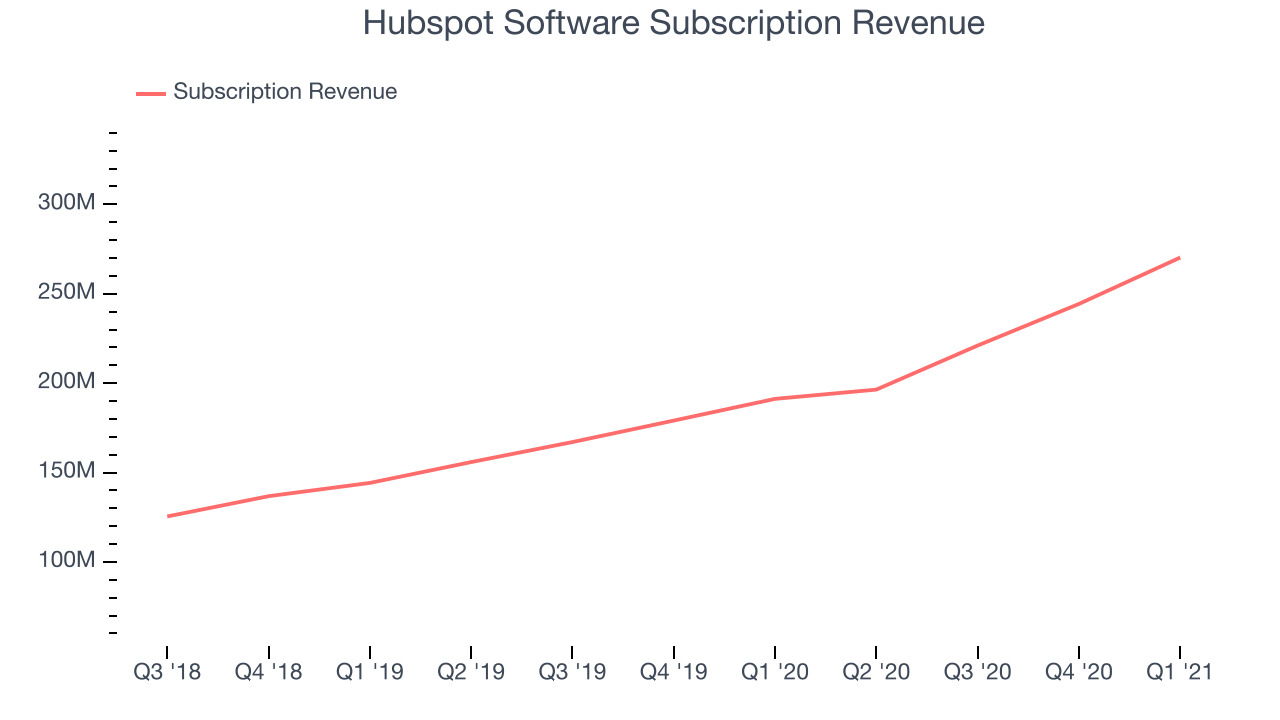

And as you can see below, Hubspot's subscription revenue growth has been very strong over the last twelve months, growing 33.2% from $191 million to $270 million.

And unsurprisingly, this was another great quarter for Hubspot with subscription revenue up an absolutely stunning 41.3% year on year. On top of that, subscription revenue increased $25.9 million quarter on quarter, a solid improvement on the $23.2 million increase in Q4 2020, and even a sign of slight acceleration of growth.

Inbound Go-to-market

Hubspot pioneered the concept of inbound marketing, a strategy where companies attract customers by creating interesting content on topics their customers care about rather than buying ads. Practicing what they preach the company is attracting customers mainly by creating free online content and tools. That seems to be a fit for their business model because with the large number of smaller customers it would be too expensive to hire a classic enterprise sales team to sell to them.

You can see below that Hubspot reported 113,925 customers at the end of the quarter, an increase of 9,931 on last quarter. That is quite a bit better customer growth than last quarter and quite a bit above the typical customer growth we have seen lately, demonstrating that the business itself has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from Hubspot's Q1 Results

Sporting a market capitalisation of $23.4 billion, more than $1.17 billion in cash and operating free cash flow positive over the last twelve months, we're confident that Hubspot has the resources it needs to pursue a high growth business strategy.

We were impressed by the very optimistic revenue guidance Hubspot provided for the next quarter. And we were also excited to see it that it outperformed Wall St’s revenue expectations. Zooming out, we think this impressive quarter should have shareholders feeling very positive. Therefore, we think Hubspot will continue to stand out as a compelling growth stock, arguably even more so than before.

PS. Have you noticed we published this analysis in less than 300 seconds since Hubspot made their numbers public? We use technology until now only reserved for the top hedge funds to provide you with the fastest earnings analysis on the market. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.