Sales and marketing software maker HubSpot (NYSE:HUBS) announced better-than-expected results in Q3 FY2023, with revenue up 25.6% year on year to $557.6 million. Revenue guidance for the full year also exceeded analysts' estimates. Turning to EPS, HubSpot made a non-GAAP profit of $1.59 per share, improving from its profit of $0.69 per share in the same quarter last year.

Is now the time to buy HubSpot? Find out by accessing our full research report, it's free.

HubSpot (HUBS) Q3 FY2023 Highlights:

- Revenue: $557.6 million vs analyst estimates of $534.4 million (4.3% beat)

- EPS (non-GAAP): $1.59 vs analyst estimates of $1.24 (27.9% beat)

- Revenue Guidance for Q4 2023 is $557 million at the midpoint, roughly in line with what analysts were expecting

- Free Cash Flow of $64.74 million, similar to the previous quarter

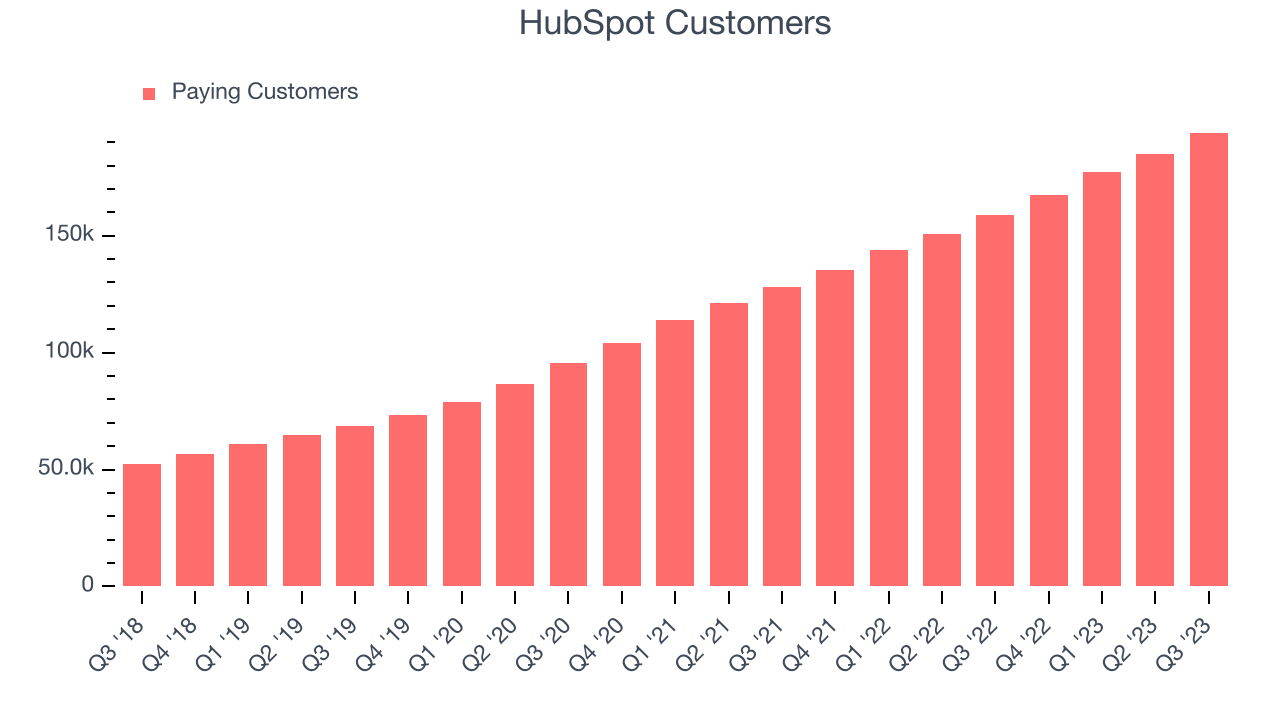

- Customers: 194,098, up from 184,924 in the previous quarter

- Gross Margin (GAAP): 84.3%, up from 81.5% in the same quarter last year

“We had another quarter of strong momentum, driven by the team’s focused execution and rapid product innovation as we make progress towards becoming the #1 customer platform for scaling companies,” said Yamini Rangan, Chief Executive Officer at HubSpot.

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software-as-a-service platform that helps small and medium-sized businesses market themselves, sell, and get found on the internet.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

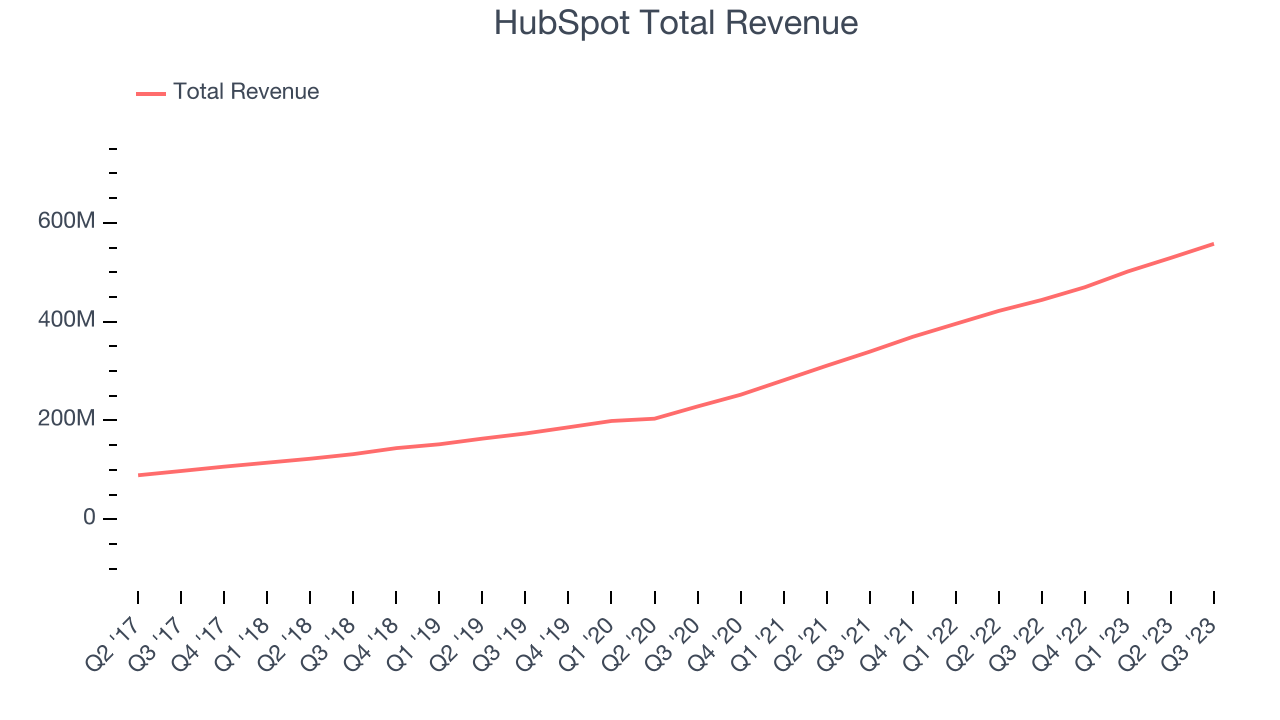

Sales Growth

As you can see below, HubSpot's revenue growth has been very strong over the last two years, growing from $339.2 million in Q3 FY2021 to $557.6 million this quarter.

This quarter, HubSpot's quarterly revenue was once again up a very solid 25.6% year on year. Quarter on quarter, its revenue increased by $28.42 million in Q3, which was roughly in line with the Q2 2023 increase. This steady growth shows that the company can maintain a strong growth trajectory.

Next quarter's guidance suggests that HubSpot is expecting revenue to grow 18.6% year on year to $557 million, slowing down from the 27.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 17.8% over the next 12 months before the earnings results announcement.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Customer Growth

HubSpot reported 194,098 customers at the end of the quarter, an increase of 9,174 from the previous quarter. That's a little better customer growth than last quarter and a fair bit above the typical growth we've seen in past quarters, demonstrating that the business has strong sales momentum. We've no doubt shareholders will take this as an indication that HubSpot's go-to-market strategy is working very well.

Key Takeaways from HubSpot's Q3 Results

With a market capitalization of $21.9 billion, a $1.60 billion cash balance, and positive free cash flow over the last 12 months, we're confident that HubSpot has the resources needed to pursue a high-growth business strategy.

It was good to see HubSpot beat analysts' revenue expectations this quarter. We were also glad its customer growth accelerated and free cash flow improved. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 9.1% after reporting and currently trades at $482.55 per share.

So should you invest in HubSpot right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.