As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q2. Today we are looking at the sales software stocks, starting with HubSpot (NYSE:HUBS).

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality, coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrate data analytics with sales and marketing functions.

The 5 sales software stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 2.44%, while on average next quarter revenue guidance was 1.12% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital and while some of the sales software stocks have fared somewhat better than others, they have not been spared, with share prices declining 6.21% since the previous earnings results, on average.

HubSpot (NYSE:HUBS)

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software as a service platform that helps small and medium-size businesses sell, market themselves, and get found on the internet.

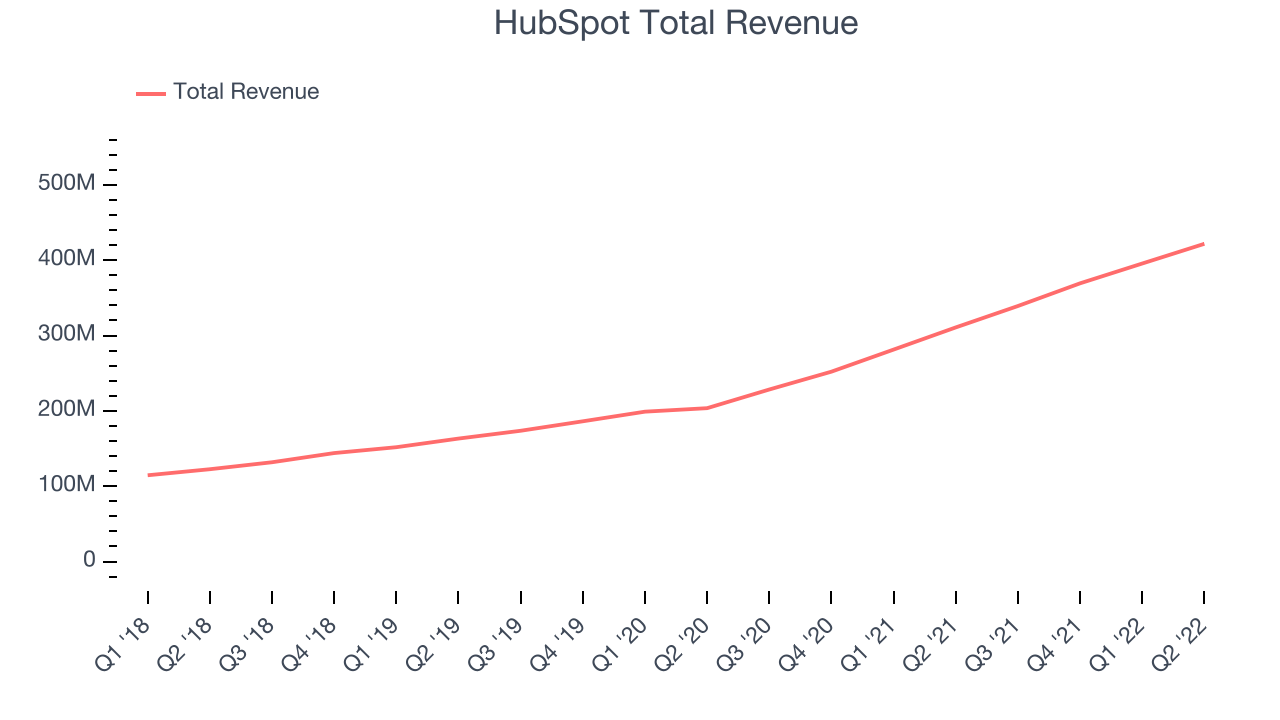

HubSpot reported revenues of $421.7 million, up 35.7% year on year, beating analyst expectations by 3.02%. Despite the solid topline results, it was a weak quarter for the company, with guidance for both the next quarter and full year missing analysts' expectations.

"Our solid results in the second quarter were driven by strong product innovation and a deep understanding of what our customers need to adapt to this macroeconomic climate," said Yamini Rangan, Chief Executive Officer at HubSpot.

The stock is down 22.3% since the results and currently trades at $275.80.

Is now the time to buy HubSpot? Access our full analysis of the earnings results here, it's free.

Best Q2: ZoomInfo (NASDAQ:ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

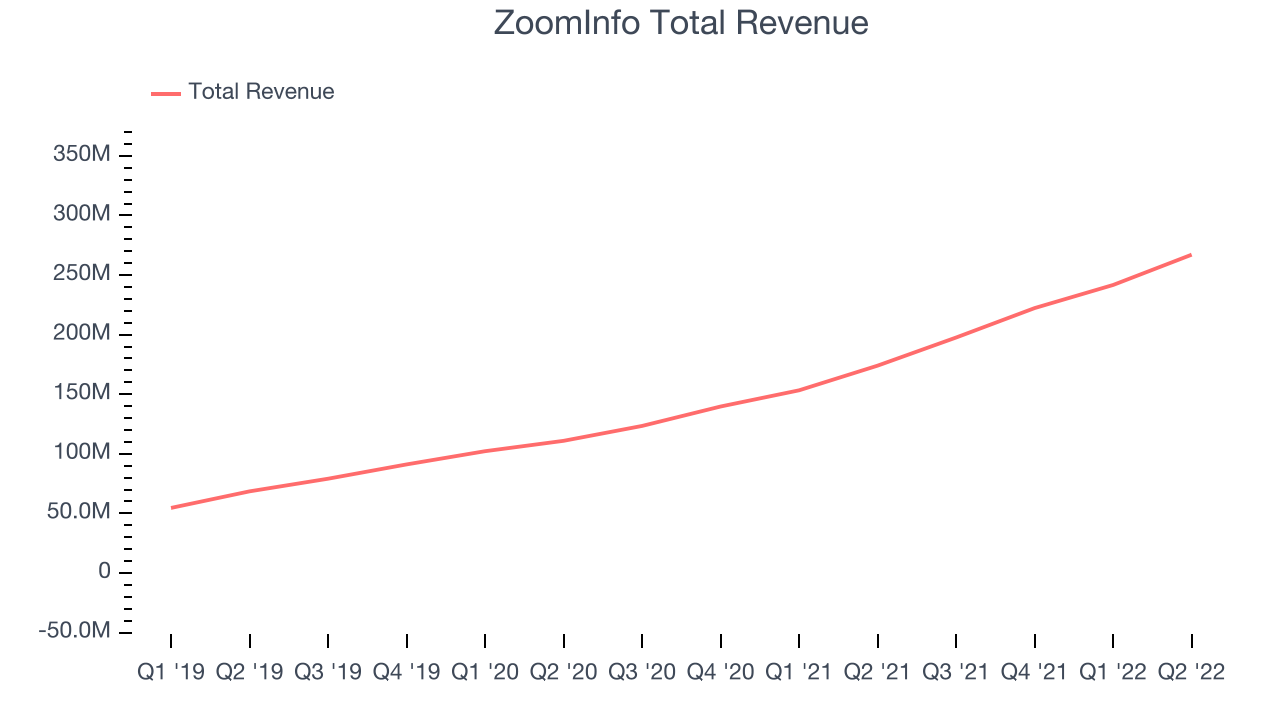

ZoomInfo reported revenues of $267.1 million, up 53.5% year on year, beating analyst expectations by 5.3%. It was a strong quarter for the company, with an exceptional revenue growth and a solid beat of analyst estimates.

ZoomInfo scored the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 140 enterprise customers paying more than $100,000 annually to a total of 1,763. The stock is up 7.28% since the results and currently trades at $40.50.

Is now the time to buy ZoomInfo? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Salesforce (NYSE:CRM)

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software as a service platform that helps companies access, manage and share sales information.

Salesforce reported revenues of $7.72 billion, up 21.7% year on year, in line with analyst expectations. It was a weak quarter for the company, with guidance for both the next quarter and the full year missing analysts' expectations.

Salesforce had the weakest performance against analyst estimates, slowest revenue growth, and weakest full year guidance update in the group. The stock is down 17.5% since the results and currently trades at $148.92.

Read our full analysis of Salesforce's results here.

Freshworks (NASDAQ:FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium sized businesses.

Freshworks reported revenues of $121.4 million, up 37.4% year on year, beating analyst expectations by 2.95%. It was a slower quarter for the company, with an underwhelming revenue guidance for the next quarter.

The company added 573 enterprise customers paying more than $5,000 annually to a total of 16,212. The stock is down 0.21% since the results and currently trades at $13.89.

Read our full, actionable report on Freshworks here, it's free.

Zendesk (NYSE:ZEN)

Founded in 2006 by three Danish friends who got tired of implementing complex old-school solutions, Zendesk (NYSE:ZEN) is a software as a service platform that makes it easier for companies to provide help and support to their customers.

Zendesk reported revenues of $407.2 million, up 27.9% year on year, in line with analyst expectations. It was a mixed quarter for the company, with a strong top line growth but a decline in gross margin.

The stock is up 1.81% since the results and currently trades at $76.45.

Zendesk has agreed to be acquired by a group of buyout firms led by Hellman & Friedman and Permira in an all-cash transaction that values Zendesk at approximately $10.2 billion

Read our full, actionable report on Zendesk here, it's free.

The author has no position in any of the stocks mentioned