Boat and marine products retailer MarineMax (NYSE:HZO) missed analysts' expectations in Q1 CY2024, with revenue up 2.2% year on year to $582.9 million. It made a non-GAAP profit of $0.18 per share, down from its profit of $1.23 per share in the same quarter last year.

Is now the time to buy MarineMax? Find out by accessing our full research report, it's free.

MarineMax (HZO) Q1 CY2024 Highlights:

- Revenue: $582.9 million vs analyst estimates of $590.2 million (1.2% miss)

- EPS (non-GAAP): $0.18 vs analyst estimates of $0.67 (-$0.49 miss)

- Gross Margin (GAAP): 32.7%, down from 35.2% in the same quarter last year

- Same-Store Sales were up 2% year on year

- Store Locations: 83 at quarter end, increasing by 5 over the last 12 months

- Market Capitalization: $606.1 million

“Although we continue to operate in a challenging market environment, as evidenced by industrywide larger than expected declines in boat registrations, we drove an increase in sales in the second quarter. Our gross margin also remains strong as a direct result of the strategic growth in our higher-margin businesses,” said Brett McGill, Chief Executive Officer and President of MarineMax.

Appropriately headquartered in Clearwater, Florida, MarineMax (NYSE:HZO) sells boats, yachts, and other marine products.

Boat & Marine Retailer

Retailers that sell boats and marine products sell products, sure, but they also sell an image and lifestyle to an often wealthier customer. Unlike a car–which many use daily to get to/from work and to run personal and family errands–a boat or yacht is certainly a discretionary, luxury, nice-to-have purchase. While there is online competition, especially for research and discovery, the boat and yacht market is still very brick-and-mortar based given the magnitude of the purchase and the logistical costs associated with moving these products over long distances.

Sales Growth

MarineMax is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

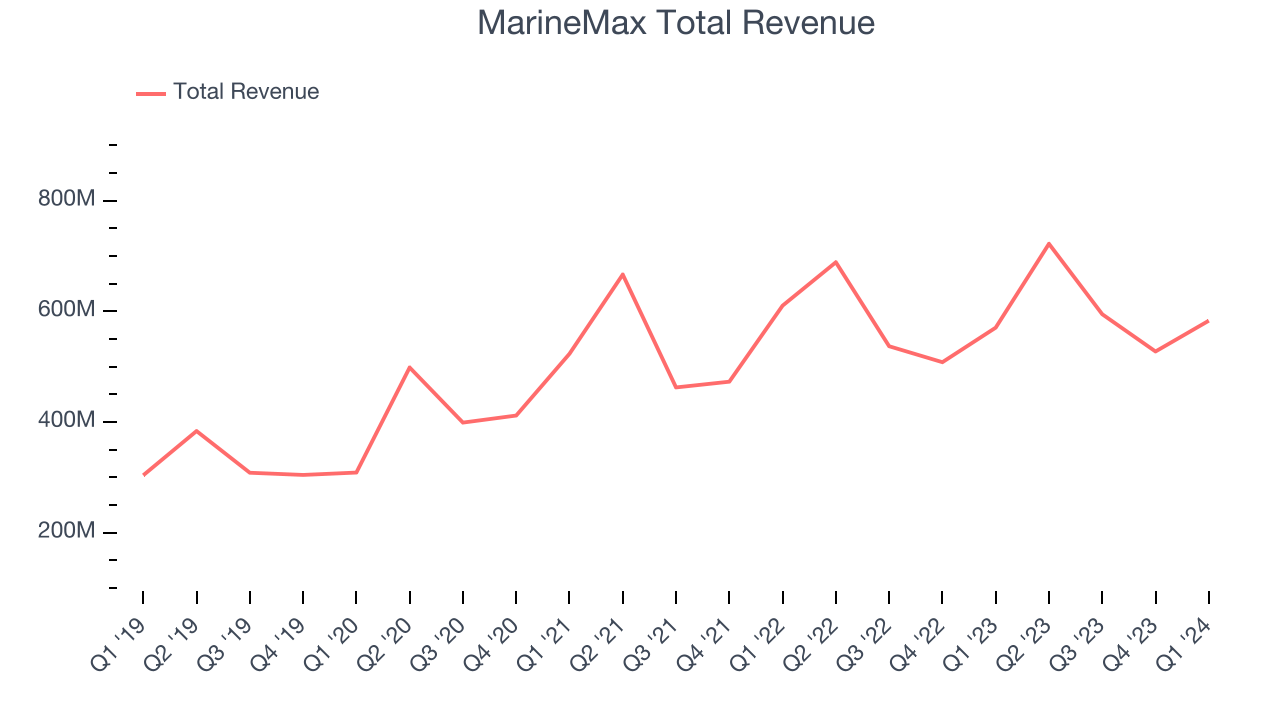

As you can see below, the company's annualized revenue growth rate of 14.8% over the last five years was solid despite not opening many new stores, implying that growth was driven by increased sales at existing, established stores.

This quarter, MarineMax's revenue grew 2.2% year on year to $582.9 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.3% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

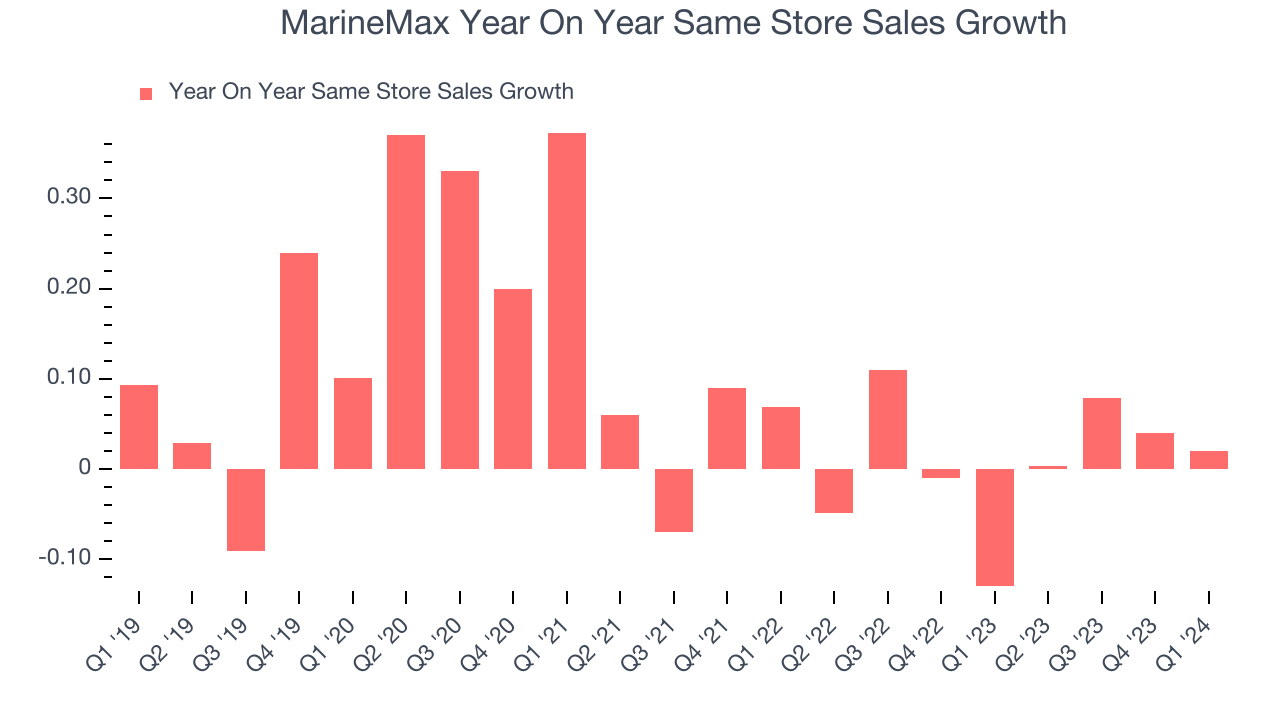

MarineMax's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, MarineMax's same-store sales rose 2% year on year. This growth was a well-appreciated turnaround from the 13% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from MarineMax's Q1 Results

We struggled to find many strong positives in these results. Its revenue and EPS missed analysts as its same-store sales fell short of analysts' expectations (2% vs estimates of 4%). Management was forced to use more aggressive promotional activity to stimulate demand as it cited a challenging market environment; there was an industrywide decline in boat registrations this quarter.

As a result of the macroeconomic softness, MarineMax significantly lowered its full-year earnings forecast (EPS and EBITDA), missing Wall Street's estimates.

During the quarter, the company completed its acquisition of William Tenders USA, a luxury yacht tender.

Overall, this was a bad quarter for MarineMax. The stock is down 8.9% after reporting and currently trades at $27.18 per share.

So should you invest in MarineMax right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.