Internet of Things company Samsara (NYSE:IOT) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 37.4% year on year to $280.7 million. The company expects next quarter's revenue to be around $289 million, in line with analysts' estimates. It made a GAAP loss of $0.10 per share, improving from its loss of $0.13 per share in the same quarter last year.

Is now the time to buy Samsara? Find out by accessing our full research report, it's free.

Samsara (IOT) Q1 CY2024 Highlights:

- Revenue: $280.7 million vs analyst estimates of $272.4 million (3.1% beat)

- EPS: -$0.10 vs analyst estimates of -$0.13 (23.5% beat)

- Revenue Guidance for Q2 CY2024 is $289 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 75.6%, up from 71.8% in the same quarter last year

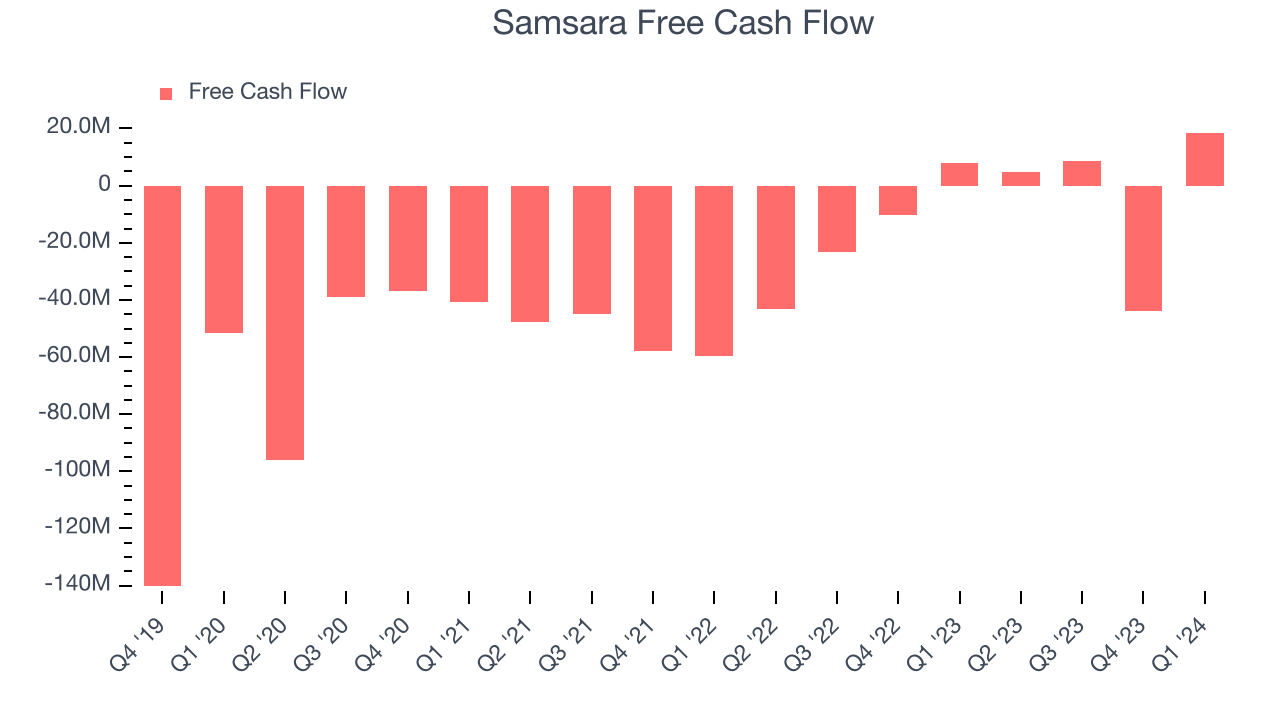

- Free Cash Flow of $18.61 million is up from -$43.97 million in the previous quarter

- Market Capitalization: $18.73 billion

One of the few public companies where Marc Andreessen is a Board member, Samsara (NYSE:IOT) provides software and hardware to track industrial equipment, assets, and fleets.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Sales Growth

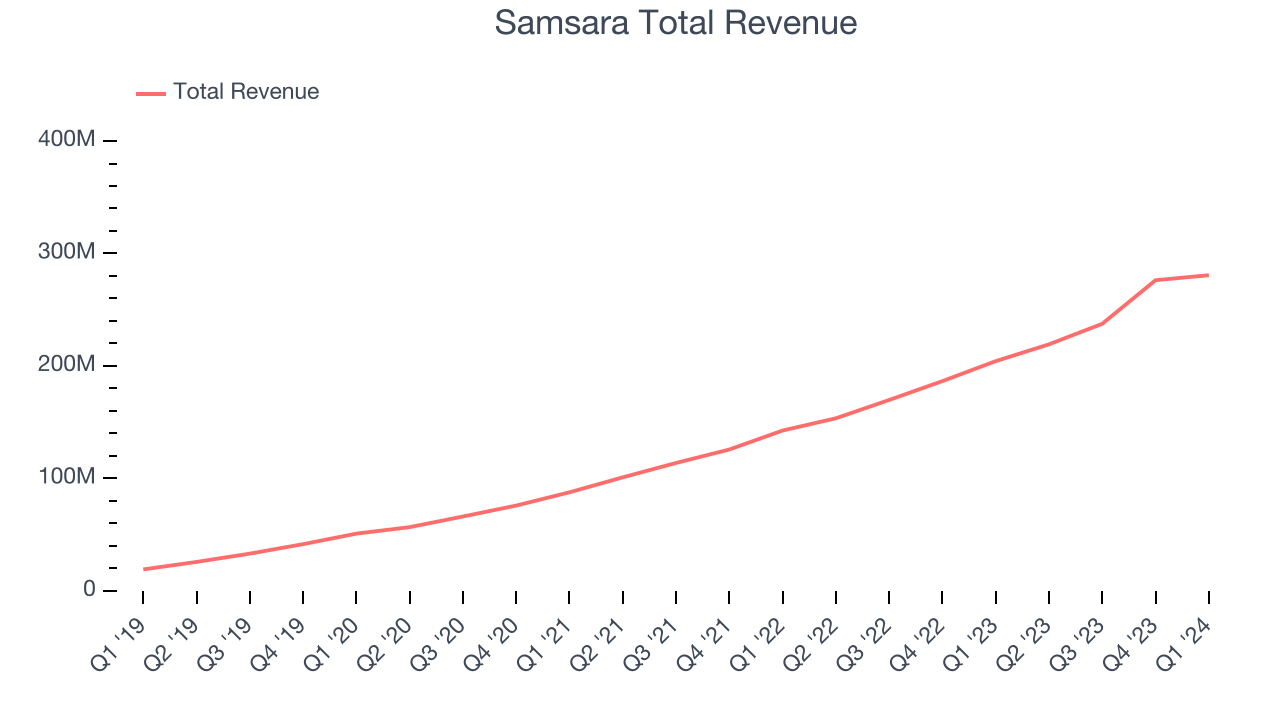

As you can see below, Samsara's revenue growth has been exceptional over the last three years, growing from $87.73 million in Q1 2022 to $280.7 million this quarter.

Unsurprisingly, this was another great quarter for Samsara with revenue up 37.4% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $4.45 million in Q1 compared to $38.74 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Samsara is expecting revenue to grow 31.8% year on year to $289 million, slowing down from the 42.8% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 24.9% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Samsara's free cash flow came in at $18.61 million in Q1, up 134% year on year.

Samsara has burned through $12.12 million of cash over the last 12 months, resulting in a negative 1.2% free cash flow margin. This low FCF margin stems from Samsara's constant need to reinvest in its business to stay competitive.

Key Takeaways from Samsara's Q1 Results

Samsara had a fantastic "beat and raise" quarter. In layman's terms, it topped analysts' revenue and EPS expectations and exceeded their full-year revenue and EPS estimates. Shareholders should feel optimistic about these results. Given its high valuation and the recent run-up in its stock price over the last few days, however, the market was likely expecting more. The stock is down 6.2% after reporting and currently trades at $32.65 per share.

So should you invest in Samsara right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.