Building products manufacturer JELD-WEN (NYSE:JELD) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 13.2% year on year to $934.7 million. The company’s full-year revenue guidance of $3.73 billion at the midpoint came in 4.6% below analysts’ estimates. Its non-GAAP profit of $0.32 per share was also 20.7% below analysts’ consensus estimates.

Is now the time to buy JELD-WEN? Find out by accessing our full research report, it’s free.

JELD-WEN (JELD) Q3 CY2024 Highlights:

- Revenue: $934.7 million vs analyst estimates of $990.6 million (5.6% miss)

- Adjusted EPS: $0.32 vs analyst expectations of $0.40 (20.7% miss)

- EBITDA: $81.6 million vs analyst estimates of $91.64 million (11% miss)

- The company dropped its revenue guidance for the full year to $3.73 billion at the midpoint from $4 billion, a 6.9% decrease

- EBITDA guidance for the full year is $272.5 million at the midpoint, below analyst estimates of $342.4 million

- Gross Margin (GAAP): 19.2%, down from 20.8% in the same quarter last year

- Operating Margin: -5.6%, down from 4.5% in the same quarter last year

- EBITDA Margin: 8.7%, down from 9.8% in the same quarter last year

- Free Cash Flow was -$4.4 million, down from $86.18 million in the same quarter last year

- Organic Revenue fell 13% year on year (-8.4% in the same quarter last year)

- Market Capitalization: $1.20 billion

Company Overview

Founded in the 1960s as a general wood-making company, JELD-WEN (NYSE:JELD) manufactures doors, windows, and other related building products.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

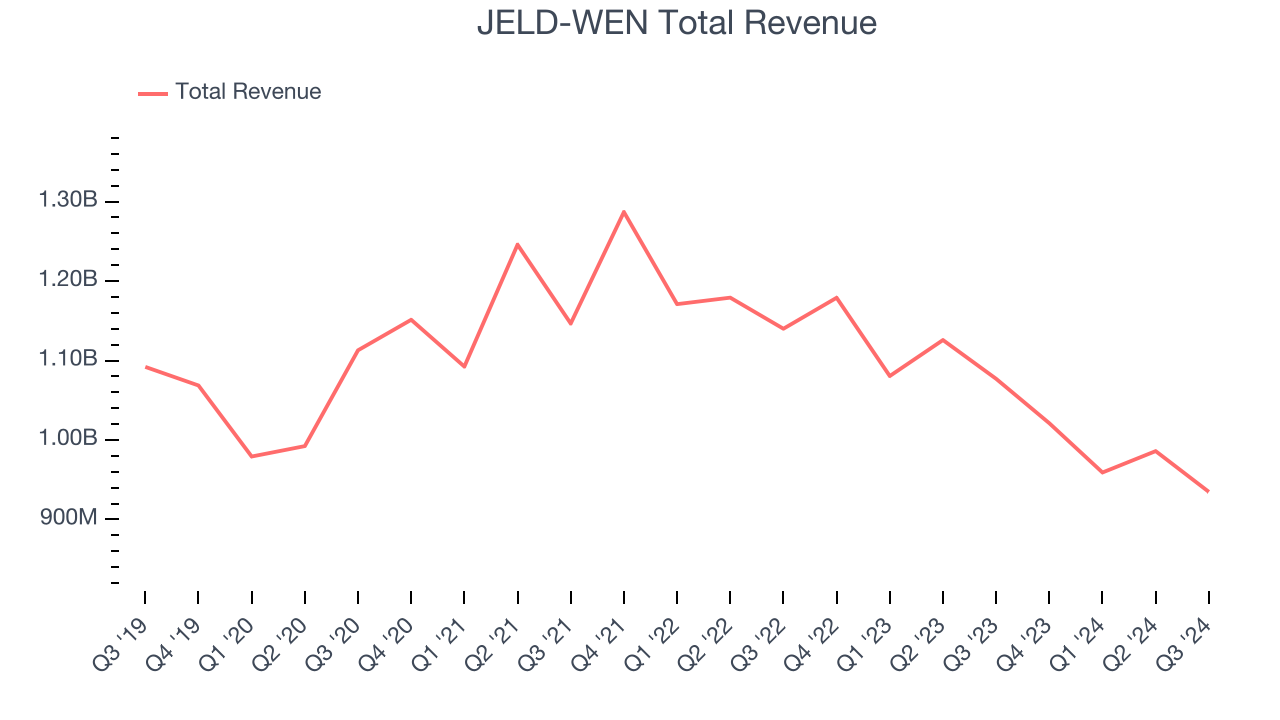

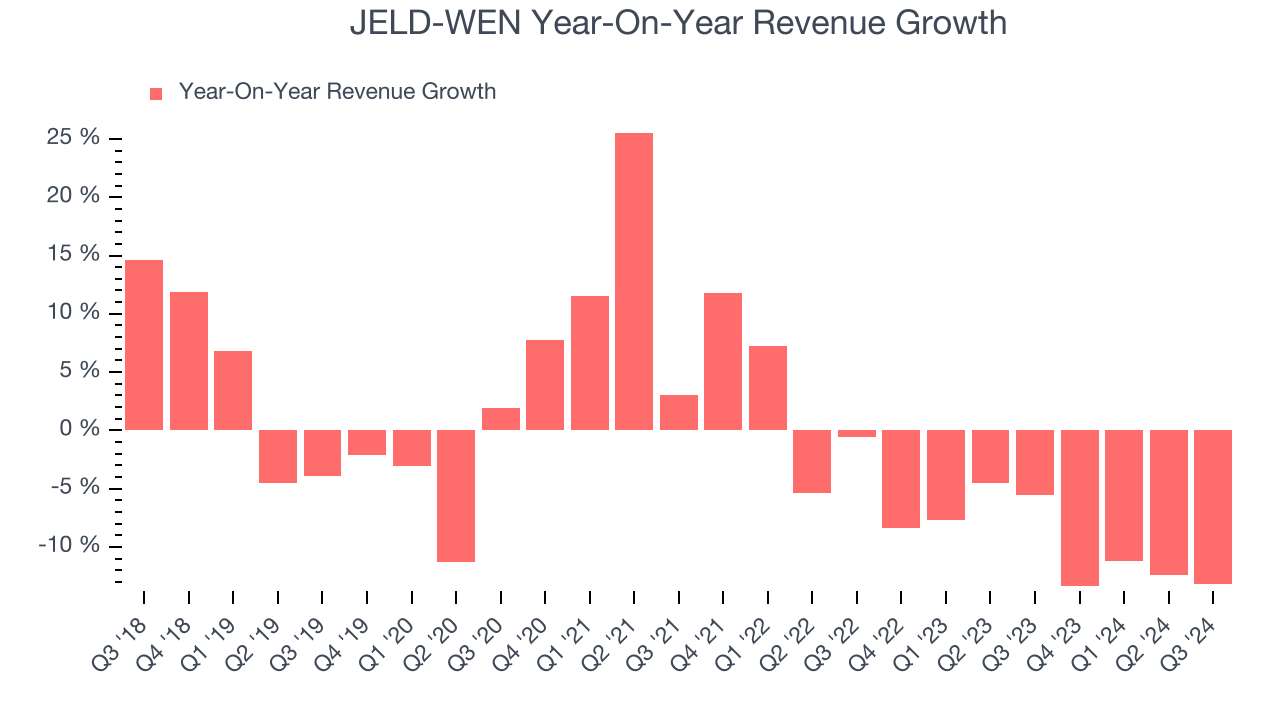

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, JELD-WEN’s revenue declined by 2% per year. This shows demand was weak, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. JELD-WEN’s recent history shows its demand has stayed suppressed as its revenue has declined by 9.6% annually over the last two years.

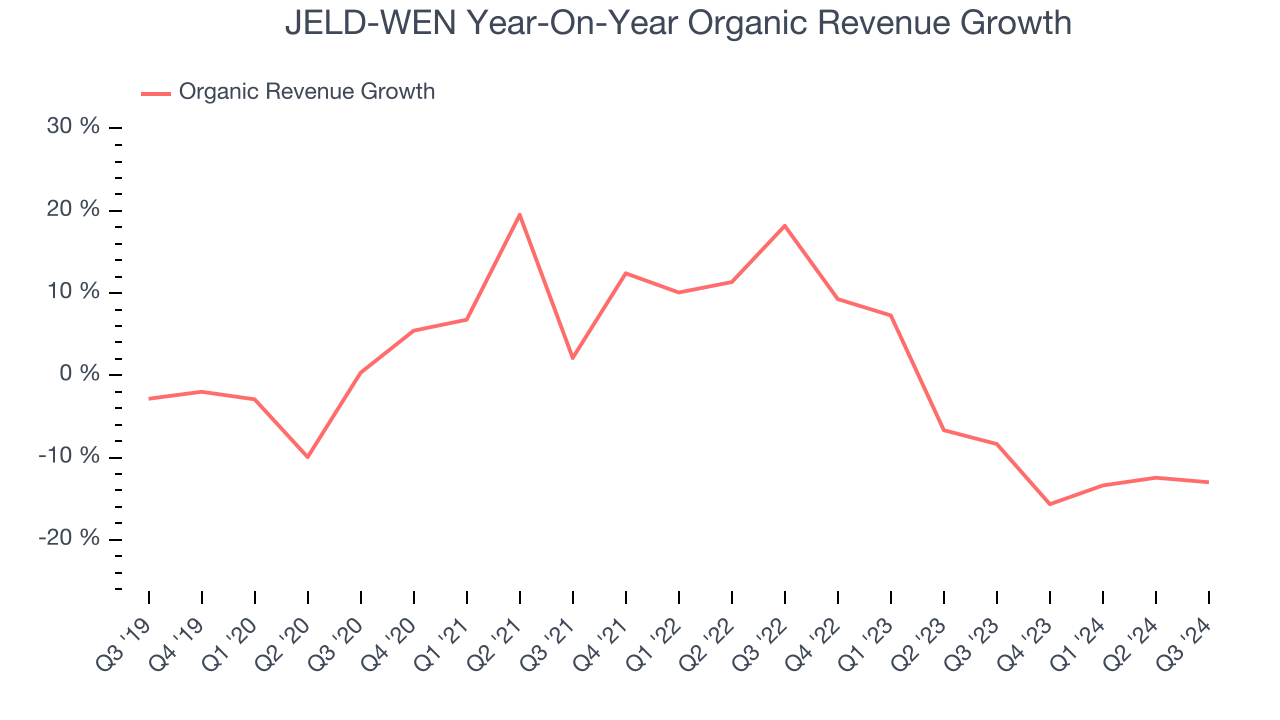

JELD-WEN also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, JELD-WEN’s organic revenue averaged 6.6% year-on-year declines. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline performance.

This quarter, JELD-WEN missed Wall Street’s estimates and reported a rather uninspiring 13.2% year-on-year revenue decline, generating $934.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, an improvement versus the last two years. While this projection indicates the market believes its newer products and services will spur better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

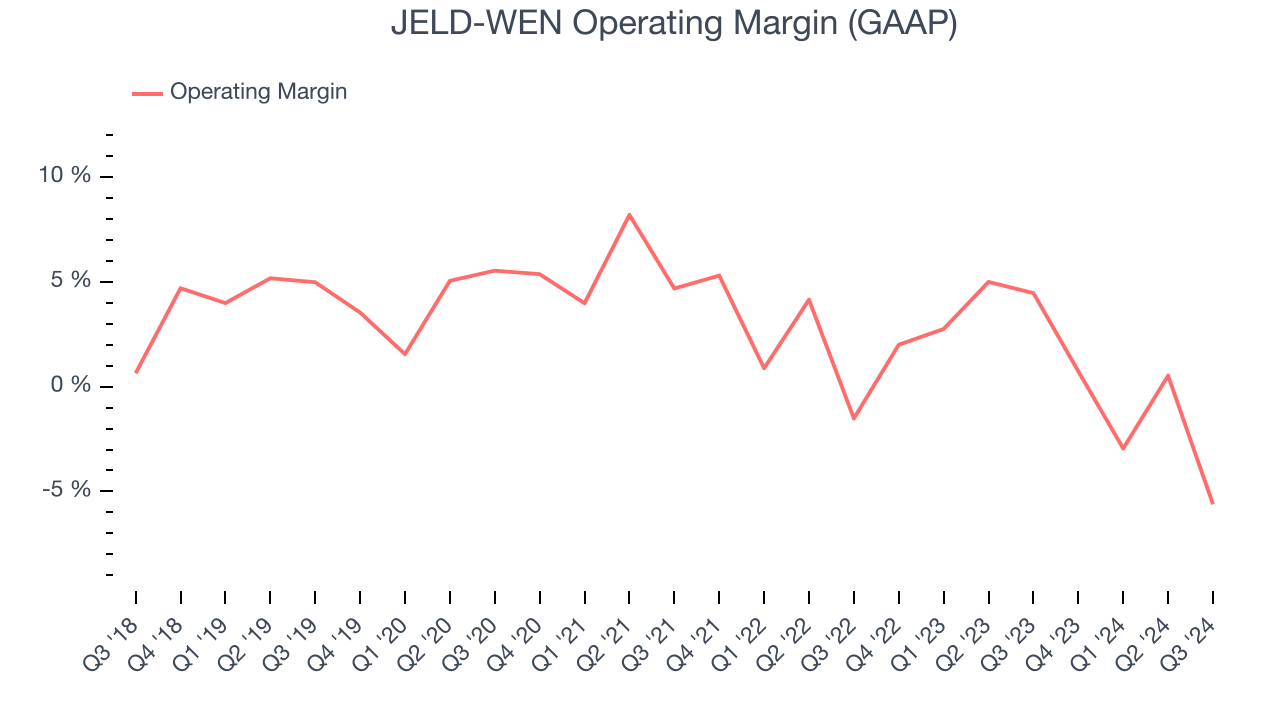

JELD-WEN was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.9% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, JELD-WEN’s annual operating margin decreased by 5.7 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, JELD-WEN generated an operating profit margin of negative 5.6%, down 10.1 percentage points year on year. Since JELD-WEN’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

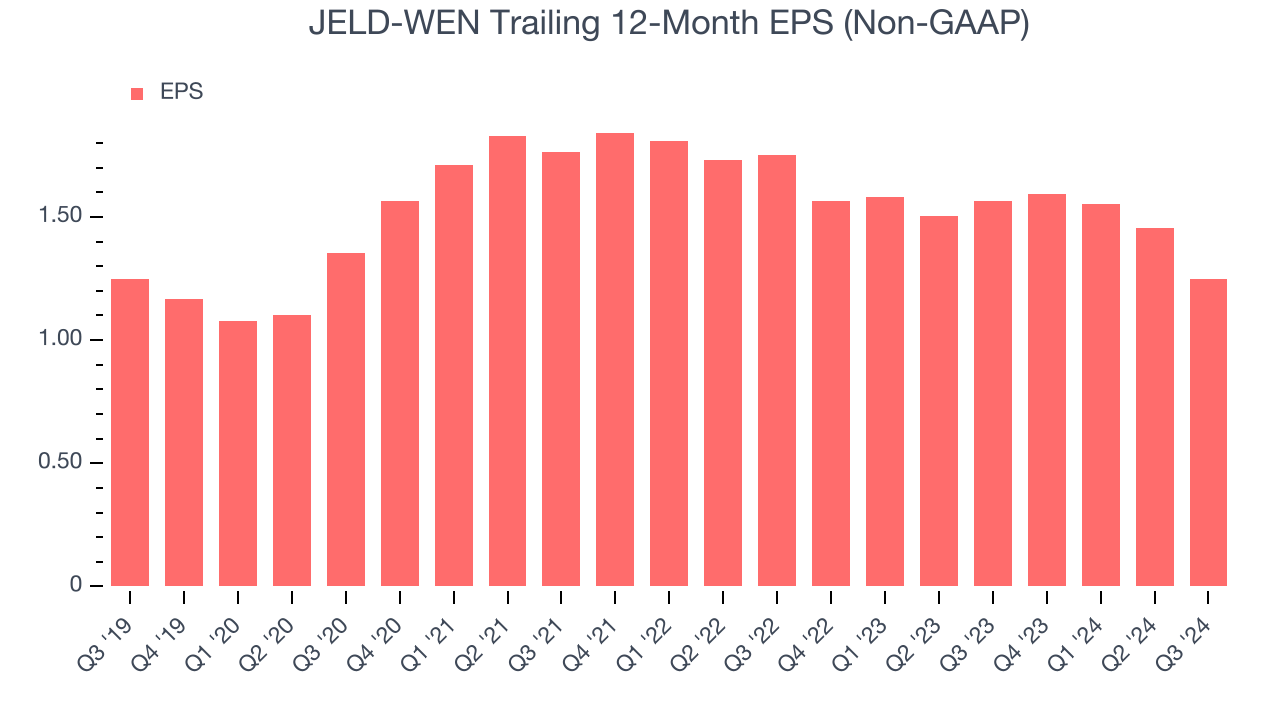

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

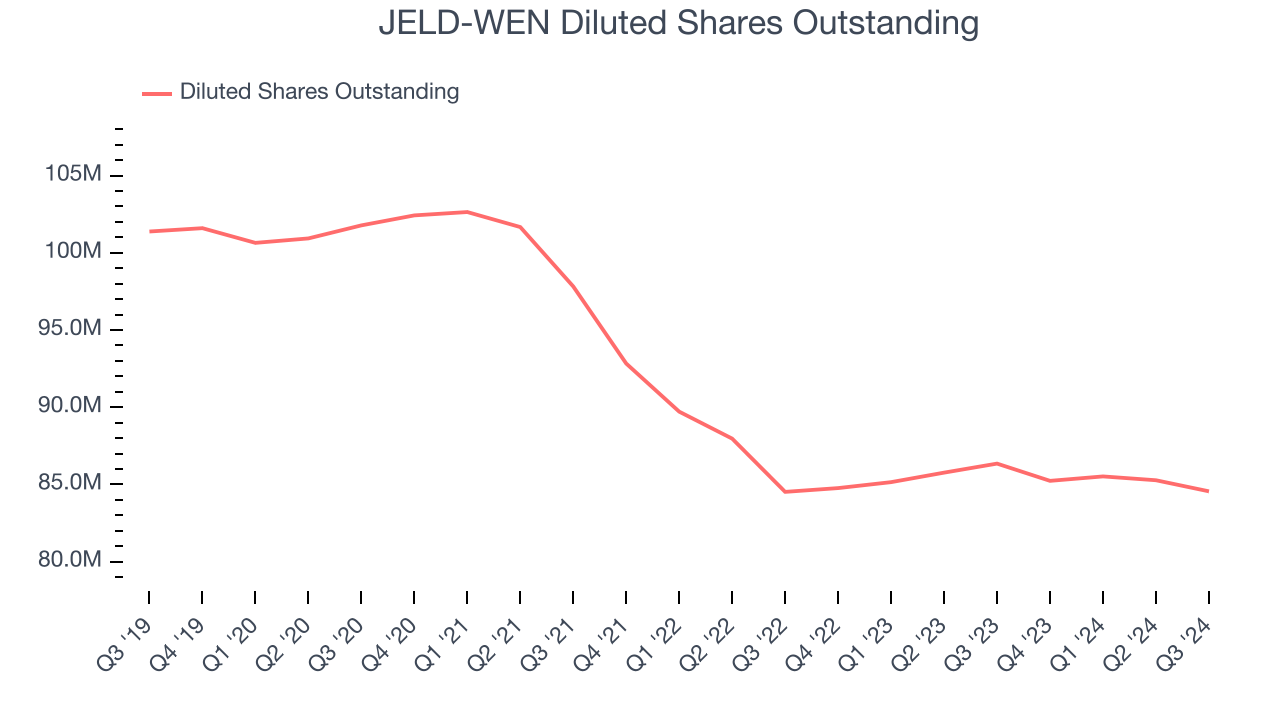

JELD-WEN’s flat EPS over the last five years was weak but better than its 2% annualized revenue declines. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

We can take a deeper look into JELD-WEN’s earnings to better understand the drivers of its performance. A five-year view shows that JELD-WEN has repurchased its stock, shrinking its share count by 16.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For JELD-WEN, its two-year annual EPS declines of 15.6% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.In Q3, JELD-WEN reported EPS at $0.32, down from $0.53 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects JELD-WEN’s full-year EPS of $1.25 to grow by 31.5%.

Key Takeaways from JELD-WEN’s Q3 Results

We struggled to find many strong positives in these results. Revenue and EPS in the quarter missed by a meaningful amount. Its full-year revenue guidance was lowered and also missed. Additionally, its EBITDA guidance for the full year also short of Wall Street’s estimates. Overall, this was a very bad quarter. The stock traded down 25.7% to $10.51 immediately following the results.

The latest quarter from JELD-WEN’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.