As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at home construction materials stocks, starting with JELD-WEN (NYSE:JELD).

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 12 home construction materials stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 2.4% while next quarter’s revenue guidance was 22.9% below.

Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. This year has been a different story as mixed inflation signals have led to market volatility. However, home construction materials stocks have held steady amidst all this with share prices up 2.9% on average since the latest earnings results.

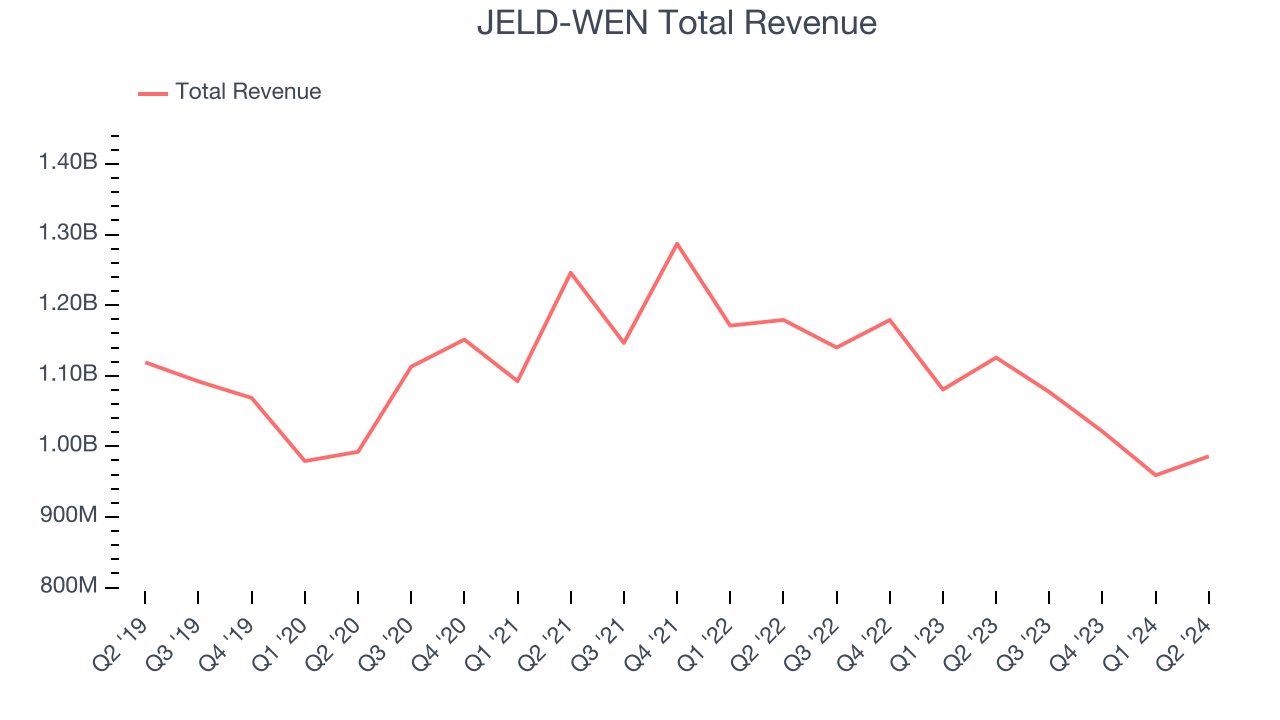

Best Q2: JELD-WEN (NYSE:JELD)

Founded in the 1960s as a general wood-making company, JELD-WEN (NYSE:JELD) manufactures doors, windows, and other related building products.

JELD-WEN reported revenues of $986 million, down 12.4% year on year. This print fell short of analysts’ expectations by 1.4%, but it was still a very strong quarter for the company with an impressive beat of analysts’ organic revenue and earnings estimates.

"We continue to make strides in our transformation journey, positioning JELD-WEN for improved performance," said Chief Executive Officer William J. Christensen.

JELD-WEN delivered the slowest revenue growth of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $14.75.

Is now the time to buy JELD-WEN? Access our full analysis of the earnings results here, it’s free.

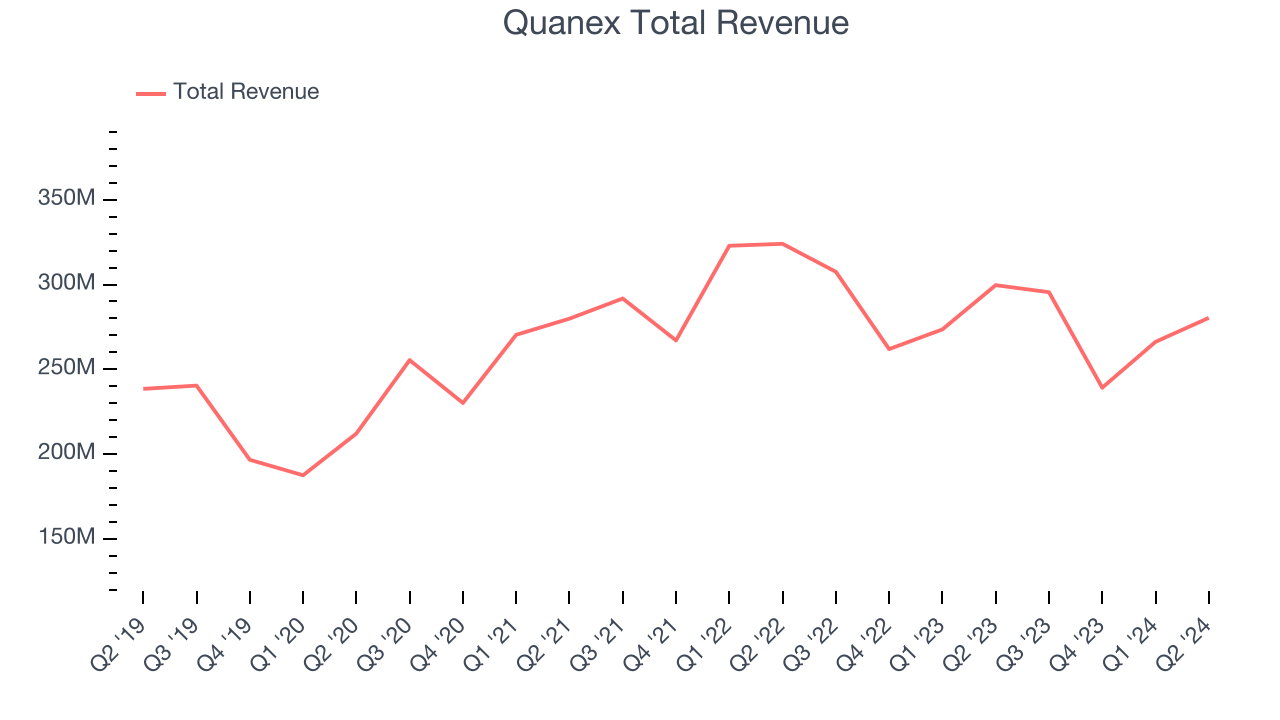

Quanex (NYSE:NX)

Starting in the seamless tube industry, Quanex (NYSE:NX) manufactures building products like window, door, kitchen, and bath cabinet components.

Quanex reported revenues of $280.3 million, down 6.4% year on year, in line with analysts’ expectations. The business had a strong quarter with a solid beat of analysts’ Cabinet Components revenue estimates and a decent beat of analysts’ operating margin estimates.

Quanex delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 11.8% since reporting. It currently trades at $27.78.

Is now the time to buy Quanex? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Gibraltar (NASDAQ:ROCK)

Gibraltar (NASDAQ:ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

Gibraltar reported revenues of $353 million, down 3.3% year on year, falling short of analysts’ expectations by 5.5%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates. In addition, full-year revenue guidance missed analysts’ expectations.

As expected, the stock is down 13.5% since the results and currently trades at $69.41.

Read our full analysis of Gibraltar’s results here.

Masco (NYSE:MAS)

Headquartered just outside of Detroit, MI, Masco (NYSE:MAS) designs and manufactures home-building products such as glass shower doors, decorative lighting, bathtubs, and faucets.

Masco reported revenues of $2.09 billion, down 1.7% year on year. This result was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it also produced a decent beat of analysts’ operating margin estimates but a miss of analysts’ organic revenue estimates.

The stock is up 14.8% since reporting and currently trades at $81.04.

Read our full, actionable report on Masco here, it’s free.

Fortune Brands (NYSE:FBIN)

Targeting a wide customer base of residential and commercial customers, Fortune Brands (NYSE:FBIN) makes plumbing, security, and outdoor living products.

Fortune Brands reported revenues of $1.24 billion, up 6.6% year on year. This print lagged analysts' expectations by 3.1%. It was a softer quarter as it also logged a miss of analysts’ earnings and organic revenue estimates.

The stock is up 16.4% since reporting and currently trades at $84.10.

Read our full, actionable report on Fortune Brands here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.