Luxury department store chain Nordstrom (NYSE:JWN) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 4.8% year on year to $3.34 billion. It made a GAAP loss of $0.24 per share, improving from its loss of $1.27 per share in the same quarter last year.

Is now the time to buy Nordstrom? Find out by accessing our full research report, it's free.

Nordstrom (JWN) Q1 CY2024 Highlights:

- Revenue: $3.34 billion vs analyst estimates of $3.20 billion (4.3% beat)

- Gross Margin (GAAP): 33.9%, down from 36.2% in the same quarter last year (meaningful miss vs. expectations of 35.5%)

- EPS (non-GAAP): -$0.24 vs analyst estimates of -$0.07 (-$0.17 miss)

- Free Cash Flow of $48 million is up from -$90 million in the same quarter last year

- Locations: 365 at quarter end, up from 347 in the same quarter last year

- Market Capitalization: $3.51 billion

"The positive sales growth we saw across the company in the first quarter is very encouraging, and we're particularly excited about the progress that our Rack banner is making," said Erik Nordstrom, chief executive officer of Nordstrom,

Known for its exceptional customer service that features a ‘no questions asked’ return policy, Nordstrom (NYSE:JWN) is a high-end department store chain.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Sales Growth

Nordstrom is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

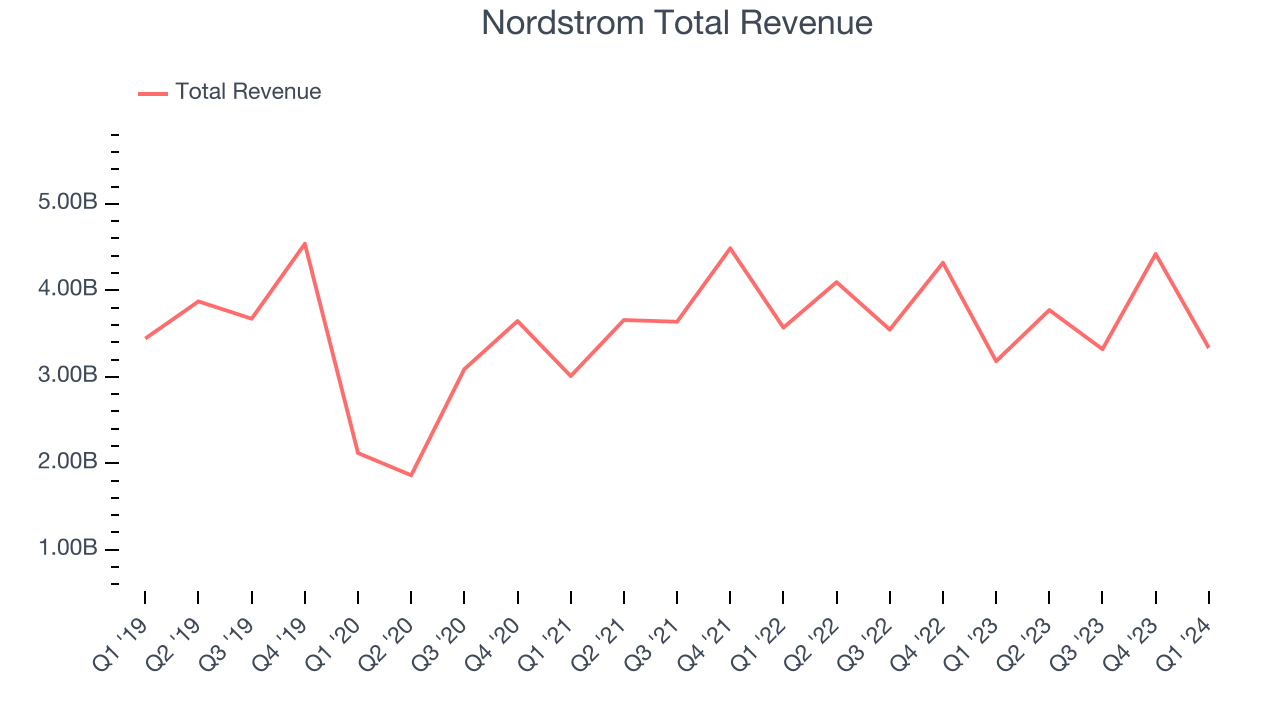

As you can see below, the company's revenue has declined over the last four years, dropping 1.2% annually as it failed to grow its store footprint meaningfully.

This quarter, Nordstrom reported decent year-on-year revenue growth of 4.8%, and its $3.34 billion in revenue topped Wall Street's estimates by 4.3%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Number of Stores

The number of stores a retailer operates is a major factor of how much it can sell and its growth is a critical driver of how quickly its sales can grow.

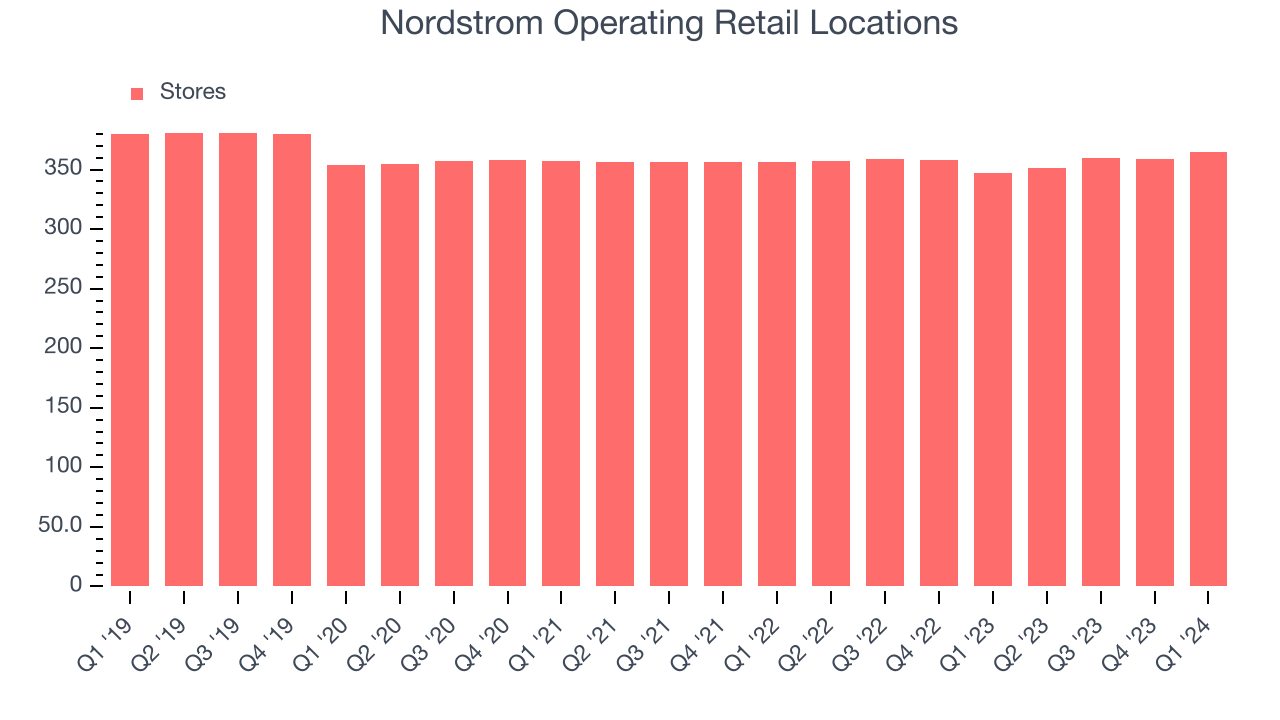

When a retailer like Nordstrom keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. Nordstrom's store count increased by 18 locations, or 5.2%, over the last 12 months to 365 total retail locations in the most recently reported quarter.

Taking a step back, the company has kept its physical footprint more or less flat over the last two years while other consumer retail businesses have opted for growth. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Key Takeaways from Nordstrom's Q1 Results

We liked that Nordstrom beat analysts' revenue expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its gross margin was well below expectations, leading to an EPS miss. Gross margin is important for any company but especially an area of focus for clothing and apparel retailers because misses on this line could mean discounting activity is higher than expected, which could suggest more price competition in the market or a poor inventory position (I have too much winter wear and now need to discount it during Spring to make space on the selling floor). Zooming out, we think this was still a mixed, quarter. The market was likely expecting more, and the stock is down 7.3% after reporting, trading at $19.50 per share.

So should you invest in Nordstrom right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.