Homebuilder KB Home (NYSE:KBH) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 5.2% year on year to $1.39 billion. The company’s full-year revenue guidance of $6.8 billion at the midpoint came in 3.4% below analysts’ estimates. Its GAAP profit of $1.49 per share was 6.4% below analysts’ consensus estimates.

Is now the time to buy KB Home? Find out by accessing our full research report, it’s free.

KB Home (KBH) Q1 CY2025 Highlights:

- Revenue: $1.39 billion vs analyst estimates of $1.5 billion (5.2% year-on-year decline, 7.2% miss)

- EPS (GAAP): $1.49 vs analyst expectations of $1.59 (6.4% miss)

- Adjusted EBITDA: $137 million vs analyst estimates of $187.3 million (9.8% margin, 26.8% miss)

- The company dropped its revenue guidance for the full year to $6.8 billion at the midpoint from $7.25 billion, a 6.2% decrease

- Operating Margin: 9.1%, down from 11.1% in the same quarter last year

- Backlog: $2.20 billion at quarter end, down 21.1% year on year

- Market Capitalization: $4.31 billion

“Consumers are working through affordability concerns and uncertainties related to macroeconomic and geopolitical issues, which are causing them to move slowly in their homebuying decisions,” said Jeffrey Mezger, Chairman and Chief Executive Officer.

Company Overview

The first homebuilder to be listed on the NYSE, KB Home (NYSE:KB) is a homebuilding company targeting the first-time home buyer and move-up buyer markets.

Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Sales Growth

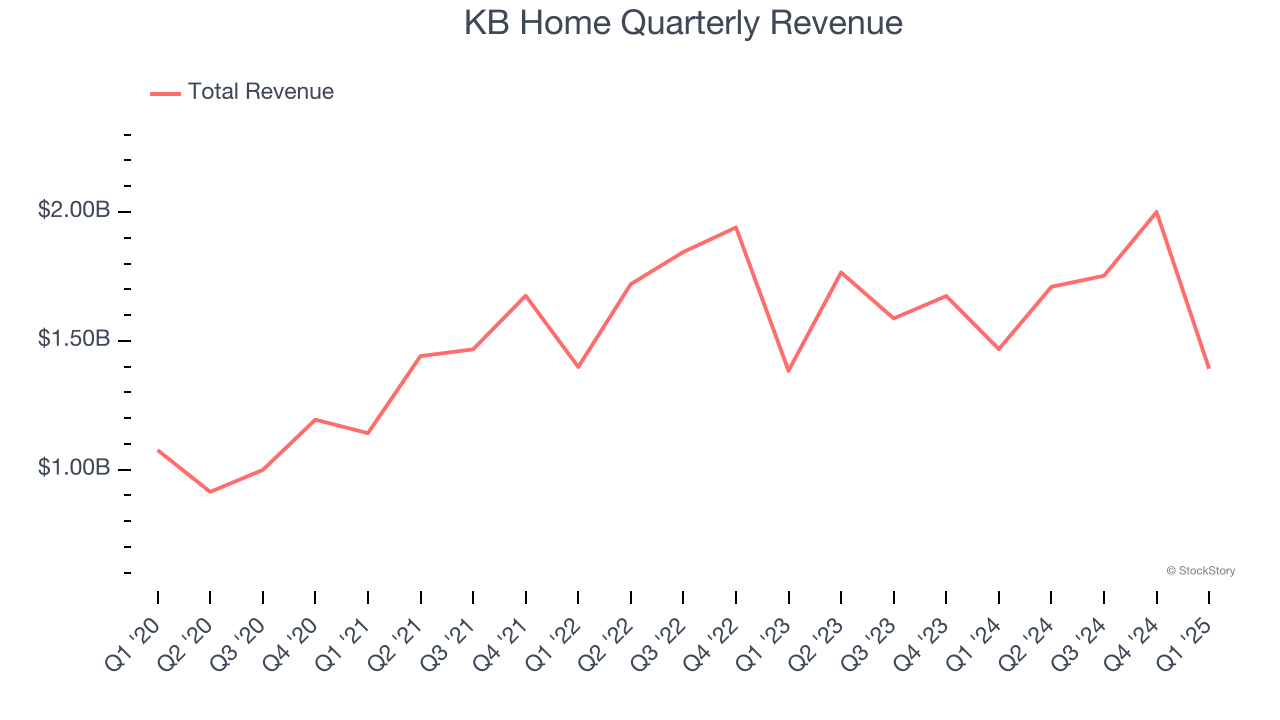

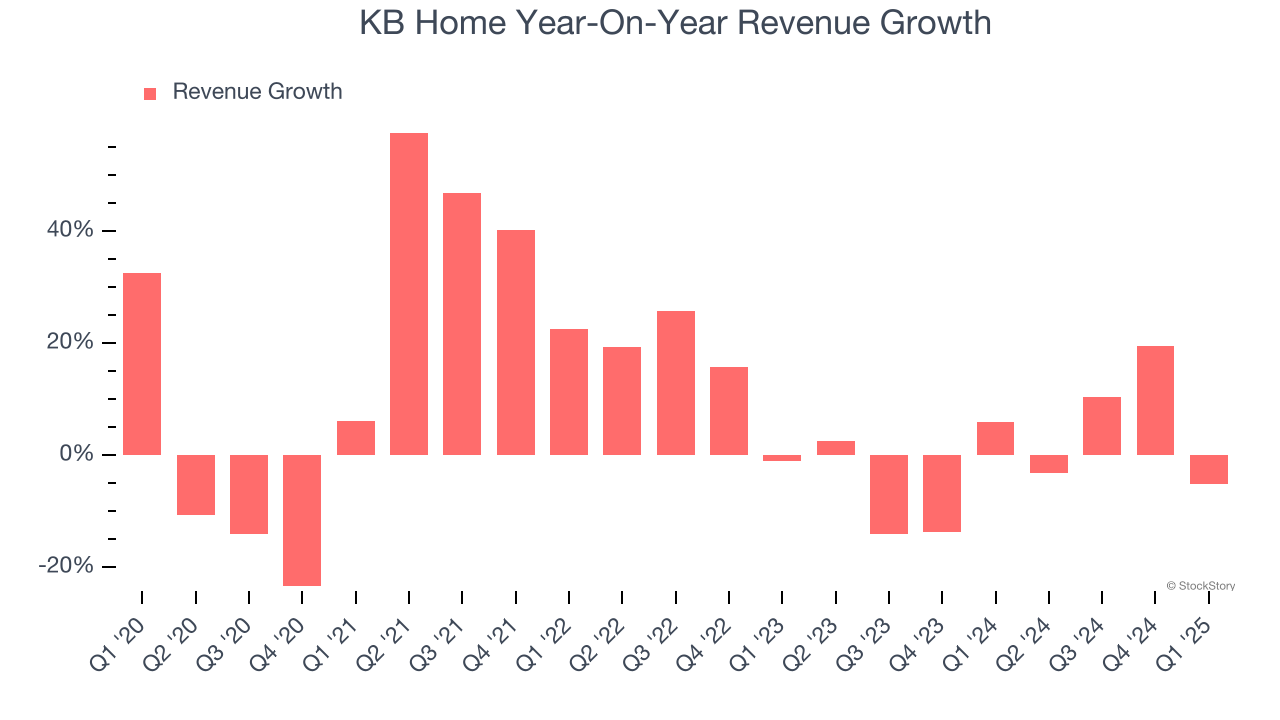

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, KB Home’s 7.3% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. KB Home’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

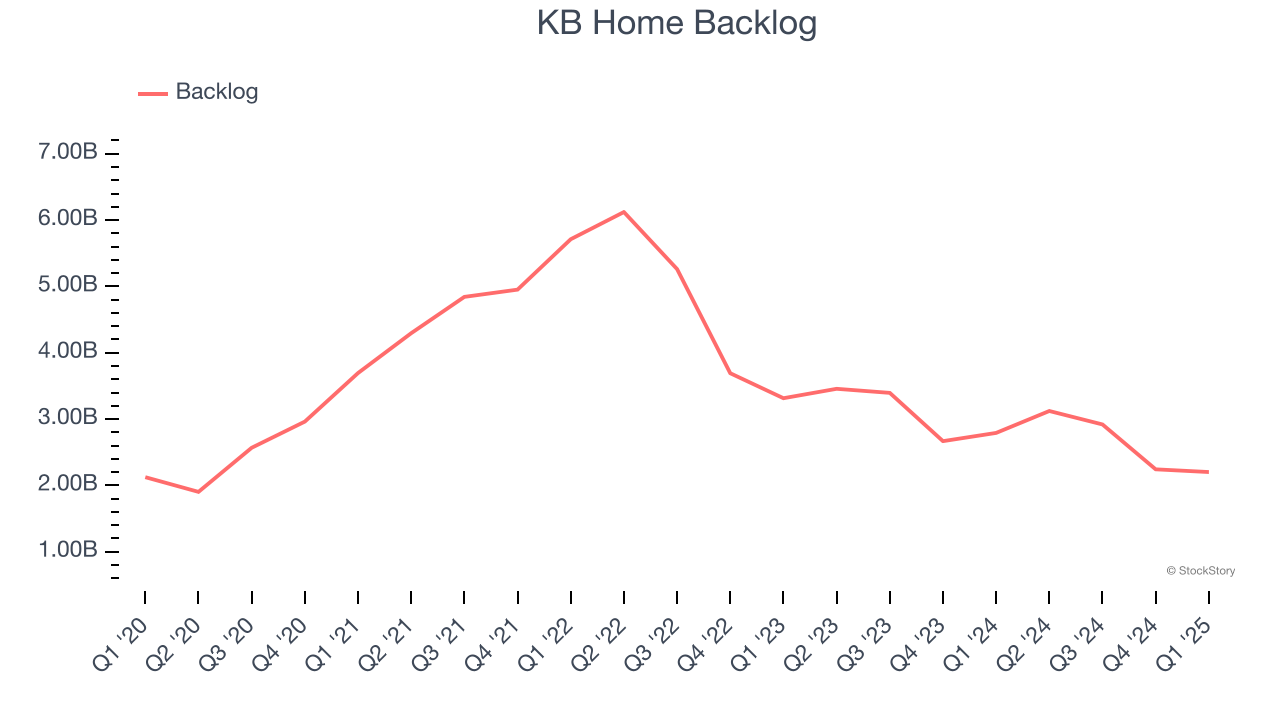

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. KB Home’s backlog reached $2.20 billion in the latest quarter and averaged 22.9% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, KB Home missed Wall Street’s estimates and reported a rather uninspiring 5.2% year-on-year revenue decline, generating $1.39 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

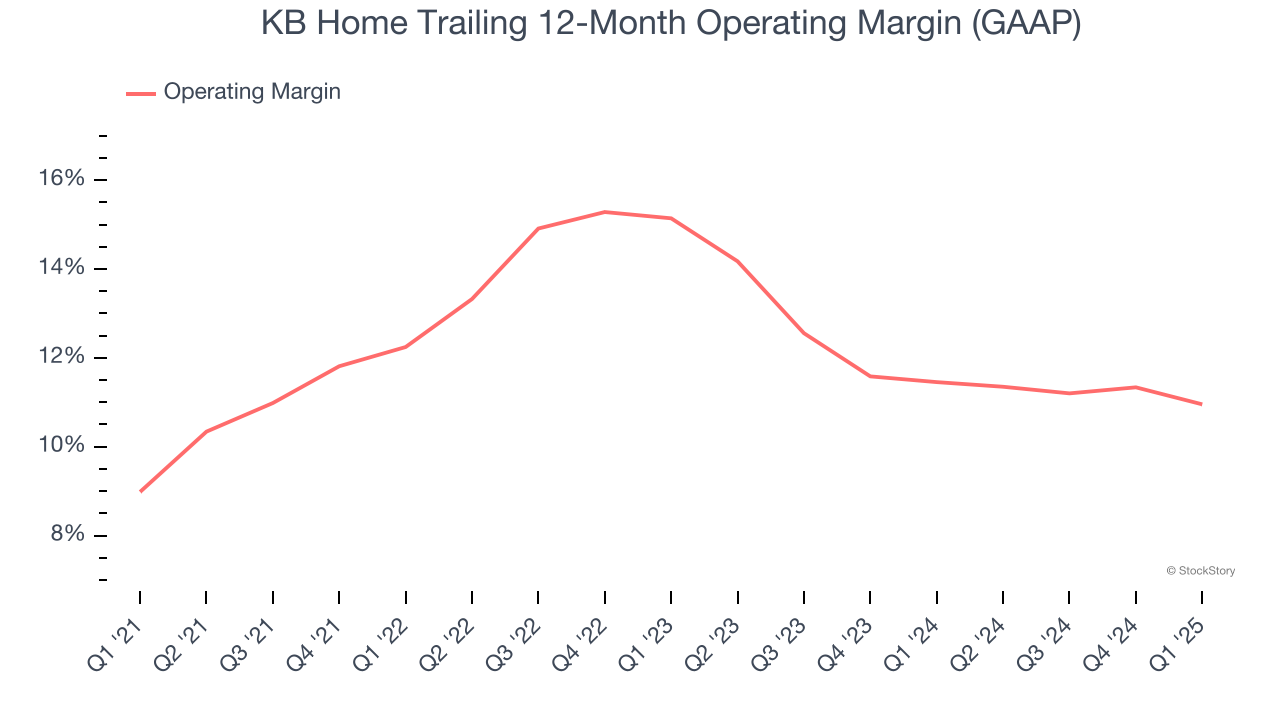

KB Home has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, KB Home’s operating margin rose by 2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, KB Home generated an operating profit margin of 9.1%, down 1.9 percentage points year on year. Since KB Home’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

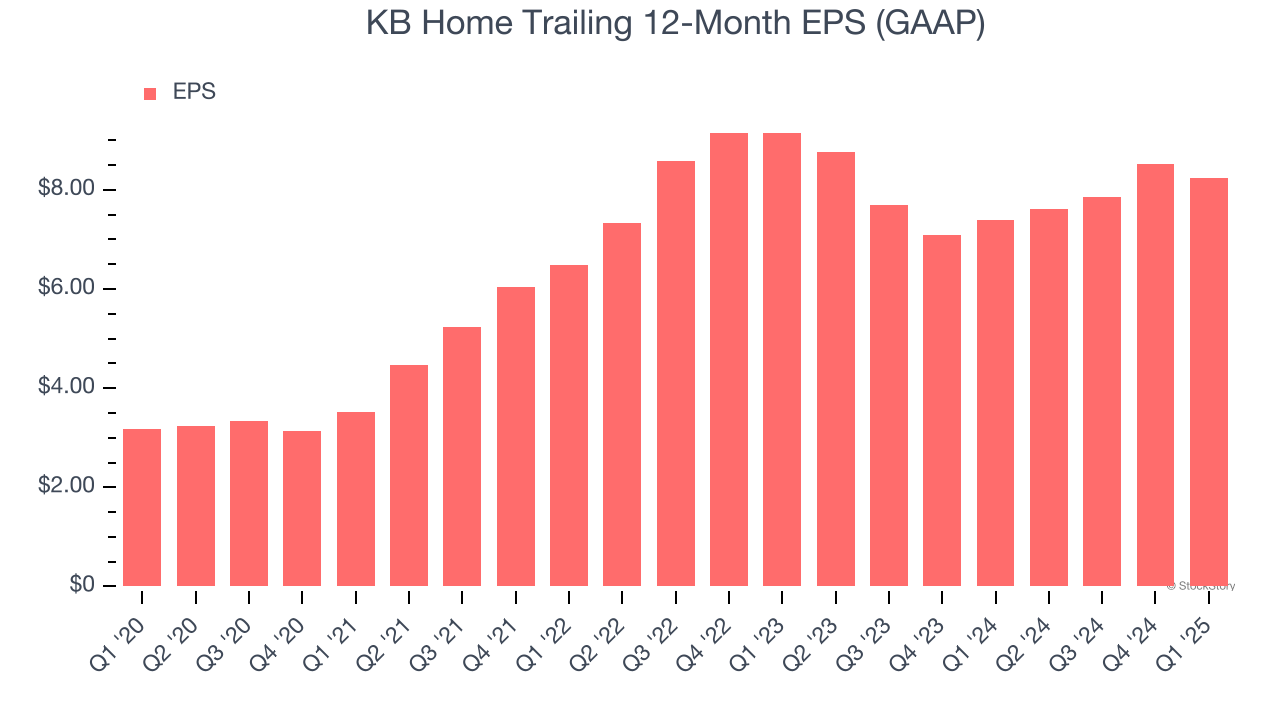

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

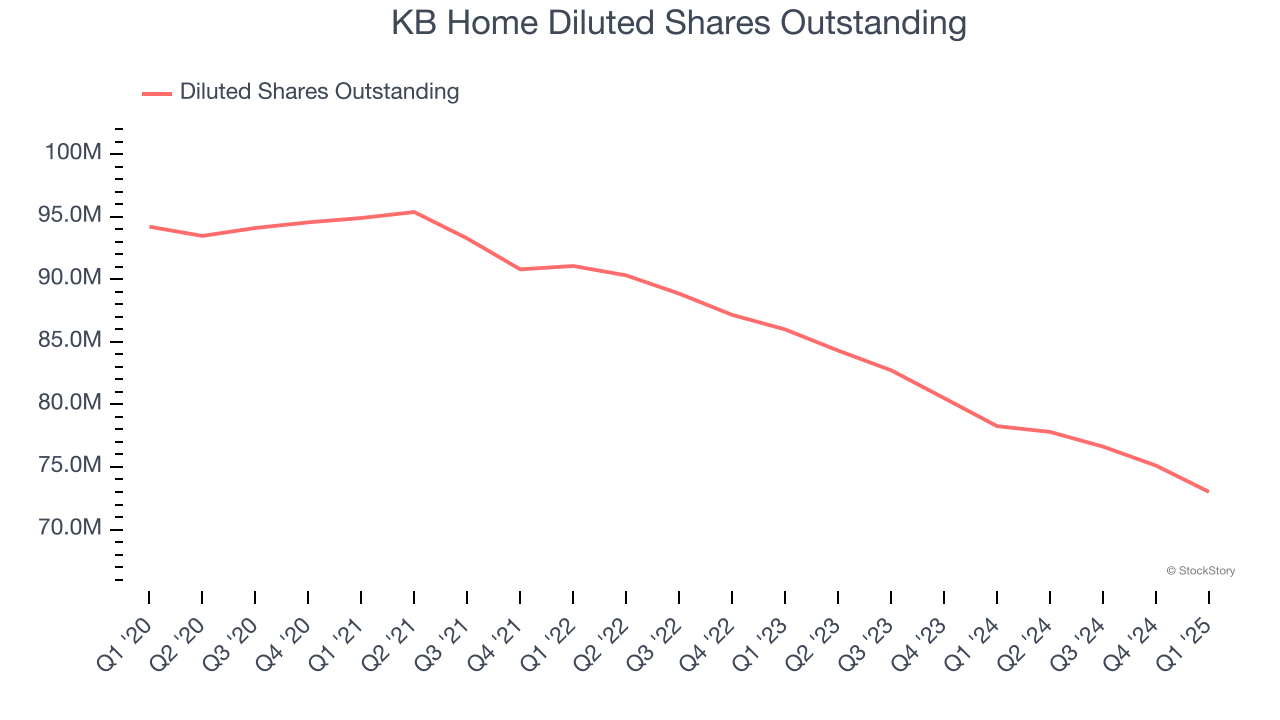

KB Home’s EPS grew at an astounding 21% compounded annual growth rate over the last five years, higher than its 7.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into KB Home’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, KB Home’s operating margin declined this quarter but expanded by 2 percentage points over the last five years. Its share count also shrank by 22.5%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For KB Home, its two-year annual EPS declines of 5.1% mark a reversal from its (seemingly) healthy five-year trend. We hope KB Home can return to earnings growth in the future.

In Q1, KB Home reported EPS at $1.49, down from $1.77 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects KB Home’s full-year EPS of $8.25 to stay about the same.

Key Takeaways from KB Home’s Q1 Results

We struggled to find many positives in these results as it lowered its full-year revenue guidance and missed across all key metrics. Overall, this was a softer quarter. The stock traded down 10.1% to $55.55 immediately following the results.

KB Home underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.