Neighborhood social network Nextdoor (NYSE:KIND) announced better-than-expected results in Q1 CY2024, with revenue up 6.8% year on year to $53.15 million. Guidance for next quarter's revenue was also optimistic at $58 million at the midpoint, 2.8% above analysts' estimates. It made a GAAP loss of $0.07 per share, improving from its loss of $0.09 per share in the same quarter last year.

Is now the time to buy Nextdoor? Find out by accessing our full research report, it's free.

Nextdoor (KIND) Q1 CY2024 Highlights:

- Revenue: $53.15 million vs analyst estimates of $50.81 million (4.6% beat)

- Adjusted EBITDA: ($14.0) million loss vs analyst estimates of ($19.6) million loss (beat)

- EPS: -$0.07 vs analyst estimates of -$0.09 (22.2% beat)

- Revenue Guidance for Q2 CY2024 is $58 million at the midpoint, above analyst estimates of $56.4 million (adjusted EBITDA guidance for the period also slightly ahead)

- Gross Margin (GAAP): 81.2%, up from 80.1% in the same quarter last year

- Free Cash Flow was -$13.65 million compared to -$14.94 million in the previous quarter

- Weekly Active Users: 43.4 million, up 1 million year on year

- Market Capitalization: $866 million

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

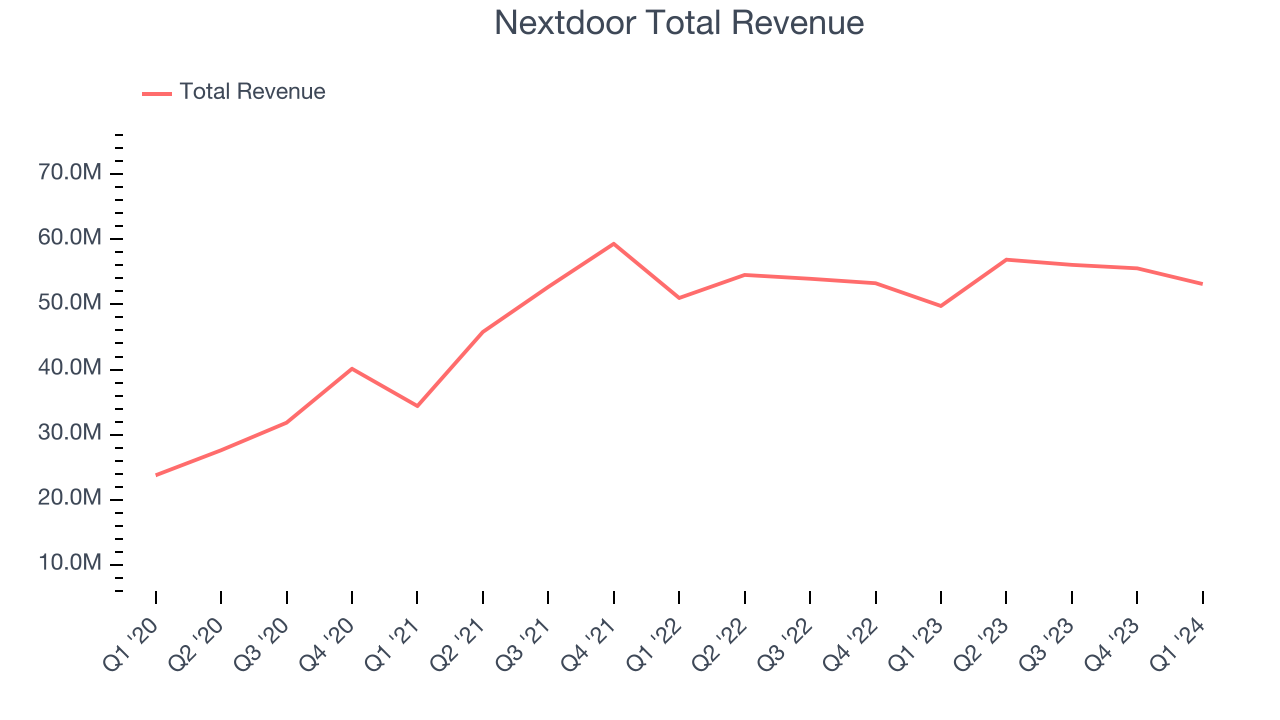

Sales Growth

Nextdoor's revenue growth over the last three years has been strong, averaging 21.3% annually. This quarter, Nextdoor beat analysts' estimates but reported mediocre 6.8% year-on-year revenue growth.

Guidance for the next quarter indicates Nextdoor is expecting revenue to grow 2% year on year to $58 million, slowing from the 4.3% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 7.4% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

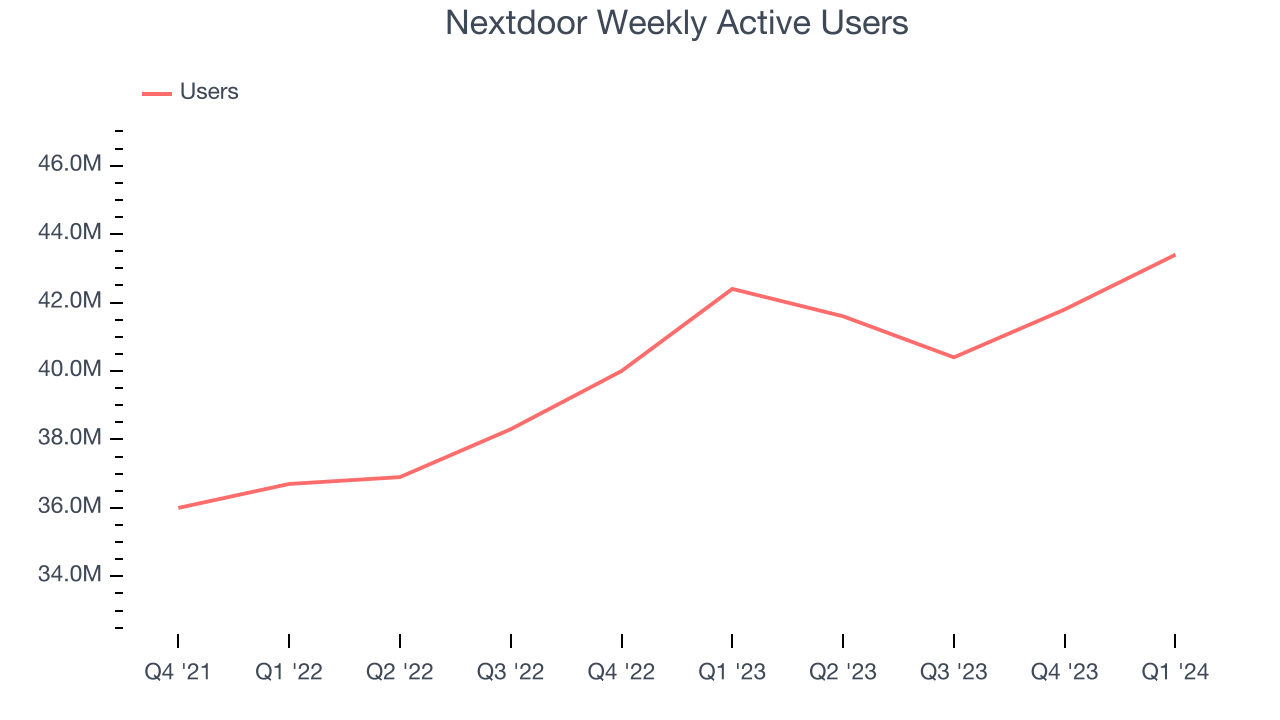

Usage Growth

As a social network, Nextdoor generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Nextdoor's monthly active users, a key performance metric for the company, grew 8.6% annually to 43.4 million. This is decent growth for a consumer internet company.

In Q1, Nextdoor added 1 million monthly active users, translating into 2.4% year-on-year growth.

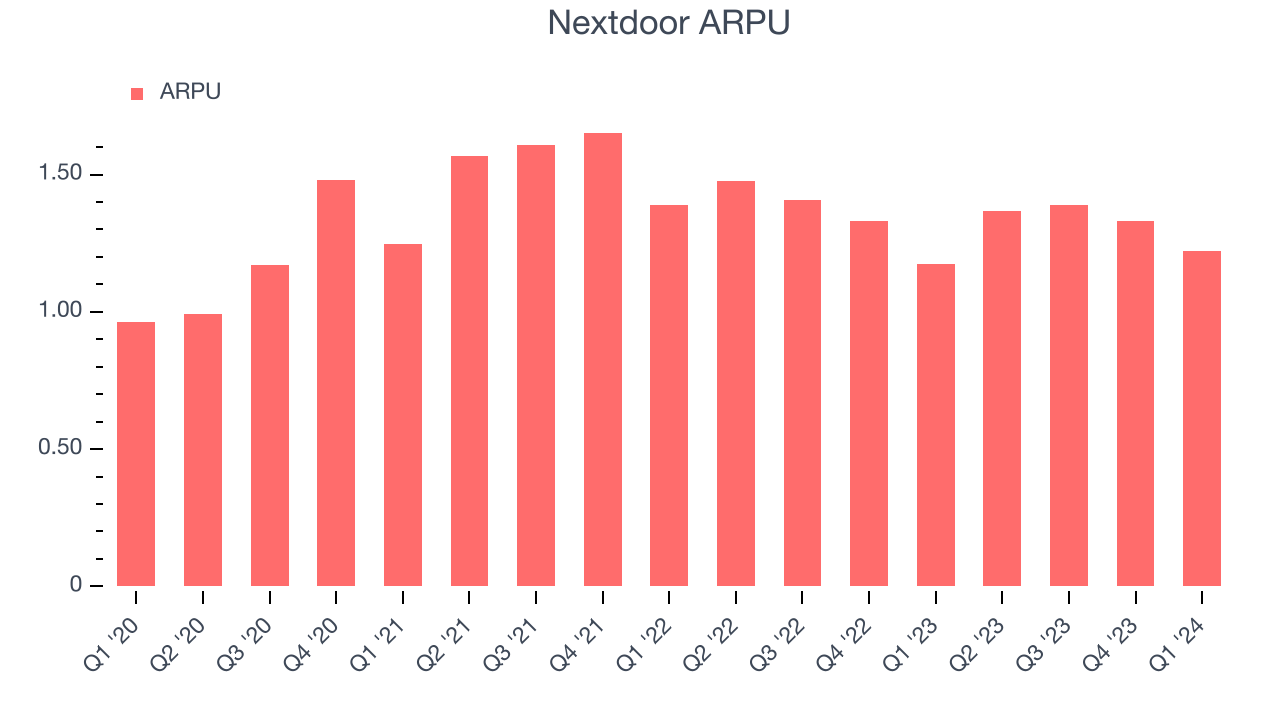

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Nextdoor because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Nextdoor's audience and its ad-targeting capabilities.

Nextdoor's ARPU has declined over the last two years, averaging 7.3%. Although the company's users have continued to grow, it's lost its pricing power and will have to make improvements soon. This quarter, ARPU grew 3.9% year on year to $1.22 per user.

Key Takeaways from Nextdoor's Q1 Results

It was good to see Nextdoor's strong revenue guidance for next quarter, which topped analysts' expectations. Adjusted EBITDA guidance for next quarter was also ahead. With regards to the reported quarter itself, we were also excited its revenue and adjusted EBITDA outperformed Wall Street's estimates. On the other hand, its revenue growth regrettably slowed. Zooming out, we think this was still a strong quarter. The stock is up 8.2% after reporting and currently trades at $2.44 per share.

So should you invest in Nextdoor right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.