Acoustic component provider Knowles (NYSE:KN) reported Q3 CY2024 results beating Wall Street’s revenue expectations, but sales fell 18.6% year on year to $142.5 million. The company expects next quarter’s revenue to be around $146 million, close to analysts’ estimates. Its GAAP profit of $0.01 per share was 93.5% below analysts’ consensus estimates.

Is now the time to buy Knowles? Find out by accessing our full research report, it’s free.

Knowles (KN) Q3 CY2024 Highlights:

- Revenue: $142.5 million vs analyst estimates of $141 million (1.1% beat)

- EPS: $0.01 vs analyst estimates of $0.15 (-$0.14 miss)

- EBITDA: $35 million vs analyst estimates of $34 million (2.9% beat)

- Revenue Guidance for Q4 CY2024 is $146 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 44.2%, up from 41.3% in the same quarter last year

- Operating Margin: 13.1%, up from 10.2% in the same quarter last year

- EBITDA Margin: 24.6%

- Free Cash Flow Margin: 34.5%, up from 20.4% in the same quarter last year

- Market Capitalization: $1.51 billion

“I am pleased that we delivered revenues from continuing operations and cash provided by operating activities at or above the high end of our guided range, with non-GAAP diluted EPS from continuing operations at the mid-point of our guided range,” commented Jeffrey Niew, President, and CEO of Knowles.

Company Overview

Holding a swath of patents, Knowles (NYSSE:KN) offers acoustics components for various industries.

Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Sales Growth

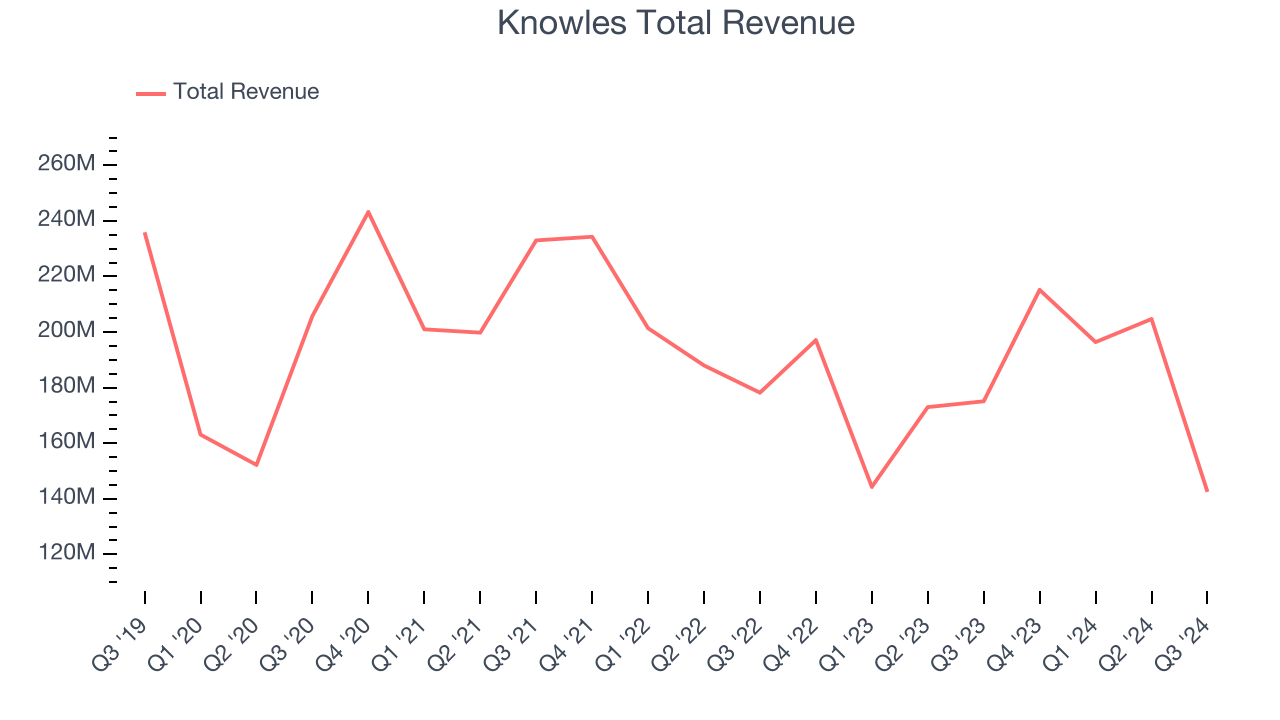

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Knowles’s demand was weak over the last five years as its sales fell by 2.1% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Knowles’s annualized revenue declines of 2.7% over the last two years align with its five-year trend, suggesting its demand consistently shrunk. Knowles isn’t alone in its struggles as the Electronic Components industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Knowles’s revenue fell 18.6% year on year to $142.5 million but beat Wall Street’s estimates by 1.1%. Management is currently guiding for a 32.2% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to decline 23.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market thinks its products and services will see some demand headwinds.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

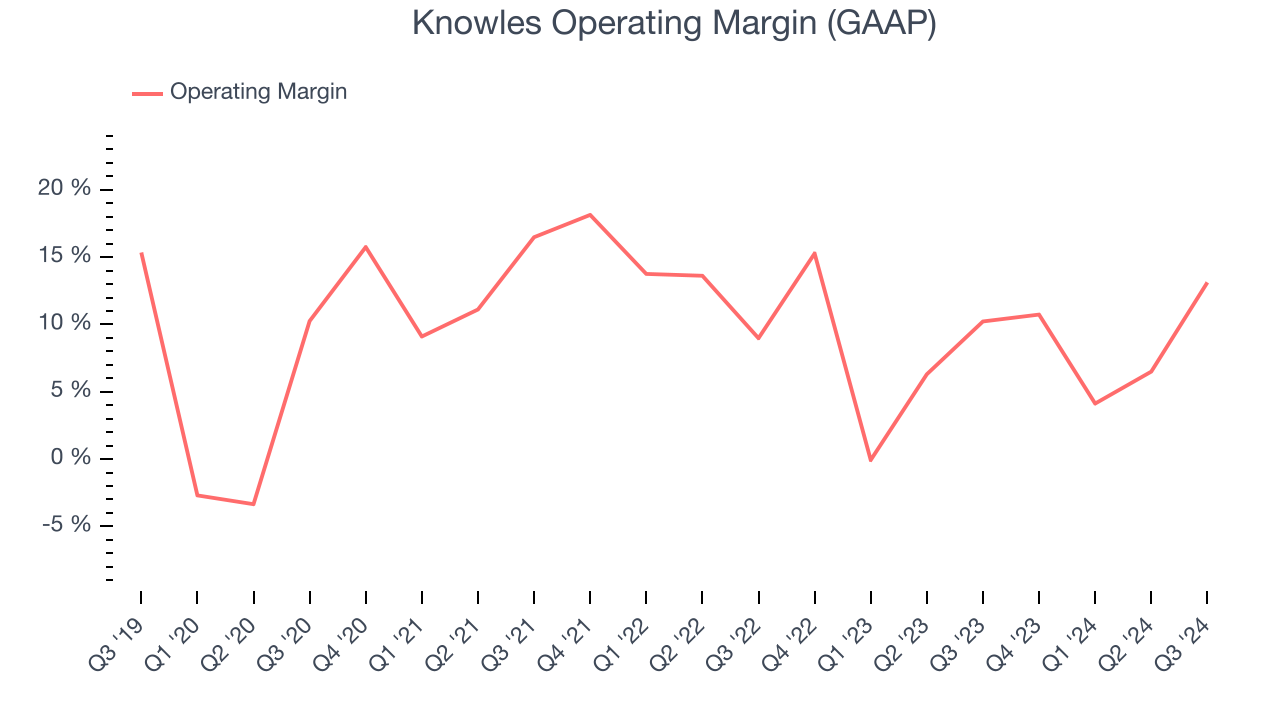

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Knowles has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 9.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Knowles’s annual operating margin rose by 5.2 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q3, Knowles generated an operating profit margin of 13.1%, up 2.9 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

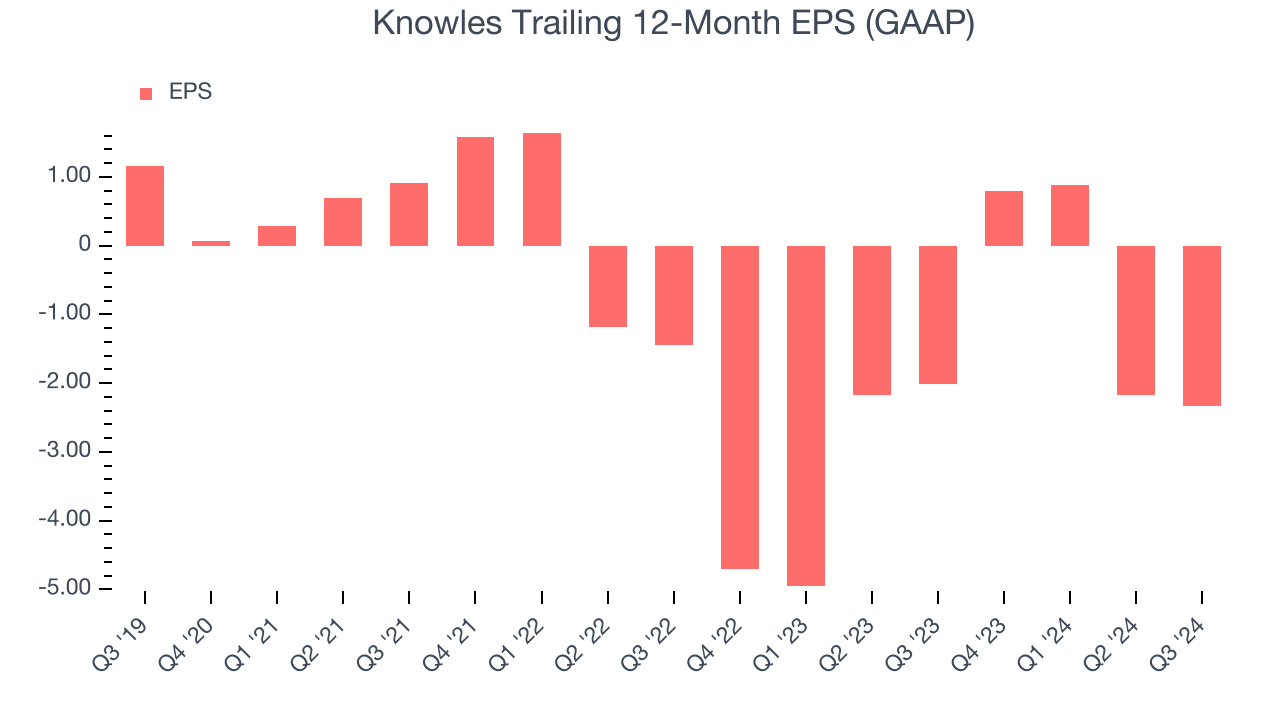

Analyzing long-term revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Knowles, its EPS by declined more than its revenue over the last five years, dropping 32% annually. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Knowles, its two-year annual EPS declines of 27.6% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q3, Knowles reported EPS at $0.01, down from $0.18 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Knowles’s full-year EPS of negative $2.34 will flip to positive $0.69.

Key Takeaways from Knowles’s Q3 Results

It was good to see Knowles beat analysts’ revenue and EBITDA expectations this quarter. On the other hand, its EPS missed. Overall, this quarter could have been better. The stock remained flat at $17.22 immediately after reporting.

Is Knowles an attractive investment opportunity at the current price?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.