Department store chain Kohl’s (NYSE:KSS) reported results ahead of analysts' expectations in Q4 FY2023, with revenue down 1% year on year to $5.96 billion. It made a GAAP profit of $1.67 per share, improving from its loss of $2.48 per share in the same quarter last year.

Is now the time to buy Kohl's? Find out by accessing our full research report, it's free.

Kohl's (KSS) Q4 FY2023 Highlights:

- Revenue: $5.96 billion vs analyst estimates of $5.77 billion (3.2% beat)

- EPS: $1.67 vs analyst estimates of $1.28 (30.8% beat)

- Full year guidance: Same store sales growth of 1% year on year was better than expectations, but EPS of $2.40 missed expectations

- Gross Margin (GAAP): 35.2%, up from 26.2% in the same quarter last year

- Free Cash Flow of $707 million, up 15.1% from the same quarter last year

- Same-Store Sales were down 4.3% year on year (miss vs. expectations of down 3.2% year on year)

- Market Capitalization: $3.01 billion

Tom Kingsbury, Kohl’s chief executive officer, said “2023 represented an important year for Kohl’s. We enhanced our store experience, expanded our partnership with Sephora, and invested in underpenetrated categories. We also simplified our value strategies and implemented new inventory management processes. The early success of our strategies is evident. Our store business had its best comparable sales performance since 2010, Sephora at Kohl’s continued to drive meaningful beauty sales growth, and we managed inventory down 10% at year end. I want to thank the broader Kohl’s team for driving significant change to reposition the company for future growth.”

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE:KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Sales Growth

Kohl's is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

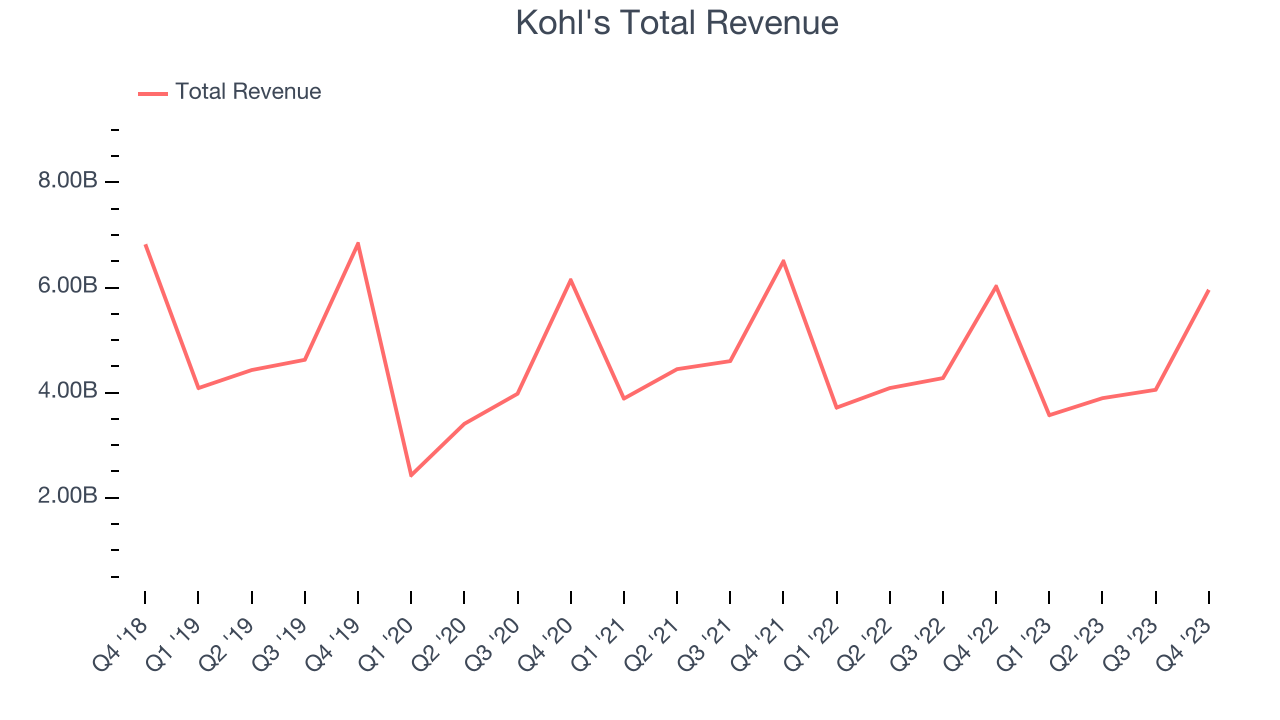

As you can see below, the company's revenue has declined over the last four years, dropping 3.3% annually as it failed to grow its store footprint meaningfully and observed lower sales at existing, established stores.

This quarter, Kohl's revenue fell 1% year on year to $5.96 billion but beat Wall Street's estimates by 3.2%. Looking ahead, Wall Street expects revenue to decline 4.6% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

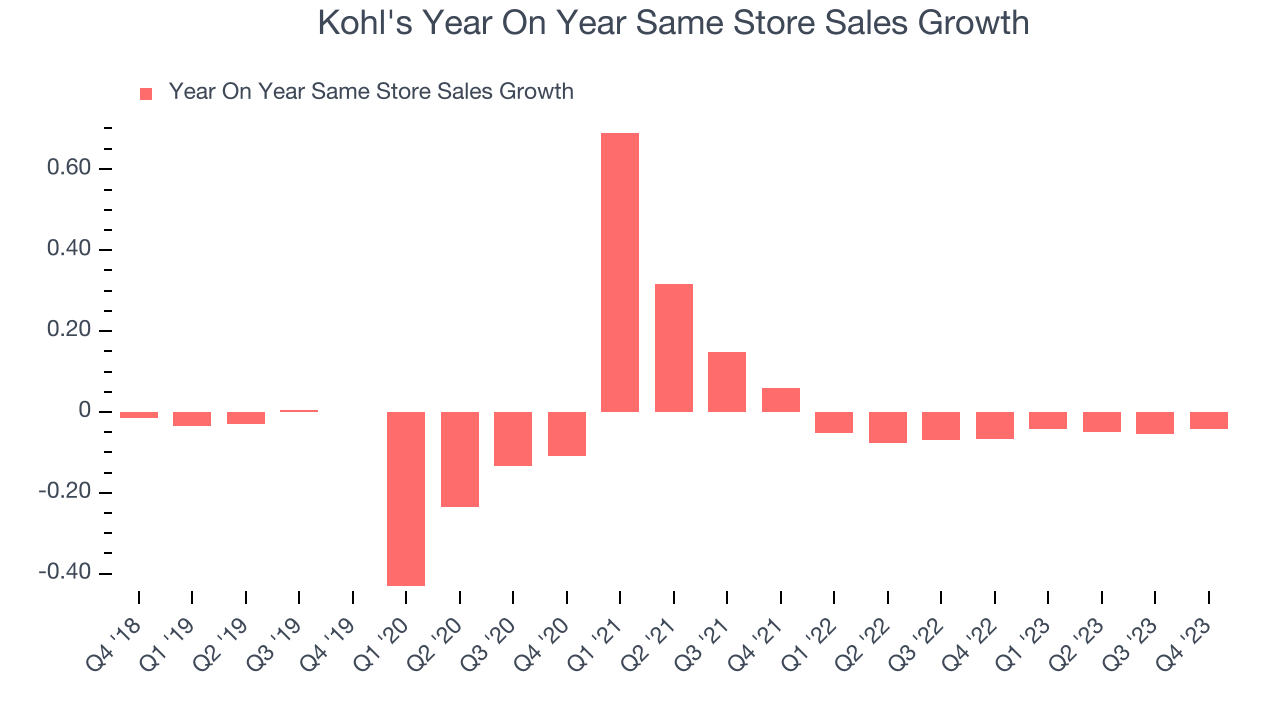

Kohl's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 5.7% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Kohl's same-store sales fell 4.3% year on year. This decrease was a further deceleration from the 6.6% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Kohl's Q4 Results

We were impressed by how significantly Kohl's blew past analysts' EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street's estimates. On the other hand, its full-year earnings forecast missed analysts' expectations. Overall, we think this was a really good quarter that should please shareholders. The stock is flat after reporting and currently trades at $27.26 per share.

Kohl's may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.