Automotive retailer Lithia Motors (NYSE:LAD) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 22.7% year on year to $8.56 billion. It made a non-GAAP profit of $6.11 per share, down from its profit of $8.44 per share in the same quarter last year.

Is now the time to buy Lithia? Find out by accessing our full research report, it's free.

Lithia (LAD) Q1 CY2024 Highlights:

- Revenue: $8.56 billion vs analyst estimates of $8.56 billion (small miss)

- EPS (non-GAAP): $6.11 vs analyst expectations of $7.88 (22.5% miss)

- Gross Margin (GAAP): 15.6%, down from 17% in the same quarter last year

- Free Cash Flow of $212.8 million is up from -$87.9 million in the same quarter last year

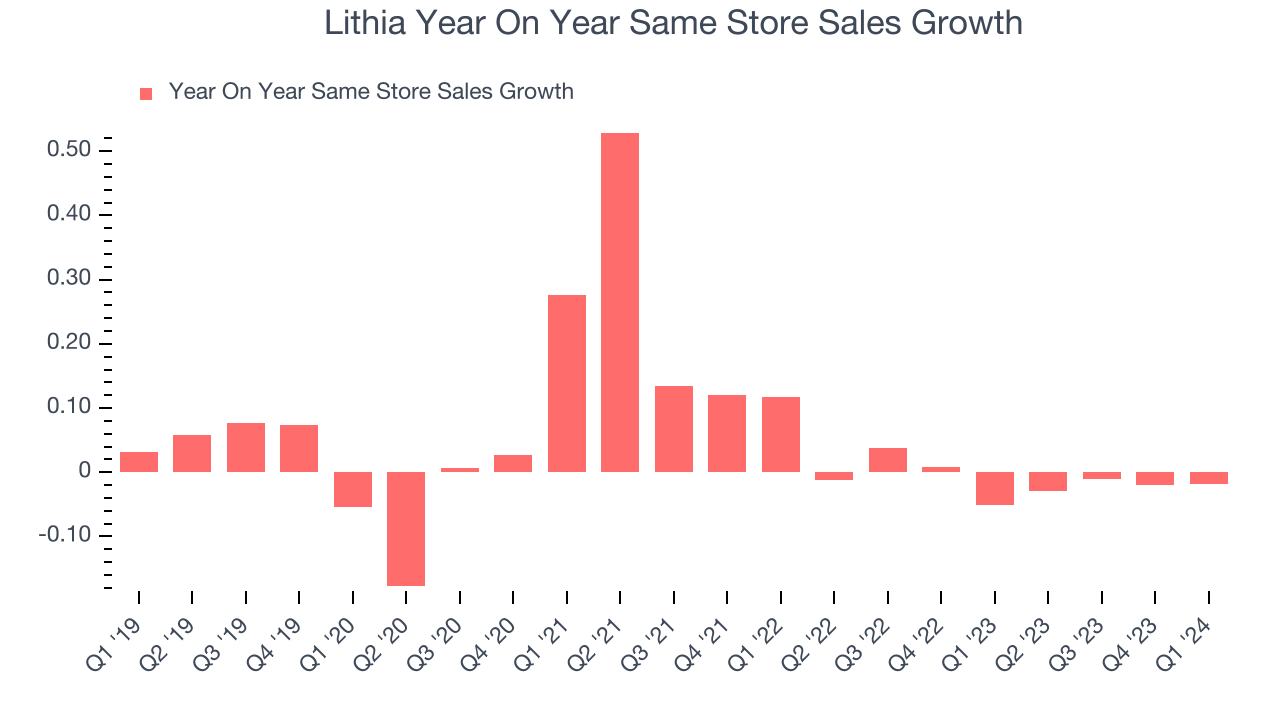

- Same-Store Sales were down 1.9% year on year

- Market Capitalization: $7.28 billion

"In the first quarter, our teams responded as the industry continued to normalize inventories and profitability. We are committed to driving improvements across our business," said Bryan DeBoer, President and CEO.

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Sales Growth

Lithia is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

As you can see below, the company's annualized revenue growth rate of 22.1% over the last five years was exceptional as it added more brick-and-mortar locations and expanded its reach.

This quarter, Lithia generated an excellent 22.7% year-on-year revenue growth rate, but its $8.56 billion in revenue fell short of Wall Street's high expectations. Looking ahead, Wall Street expects sales to grow 14.1% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

Lithia's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 1.2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Lithia's same-store sales fell 1.9% year on year. This decrease was an improvement from the 5.1% year-on-year decline it posted 12 months ago. It's always great to see a business improve its prospects.

Key Takeaways from Lithia's Q1 Results

We struggled to find many strong positives in these results. Despite growing revenue, its same-store sales shrunk, meaning its incremental revenue stemmed from new stores. That growth is more capital-intensive and less profitable, however, and it showed in Lithia's bottom line as its EPS missed analysts' expectations. Overall, this was a bad quarter for Lithia. The company is down 6.2% on the results and currently trades at $248 per share.

Lithia may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.