Automotive retailer Lithia Motors (NYSE:LAD) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 22.7% year on year to $8.56 billion. It made a non-GAAP profit of $6.11 per share, down from its profit of $8.44 per share in the same quarter last year.

Lithia (LAD) Q1 CY2024 Highlights:

- Revenue: $8.56 billion vs analyst estimates of $8.56 billion (small miss)

- EPS (non-GAAP): $6.11 vs analyst expectations of $7.88 (22.5% miss)

- Gross Margin (GAAP): 15.6%, down from 17% in the same quarter last year

- Free Cash Flow of $212.8 million is up from -$87.9 million in the same quarter last year

- Same-Store Sales were down 1.9% year on year

- Market Capitalization: $7.28 billion

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

In addition to the broad selection of cars, Lithia also integrates sales, financing, and service in a single location, which streamlines the car-buying process and offers convenience to shoppers and customers. The core customer is therefore someone in the market to purchase a vehicle. This potential customer–typically an individual or family that relies on a car for work, errands, and general family activities–may not know whether they want a new car or a used one, a sedan or an SUV. However, this customer values the selection that Lithia offers.

Lithia Motors locations range from around 20,000 to 50,000 square feet. These stores are standalone and typically positioned in high-traffic areas, often near major highways or busy city centers. Vehicles are usually positioned outside so passersby can see popular or new models. Inside, more vehicles are displayed and sales professionals are available to talk shop, set up test drives, or answer questions about financing.

In addition to its physical locations, Lithia Motors has an online presence that was launched in 2018. You can either use the platform to research and check what’s for sale at nearby locations, or you can use it to actually buy a car.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Competitors in the auto retail space include AutoNation (NYSE:AN), Carvana (NYSE:CVNA), and Group 1 Automotive (NYSE:GPI).Sales Growth

Lithia is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

As you can see below, the company's annualized revenue growth rate of 22.1% over the last five years was exceptional as it added more brick-and-mortar locations and expanded its reach.

This quarter, Lithia generated an excellent 22.7% year-on-year revenue growth rate, but its $8.56 billion in revenue fell short of Wall Street's high expectations. Looking ahead, Wall Street expects sales to grow 14.1% over the next 12 months, a deceleration from this quarter.

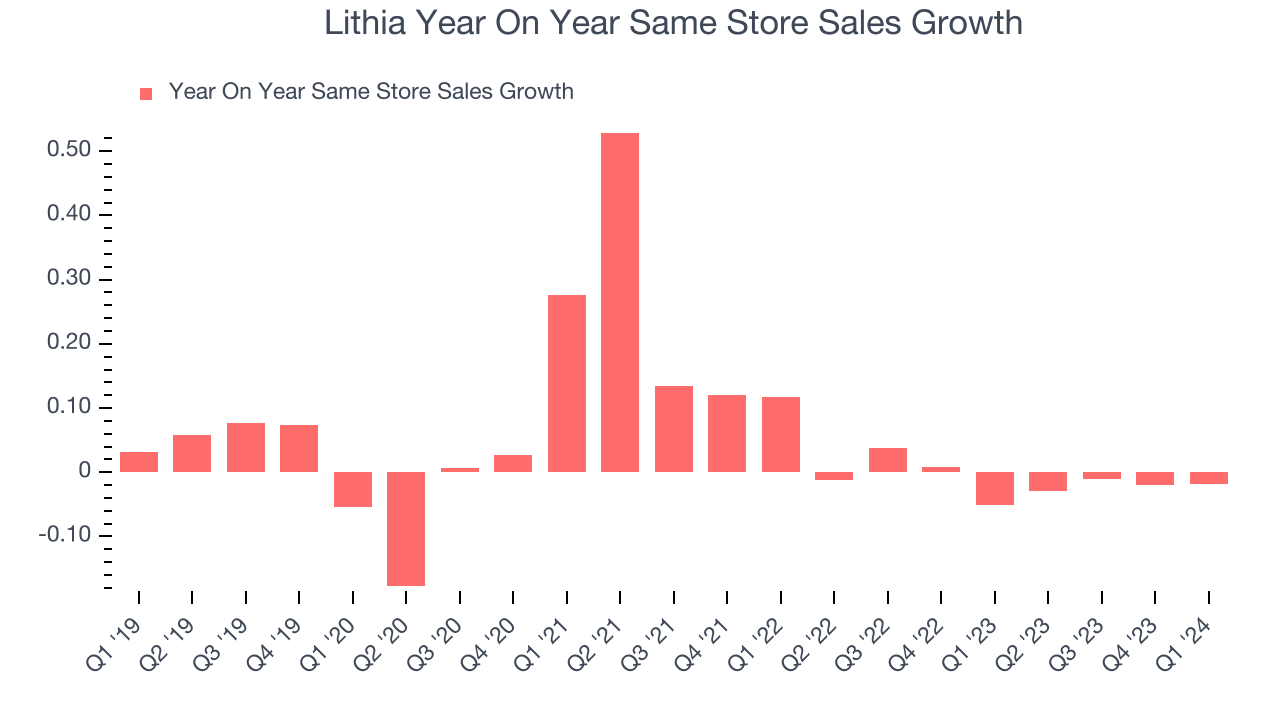

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

Lithia's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 1.2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Lithia's same-store sales fell 1.9% year on year. This decrease was an improvement from the 5.1% year-on-year decline it posted 12 months ago. It's always great to see a business improve its prospects.

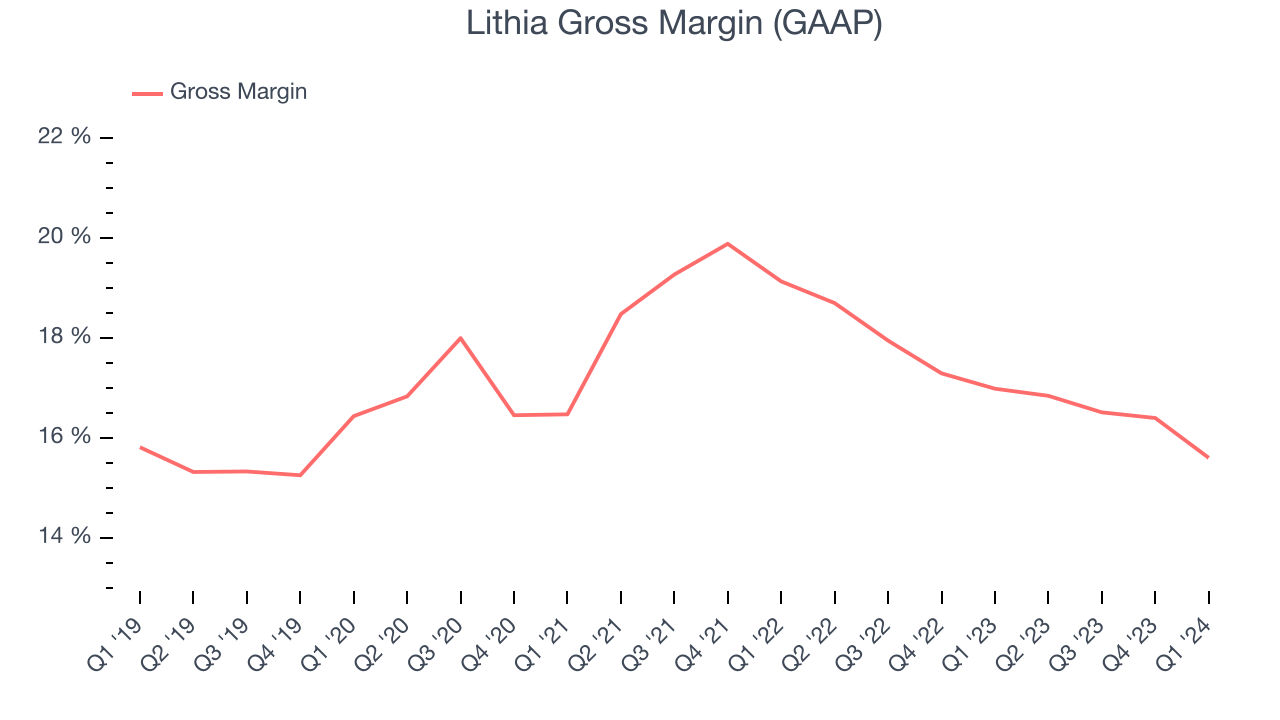

Gross Margin & Pricing Power

Gross profit margins tell us how much money a retailer gets to keep after paying for the goods it sells.

Lithia has poor unit economics for a retailer, leaving it with little room for error if things go awry. As you can see below, it's averaged a 17% gross margin over the last two years. This means the company makes $0.17 for every $1 in revenue before accounting for its operating expenses.

Lithia's gross profit margin came in at 15.6% this quarter, marking a 1.4 percentage point decrease from 17% in the same quarter last year. One quarter of margin contraction shouldn't worry investors as a retailer's gross margin can often change due to factors such as product discounting and dynamic input costs (think distribution and freight expenses to move goods).

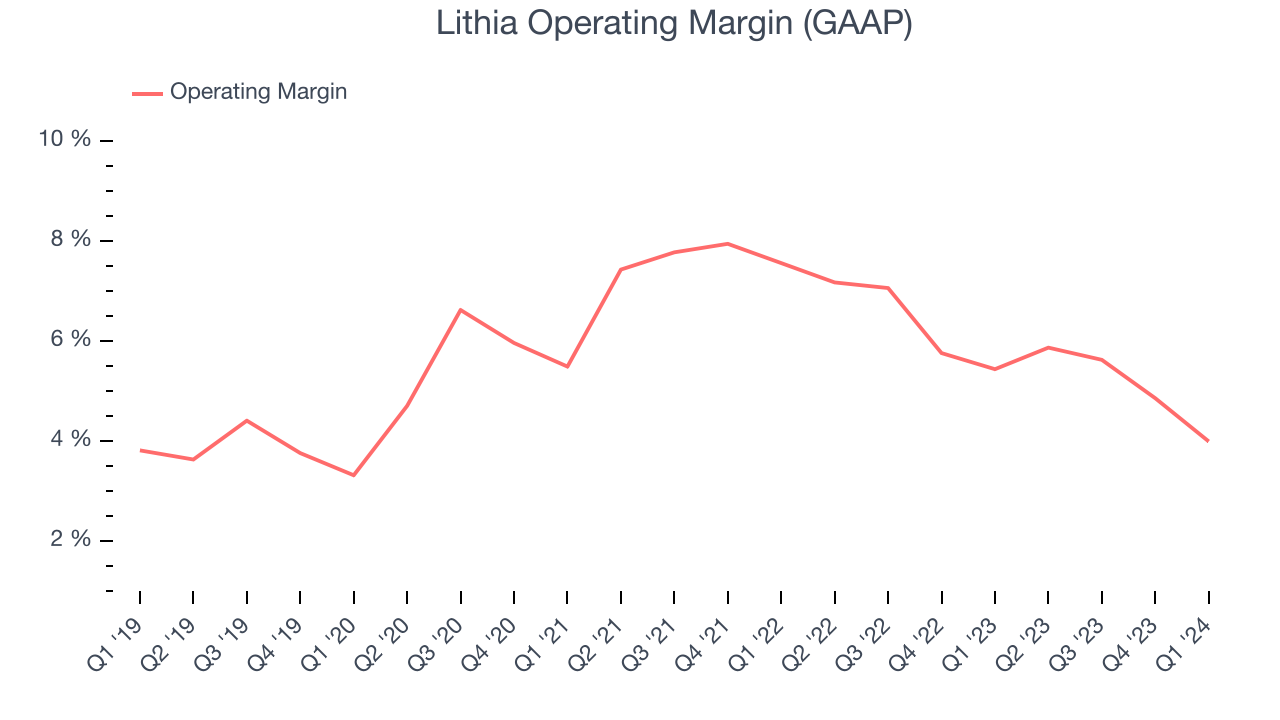

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Lithia generated an operating profit margin of 4%, down 1.4 percentage points year on year. We can infer Lithia was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, Lithia was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 5.7%. On top of that, Lithia's margin has slightly declined, on average, by 1.3 percentage points year on year. This shows Lithia has faced some speed bumps.

Zooming out, Lithia was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 5.7%. On top of that, Lithia's margin has slightly declined, on average, by 1.3 percentage points year on year. This shows Lithia has faced some speed bumps.EPS

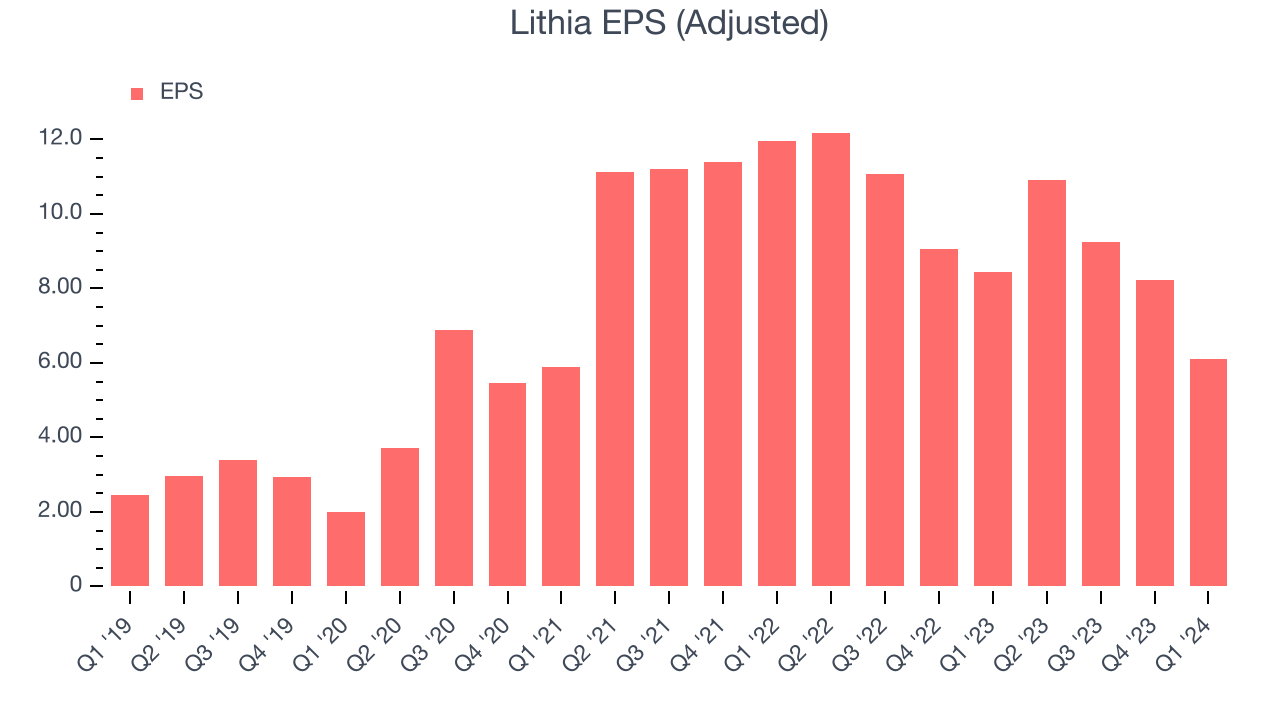

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Lithia reported EPS at $6.11, down from $8.44 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 4.3% year-on-year increase in EPS.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

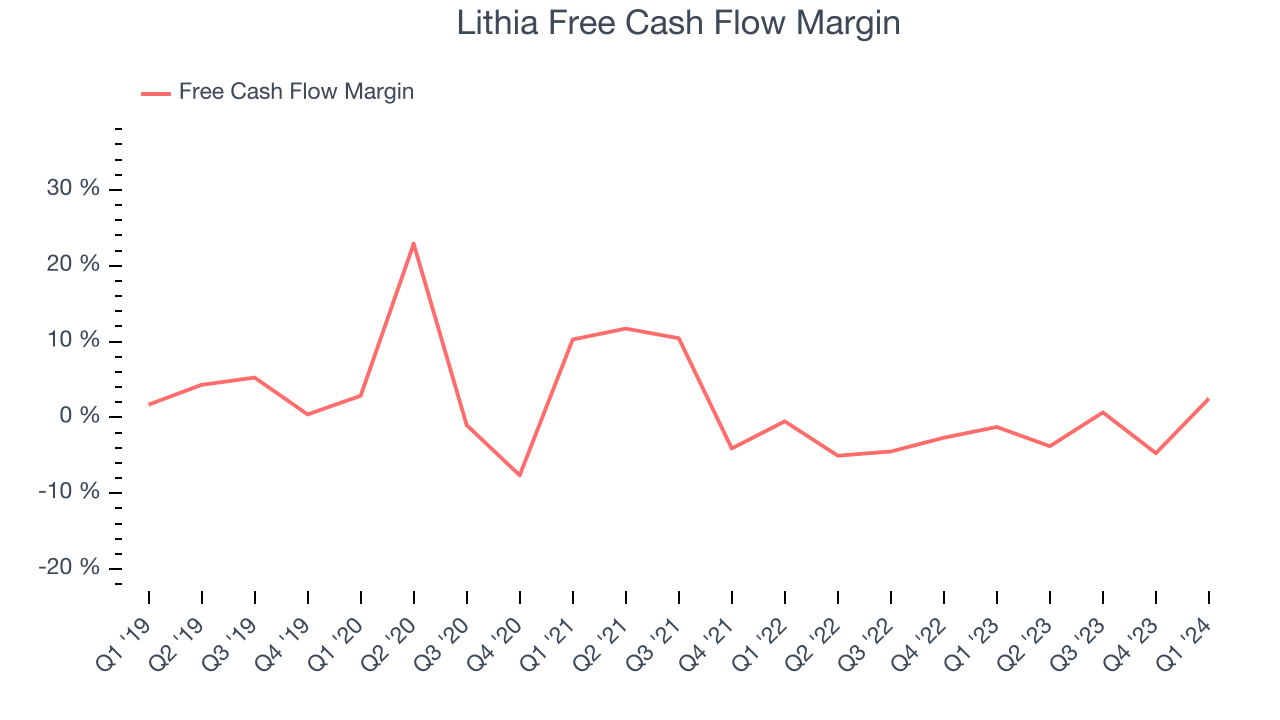

Lithia's free cash flow came in at $212.8 million in Q1, representing a 2.5% margin and flipping from negative in the same quarter last year to positive this quarter. Seasonal factors aside, this was great for the business.

While Lithia posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Lithia's capital-intensive business model and large investments in new store buildouts have consumed many company resources. Its free cash flow margin has averaged negative 2.2%, weak for a consumer retail business. However, its margin has averaged year-on-year increases of 2.2 percentage points, showing the company is at least improving.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

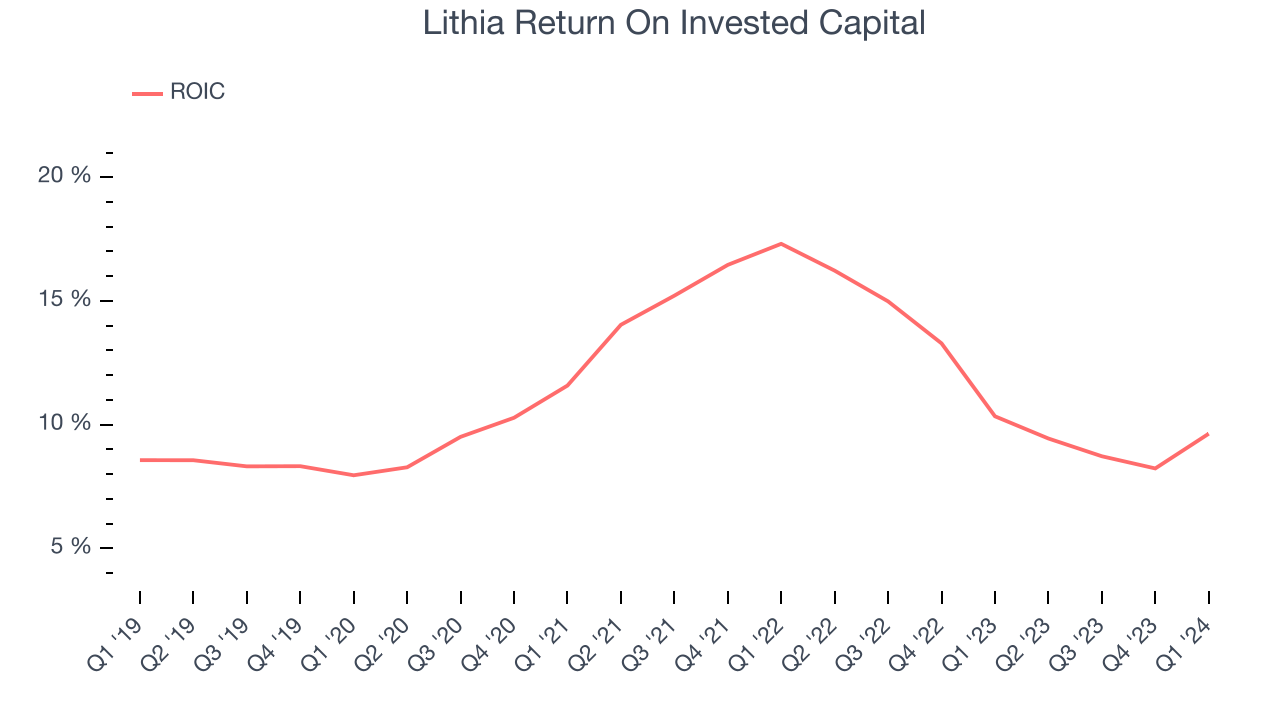

Lithia's five-year average ROIC was 11.4%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Lithia's ROIC has stayed the same over the last few years. If the company wants to become an investable business, it will need to increase its returns.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Lithia reported $404.6 million of cash and $7.47 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $1.84 billion of EBITDA over the last 12 months, we view Lithia's 3.8x net-debt-to-EBITDA ratio as safe. We also see its $344.2 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Lithia's Q1 Results

We struggled to find many strong positives in these results. Despite growing revenue, its same-store sales shrunk, meaning its incremental revenue stemmed from new stores. That growth is more capital-intensive and less profitable, however, and it showed in Lithia's bottom line as its EPS missed analysts' expectations. Overall, this was a bad quarter for Lithia. The company is down 6.2% on the results and currently trades at $248 per share.

Is Now The Time?

Lithia may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Lithia isn't a bad business. First off, its revenue growth has been exceptional over the last five years. And while its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses, its new store openings have increased its brand equity.

Lithia's price-to-earnings ratio based on the next 12 months is 7.3x. In the end, beauty is in the eye of the beholder. While Lithia wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $346.23 per share right before these results (compared to the current share price of $248).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.