Manufacturing company Leggett & Platt (NYSE:LEG) fell short of analysts' expectations in Q1 CY2024, with revenue down 9.6% year on year to $1.10 billion. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $4.5 billion at the midpoint. It made a non-GAAP profit of $0.23 per share, down from its profit of $0.39 per share in the same quarter last year.

Leggett & Platt (LEG) Q1 CY2024 Highlights:

- Revenue: $1.10 billion vs analyst estimates of $1.12 billion (2% miss)

- EPS (non-GAAP): $0.23 vs analyst expectations of $0.24 (4.6% miss)

- The company reconfirmed its revenue guidance for the full year of $4.5 billion at the midpoint

- Gross Margin (GAAP): 17%, down from 18% in the same quarter last year

- Free Cash Flow was -$32 million, down from $122.7 million in the previous quarter

- Market Capitalization: $2.45 billion

Founded in 1883, Leggett & Platt (NYSE:LEG) is a diversified manufacturer making products for various industries.

The company started as a producer of bedding components and has since expanded into numerous other sectors. Leggett & Platt's business is divided into several segments, including Bedding, Specialized Products, and Furniture, Flooring & Textile (FF&T). This diversification strategy has enabled the company to maintain stability.

In the Bedding Products segment, Leggett & Platt is a leading manufacturer of components used in the production of mattresses, such as innerspring mattresses and foundations. The company has numerous patents and industry-firsts that have shaped the way mattresses are made and experienced.

The Specialized Products segment focuses on producing components for automobiles, such as lumbar support systems and seat suspension systems.

Leggett & Platt's Furniture, Flooring & Textile Products segment includes the production of components used in the manufacturing of upholstered furniture, such as recliner mechanisms and sofa sleeper mechanisms. Additionally, this segment produces carpet cushions and hard surface flooring underlayment for residential and commercial markets.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Leggett & Platt's primary competitors include Tempur Sealy (NYSE:TPX), Serta Simmons Bedding, Herman Miller (NASDAQ:MLHR), Flexsteel Industries (NASDAQ:FLXS), and private companies L&P Aerospace and Precision Fabrics.Sales Growth

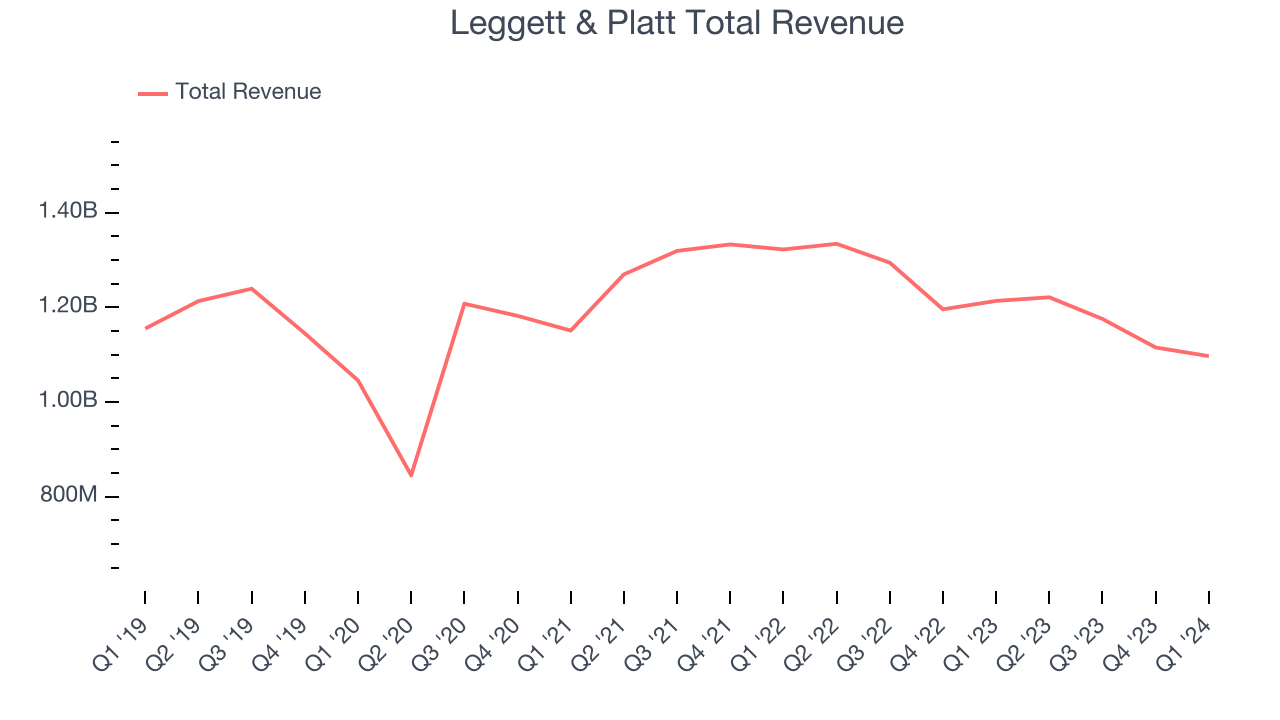

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Leggett & Platt's revenue was flat over the last five years.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Leggett & Platt's recent history shows a reversal from its five-year trend as its revenue has shown annualized declines of 6.3% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Leggett & Platt's recent history shows a reversal from its five-year trend as its revenue has shown annualized declines of 6.3% over the last two years.

We can dig even further into the company's revenue dynamics by analyzing its three most important segments: Bedding, FF&T, and Specialized Products, which are 40.8%, 30.4%, and 28.8% of revenue. Over the last two years, Leggett & Platt's Bedding (mattresses and foundations) and FF&T (sofa parts and tiles ) revenues averaged year-on-year declines of 14% and 6.9% while Specialized Products (automobile components) averaged 13% growth.

This quarter, Leggett & Platt missed Wall Street's estimates and reported a rather uninspiring 9.6% year-on-year revenue decline, generating $1.10 billion of revenue. Looking ahead, Wall Street expects revenue to decline 2% over the next 12 months.

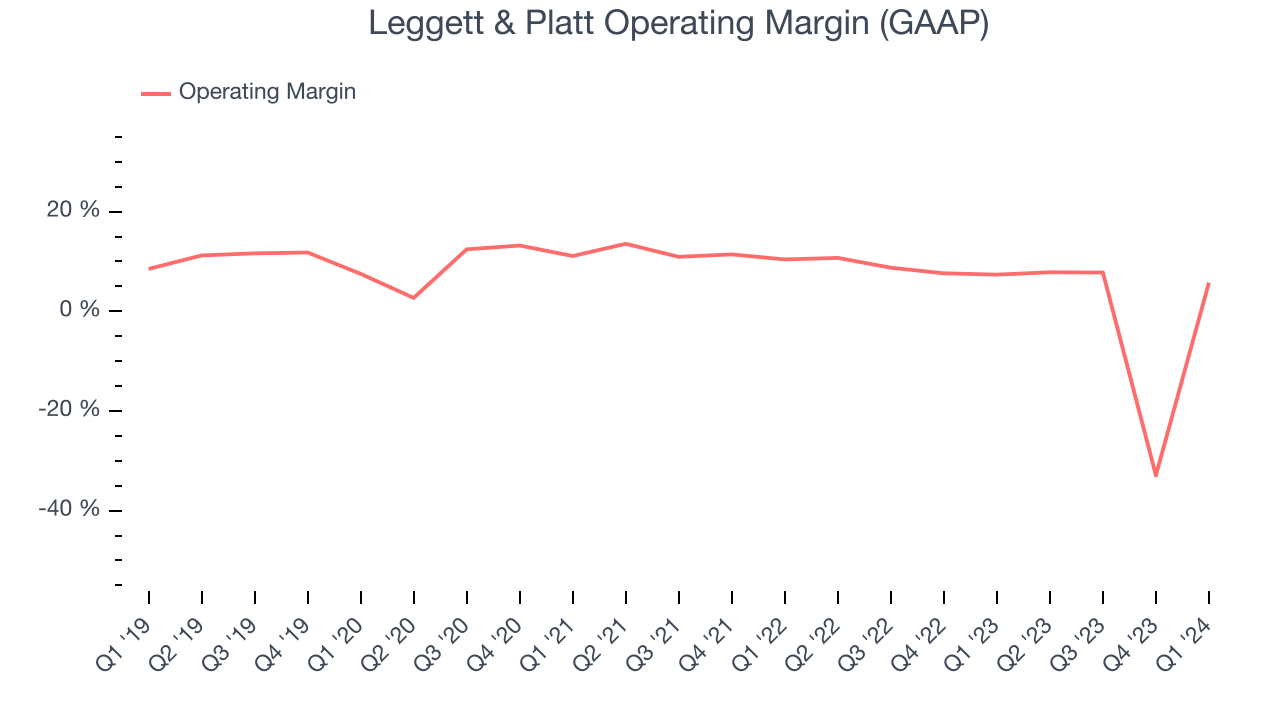

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Leggett & Platt was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.3% has been paltry for a consumer discretionary business.

This quarter, Leggett & Platt generated an operating profit margin of 5.7%, down 1.6 percentage points year on year.

Over the next 12 months, Wall Street expects Leggett & Platt to become profitable. Analysts are expecting the company’s LTM operating margin of negative 2.5% to rise to positive 6.8%.EPS

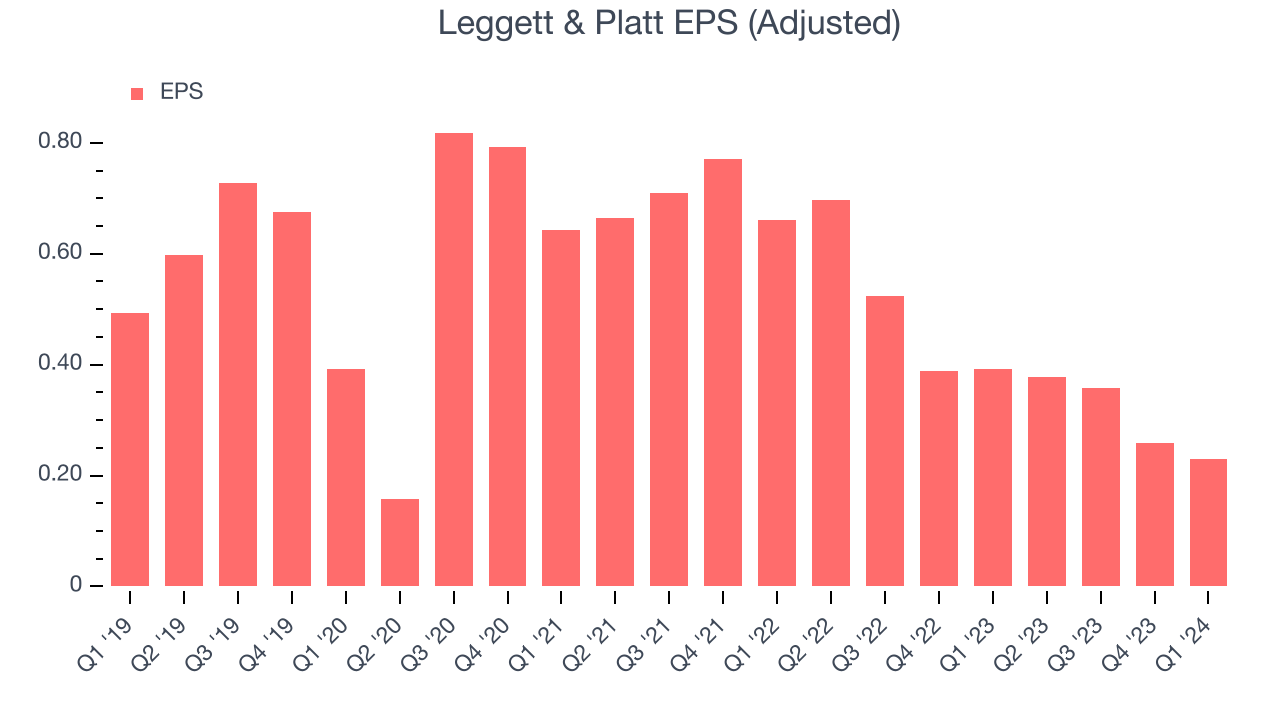

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Leggett & Platt's EPS dropped 81.4%, translating into 12.6% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, Leggett & Platt reported EPS at $0.23, down from $0.39 in the same quarter last year. This print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street expects Leggett & Platt's LTM EPS of $1.22 to stay about the same.

Cash Is King

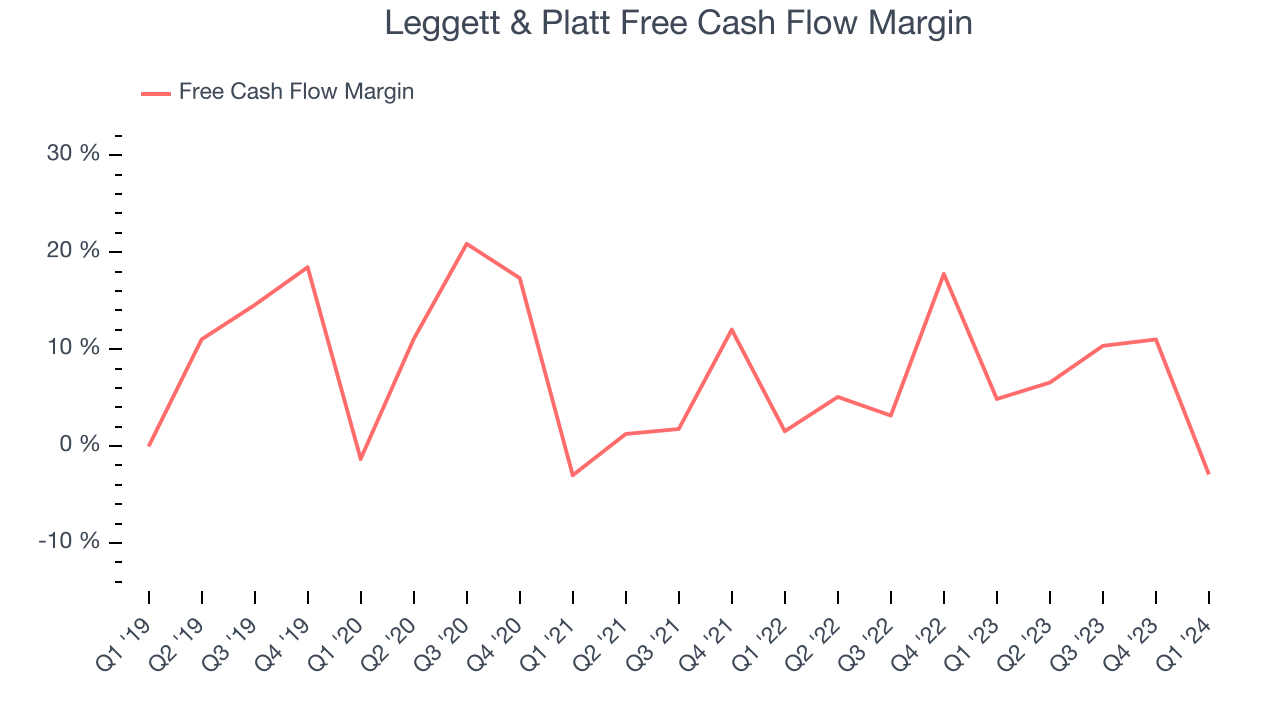

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Leggett & Platt has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 7%, subpar for a consumer discretionary business.

Leggett & Platt burned through $32 million of cash in Q1, equivalent to a negative 2.9% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter.

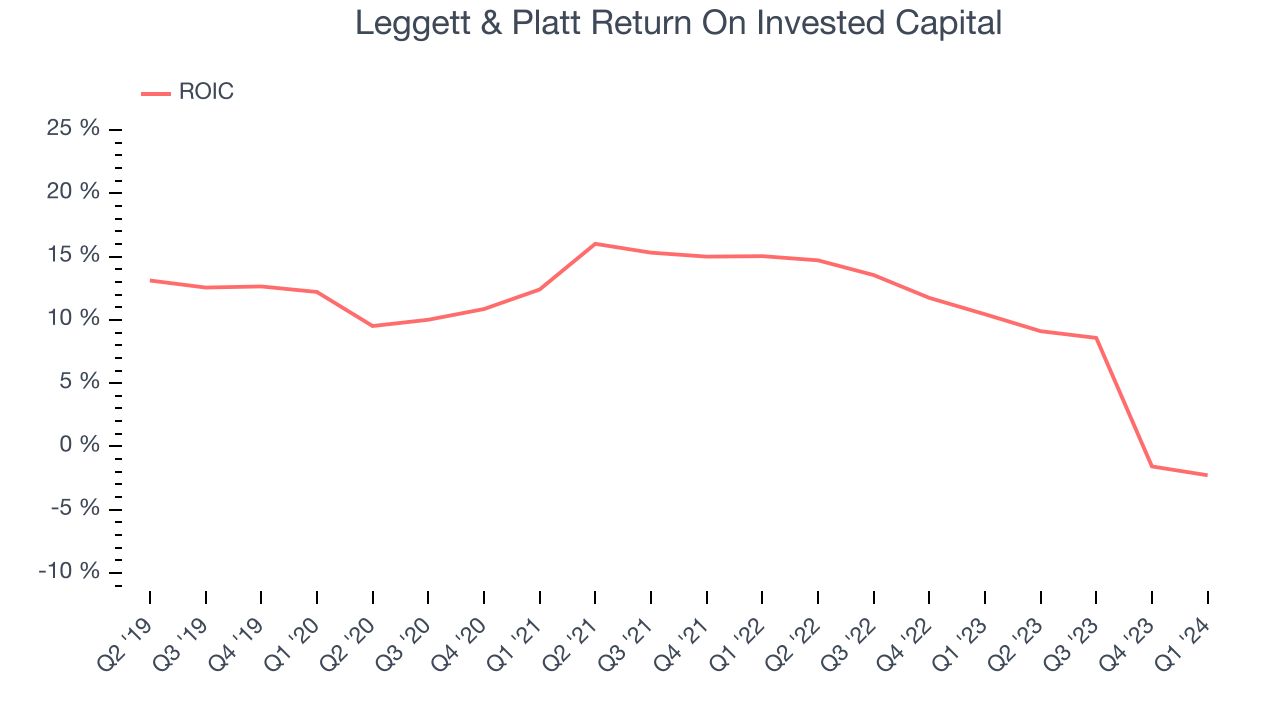

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Leggett & Platt's five-year average return on invested capital was 9.6%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Leggett & Platt's ROIC averaged 8.2 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Leggett & Platt's Q1 Results

We struggled to find many strong positives in these results as its revenue and EPS fell short of Wall Street's estimates. The company stated its underperformance stemmed from weak demand in its residential end markets. Additionally, operating cash flows were negative $6 million, down from $103 million in Q1 2023. This was primarily driven by lower accounts payable and earnings.

Looking ahead, the company reconfirmed its revenue guidance for the full year, but its earnings forecast missed. Overall, this was a bad quarter for Leggett & Platt. The company is down 8.7% on the results and currently trades at $16.5 per share.

Is Now The Time?

Leggett & Platt may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Leggett & Platt, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years, and analysts expect growth to deteriorate from here. On top of that, its declining EPS over the last five years makes it hard to trust, and its projected EPS for the next year is lacking.

Leggett & Platt's price-to-earnings ratio based on the next 12 months is 14.9x. While we've no doubt one can find things to like about Leggett & Platt, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $18 per share right before these results (compared to the current share price of $16.55).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.