Security and Aerospace company Lockheed Martin (NYSE:LMT) fell short of the market’s revenue expectations in Q3 CY2024 as sales only rose 1.3% year on year to $17.1 billion. On the other hand, the company’s full-year revenue guidance of $71.25 billion at the midpoint came in 269,452,076,194% above analysts’ estimates. Its GAAP profit of $6.80 per share was 5% above analysts’ consensus estimates.

Is now the time to buy Lockheed Martin? Find out by accessing our full research report, it’s free.

Lockheed Martin (LMT) Q3 CY2024 Highlights:

- Revenue: $17.1 billion vs analyst estimates of $17.37 billion (1.5% miss)

- EPS: $6.80 vs analyst estimates of $6.48 (5% beat)

- EBITDA: $2.76 billion vs analyst estimates of $2.43 billion (13.6% beat)

- The company slightly lifted its revenue guidance for the full year to $71.25 billion at the midpoint from $71 billion

- EPS (GAAP) guidance for the full year is $26.65 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 12.4%, in line with the same quarter last year

- Free Cash Flow Margin: 12.2%, down from 15% in the same quarter last year

- Backlog: $165.7 billion at quarter end

- Market Capitalization: $146.5 billion

"In the third quarter, we advanced our strategic, operational and financial priorities, as demonstrated by our record backlog of more than $165 billion, 48 F-35 deliveries, increased production on missile programs, and $2.1 billion of free cash flow generation," said Lockheed Martin Chairman, President and CEO Jim Taiclet.

Company Overview

Headquartered in Maryland, Famous for the F-35 aircraft, Lockheed Martin (NYSE:LMT) specializes in defense, space, homeland security, and information technology products.

Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

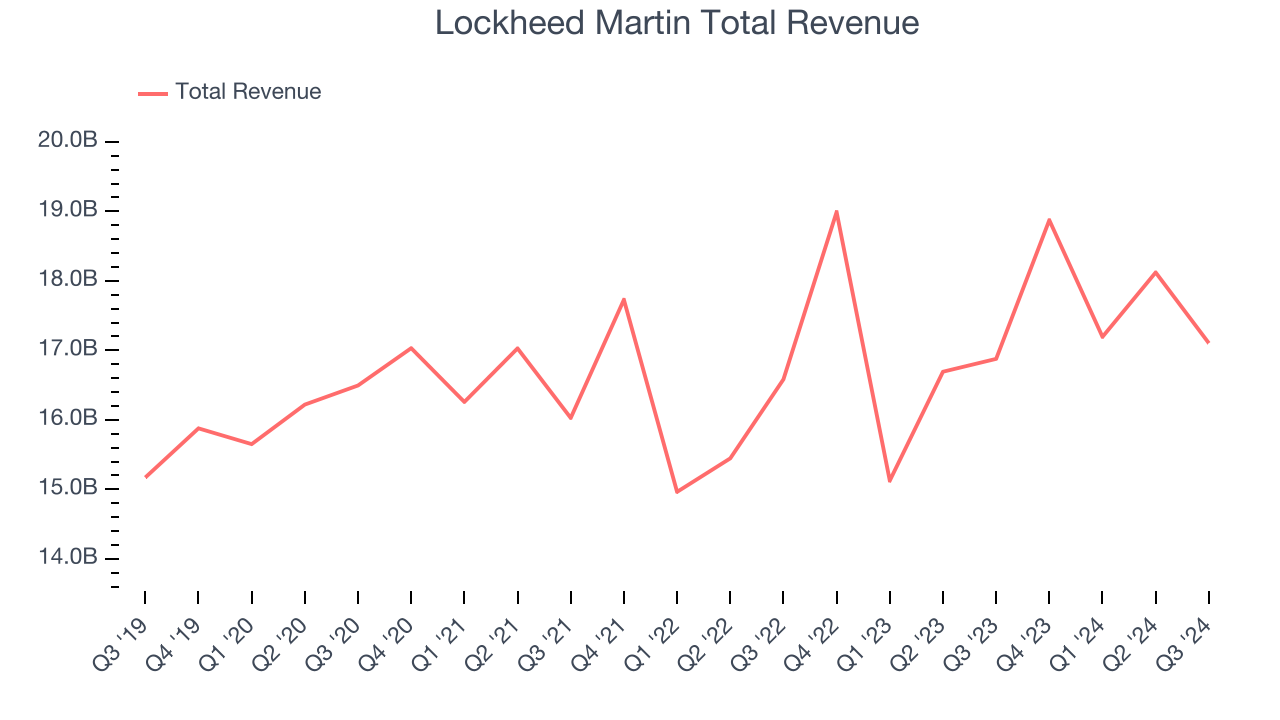

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, Lockheed Martin grew its sales at a sluggish 4.1% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Lockheed Martin’s annualized revenue growth of 5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Lockheed Martin’s revenue grew 1.3% year on year to $17.1 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and shows the market thinks its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

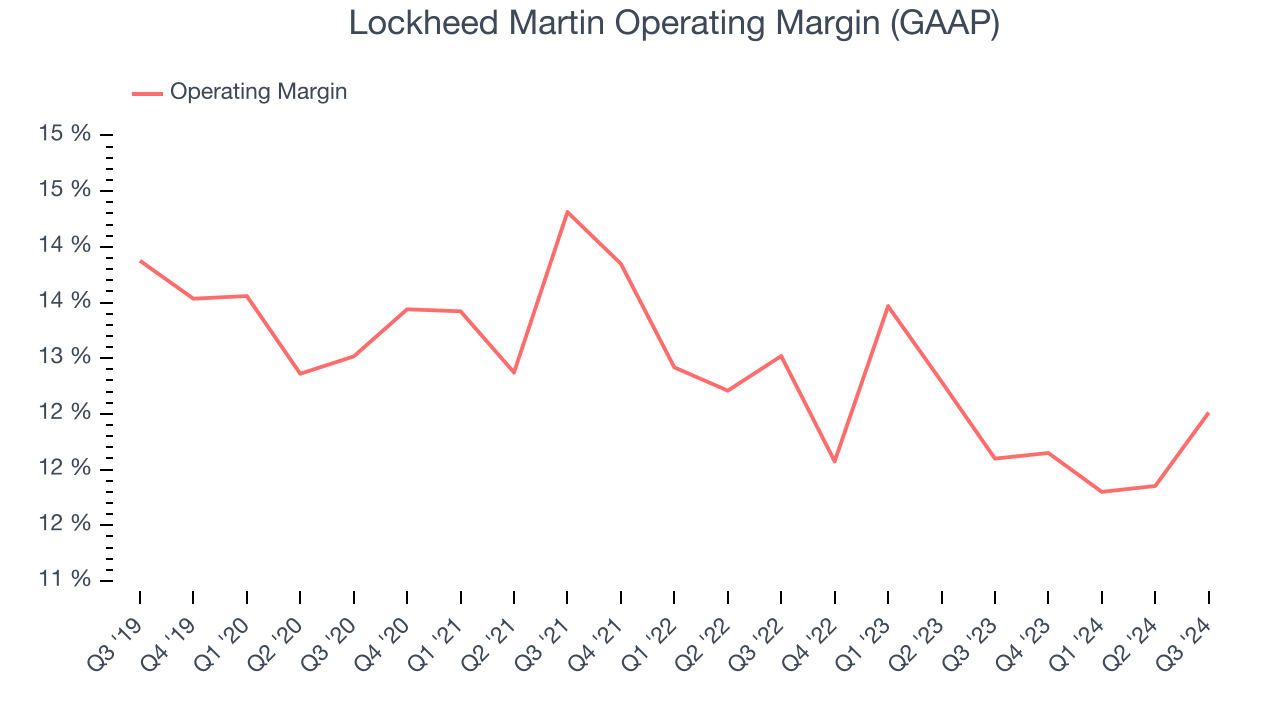

Operating Margin

Lockheed Martin has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.9%.

Looking at the trend in its profitability, Lockheed Martin’s annual operating margin decreased by 1.2 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Lockheed Martin become more profitable in the future.

In Q3, Lockheed Martin generated an operating profit margin of 12.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

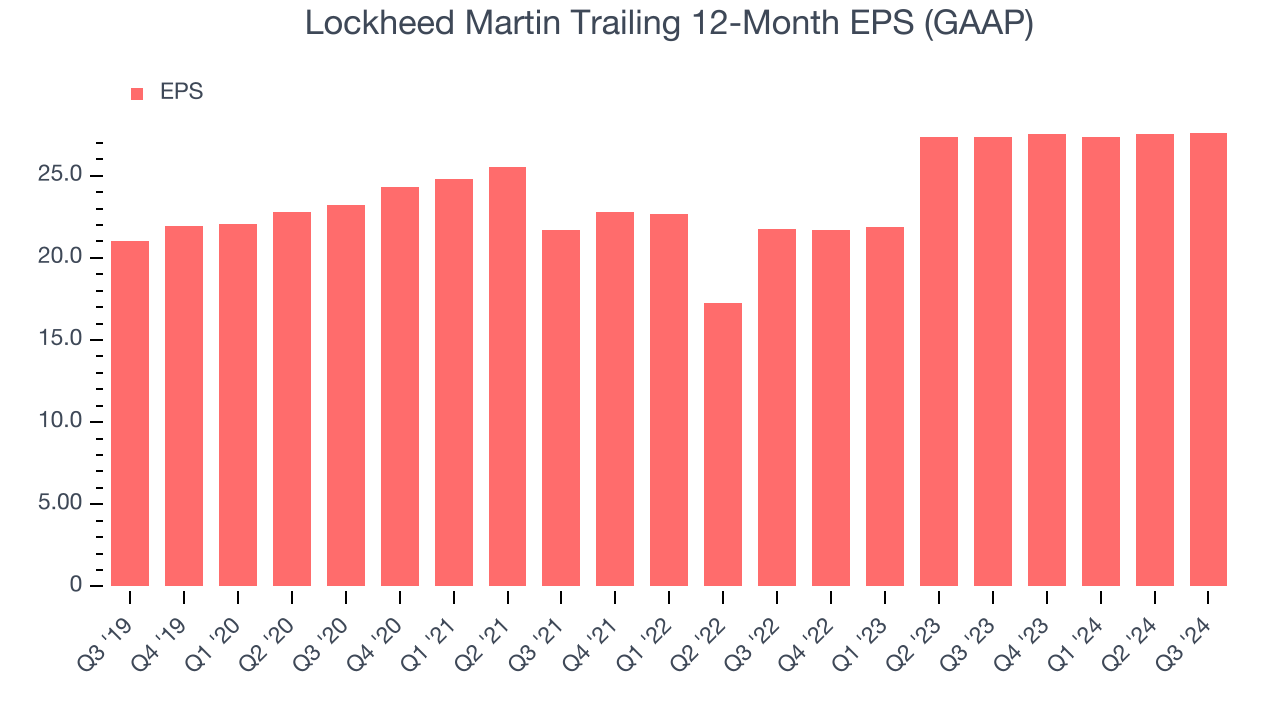

Earnings Per Share

Analyzing long-term revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

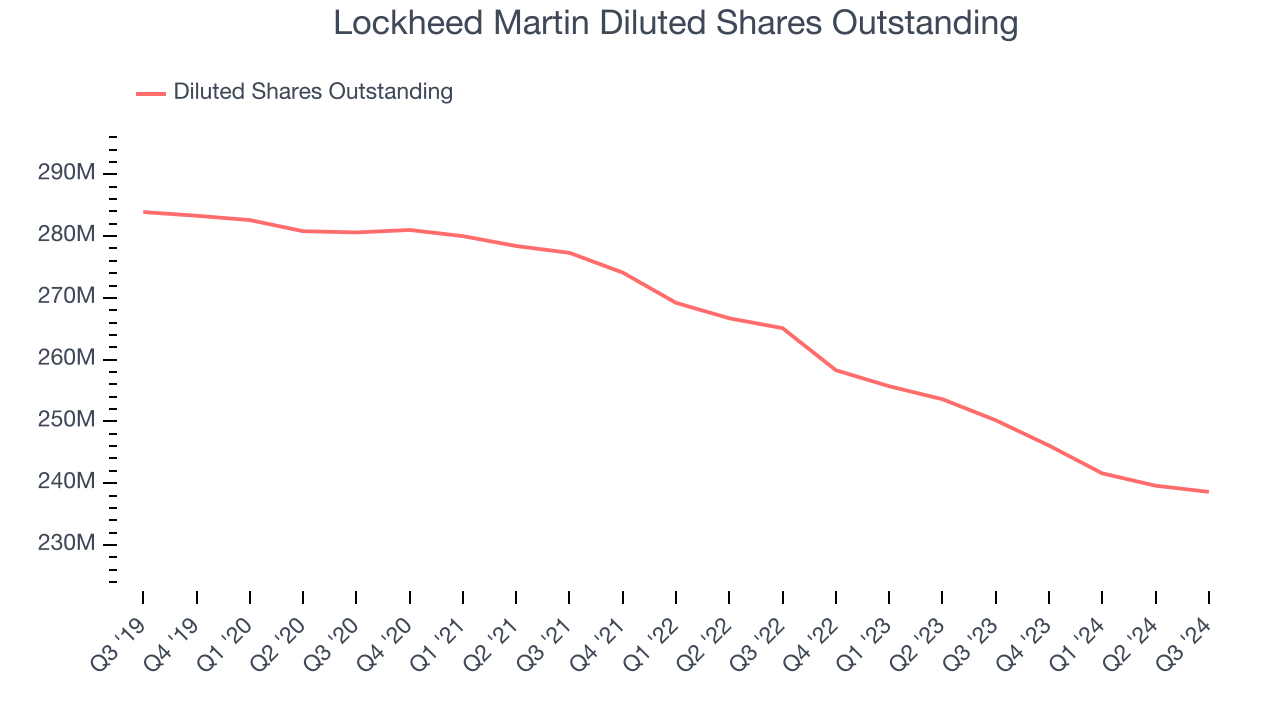

Lockheed Martin’s EPS grew at an unimpressive 5.6% compounded annual growth rate over the last five years. This performance was better than its 4.1% annualized revenue growth but doesn’t tell us much about its day-to-day operations because its operating margin didn’t expand.

Diving into the nuances of Lockheed Martin’s earnings can give us a better understanding of its performance. A five-year view shows that Lockheed Martin has repurchased its stock, shrinking its share count by 16%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business. For Lockheed Martin, its two-year annual EPS growth of 12.6% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, Lockheed Martin reported EPS at $6.80, up from $6.73 in the same quarter last year. This print beat analysts’ estimates by 5%. Over the next 12 months, Wall Street expects Lockheed Martin’s full-year EPS of $27.62 to stay about the same.

Key Takeaways from Lockheed Martin’s Q3 Results

We were impressed by how significantly Lockheed Martin blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street’s estimates. On the other hand, its revenue this quarter unfortunately missed. Overall, we think this was a solid quarter with some key areas of upside despite the revenue miss. The stock remained flat at $613 immediately following the results.

Should you buy the stock or not?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.