Home improvement retailer Lowe’s (NYSE:LOW) fell short of analysts' expectations in Q3 FY2023, with revenue down 12.8% year on year to $20.47 billion. Its full-year revenue guidance of $86 billion at the midpoint also came in 1.8% below analysts' estimates. Turning to EPS, Lowe's made a GAAP profit of $3.06 per share, improving from its profit of $0.25 per share in the same quarter last year.

Is now the time to buy Lowe's? Find out by accessing our full research report, it's free.

Lowe's (LOW) Q3 FY2023 Highlights:

- Revenue: $20.47 billion vs analyst estimates of $20.86 billion (1.8% miss)

- EPS: $3.06 vs analyst estimates of $3.02 (1.4% beat)

- The company dropped its revenue guidance for the full year from $88 billion to $86 billion at the midpoint, a 2.3% decrease (full year EPS guide also lowered)

- Free Cash Flow of $546 million, down 68.3% from the same quarter last year

- Gross Margin (GAAP): 33.7%, up from 33.3% in the same quarter last year

- Same-Store Sales were down 7.4% year on year (miss vs. expectations of down 5.0% year on year)

- Store Locations: 1,746 at quarter end, decreasing by 223 over the last 12 months

"In the third quarter, the company delivered strong operating performance and improved customer service despite a greater-than-expected pullback in DIY discretionary spending, particularly in bigger ticket categories. Given our 75% DIY mix, the DIY pressure disproportionately impacted our third quarter comp performance. At the same time, our investments in Pro continue to resonate, resulting in positive Pro comps again this quarter," said Marvin R. Ellison, Lowe's chairman, president and CEO.

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Sales Growth

Lowe's is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

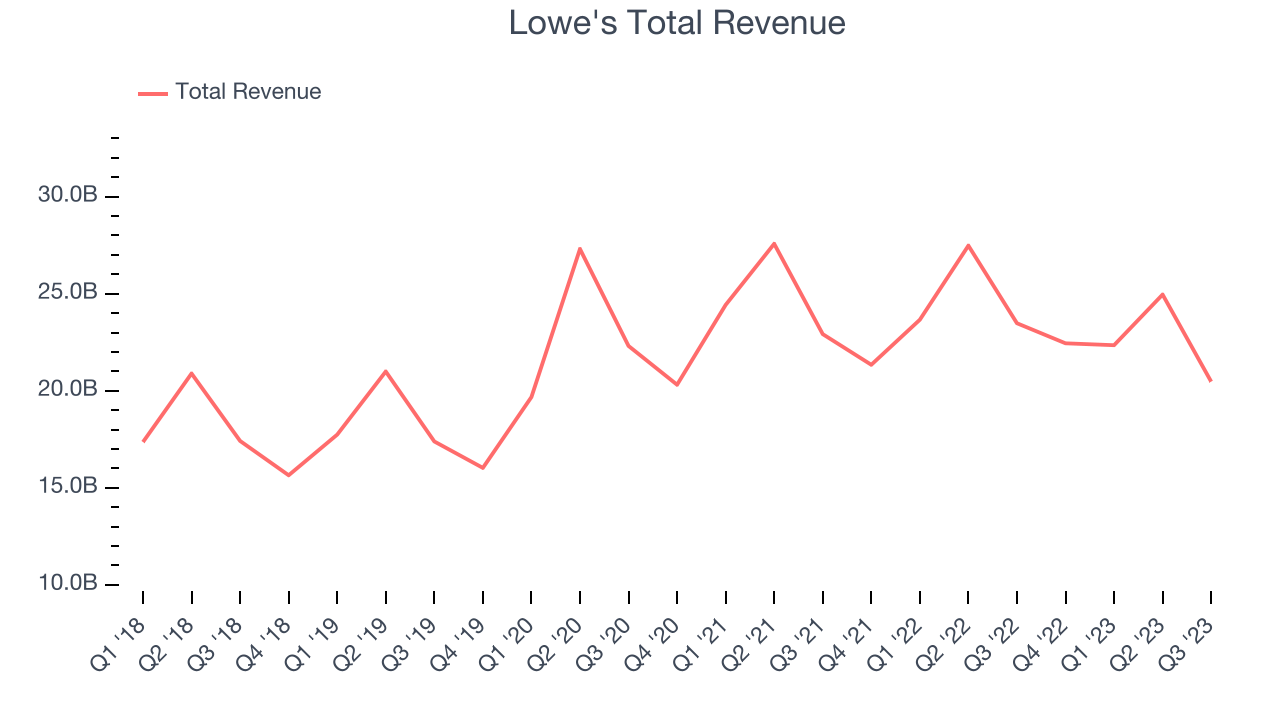

As you can see below, the company's annualized revenue growth rate of 5.9% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre as its store count dropped.

This quarter, Lowe's reported a rather uninspiring 12.8% year-on-year revenue decline, missing Wall Street's expectations. Looking ahead, analysts expect revenue to decline 2.4% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Number of Stores

When a retailer like Lowe's is shuttering stores, it usually means that brick-and-mortar demand is less than supply, and the company is responding by closing underperforming locations and possibly shifting sales online. Since last year, Lowe's store count shrank by 223 locations, or 11.3%, to 1,746 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally closed its stores over the last two years, averaging a 10.2% annual decline in its physical footprint. A smaller store base means that the company must rely on higher foot traffic and sales per customer at its remaining stores as well as e-commerce sales to fuel revenue growth.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

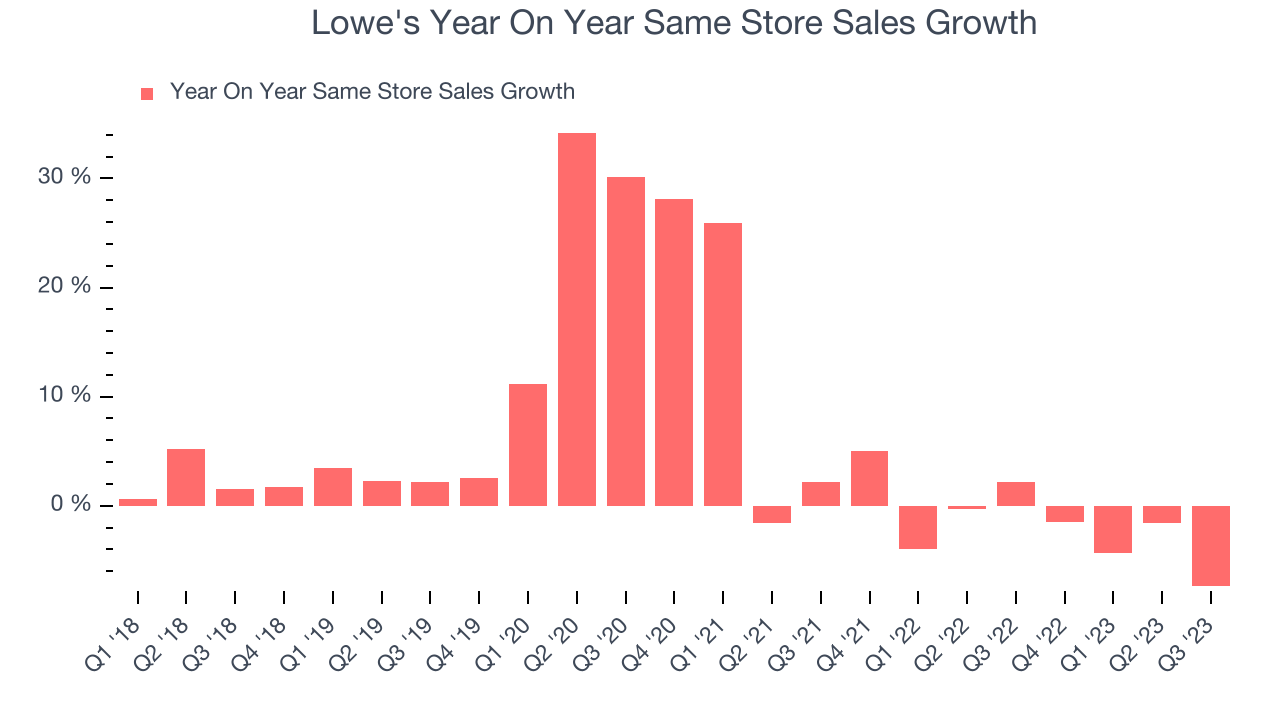

Lowe's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 1.5% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Lowe's same-store sales fell 7.4% year on year. This decline was a reversal from the 2.2% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Lowe's Q3 Results

Sporting a market capitalization of $118 billion, more than $1.53 billion in cash on hand, and positive free cash flow over the last 12 months, we believe that Lowe's is attractively positioned to invest in growth.

It was encouraging to see Lowe's top analysts' EPS expectations this quarter. Other than that, revenue missed, driven by worse-than-expected same-store sales. Guidance for the full year was also lowered for same-store sales, revenue, and EPS. The company is down 5.6% on the results and currently trades at $192.9 per share.

Lowe's may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.