As Q3 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the home furnishing and improvement retail stocks, including Lowe's (NYSE:LOW) and its peers.

Home furnishing and improvement retailers understand that ‘home is where the heart is’ but that a home is only right when it’s in livable condition and furnished just right. These stores therefore focus on providing what is needed for both the upkeep of a house as well as what is desired for the aesthetics of a home. Decades ago, it was thought that furniture and home improvement would resist e-commerce because of the logistical challenges of shipping a sofa or lawn mower, but now you can buy both online; so just like other retailers, these stores need to adapt to new realities and consumer behaviors.

The 7 home furnishing and improvement retail stocks we track reported a slower Q3; on average, revenues missed analyst consensus estimates by 1.9% Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but home furnishing and improvement retail stocks held their ground better than others, with the share prices up 10.8% on average since the previous earnings results.

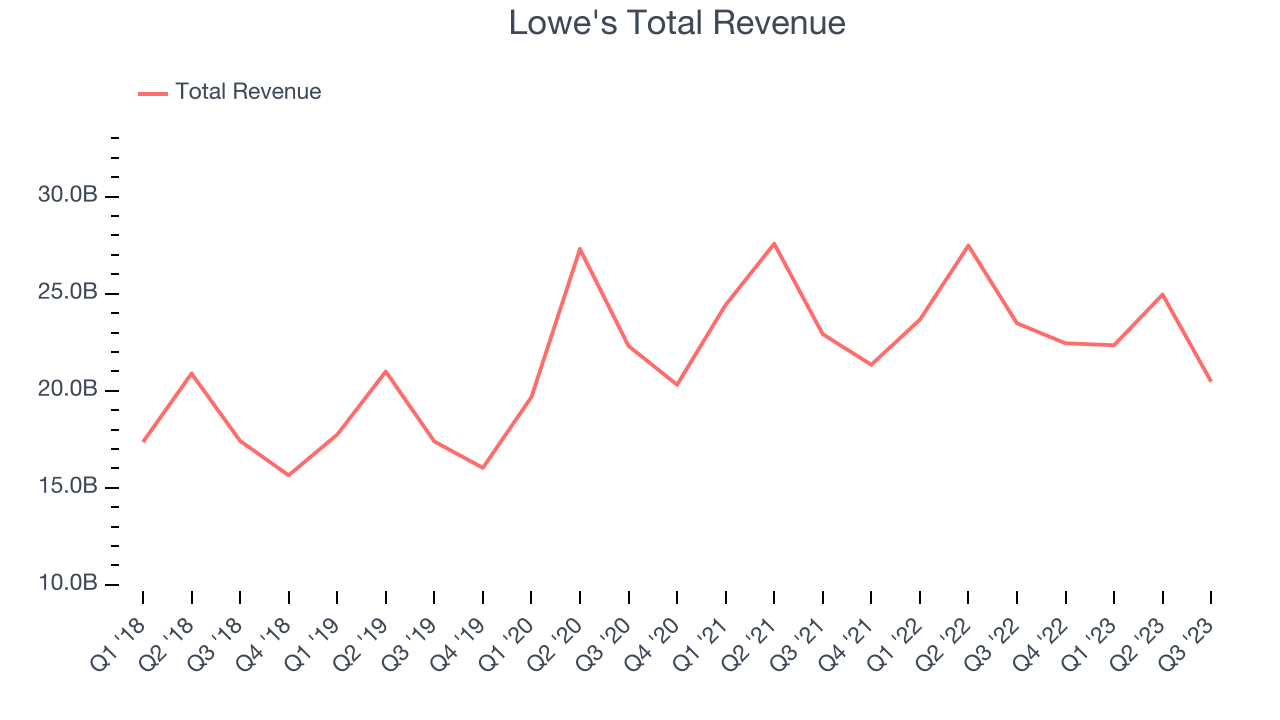

Lowe's (NYSE:LOW)

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

Lowe's reported revenues of $20.47 billion, down 12.8% year on year, falling short of analyst expectations by 1.8%. It was a slower quarter for the company, with a miss of analysts' revenue estimates and full-year revenue guidance missing analysts' expectations.

"In the third quarter, the company delivered strong operating performance and improved customer service despite a greater-than-expected pullback in DIY discretionary spending, particularly in bigger ticket categories. Given our 75% DIY mix, the DIY pressure disproportionately impacted our third quarter comp performance. At the same time, our investments in Pro continue to resonate, resulting in positive Pro comps again this quarter," said Marvin R. Ellison, Lowe's chairman, president and CEO.

The stock is up 7.1% since the results and currently trades at $218.91.

Is now the time to buy Lowe's? Access our full analysis of the earnings results here, it's free.

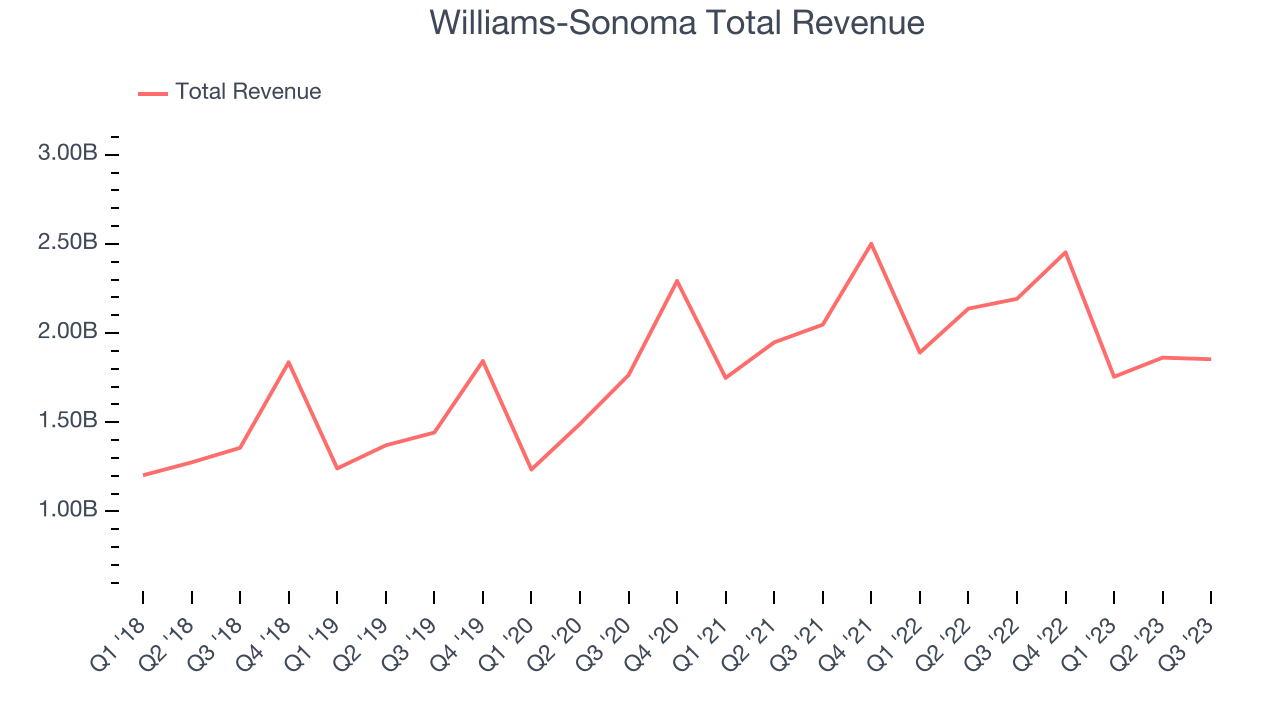

Best Q3: Williams-Sonoma (NYSE:WSM)

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

Williams-Sonoma reported revenues of $1.85 billion, down 15.5% year on year, falling short of analyst expectations by 4.5%. It was a decent quarter for the company, with an impressive beat of analysts' gross margin estimates but a miss of analysts' revenue estimates.

Williams-Sonoma had the slowest revenue growth among its peers. The stock is up 22.8% since the results and currently trades at $198.08.

Is now the time to buy Williams-Sonoma? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Sleep Number (NASDAQ:SNBR)

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Sleep Number reported revenues of $472.6 million, down 12.6% year on year, falling short of analyst expectations by 7.7%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year and a miss of analysts' revenue estimates.

Sleep Number had the weakest performance against analyst estimates in the group. The stock is down 24.8% since the results and currently trades at $12.06.

Read our full analysis of Sleep Number's results here.

RH (NYSE:RH)

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of of high-end furniture and home decor.

RH reported revenues of $751.2 million, down 13.6% year on year, falling short of analyst expectations by 0.9%. It was a weak quarter for the company, with a miss of analysts' earnings and revenue estimates.

The stock is down 2.9% since the results and currently trades at $273.12.

Read our full, actionable report on RH here, it's free.

Home Depot (NYSE:HD)

Founded and headquartered in Atlanta, Georgia, Home Depot (NYSE:HD) is a home improvement retailer that sells everything from tools to building materials to appliances.

Home Depot reported revenues of $37.71 billion, down 3% year on year, in line with analyst expectations. It was a decent quarter for the company, with a narrow beat of analysts' revenue estimates.

The stock is up 23.4% since the results and currently trades at $355.01.

Read our full, actionable report on Home Depot here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned