Home improvement retailer Lowe’s (NYSE:LOW) reported results in line with analysts' expectations in Q4 FY2023, with revenue down 17.1% year on year to $18.6 billion. The company's full-year revenue guidance of $84.5 billion at the midpoint came in 1.3% below analysts' estimates. It made a GAAP profit of $1.77 per share, down from its profit of $2.28 per share in the same quarter last year.

Lowe's (LOW) Q4 FY2023 Highlights:

- Revenue: $18.6 billion vs analyst estimates of $18.47 billion (small beat)

- EPS: $1.77 vs analyst estimates of $1.67 (6.2% beat)

Management's revenue guidance for the upcoming financial year 2024 is $84.5 billion at the midpoint, missing analyst estimates by 1.3% and implying 2.2% decline (vs -11.2% in FY2023)

- Free Cash Flow of $427 million is up from -$288 million in the same quarter last year

- Gross Margin (GAAP): 32.4%, in line with the same quarter last year

- Same-Store Sales were down 6.2% year on year

- Store Locations: 1,746 at quarter end, increasing by 8 over the last 12 months

- Market Capitalization: $133 billion

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

The core Lowe’s customer is the do-it-yourself (DIY) homeowner, often shopping for design, remodeling, or home decor needs. The company also serves professional contractors as well. Like its closest competitor Home Depot, Lowe’s has a broad range of home improvement and design products at competitive prices. For the DIY shopper, Lowe’s offers installation services for products such as cabinets and flooring as well as design consultation services. For the professional contractor, Lowe’s has loyalty programs and volume discounts. There is also a Pro Desk in most stores, where contractors can place large or custom orders and consult with specialists trained to specifically assist professionals.

Since Lowe’s and Home Depot are the two largest home improvement retailers in North America with many similarities, a common question is how they differ. One difference is that Home Depot has a larger selection of appliances and power tools, while Lowe's may have a better selection of home decor and seasonal items. Another difference is the store aesthetic. When you walk into a Home Depot, it looks like a sprawling warehouse, and the feel is very utilitarian. Lowe’s stores, on the other hand, are slightly smaller and have a more traditional retail aesthetic with brighter colors.

Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Home improvement retail competitors include Home Depot (NYSE:HD) and private company Ace Hardware. Amazon.com (NASDAQ:AMZN) and Wayfair (NYSE:W) also offer some home improvement products.Sales Growth

Lowe's is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

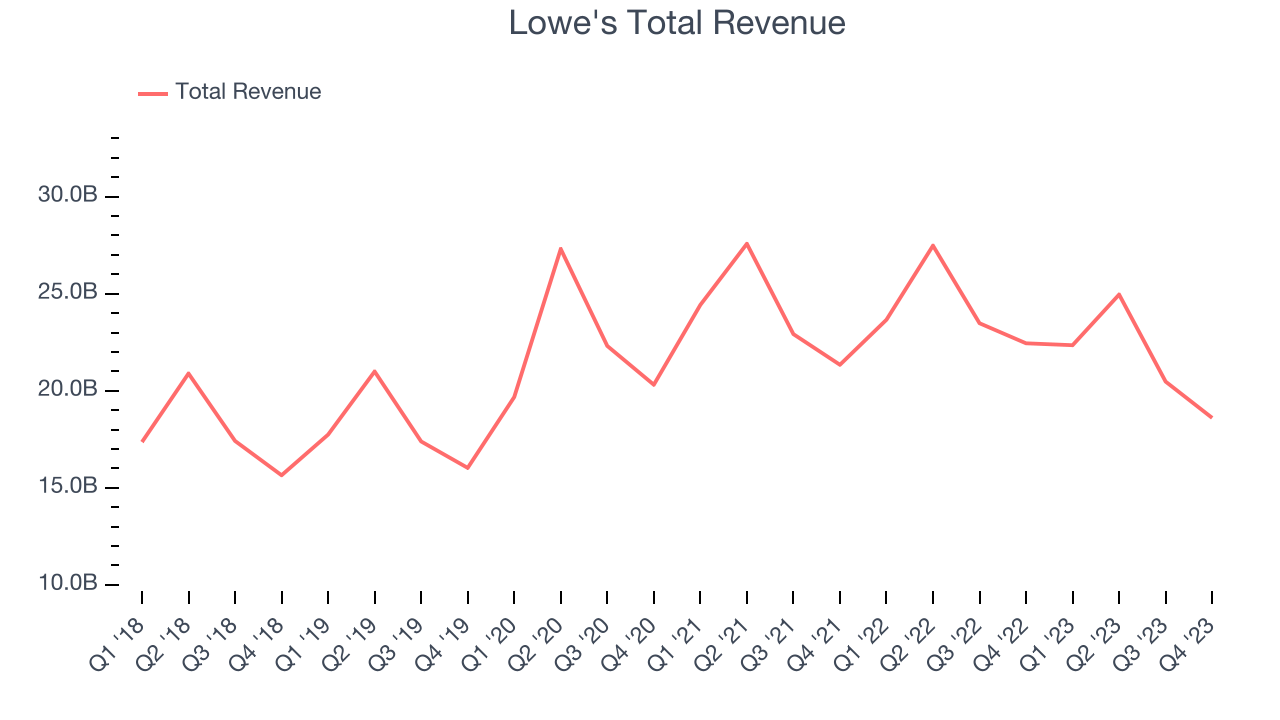

As you can see below, the company's annualized revenue growth rate of 4.6% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak as its store count dropped.

This quarter, Lowe's reported a rather uninspiring 17.1% year-on-year revenue decline to $18.6 billion in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to decline 1.1% over the next 12 months.

Number of Stores

A retailer's store count often determines on how much revenue it can generate.

When a retailer like Lowe's is shuttering stores, it usually means that brick-and-mortar demand is less than supply, and the company is responding by closing underperforming locations and possibly shifting sales online. As of the most recently reported quarter, Lowe's operated 1,746 total retail locations, in line with its store count a year ago.

Taking a step back, the company has generally closed its stores over the last two years, averaging a 5.8% annual decline in its physical footprint. A smaller store base means that the company must rely on higher foot traffic and sales per customer at its remaining stores as well as e-commerce sales to fuel revenue growth.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

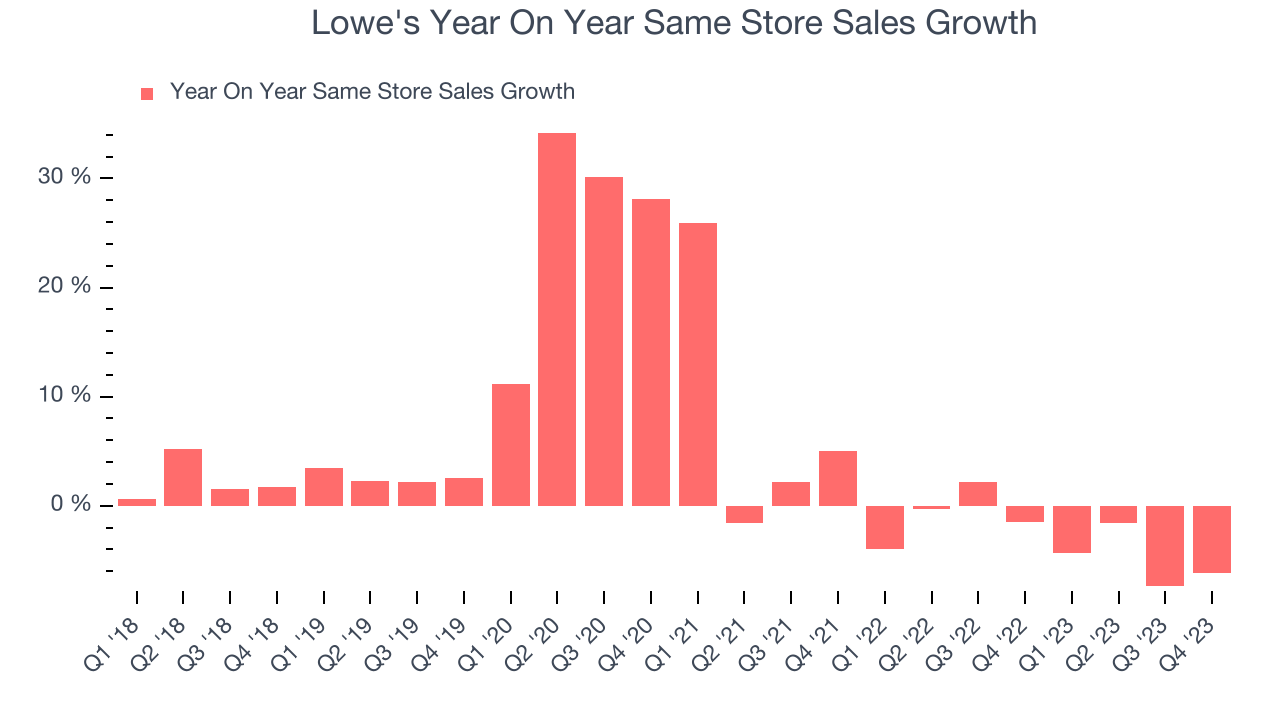

Lowe's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 2.9% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Lowe's same-store sales fell 6.2% year on year. This decrease was a further deceleration from the 1.5% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer's pricing power, product differentiation, and negotiating leverage.

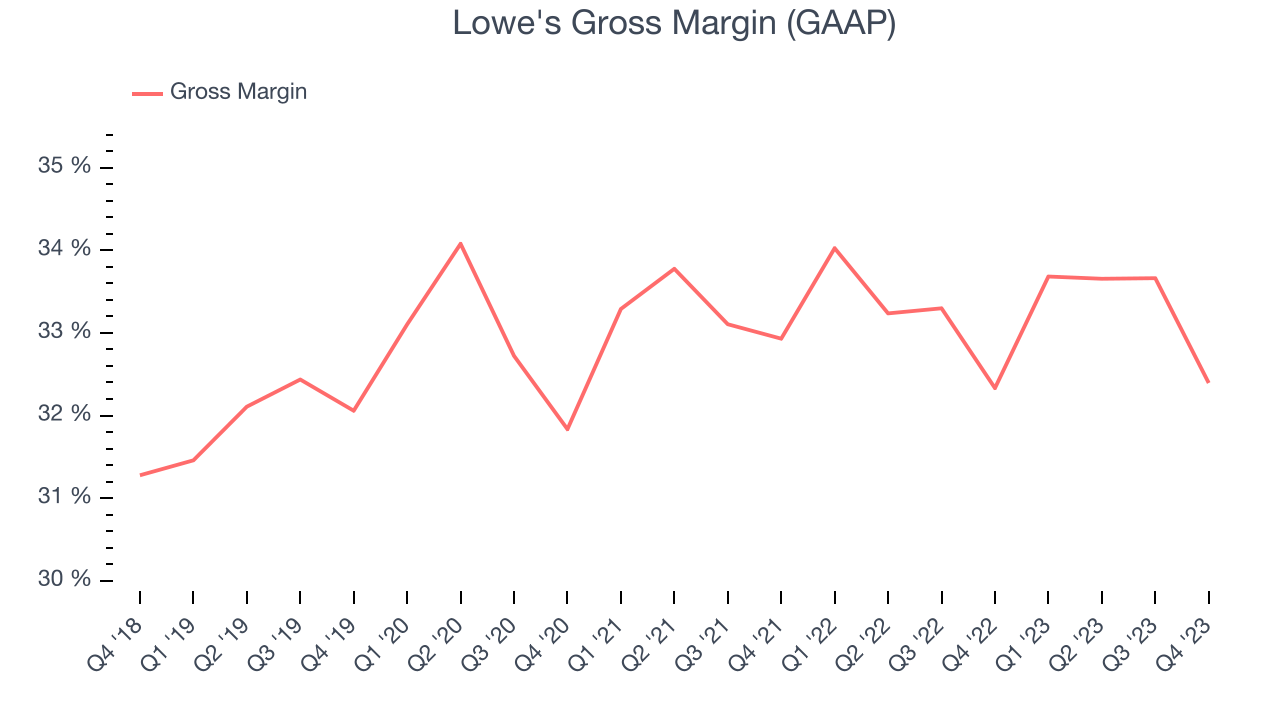

Lowe's has subpar unit economics for a retailer, making it difficult to invest in areas such as marketing and talent to grow its brand. As you can see below, it's averaged a paltry 33.3% gross margin over the last two years. This means the company makes $0.33 for every $1 in revenue before accounting for its operating expenses.

Lowe's produced a 32.4% gross profit margin in Q4, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

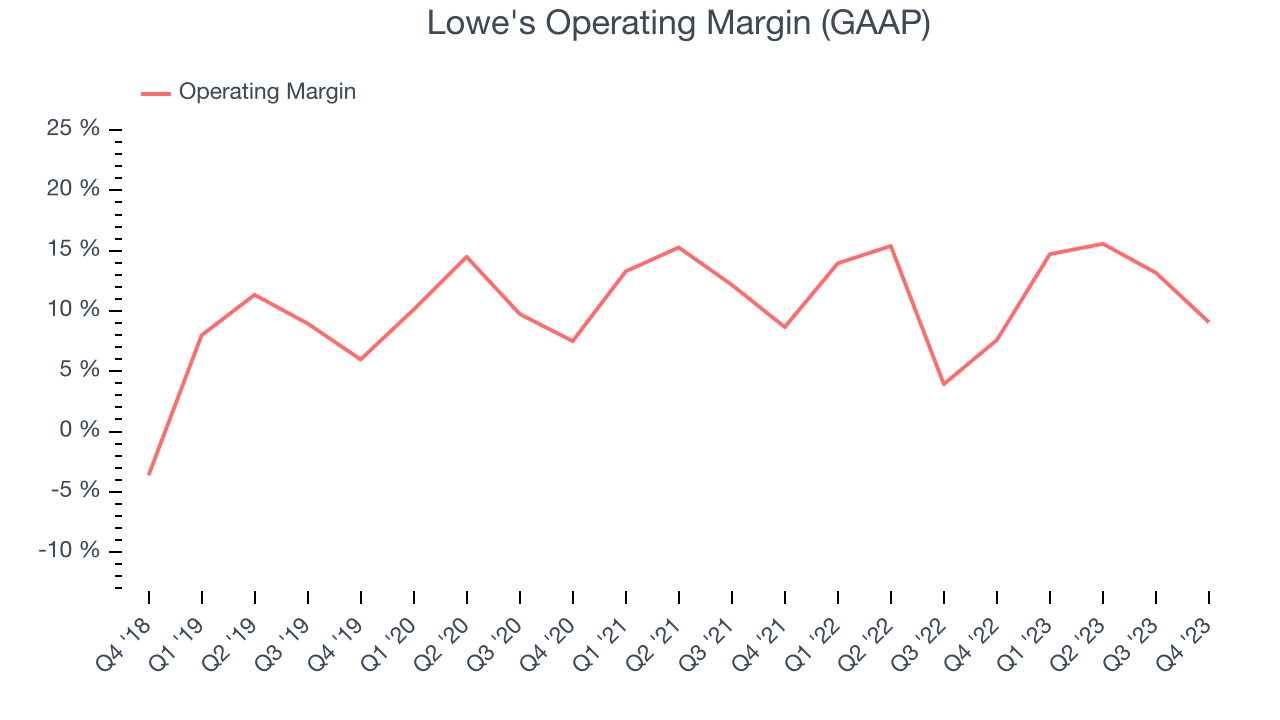

This quarter, Lowe's generated an operating profit margin of 9.1%, up 1.5 percentage points year on year. This increase was encouraging, and we can infer Lowe's was more disciplined with its expenses or gained leverage on fixed costs because its operating margin expanded more than its gross margin.

Zooming out, Lowe's has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer retail business, producing an average operating margin of 11.8%. On top of that, its margin has improved by 2.9 percentage points year on year (on average), an extremely encouraging sign for shareholders. The company's operating profitability was particularly impressive because of its low gross margin. This margin is mostly a factor of what Lowe's sells and takes fundamental shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Lowe's).

Zooming out, Lowe's has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer retail business, producing an average operating margin of 11.8%. On top of that, its margin has improved by 2.9 percentage points year on year (on average), an extremely encouraging sign for shareholders. The company's operating profitability was particularly impressive because of its low gross margin. This margin is mostly a factor of what Lowe's sells and takes fundamental shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Lowe's).EPS

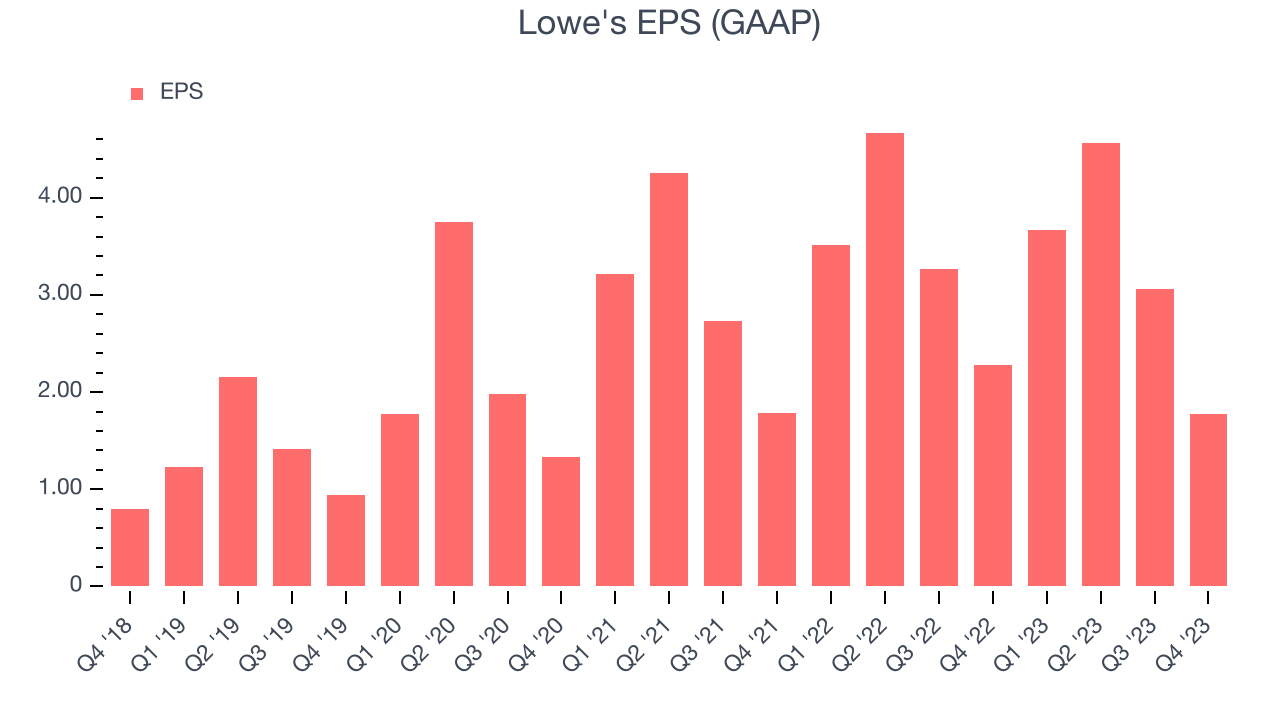

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q4, Lowe's reported EPS at $1.77, down from $2.28 in the same quarter a year ago. This print beat Wall Street's estimates by 6.2%.

Between FY2019 and FY2023, Lowe's adjusted diluted EPS grew 140%, translating into a solid 24.5% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Over the next 12 months, however, Wall Street is projecting an average 2.7% year-on-year decline in EPS.

Cash Is King

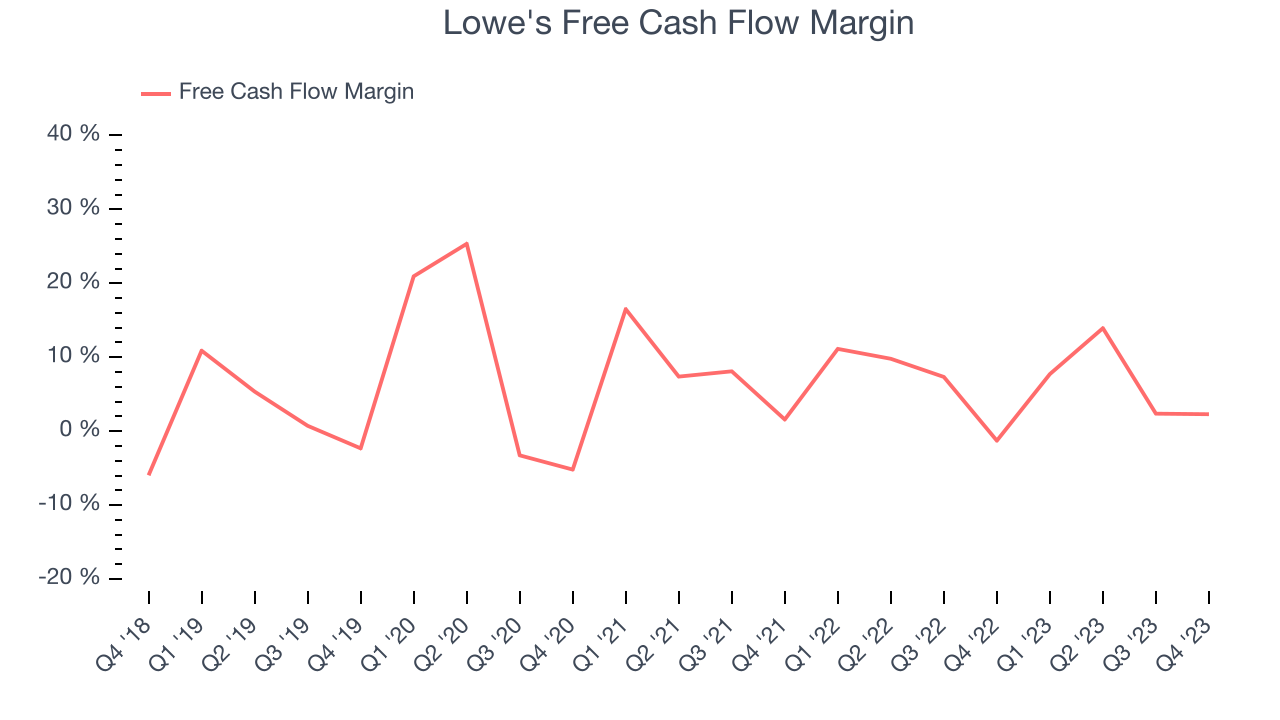

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Lowe's free cash flow came in at $427 million in Q4, representing a 2.3% margin and flipping from negative in the same quarter last year to positive this quarter. Seasonal factors aside, this was great for the business.

Over the last two years, Lowe's has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 7%, quite impressive for a consumer retail business. Furthermore, its margin has been flat, showing that the company's cash flows are relatively stable.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Lowe's hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average ROIC was 36%, splendid for a retail business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Lowe's ROIC averaged 6.9 percentage point increases each year. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Lowe's Q4 Results

It was good to see Lowe's beat analysts' EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. On the other hand, its full-year forecast missed analysts' expectations and same store sales declined. Overall, this was a mediocre quarter for Lowe's. The stock is up 2% in the pre-market and currently trades at $236 per share.

Is Now The Time?

Lowe's may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Lowe's isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been a little slower over the last four years, and analysts expect growth to deteriorate from here. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its declining physical locations suggests its demand is falling. On top of that, its shrinking same-store sales suggests it'll need to change its strategy to succeed.

Lowe's price-to-earnings ratio based on the next 12 months is 18.1x. We can find things to like about Lowe's and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $235.55 per share right before these results (compared to the current share price of $236).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.