Lowe's trades at $270.40 per share and has stayed right on track with the overall market, gaining 16.1% over the last six months while the S&P 500 returned 14.5%.

Is there a buying opportunity in Lowe's, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Ultimately, we're cautious about LOW. Here are three reasons why Lowe's doesn't excite us and one stock we'd rather own today.

Why Is Lowe's Not Exciting?

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

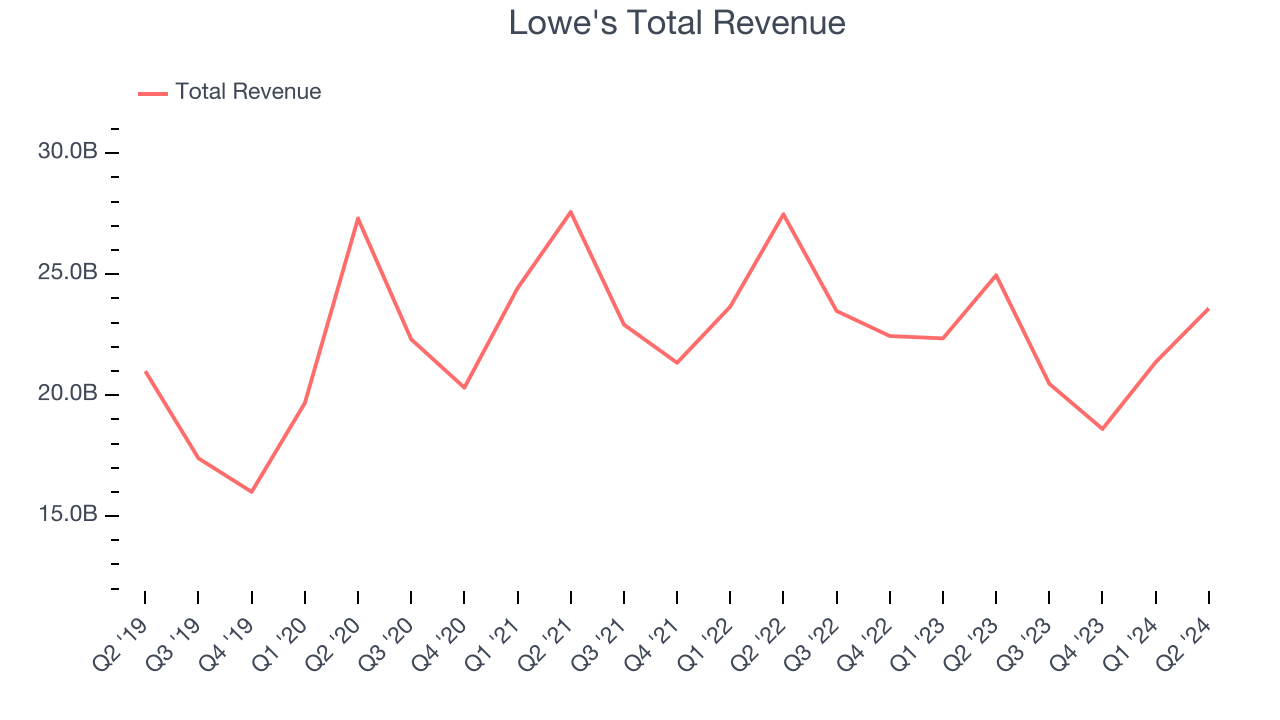

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Lowe’s 3.2% annualized revenue growth over the last five years was sluggish. This shows it couldn’t expand in any major way.

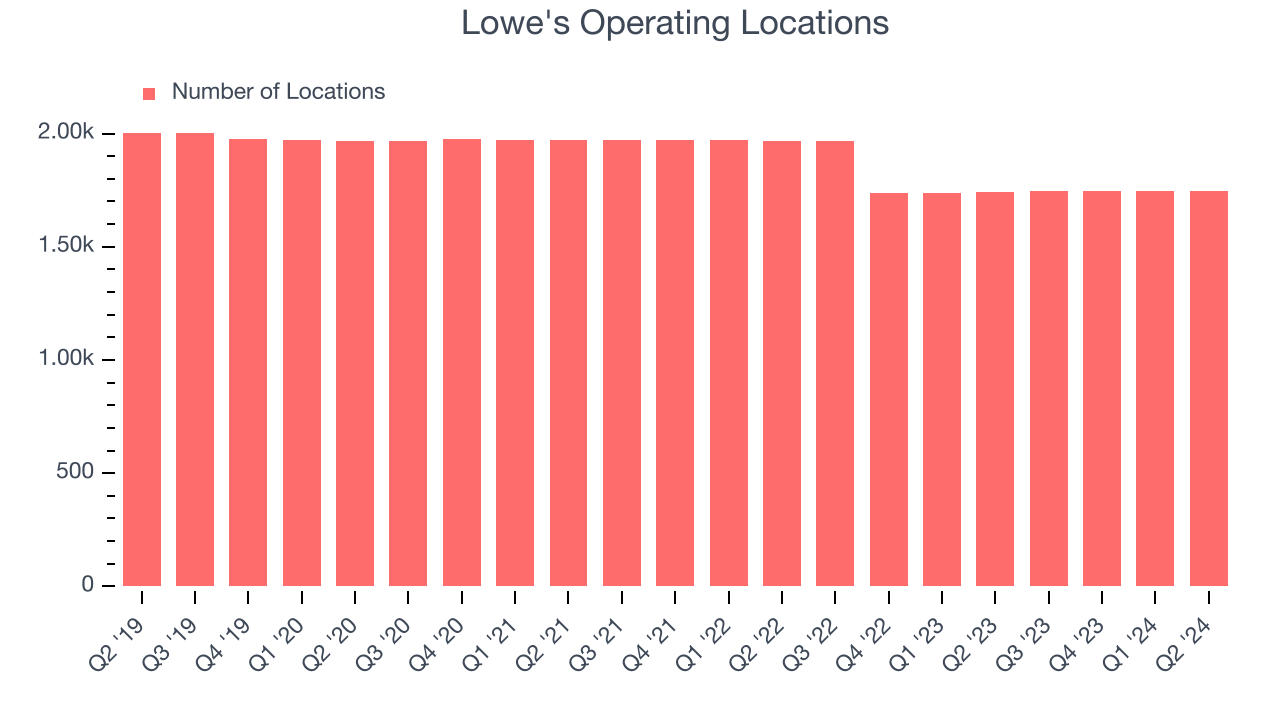

2. Stores Are Closing, a Headwind for Revenue

Lowe's listed 1,746 locations in the latest quarter and has generally closed its stores over the last two years, averaging 5.7% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

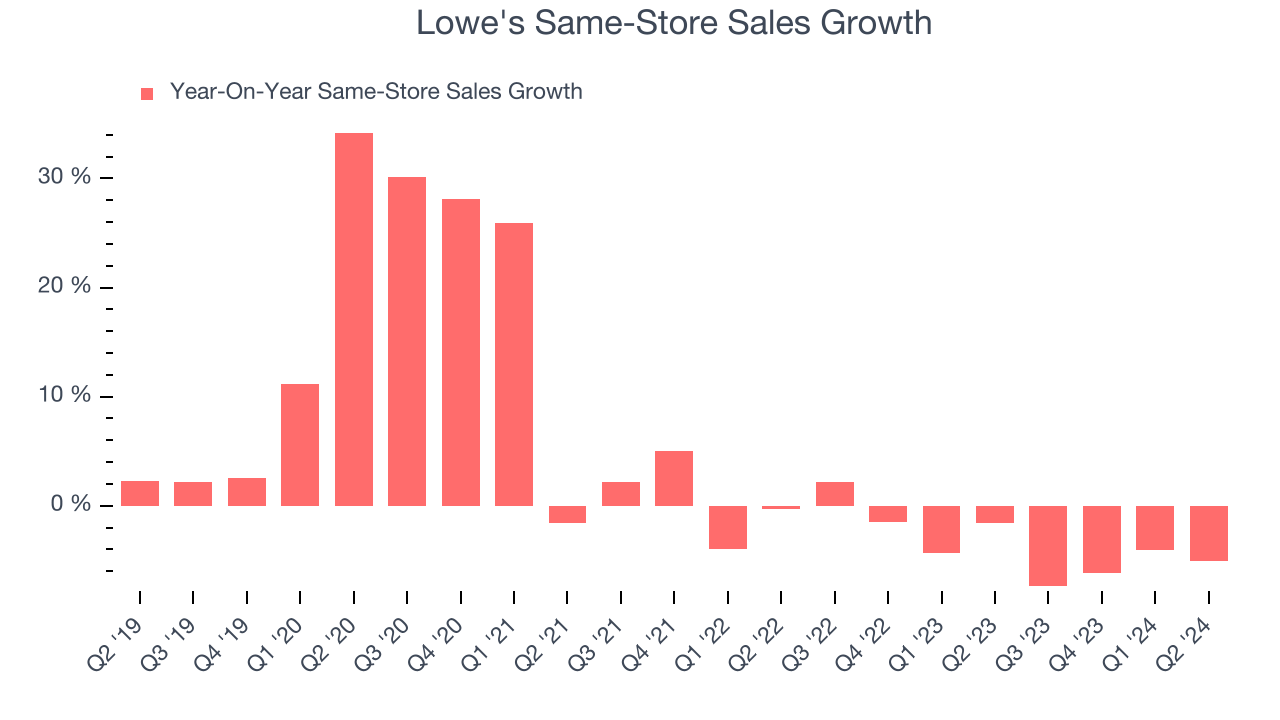

3. Declining Same-Store Sales: Where Is Demand?

Lowe’s demand has been shrinking over the last two years as its same-store sales have averaged 3.5% annual declines.

Final Judgment

Lowe's has a few positive attributes, but it doesn’t top our wishlist. That said, the stock currently trades at 21.3x forward price-to-earnings, or $270.40 per share. This valuation tells us it’s a bit of a market darling with a lot of good news priced in and we think there are better investment opportunities out there. Let us point you toward Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Would Buy Instead of Lowe's

With rates dropping, inflation stabilizing and the elections in the rearview mirror, the market is primed for a potential catalyst — and we are picking the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. These are a curated subset of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% five-year return) as well as under-the-radar businesses like Comfort Systems (+783%) and United Rentals (+550%). Find your next big winner with StockStory today, it’s free.