Premium fitness club Life Time (NYSE:LTH) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 16.8% year on year to $596.7 million. The company's full-year revenue guidance of $2.52 billion at the midpoint also came in 1.4% above analysts' estimates. It made a non-GAAP profit of $0.15 per share, improving from its profit of $0.11 per share in the same quarter last year.

Life Time (LTH) Q1 CY2024 Highlights:

- Revenue: $596.7 million vs analyst estimates of $588.5 million (1.4% beat)

- Adjusted EBITDA: $146 million vs analyst estimates of $144 million (1.1% beat)

- EPS (non-GAAP): $0.15 vs analyst expectations of $0.15 (in line)

- The company lifted its revenue guidance for the full year from $2.48 billion to $2.52 billion at the midpoint, a 1.4% increase (above analyst estimates of $2.48 billion)

- The company lifted its adjusted guidance for the full year from $603 million to $611 million at the midpoint, a 1.3% increase (above analyst estimates of $605 million)

- Free Cash Flow was -$66.39 million compared to -$36.05 million in the previous quarter

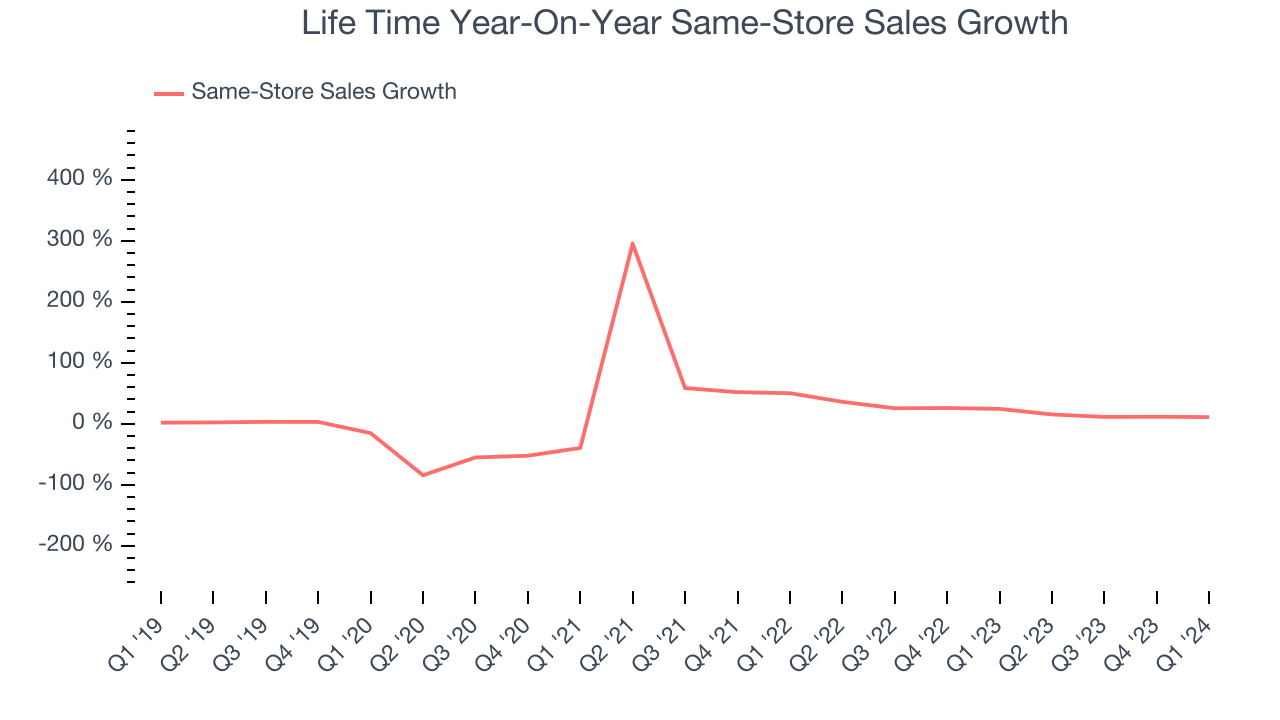

- Same-Store Sales were up 11.1% year on year

- Market Capitalization: $2.69 billion

With over 150 locations and gyms that include saunas and steam rooms, Life Time (NYSE:LTH) is an upscale fitness club emphasizing holistic well-being and fitness.

Life Time was founded in 1990 by Bahram Akradi, to redefine the traditional gym experience. Frustrated with the limitations of conventional fitness centers, Akradi envisioned a comprehensive health resort that catered to every aspect of a person's well-being, not just physical fitness.

Beyond just a place to work out, Life Time offers its members a suite of services including advanced fitness equipment, group classes, spa services, nutritional counseling, and communal events. This approach tackles the broader challenge of wellness in modern life, promoting a balanced lifestyle that incorporates physical and mental well-being.

Life Time's revenue streams are primarily driven by membership fees, with additional contributions from personal training sessions, spa treatments, and nutritional products. Its financial model capitalizes on various offerings to maximize member spending.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Competitors offering similar fitness experiences include Equinox, Xponential Fitness (NYSE:XPOF), and Planet Fitness (NYSE:PLNT).Sales Growth

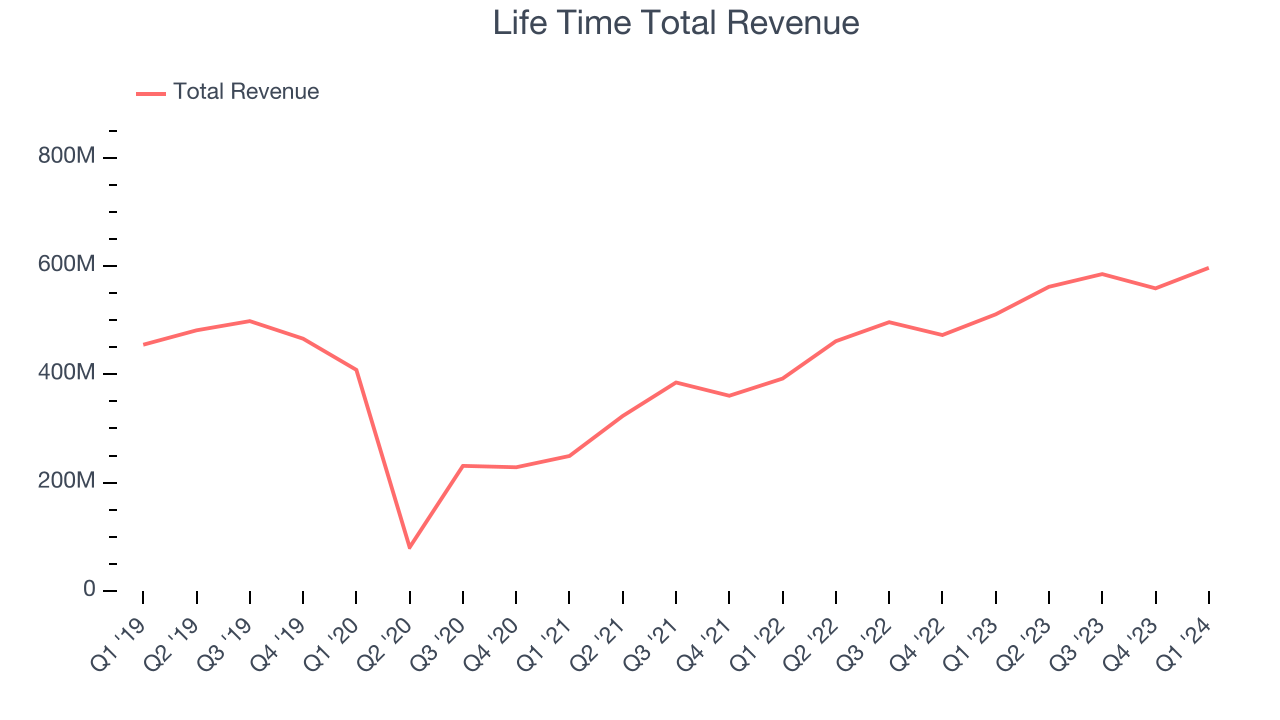

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Life Time's annualized revenue growth rate of 5.6% over the last four years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Life Time's annualized revenue growth of 25.5% over the last two years is above its four-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Life Time's annualized revenue growth of 25.5% over the last two years is above its four-year trend, suggesting some bright spots.

We can better understand the company's revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Life Time's same-store sales averaged 20.3% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company's top-line performance.

This quarter, Life Time reported robust year-on-year revenue growth of 16.8%, and its $596.7 million of revenue exceeded Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects sales to grow 10.4% over the next 12 months, a deceleration from this quarter.

Operating Margin

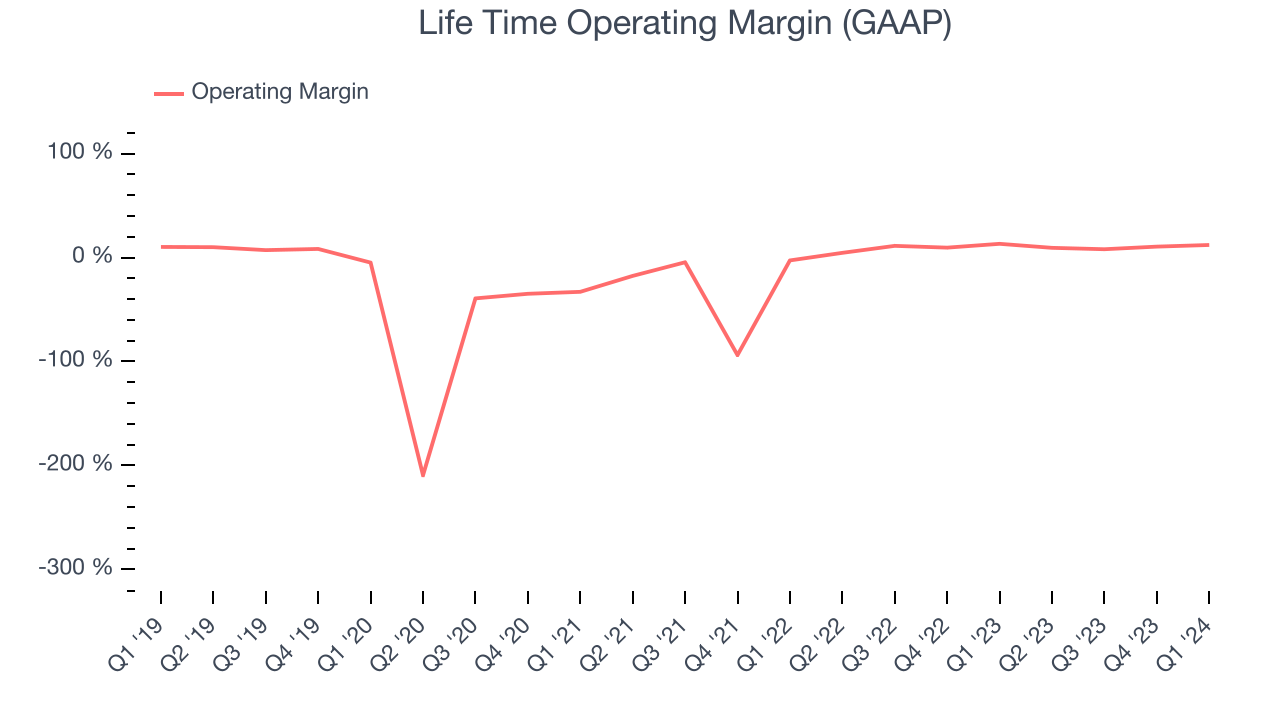

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Life Time was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 9.9%.

In Q1, Life Time generated an operating profit margin of 12.1%, down 1.1 percentage points year on year.

Over the next 12 months, Wall Street expects Life Time to become more profitable. Analysts are expecting the company’s LTM operating margin of 10% to rise to 12%.EPS

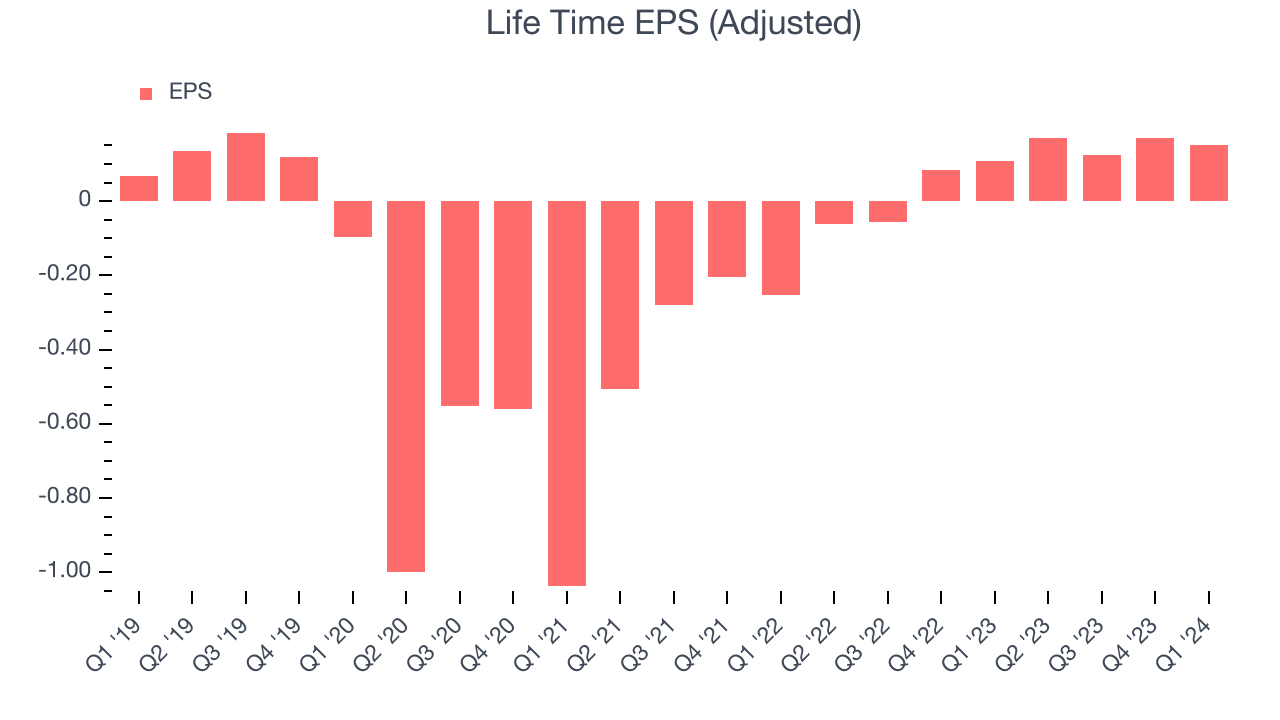

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last four years, Life Time's EPS grew 80.4%, translating into a solid 15.9% compounded annual growth rate. This performance is materially higher than its 5.6% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

While we mentioned earlier that Life Time's operating margin declined this quarter, a four-year view shows its margin has expanded 16.9 percentage points, leading to higher profitability and earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Life Time reported EPS at $0.15, up from $0.11 in the same quarter last year. This print was close to analysts' estimates. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but unfortunately, there is insufficient data.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

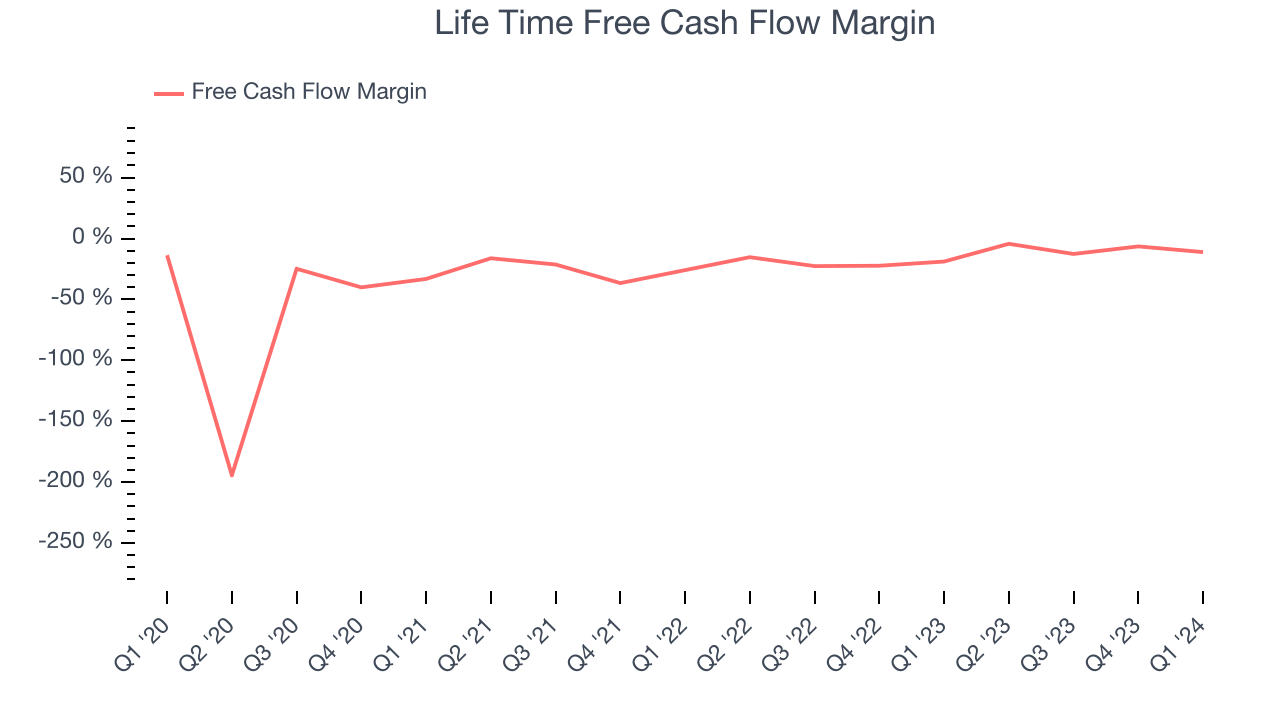

Over the last two years, Life Time's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 13.8%.

Life Time burned through $66.39 million of cash in Q1, equivalent to a negative 11.1% margin, increasing its cash burn by 31.2% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

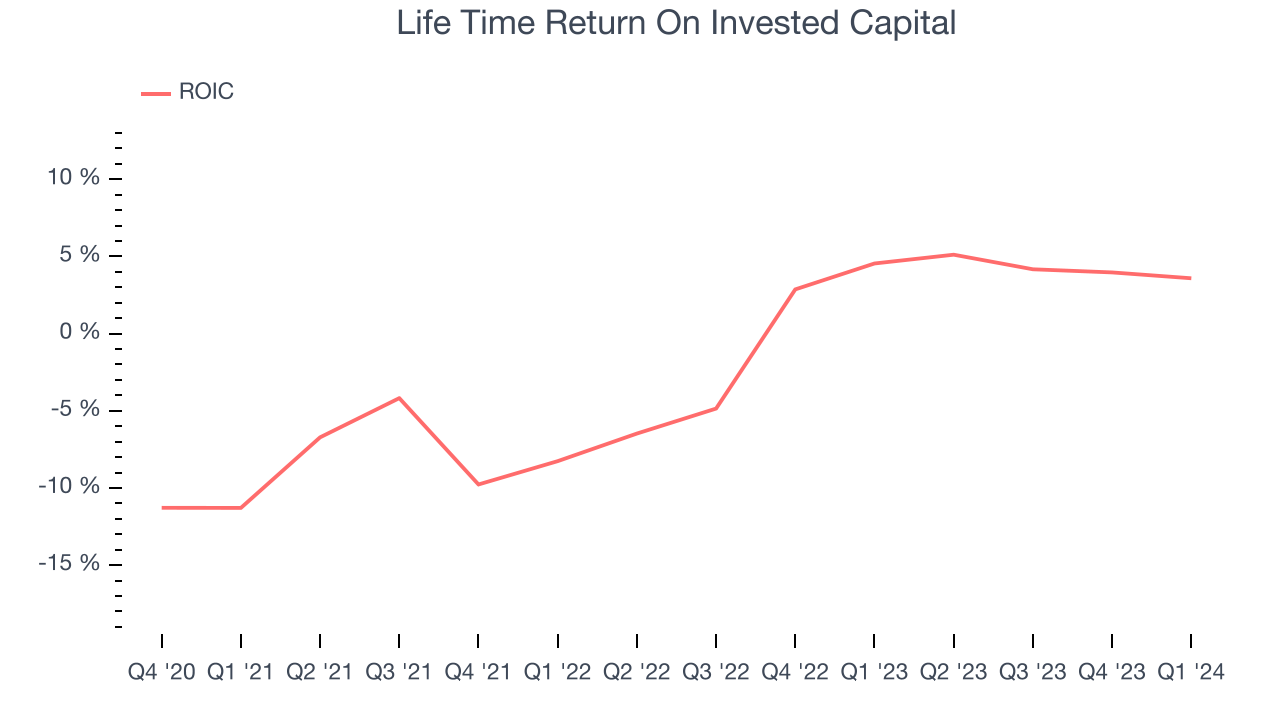

Life Time's five-year average return on invested capital was negative 2.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Life Time's ROIC averaged 13.8 percentage point increases. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Life Time's $4.33 billion of debt exceeds the $18.6 million of cash on its balance sheet. Furthermore, its 8x net-debt-to-EBITDA ratio (based on its EBITDA of $562.7 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Life Time could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Life Time can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Life Time's Q1 Results

This was one of those 'beat and raise' quarters that the market cheers. The company exceeded expectations for revenue and adjusted EBITDA and raised its full year guidance for both metrics, showing that the demand environment is now stronger than what Life Time saw just about three months ago when it gave its previous guidance. The stock is flat after reporting and currently trades at $13.66 per share.

Is Now The Time?

Life Time may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Life Time, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last four years, but at least growth is expected to increase in the short term. And while its EPS growth over the last four years has exceeded its peer group average, the downside is its relatively low ROIC suggests it has historically struggled to find compelling business opportunities. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

While there are some things to like about Life Time and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $20.80 per share right before these results (compared to the current share price of $13.66).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.