Potato products company Lamb Weston (NYSE:LW) missed analysts' expectations in Q1 CY2024, with revenue up 16.3% year on year to $1.46 billion. The company's full-year revenue guidance of $6.57 billion at the midpoint also came in 4.5% below analysts' estimates. It made a non-GAAP profit of $1.20 per share, down from its profit of $1.43 per share in the same quarter last year.

Lamb Weston (LW) Q1 CY2024 Highlights:

- Revenue: $1.46 billion vs analyst estimates of $1.65 billion (11.8% miss)

- EPS (non-GAAP): $1.20 vs analyst expectations of $1.45 (17.3% miss)

- The company dropped its revenue guidance for the full year from $6.9 billion to $6.57 billion at the midpoint, a 4.8% decrease

- Gross Margin (GAAP): 27.7%, down from 31.7% in the same quarter last year

- Free Cash Flow was -$229.5 million compared to -$119.7 million in the previous quarter

- Organic Revenue was up 16% year on year

- Sales Volumes were up 12% year on year

- Market Capitalization: $14.6 billion

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

The company was founded in 1950 and began as a small regional supplier of frozen potato products in the Pacific Northwest. Over the subsequent decades, Lamb Weston merged with and was spun off from Conagra.

Today, Lamb Weston's product portfolio still centers around potato products, whether it be frozen curly fries or potato chips of various cuts and textures. The company goes to market with its Grown in Idaho and Alexia brands, selling both to individual consumers as well as restaurants and food service businesses.

As such, Lamb Weston’s core customers can be the global fast-food chain with fries on the menu or the mom/dad that does the grocery shopping for the family. Either way, both these customers want a dependable brand that offers convenience and competitive prices. For the retail customer, Lamb Weston products can be found at supermarkets, regional grocery stores, and large general merchandise retailers that sell food.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors offering frozen or potato-based packaged foods include Hormel Foods (NYSE:HRL), Conagra Brands (NYSE:CAG), Kraft Heinz (NASDAQ:KHC), and private company McCain Foods.Sales Growth

Lamb Weston is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

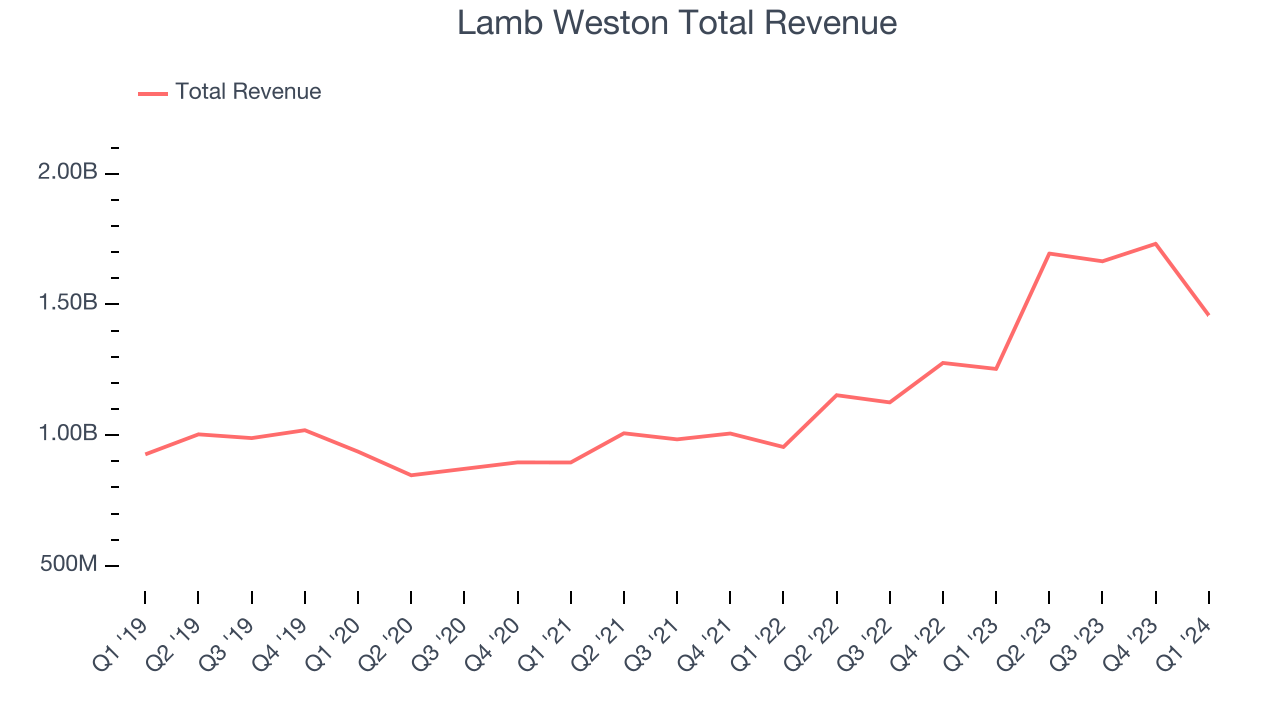

As you can see below, the company's annualized revenue growth rate of 23.1% over the last three years was excellent as consumers bought more of its products.

This quarter, Lamb Weston's revenue grew 16.3% year on year to $1.46 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 9.4% over the next 12 months, a deceleration from this quarter.

Volume Growth

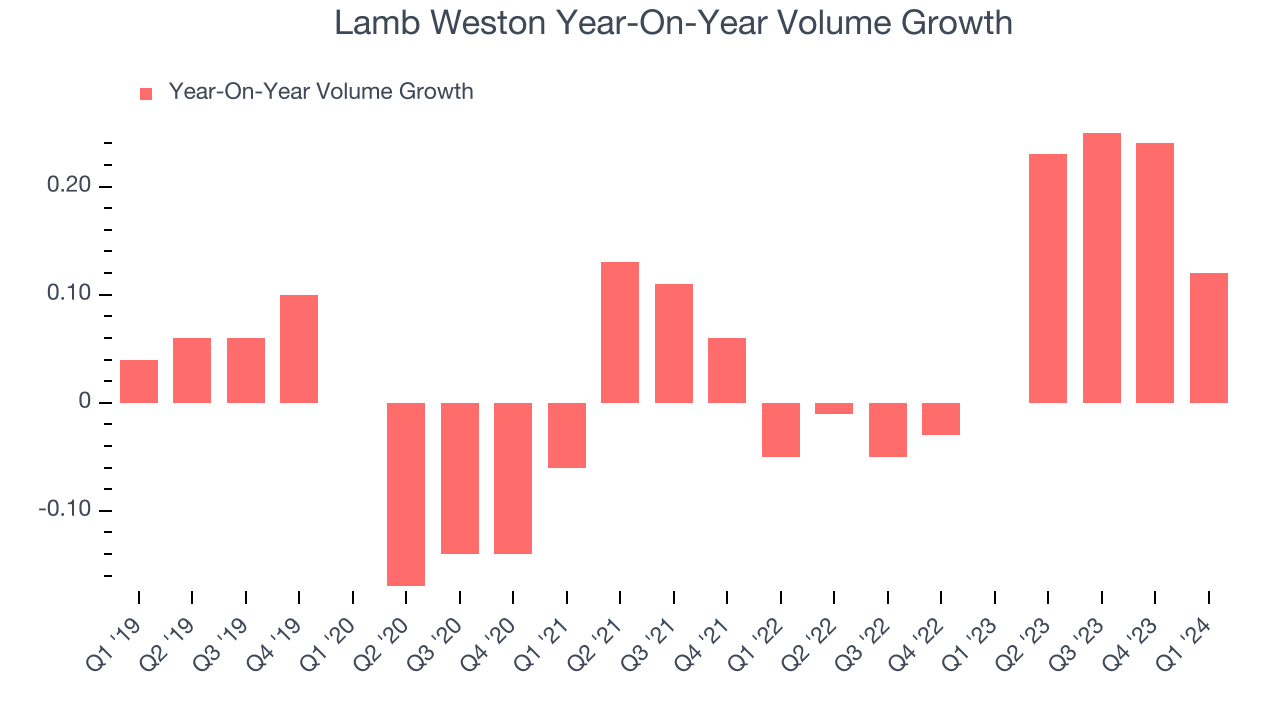

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Lamb Weston generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Lamb Weston's average quarterly volume growth was a robust 9.4%. Even with this splendid performance, we can see that most of the company's gains have come from price increases by looking at its 29.1% average organic revenue growth. The ability to sell more products while raising prices indicates Lamb Weston enjoys inelastic demand.

In Lamb Weston's Q1 2024, sales volumes jumped 12% year on year.

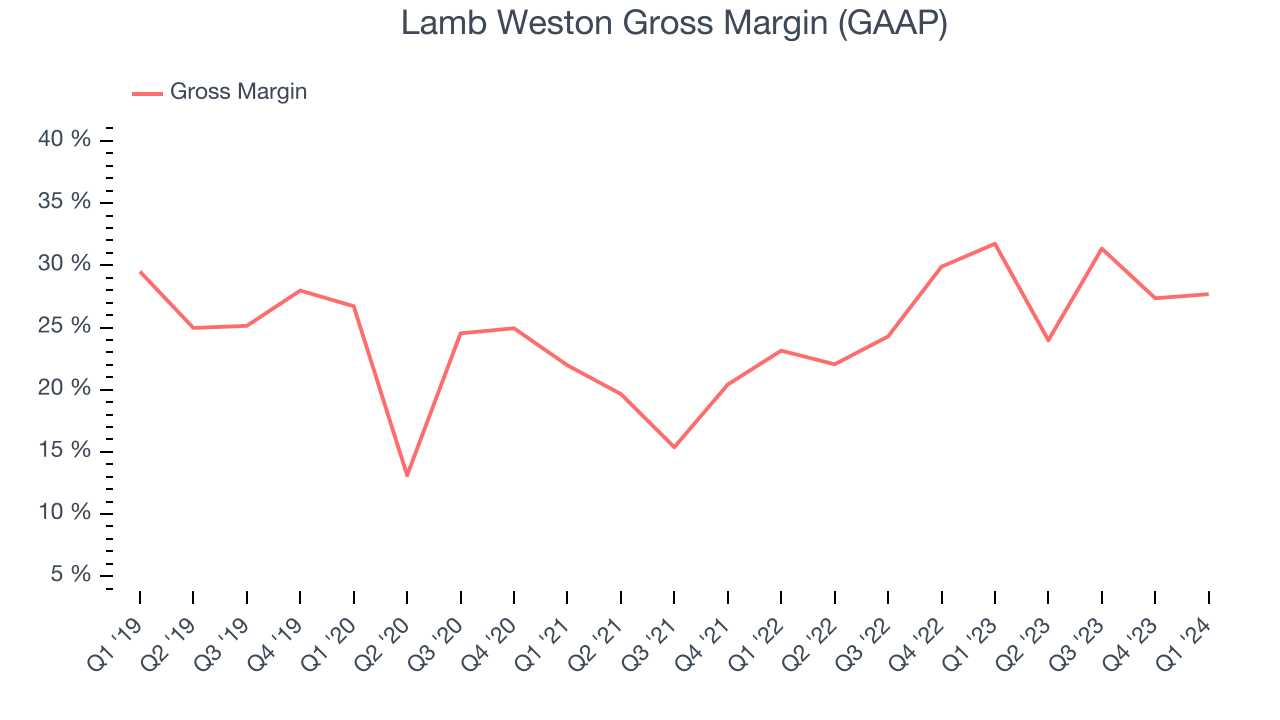

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

This quarter, Lamb Weston's gross profit margin was 27.7%, down 4 percentage points year on year. That means for every $1 in revenue, a chunky $0.72 went towards paying for raw materials, production of goods, and distribution expenses.

Lamb Weston has subpar unit economics for a consumer staples company, making it difficult to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged a 27.4% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 4.2% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

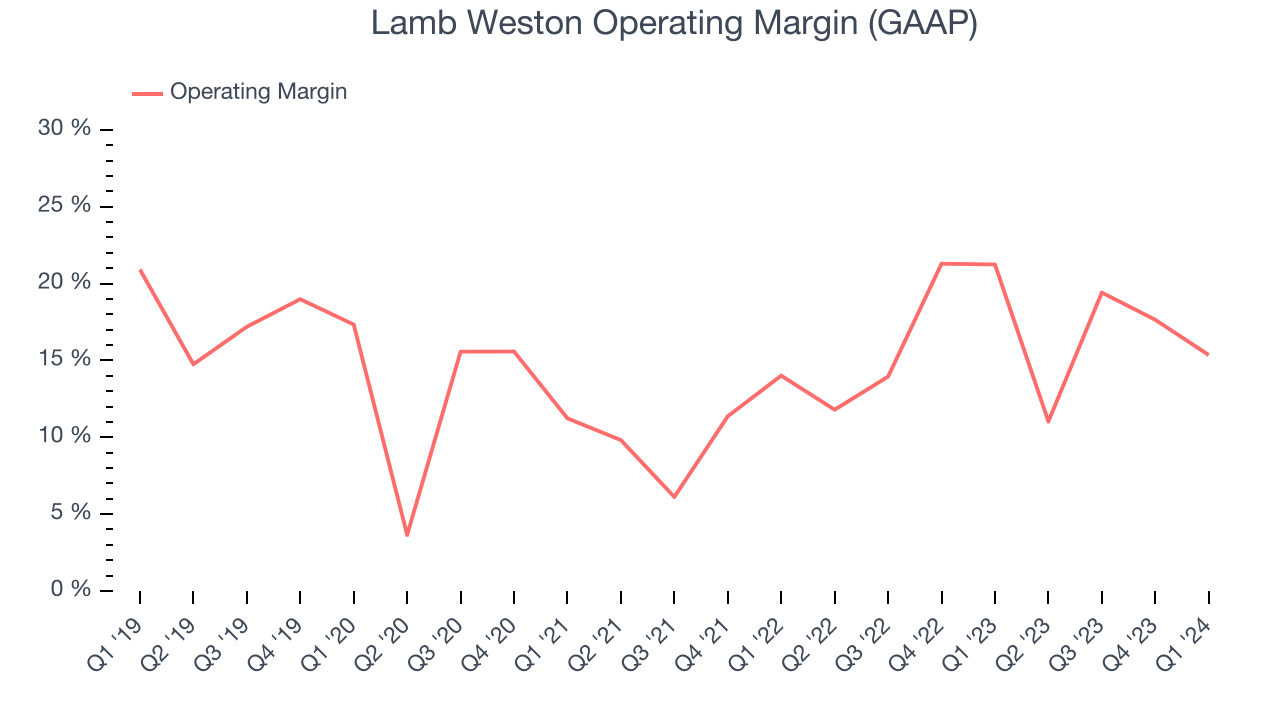

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, Lamb Weston generated an operating profit margin of 15.4%, down 5.9 percentage points year on year. Because Lamb Weston's operating margin decreased more than its gross margin, we can infer the company was less efficient and increased spending in discretionary areas like corporate overhead and advertising.

Zooming out, Lamb Weston has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 16.5%. However, Lamb Weston's margin has slightly declined by 1.4 percentage points on average over the last year. This shows the company has faced some small speed bumps along the way. The company's operating profitability was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes tectonic shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Lamb Weston).

Zooming out, Lamb Weston has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 16.5%. However, Lamb Weston's margin has slightly declined by 1.4 percentage points on average over the last year. This shows the company has faced some small speed bumps along the way. The company's operating profitability was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes tectonic shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Lamb Weston).EPS

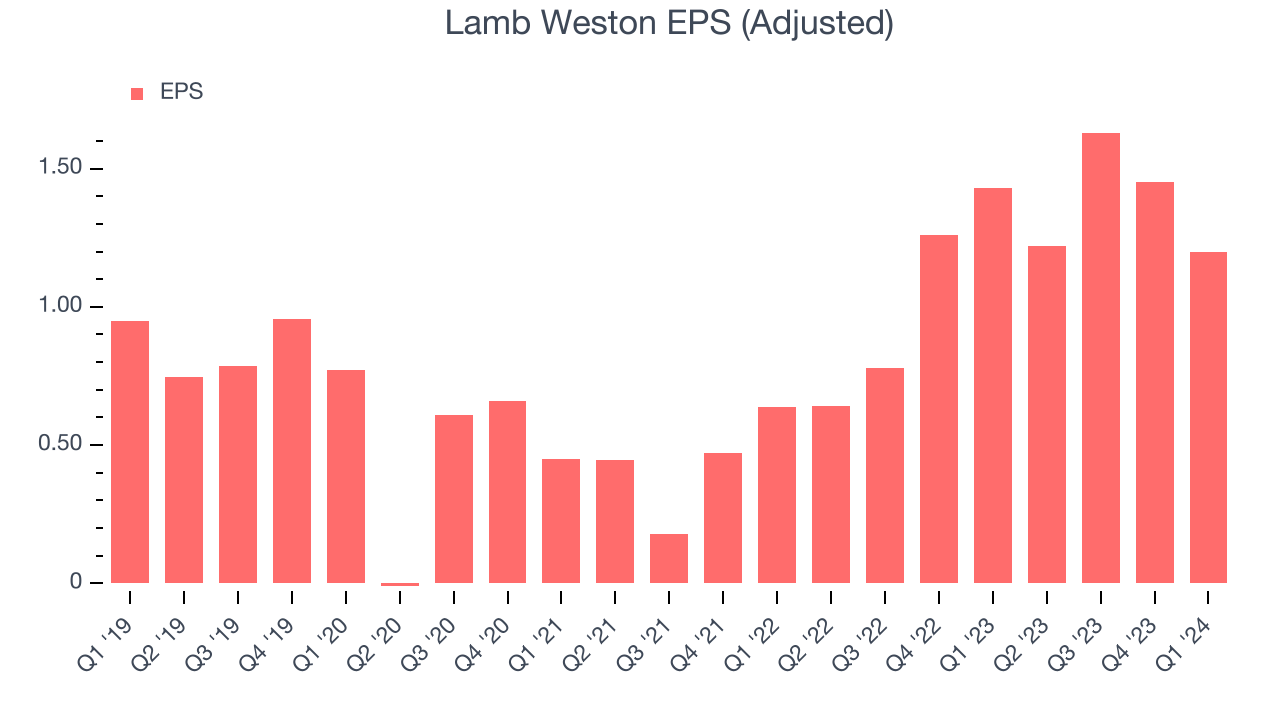

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Lamb Weston reported EPS at $1.20, down from $1.43 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, Lamb Weston's EPS grew 222%, translating into an astounding 47.7% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 17% year-on-year increase in EPS.

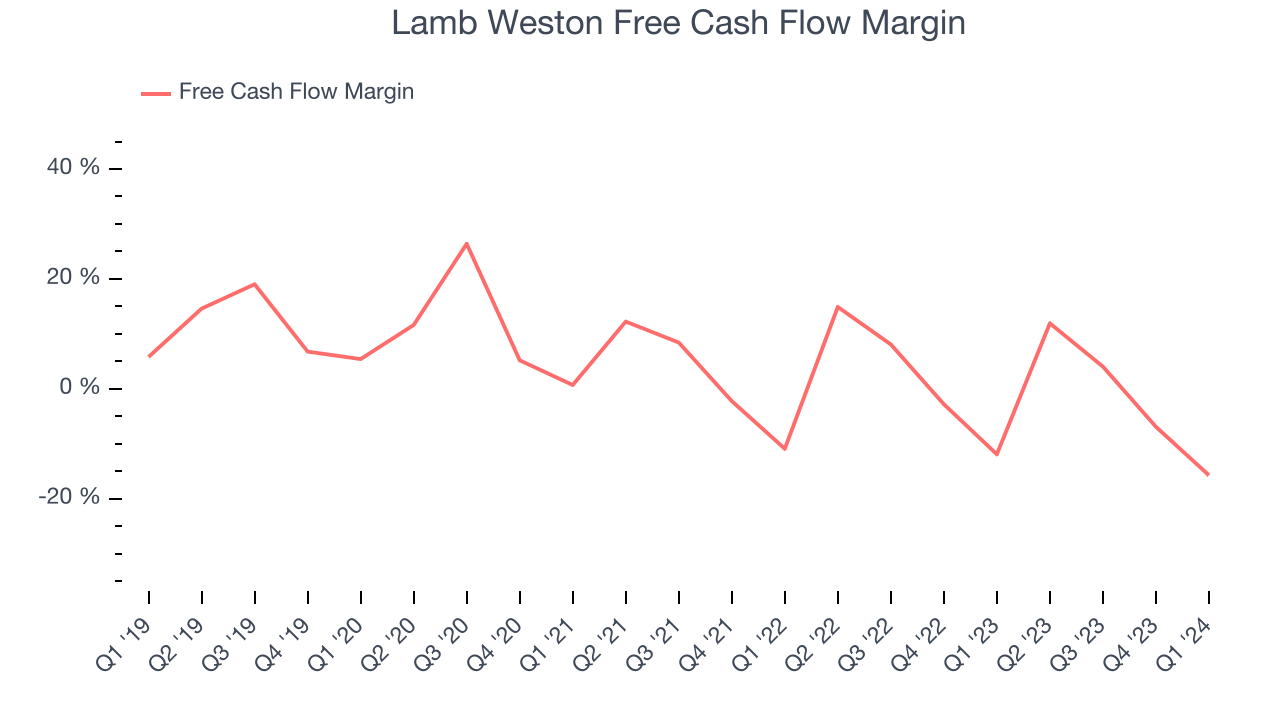

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Lamb Weston burned through $229.5 million of cash in Q1, representing a negative 15.7% free cash flow margin. The company reduced its cash burn by 53.6% year on year.

Over the last two years, Lamb Weston's demanding reinvestment strategy has consumed many company resources. Its free cash flow margin has averaged negative 0%, weak for a consumer staples business. Furthermore, Lamb Weston's margin has averaged year-on-year declines of 2.8 percentage points over the last 12 months. Investors likely aren't thrilled about the company's margin trajectory and would hope to see a reversal soon.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Lamb Weston's five-year average ROIC was 16.4%, higher than most consumer staples companies. Just as you’d like your investment dollars to generate returns, Lamb Weston's invested capital has produced solid profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Lamb Weston's ROIC averaged 3.3 percentage point increases each year. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Key Takeaways from Lamb Weston's Q1 Results

We struggled to find many strong positives in these results. Its revenue and EPS missed analysts' estimates as the company's transition to a new enterprise resource planning system (ERP) significantly disrupted its operations. According to management, the "ERP transition temporarily reduced the visibility of finished goods inventories located at distribution centers, which affected our ability to fill customer orders. In turn, this pressured sales volume and margin performance". Lamb Weston also noted soft demand for restaurants in general and lowered its full-year revenue and EPS guidance, missing Wall Street's estimates. Overall, this was a bad quarter for Lamb Weston. The company is down 11.9% on the results and currently trades at $89.02 per share.

Is Now The Time?

Lamb Weston may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Lamb Weston is a good business. First off, its revenue growth has been impressive over the last three years. And while its operations are burning a modest amount of cash, its EPS growth over the last three years has been fantastic. On top of that, its volume growth has been in a league of its own.

Lamb Weston's price-to-earnings ratio based on the next 12 months is 15.7x. There are definitely a lot of things to like about Lamb Weston, and looking at the consumer staples landscape right now, it seems to be trading at a pretty interesting price.

Wall Street analysts covering the company had a one-year price target of $128.52 per share right before these results (compared to the current share price of $89.02), implying they saw upside in buying Lamb Weston in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.