Live events and entertainment company Live Nation (NYSE:LYV) reported Q1 CY2024 results topping analysts' expectations, with revenue up 21.5% year on year to $3.8 billion. It made a GAAP loss of $0.53 per share, down from its loss of $0.25 per share in the same quarter last year.

Is now the time to buy Live Nation? Find out by accessing our full research report, it's free.

Live Nation (LYV) Q1 CY2024 Highlights:

- Revenue: $3.8 billion vs analyst estimates of $3.24 billion (17.4% beat)

- EPS: -$0.53 vs analyst estimates of -$0.18 (-$0.35 miss)

- Gross Margin (GAAP): 30.3%, down from 32.4% in the same quarter last year

- Free Cash Flow of $71.5 million, up 77.4% from the previous quarter

- Events: 11,203

- Market Capitalization: $20.66 billion

Michael Rapino, President and CEO of Live Nation Entertainment, said, "Our Q1 results demonstrate that live events remain a priority for fans around the world. Global fan demand is stronger than ever, more artists are out on the road, and more venues are being added to bring them together. While operating income will be impacted by one-time accruals, we're on track to deliver another record year with double-digit AOI growth and years of momentum still to come."

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE:LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

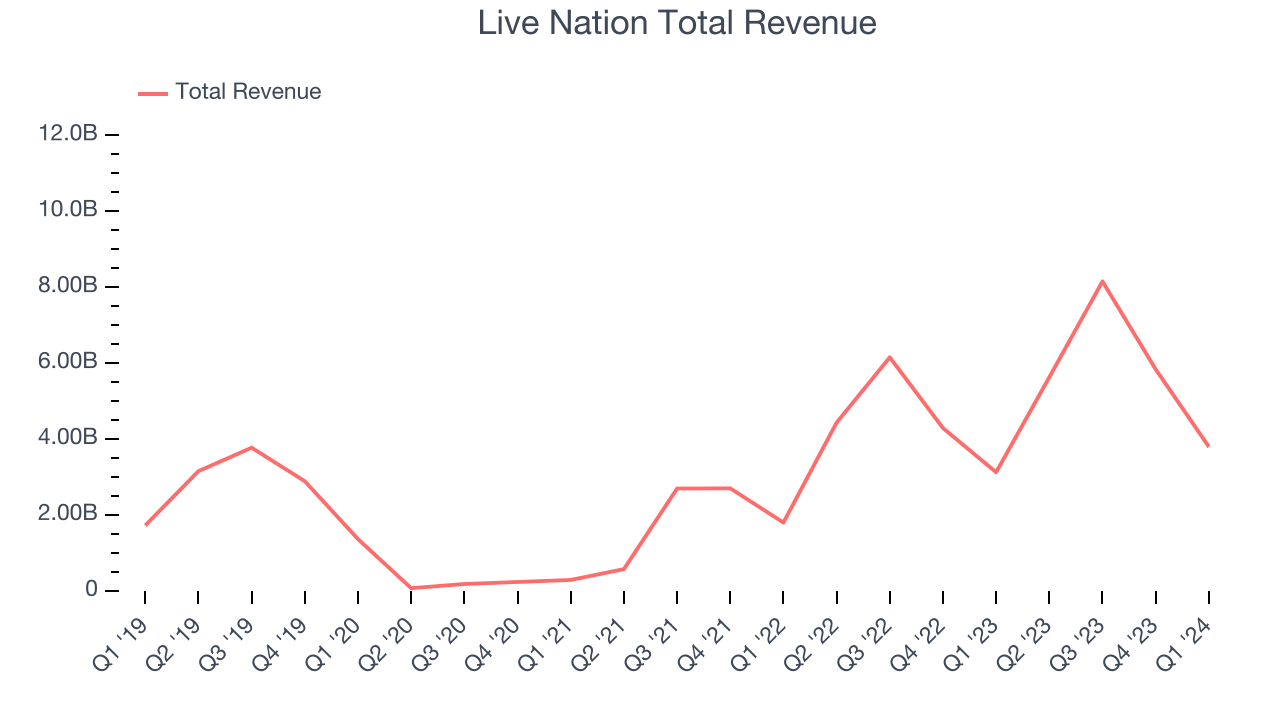

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Live Nation's annualized revenue growth rate of 16.2% over the last five years was decent for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Live Nation's annualized revenue growth of 73.5% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Live Nation's annualized revenue growth of 73.5% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Live Nation reported remarkable year-on-year revenue growth of 21.5%, and its $3.8 billion of revenue topped Wall Street estimates by 17.4%. Looking ahead, Wall Street expects sales to grow 4.6% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

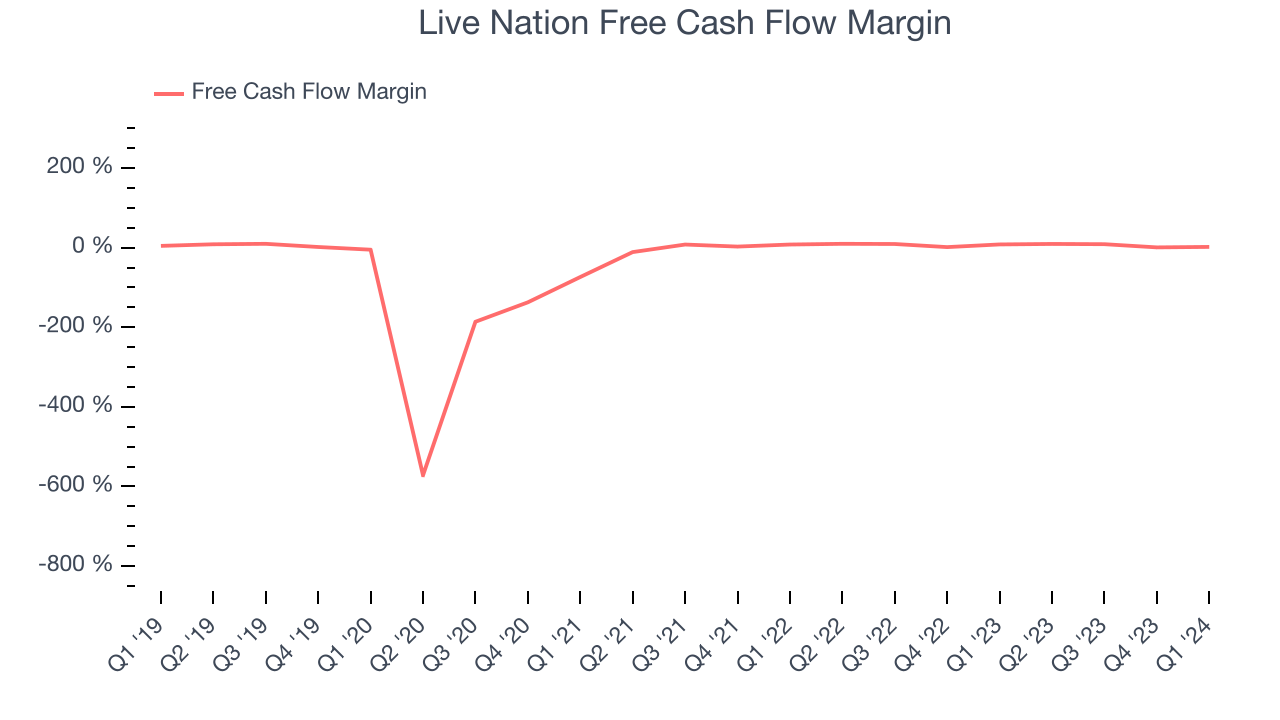

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Live Nation has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 6.4%, subpar for a consumer discretionary business.

Live Nation's free cash flow came in at $71.5 million in Q1, equivalent to a 1.9% margin and down 71.8% year on year.

Key Takeaways from Live Nation's Q1 Results

We were impressed by how significantly Live Nation blew past analysts' revenue projections this quarter as it sold more fee-bearing tickets than expected. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates. Overall, this was a mediocre quarter for Live Nation. The stock is flat after reporting and currently trades at $88.3 per share.

So should you invest in Live Nation right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.