Live events and entertainment company Live Nation (NYSE:LYV) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 21.5% year on year to $3.8 billion. It made a GAAP loss of $0.53 per share, down from its loss of $0.25 per share in the same quarter last year.

Live Nation (LYV) Q1 CY2024 Highlights:

- Revenue: $3.8 billion vs analyst estimates of $3.24 billion (17.4% beat)

- EPS: -$0.53 vs analyst estimates of -$0.18 (-$0.35 miss)

- Gross Margin (GAAP): 30.3%, down from 32.4% in the same quarter last year

- Free Cash Flow of $71.5 million, up 77.4% from the previous quarter

- Events: 11,203

- Market Capitalization: $20.66 billion

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE:LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

The company was formed from the 2010 merger of Live Nation, a concert promotion firm, and Ticketmaster, a leading online ticketing platform. This strategic combination aimed to simplify event management and ticketing processes by providing comprehensive services, including organizing live concerts, managing venues, and ticketing solutions, under one umbrella.

The core Live Nation business is unique in that it addresses the challenge of coordinating different aspects of event management, offering integrated solutions for artists to connect with their audiences in a live setting. On the other hand, Ticketmaster is a digital-first marketplace where fans can buy and sell tickets for events ranging from baseball games to music festivals.

Live Nation generates revenue from concert promotions, ticket sales, sponsorships, and advertising. Its integrated approach to live events benefits artists seeking full-service event management and fans looking for hassle-free access to live entertainment.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Competitors in the live event promotion and management sector include Endeavor (NYSE:EDR), Disney (NYSE:DIS), and MSG Entertainment (NYSE:MSGE).Sales Growth

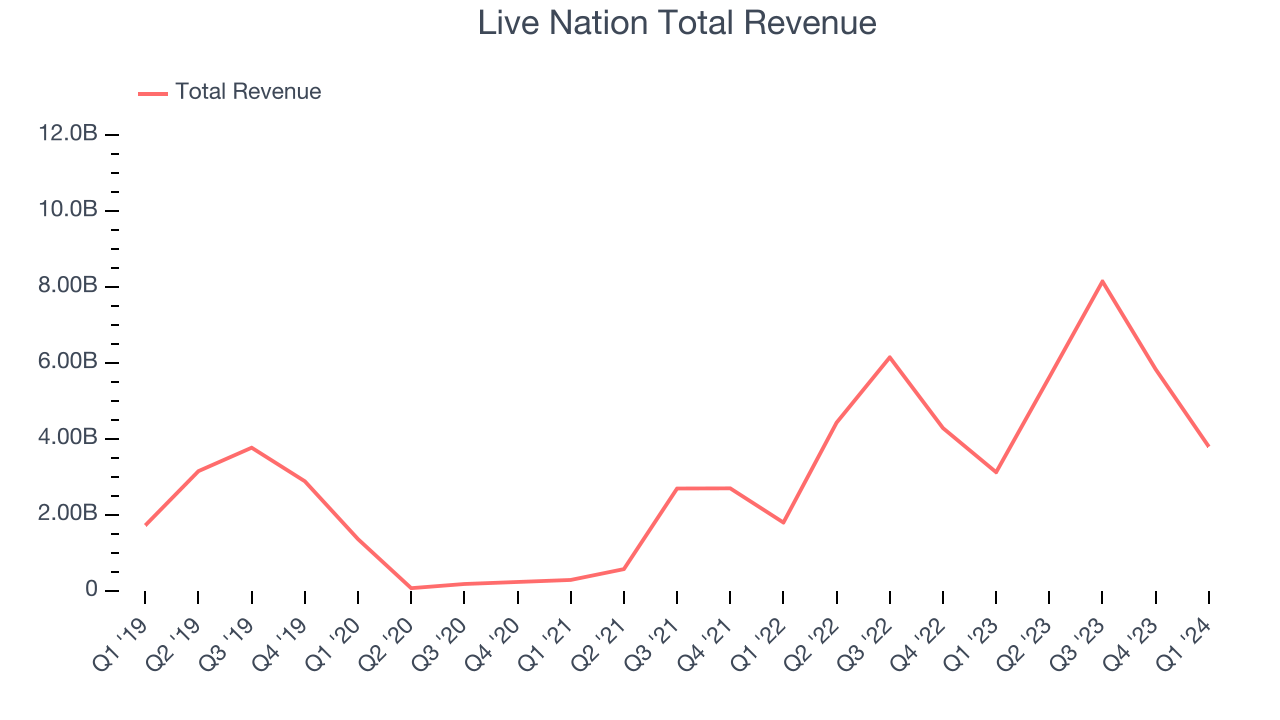

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Live Nation's annualized revenue growth rate of 16.2% over the last five years was decent for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Live Nation's annualized revenue growth of 73.5% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Live Nation's annualized revenue growth of 73.5% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Live Nation reported remarkable year-on-year revenue growth of 21.5%, and its $3.8 billion of revenue topped Wall Street estimates by 17.4%. Looking ahead, Wall Street expects sales to grow 4.6% over the next 12 months, a deceleration from this quarter.

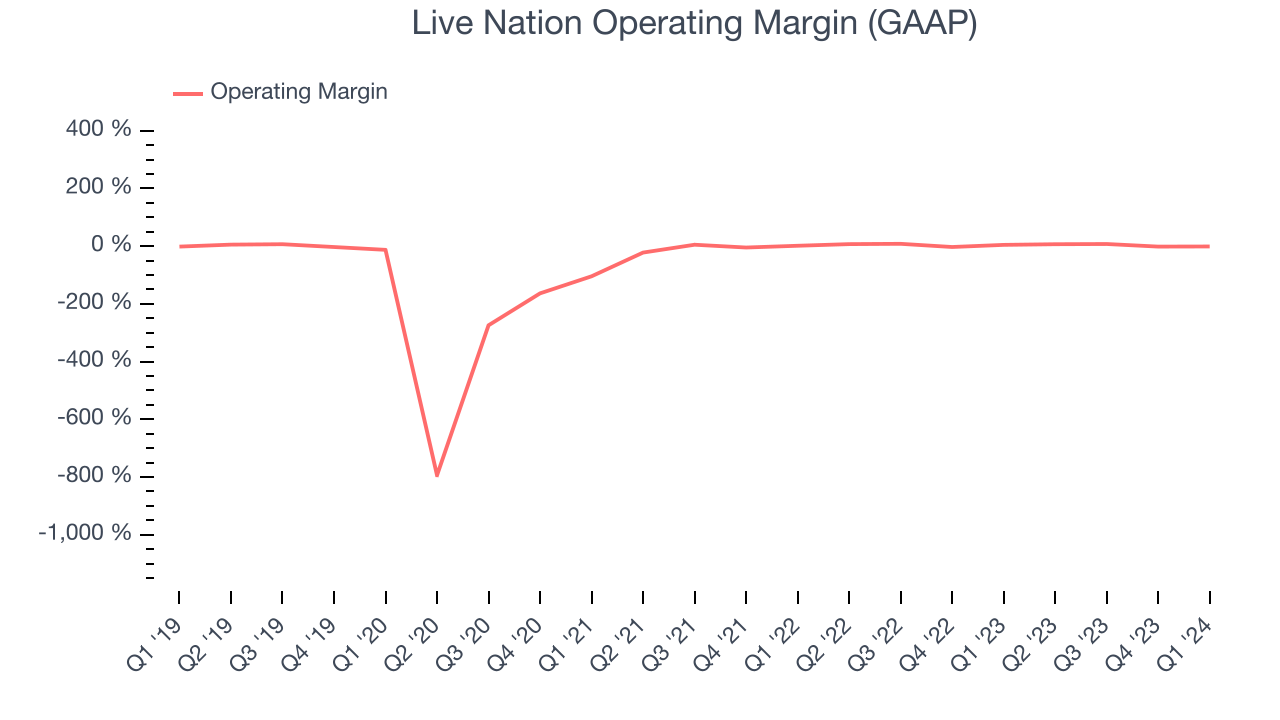

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Live Nation was profitable over the last two years but held back by its large expense base. Its average operating margin of 4.2% has been paltry for a consumer discretionary business.

This quarter, Live Nation generated an operating profit margin of negative 1%, down 5.5 percentage points year on year.

Over the next 12 months, Wall Street expects Live Nation to become more profitable. Analysts are expecting the company’s LTM operating margin of 3.8% to rise to 5.2%.EPS

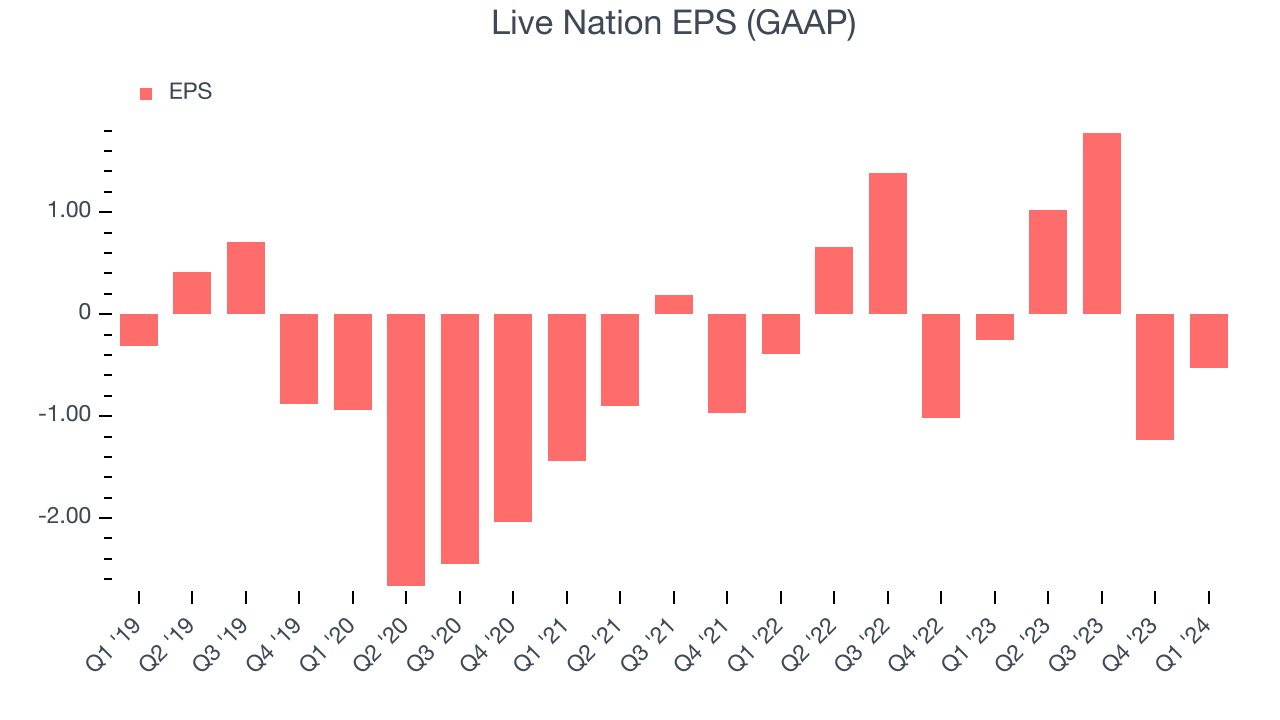

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Live Nation cut its earnings losses and improved its EPS by 53.1% each year.

In Q1, Live Nation reported EPS at negative $0.53, down from negative $0.25 in the same quarter last year. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Live Nation to grow its earnings. Analysts are projecting its LTM EPS of $1.03 to climb by 80.5% to $1.86.

Cash Is King

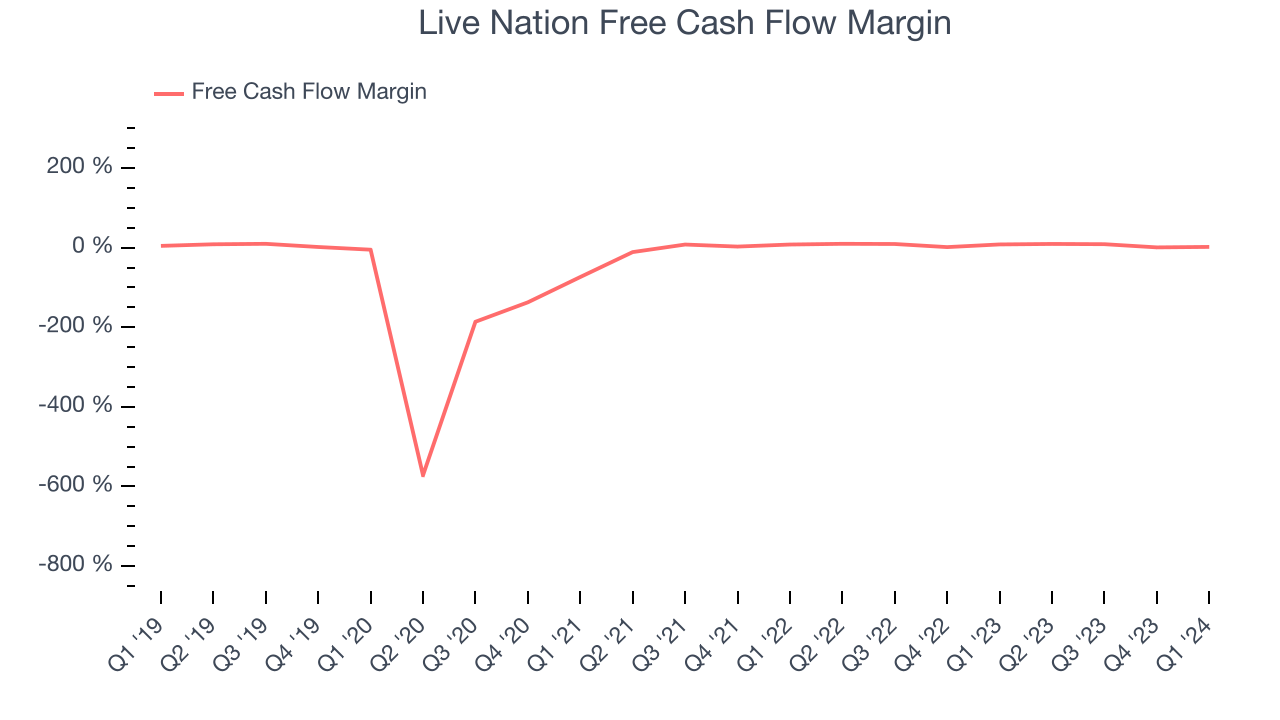

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Live Nation has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 6.4%, subpar for a consumer discretionary business.

Live Nation's free cash flow came in at $71.5 million in Q1, equivalent to a 1.9% margin and down 71.8% year on year.

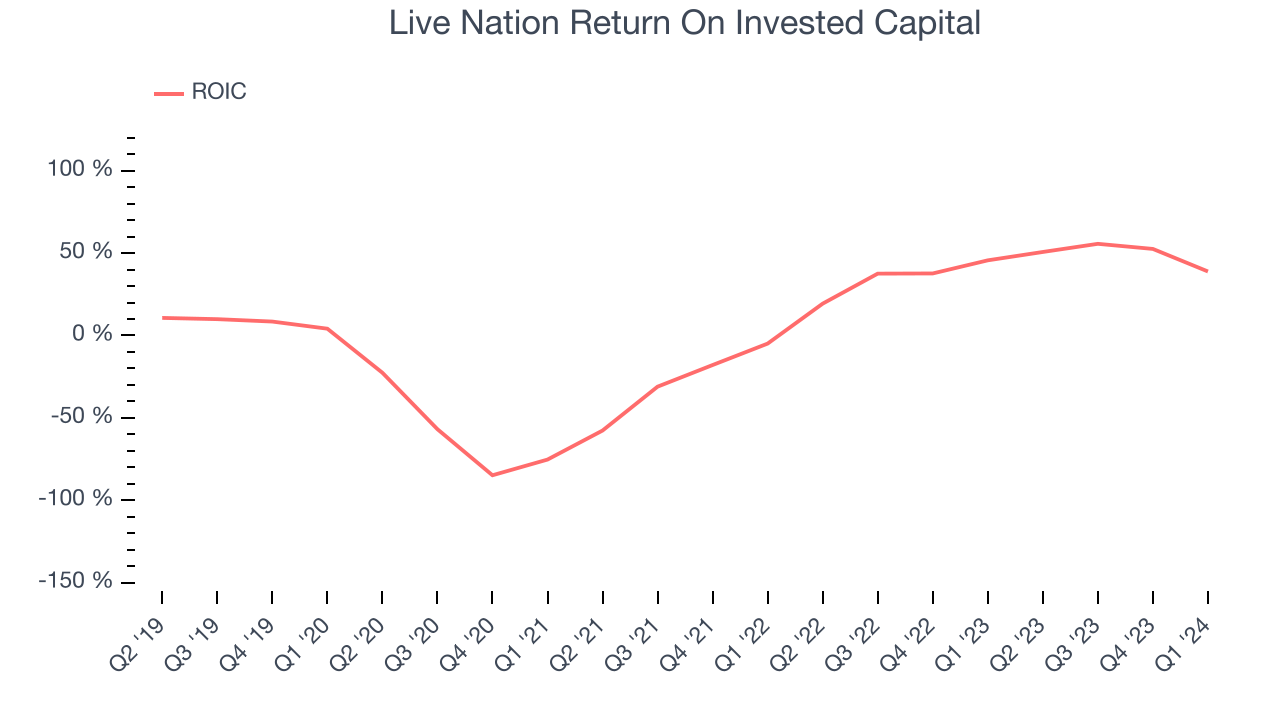

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Live Nation's five-year average return on invested capital was 1.7%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Live Nation's ROIC has significantly increased. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Live Nation reported $6.50 billion of cash and $8.02 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $2.10 billion of EBITDA over the last 12 months, we view Live Nation's 0.7x net-debt-to-EBITDA ratio as safe. We also see its $26.09 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Live Nation's Q1 Results

We were impressed by how significantly Live Nation blew past analysts' revenue projections this quarter as it sold more fee-bearing tickets than expected. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates. Overall, this was a mediocre quarter for Live Nation. The stock is flat after reporting and currently trades at $88.3 per share.

Is Now The Time?

Live Nation may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Live Nation, we'll be cheering from the sidelines. Although its revenue growth has been decent over the last five years, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its operating margins reveal poor profitability compared to other consumer discretionary companies.

While there are some things to like about Live Nation and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $117.80 per share right before these results (compared to the current share price of $88.30).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.