Furniture company La-Z-Boy (NYSE:LZB) missed analysts' expectations in Q3 FY2024, with revenue down 12.6% year on year to $500.4 million. It made a non-GAAP profit of $0.67 per share, down from its profit of $0.91 per share in the same quarter last year.

La-Z-Boy (LZB) Q3 FY2024 Highlights:

- Revenue: $500.4 million vs analyst estimates of $523.1 million (4.3% miss)

- EPS (non-GAAP): $0.67 vs analyst expectations of $0.72 (7.4% miss)

- Free Cash Flow of $36.95 million, up 106% from the previous quarter

- Gross Margin (GAAP): 42.6%, down from 43.2% in the same quarter last year

- Market Capitalization: $1.63 billion

The prized possession of every mancave, La-Z-Boy (NYSE:LZB) is a furniture company specializing in recliners, sofas, and seats.

La-Z-Boy revolutionized the furniture industry with the invention of the recliner in 1927. This flagship product quickly gained mainstream popularity for its comfort and functionality, and over the ensuing decades, La-Z-Boy expanded its product line to include sofas, loveseats, chairs, and living room, bedroom, and dining room sets.

Comfort is a driving force behind La-Z-Boy's design philosophy. Its furniture pieces are not just about aesthetic appeal; they incorporate ergonomic designs and smart features to enhance its products.

The company operates through a vast network of independent La-Z-Boy Furniture Galleries stores as well as partner stores. This extensive retail presence, complemented by an online platform, allows La-Z-Boy to reach a diverse customer base. La-Z-Boy also emphasizes customer service, allowing clients to personalize their designs and schedule home deliveries.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

La-Z-Boy’s primary competitors include Ethan Allen Interiors (NYSE:ETH), Bassett Furniture Industries (NASDAQ:BSET), Haverty Furniture Companies (NYSE:HVT), Flexsteel Industries (NASDAQ:FLXS), and private company Ashley Furniture.Sales Growth

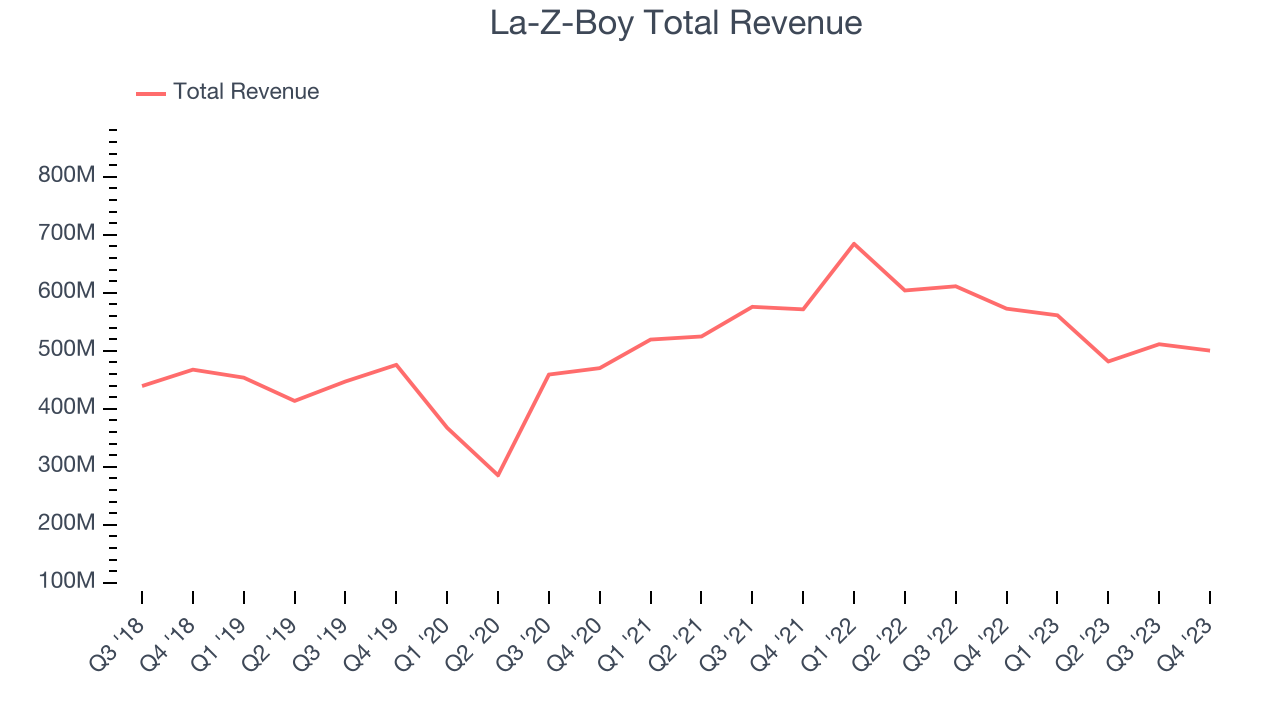

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. La-Z-Boy's annualized revenue growth rate of 3.7% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. La-Z-Boy's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 3.2% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. La-Z-Boy's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 3.2% over the last two years.

We can better understand the company's revenue dynamics by analyzing its most important segments, Wholesale and Retail, which are 63.5% and 36.5% of core revenues. Over the last two years, La-Z-Boy's Wholesale revenue (sales to retailers) averaged 4.3% year-on-year declines. On the other hand, its Retail revenue (direct sales to consumers) averaged 8.4% growth.

This quarter, La-Z-Boy missed Wall Street's estimates and reported a rather uninspiring 12.6% year-on-year revenue decline, generating $500.4 million of revenue. Looking ahead, Wall Street expects sales to grow 2.8% over the next 12 months, an acceleration from this quarter.

Operating Margin

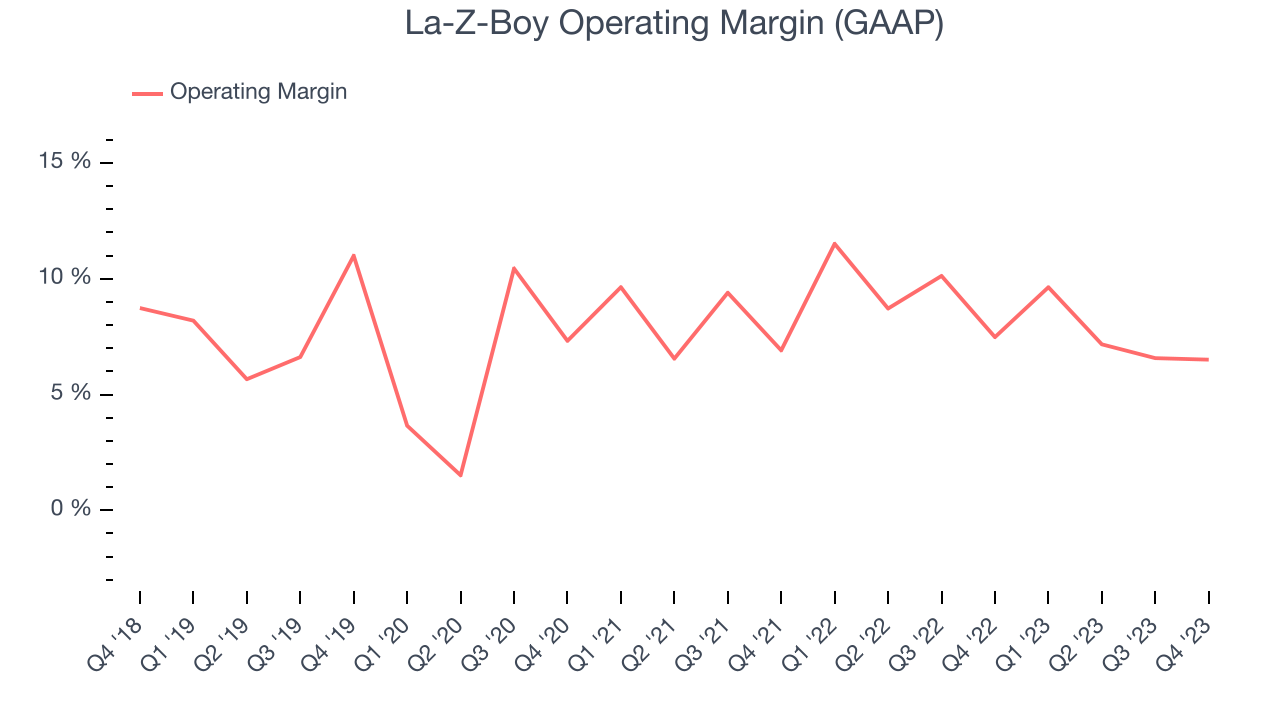

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

La-Z-Boy was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 8.6%.

In Q3, La-Z-Boy generated an operating profit margin of 6.5%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects La-Z-Boy to maintain its LTM operating margin of 7.5%.EPS

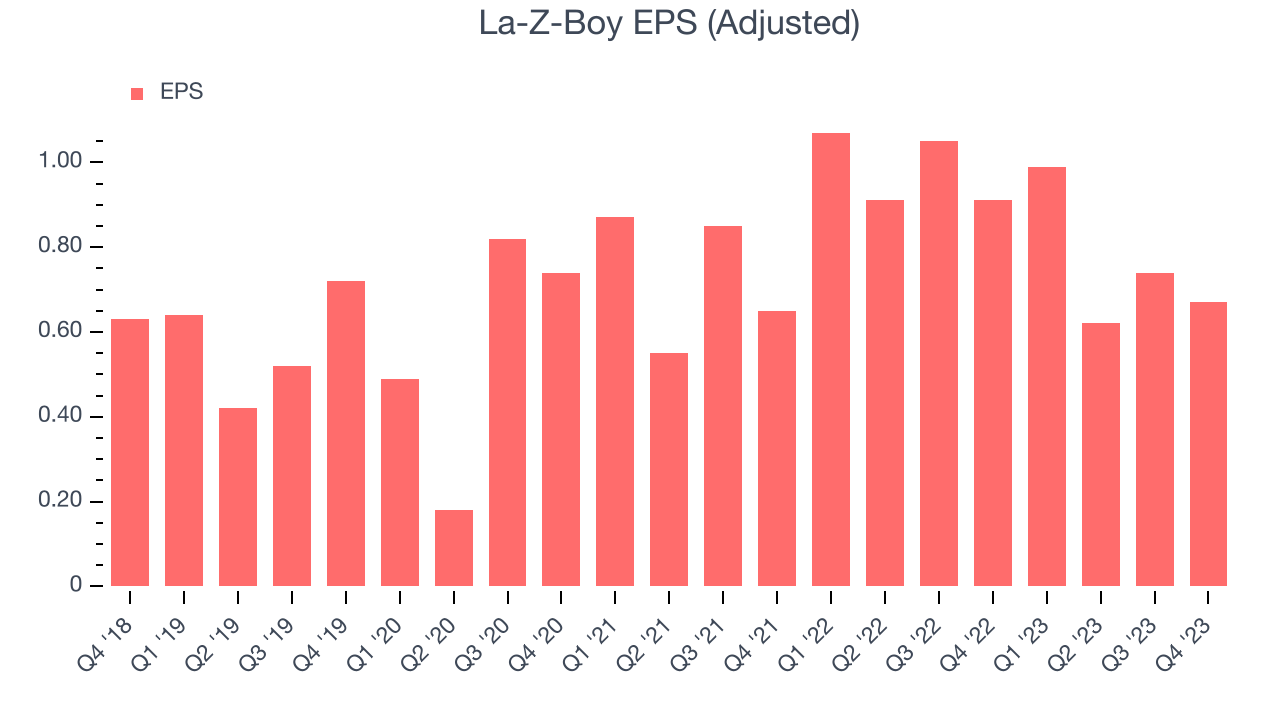

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, La-Z-Boy's EPS grew 36%, translating into an unimpressive 6.3% compounded annual growth rate. This performance, however, is materially higher than its 3.7% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

A five-year view shows that La-Z-Boy has repurchased its stock, shrinking its share count by 8.3%. This has led to higher per share earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q3, La-Z-Boy reported EPS at $0.67, down from $0.91 in the same quarter a year ago. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects La-Z-Boy's LTM EPS of $3.02 to stay about the same.

Cash Is King

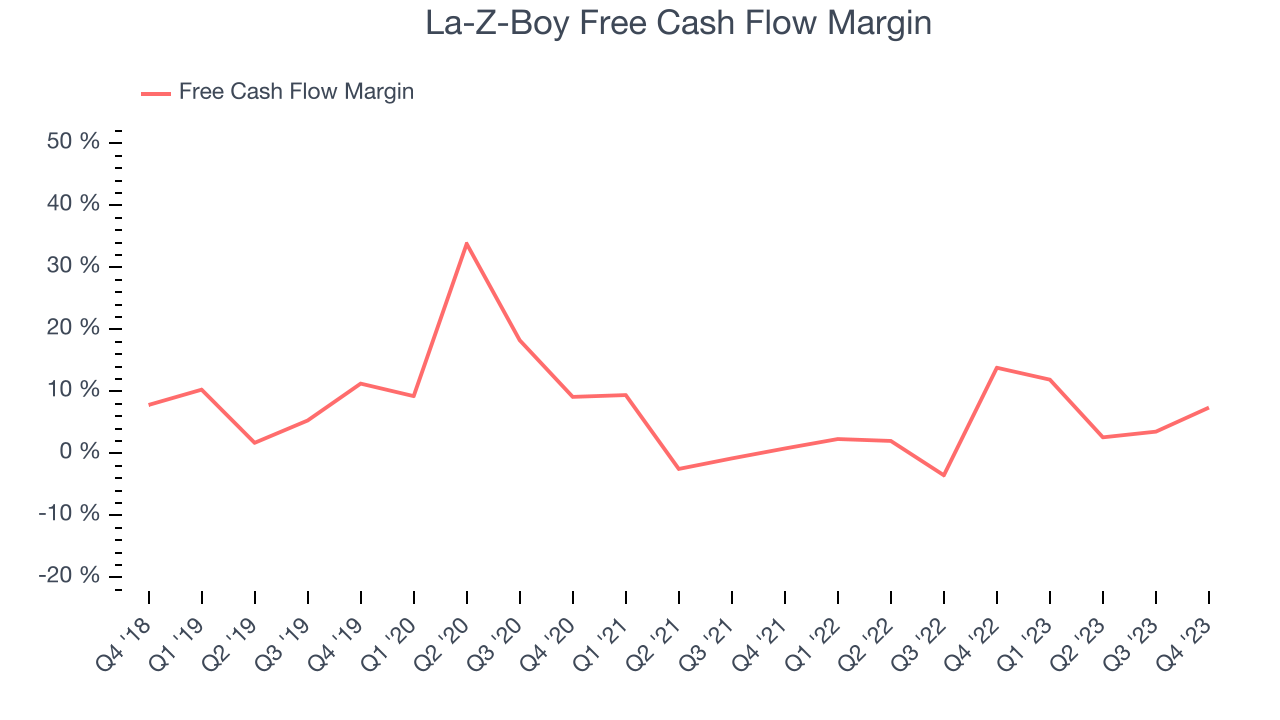

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, La-Z-Boy has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 4.8%, subpar for a consumer discretionary business.

La-Z-Boy's free cash flow came in at $36.95 million in Q3, equivalent to a 7.4% margin and down 53.3% year on year. Over the next year, analysts predict La-Z-Boy's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 6.5% will decrease to 5.4%.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although La-Z-Boy hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a solid job investing in profitable business initiatives. Its five-year average return on invested capital was 19.3%, higher than most consumer discretionary companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Uneventfully, La-Z-Boy's ROIC stayed the same over the last two years. This is fine because its returns are solid, but if the company wants to become an investable business, it will need to increase its ROIC even more.

Key Takeaways from La-Z-Boy's Q3 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed and its EPS fell short of Wall Street's estimates. Overall, this was a mediocre quarter for La-Z-Boy. The stock is flat after reporting and currently trades at $37.75 per share.

Is Now The Time?

La-Z-Boy may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of La-Z-Boy, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last five years. On top of that, its projected EPS for the next year is lacking, and its low free cash flow margins give it little breathing room.

La-Z-Boy's price-to-earnings ratio based on the next 12 months is 12.4x. While the price is reasonable and there are some things to like about La-Z-Boy, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $43 per share right before these results (compared to the current share price of $37.75).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.