Department store chain Macy’s (NYSE:M) reported Q3 FY2023 results beating Wall Street analysts' expectations, with revenue down 7.3% year on year to $5.04 billion. On the other hand, its full-year revenue guidance of $23.05 billion at the midpoint came in slightly below analysts' estimates. Turning to EPS, Macy's made a non-GAAP profit of $0.21 per share, down from its profit of $0.52 per share in the same quarter last year.

Is now the time to buy Macy's? Find out by accessing our full research report, it's free.

Macy's (M) Q3 FY2023 Highlights:

- Revenue: $5.04 billion vs analyst estimates of $4.83 billion (4.3% beat)

- EPS (non-GAAP): $0.21 vs analyst estimates of $0.01 ($0.20 beat)

- The company slightly raised its revenue guidance for the full year of $23.05 billion at the midpoint, also raised full year EPS guidance

- Free Cash Flow was -$298 million compared to -$92 million in the same quarter last year

- Gross Margin (GAAP): 42.4%, up from 41.1% in the same quarter last year

- Same-Store Sales were down 7% year on year (beat vs. expectations of down 8.4% year on year)

“I’d like to thank our teams for executing well during the quarter. We delivered better-than-expected top and bottom line third quarter results and are entering the holiday period in a healthy inventory position. Our portfolio of nameplates are leading gift-giving destinations across the value spectrum offering exclusive products. We have refined our gift assortment, simplified our promotions and improved our shopping experience,” said Jeff Gennette, chairman and chief executive officer of Macy’s,

With a storied history that began with its 1858 founding, Macy’s (NYSE:M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Sales Growth

Macy's is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

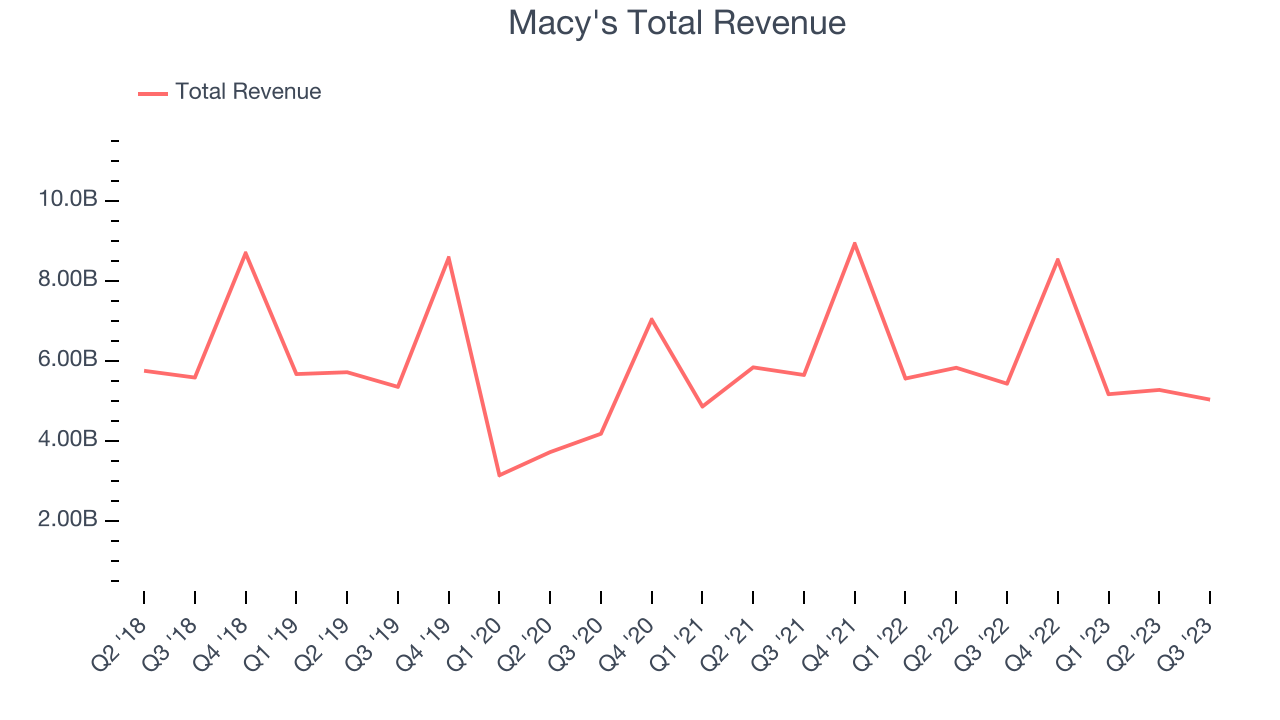

As you can see below, the company's revenue has declined over the last four years, dropping 1.4% annually.

This quarter, Macy's revenue fell 7.3% year on year to $5.04 billion but beat Wall Street's estimates by 4.3%. Looking ahead, analysts expect revenue to decline 4.3% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

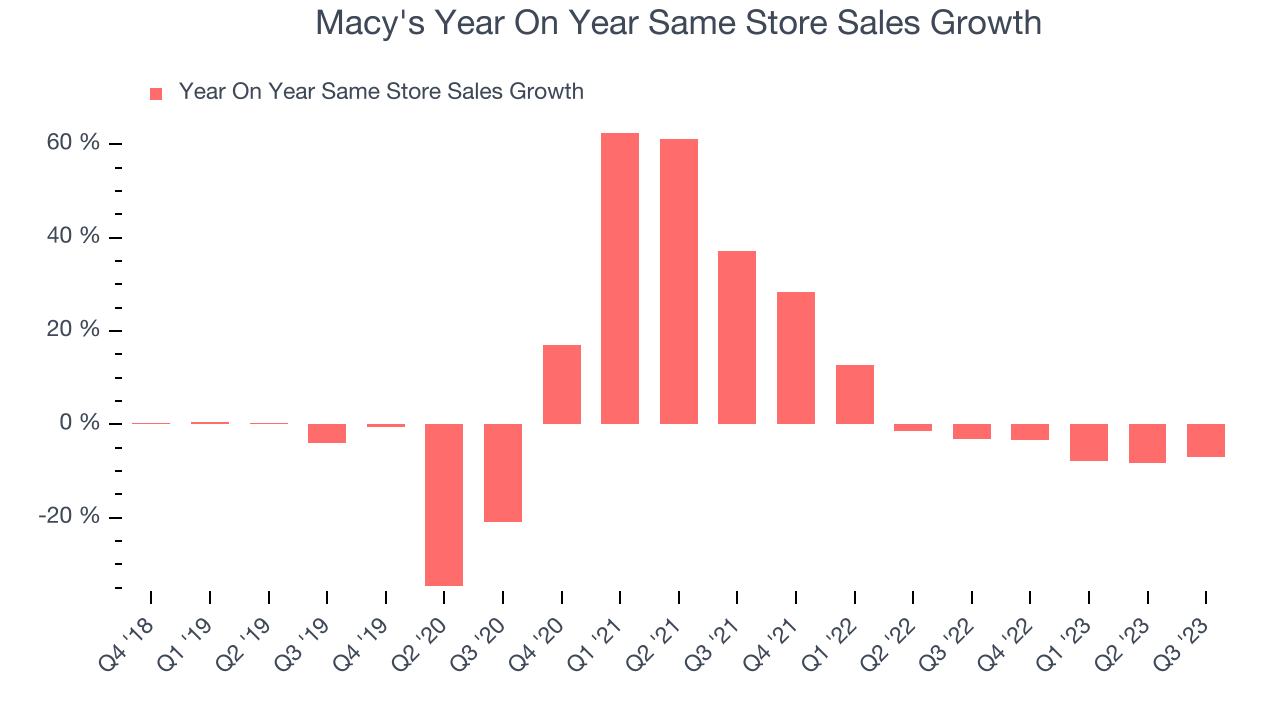

Macy's demand within its existing stores has been relatively stable over the last eight quarters but fallen behind the broader consumer retail sector. On average, the company's same-store sales have grown by 1.3% year on year.

In the latest quarter, Macy's same-store sales fell 7% year on year. This decrease was a further deceleration from the 3.1% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Macy's Q3 Results

Sporting a market capitalization of $3.45 billion, Macy's is among smaller companies, but its more than $364 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

We were impressed by how significantly Macy's blew past analysts' EPS expectations this quarter, driven in part by same-store sales and revenue beats. Full year guidance was also raised slightly across the board, from same-store sales to revenue to EPS. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 4% after reporting and currently trades at $13.12 per share.

Macy's may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.