Department store chain Macy’s (NYSE:M) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue down 1.8% year on year to $8.38 billion. On the other hand, the company's full-year revenue guidance of $22.55 billion at the midpoint came in 1% below analysts' estimates. It made a non-GAAP profit of $2.45 per share, improving from its profit of $1.88 per share in the same quarter last year.

Macy's (M) Q4 FY2023 Highlights:

- Revenue: $8.38 billion vs analyst estimates of $8.09 billion (3.5% beat)

- EPS (non-GAAP): $2.45 vs analyst estimates of $1.99 (23.3% beat)

- Management's revenue guidance for the upcoming financial year 2024 is $22.55 billion at the midpoint, missing analyst estimates by 1% and implying -5.5% growth (vs -6.5% in FY2023)

- Free Cash Flow of $903 million, up 10.8% from the same quarter last year

- Gross Margin (GAAP): 39.4%, up from 36.1% in the same quarter last year

- Same-Store Sales were down 5.4% year on year (slight miss vs. expectations of down 5.2% year on year)

- Market Capitalization: $5.29 billion

With a storied history that began with its 1858 founding, Macy’s (NYSE:M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

As the name suggests, a department store offers a wide variety of merchandise organized into different departments or sections. Before the introduction of department stores in the 19th century, consumers would have to visit three different stores to buy a hat, a bottle of perfume, and pillows for their bedroom. While not the first department store, Macy’s was a pioneer.

Today, the core customer is a woman between the ages of 25 and 54 who is looking for name-brand products in a variety of categories. This customer can find prominent brands such as Calvin Klein, Levi’s, MAC, Cuisinart, and Sony in a Macy’s store or on its e-commerce site. Stores tend to be large, between 100,000 and 200,000 square feet, and serving as anchor tenants in many suburban malls. Common departments in a store include women’s/men’s/children’s apparel, beauty/cosmetics, and home goods. Additionally, Macy's has an active e-commerce presence, launched in 1997 as one of the first major retailers to offer online purchases.

Since the introduction of e-commerce, Macy’s and peers have faced increased competition. Evolving specialty retailers and developments such as fast fashion have also pressured the department store model.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Department or general merchandise retail competitors include Nordstrom (NYSE:JWN), Kohl’s (NYSE:KSS), and Dillard’s (NYSE:DDS).Sales Growth

Macy's is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

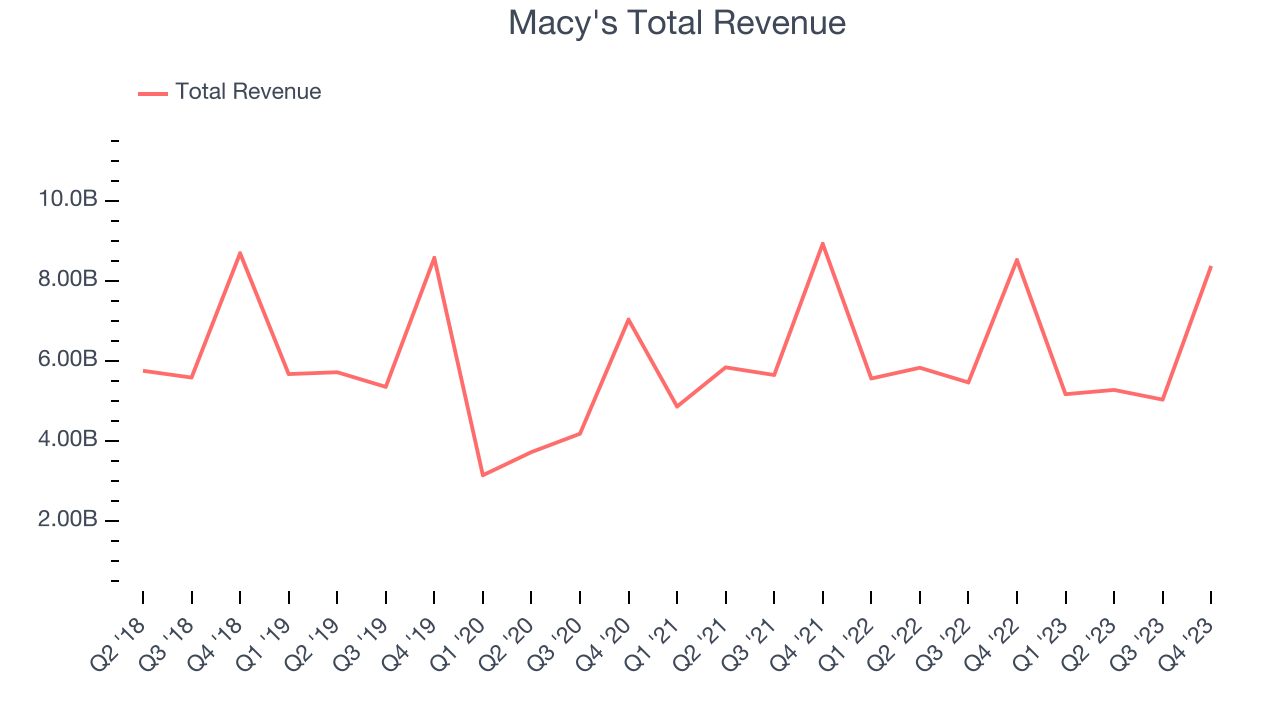

As you can see below, the company's revenue has declined over the last four years, dropping 1.5% annually as its store count and sales at existing, established stores have both shrunk.

This quarter, Macy's revenue fell 1.8% year on year to $8.38 billion but beat Wall Street's estimates by 3.5%. Looking ahead, Wall Street expects revenue to decline 5.6% over the next 12 months, a deceleration from this quarter.

Number of Stores

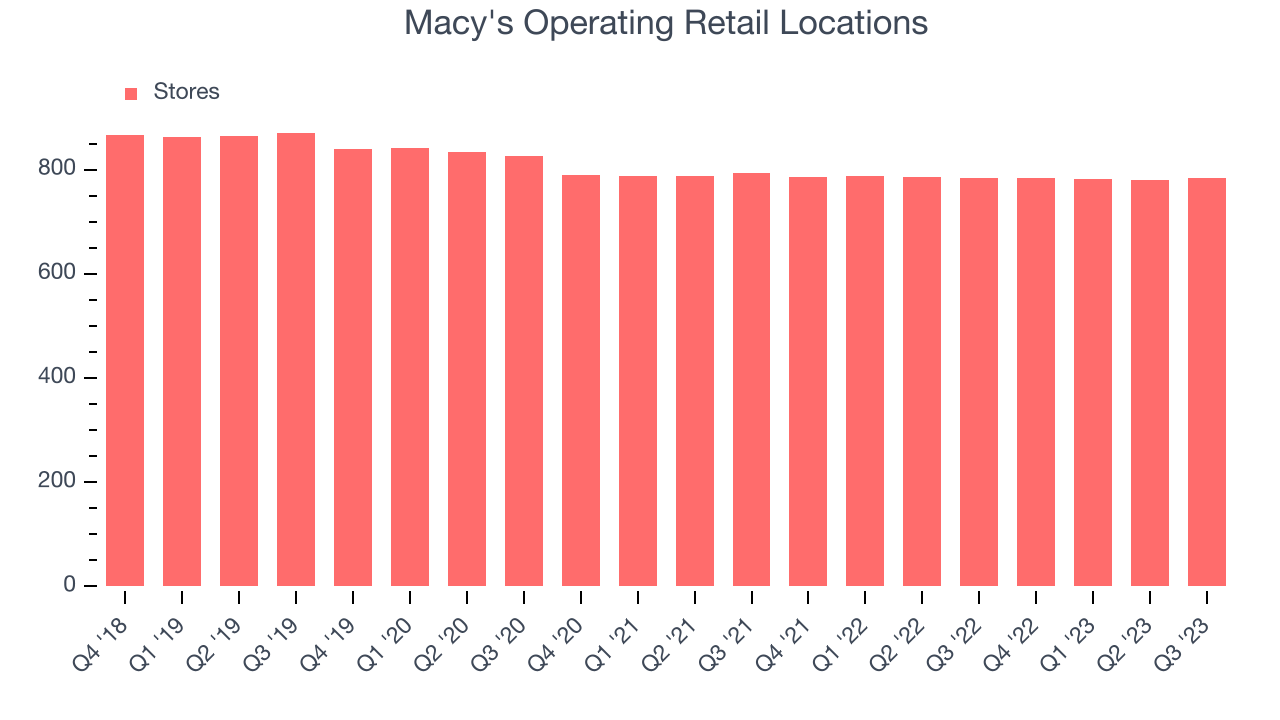

When a retailer like Macy's keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. Since last year, Macy's store count shrank by NaN locations, or NaN%, to NaN total retail locations in the most recently reported quarter.

Taking a step back, the company has kept its physical footprint more or less flat over the last two years while other consumer retail businesses have opted for growth. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

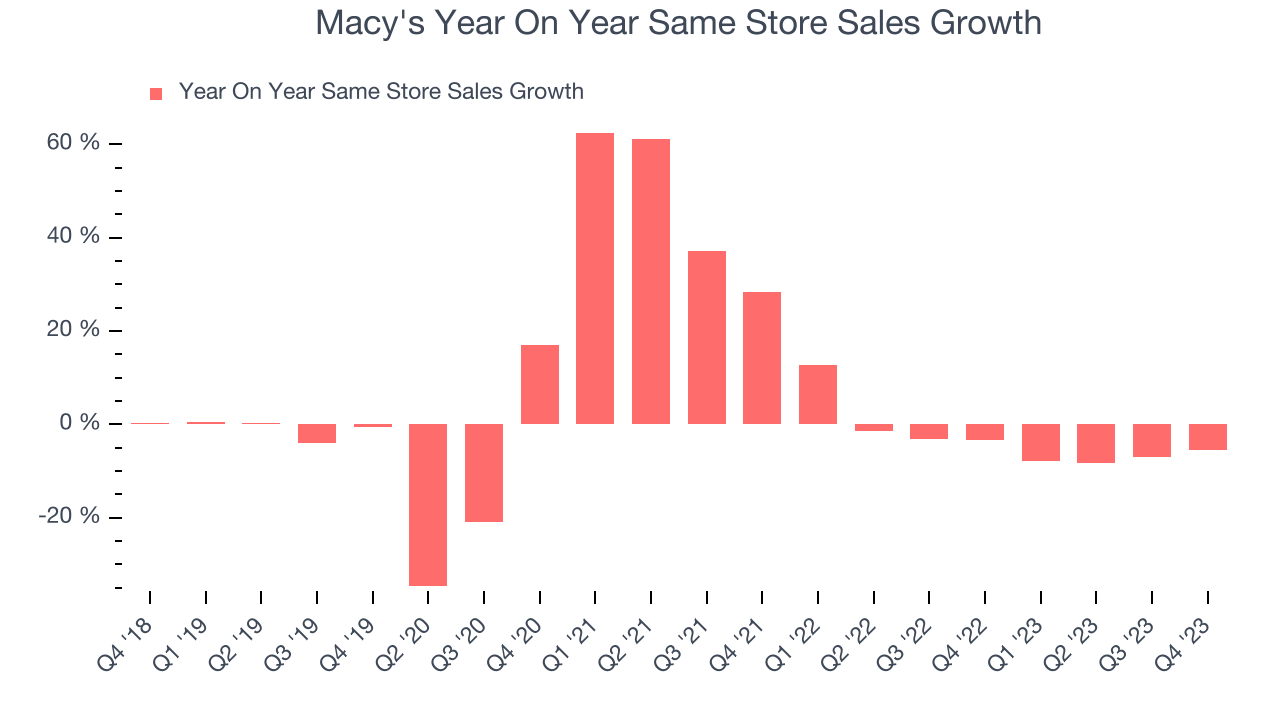

Macy's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 3% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Macy's same-store sales fell 5.4% year on year. This decrease was a further deceleration from the 3.3% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

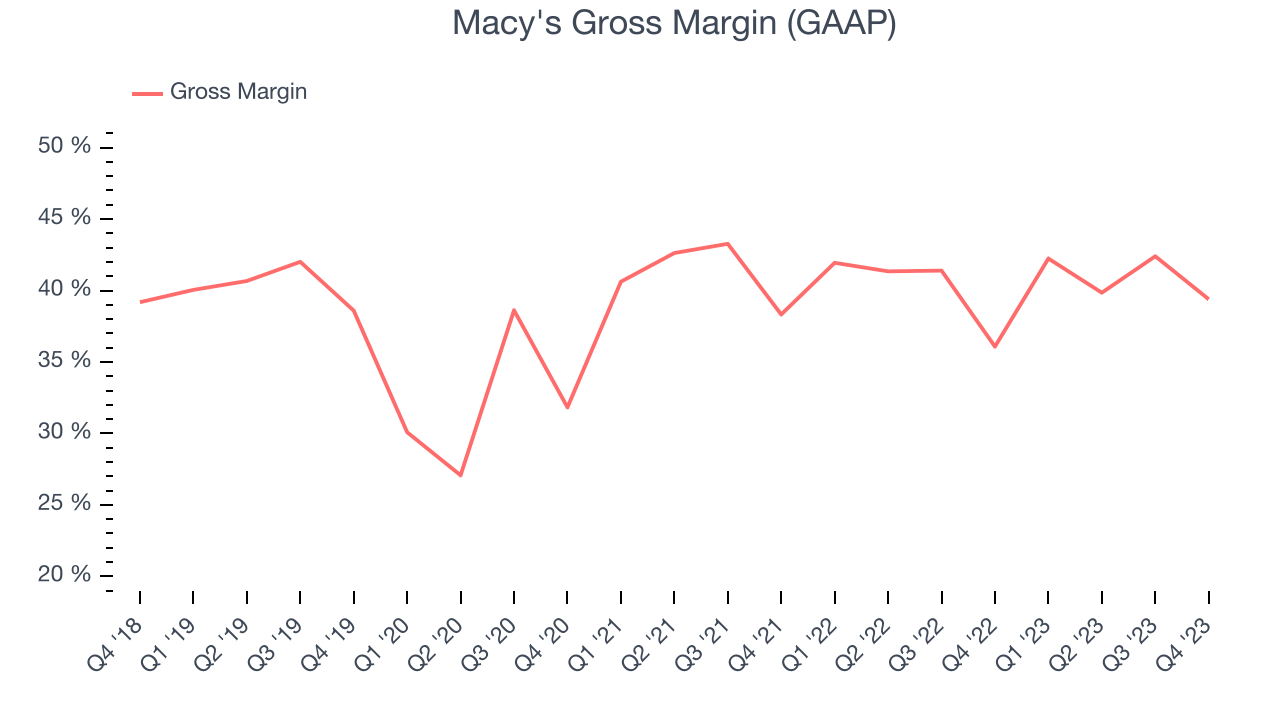

Macy's has good unit economics for a retailer, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it's averaged a healthy 40.2% gross margin over the last two years. This means the company makes $0.40 for every $1 in revenue before accounting for its operating expenses.

Macy's produced a 39.4% gross profit margin in Q4, marking a 3.3 percentage point increase from 36.1% in the same quarter last year. This margin expansion is a good sign in the near term. It shows the company increased its pricing power, and if this trend continues, it could signal a less competitive environment where it has more negotiating leverage and stable input costs (such as distribution expenses to move goods).

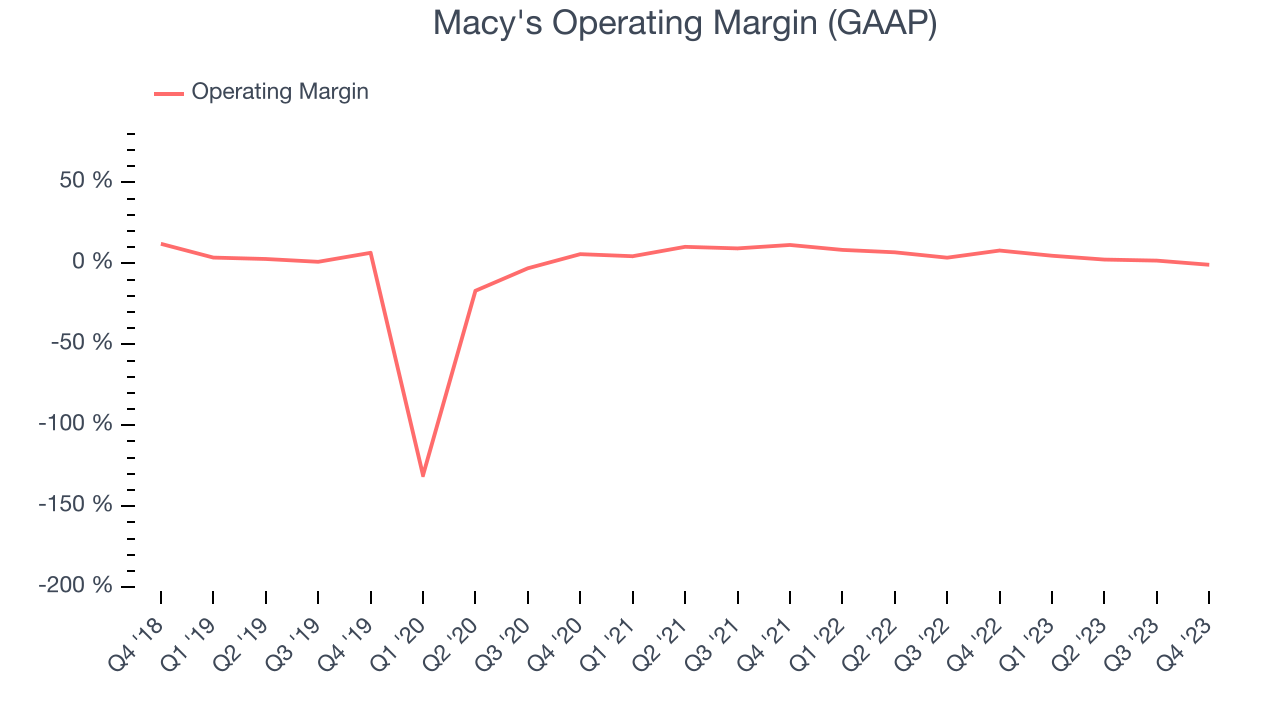

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q4, Macy's generated an operating profit margin of negative 0.9%, down 8.8 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by weaker cost controls or operating leverage on fixed costs.

Zooming out, Macy's was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 4.3%. On top of that, Macy's margin has declined, on average, by 5.2 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, Macy's was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 4.3%. On top of that, Macy's margin has declined, on average, by 5.2 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

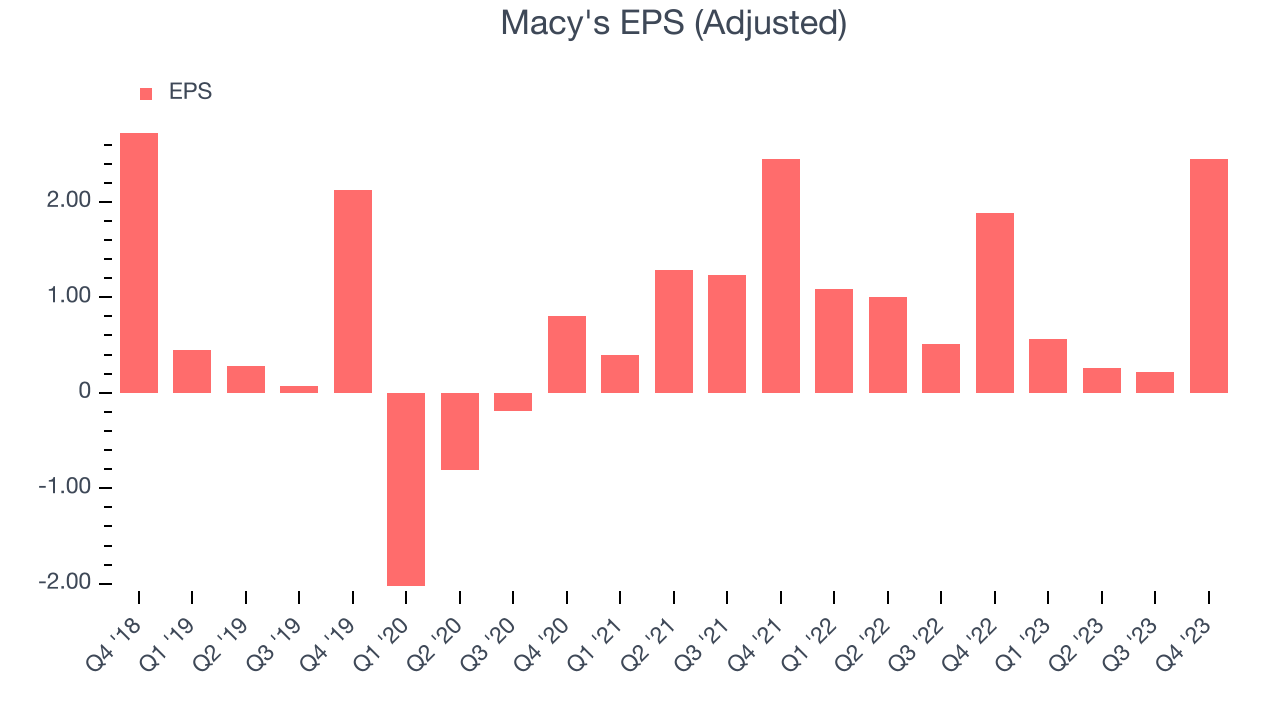

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, Macy's reported EPS at $2.45, up from $1.88 in the same quarter a year ago. This print beat Wall Street's estimates by 23.3%.

Between FY2019 and FY2023, Macy's adjusted diluted EPS grew 19.6%, translating into an unimpressive 4.6% compounded annual growth rate. This growth, however, is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Over the next 12 months, however, Wall Street is projecting an average 20% year-on-year decline in EPS.

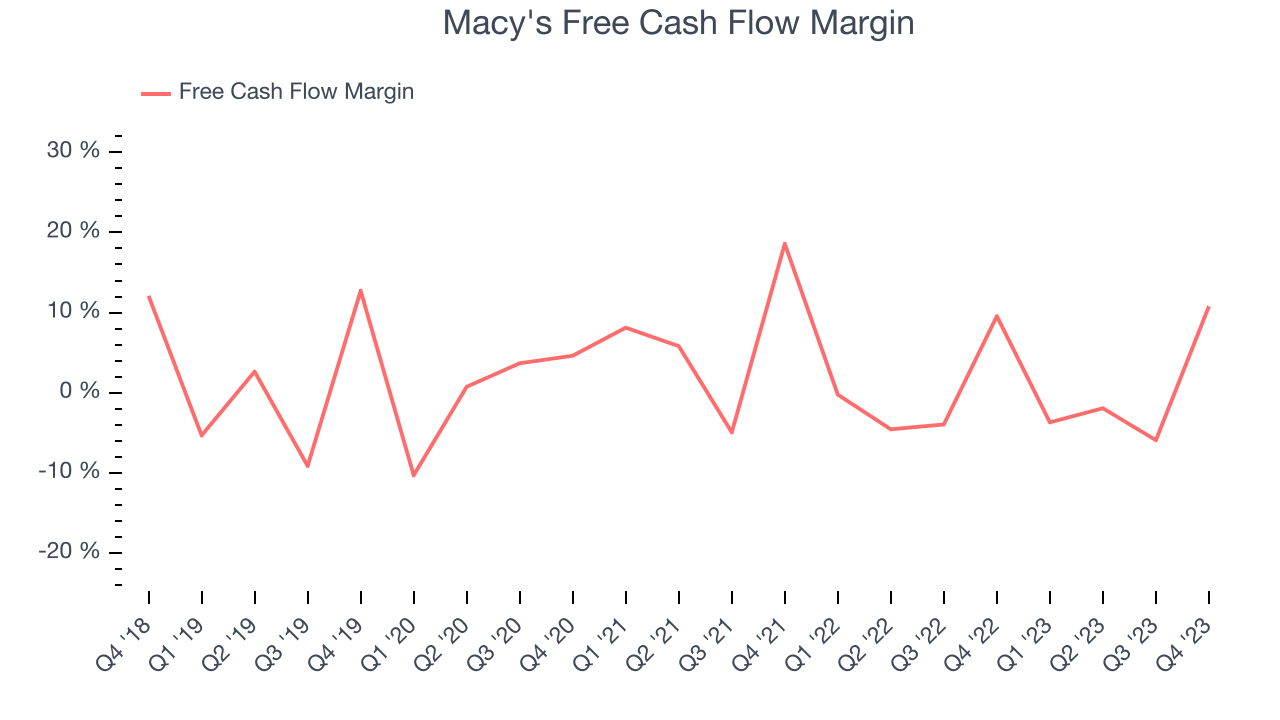

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Macy's free cash flow came in at $903 million in Q4, up 10.8% year on year. This result represents a 10.8% margin.

Over the last eight quarters, Macy's has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1.3%, subpar for a consumer retail business. Macy's margin has also been flat during that time, showing the company needs to take action and improve its cash profitability.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Macy's five-year average ROIC was 2.1%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Macy's ROIC averaged 24.8 percentage point increases each year. This is a good sign and we hope the company can continue to improving.

Key Takeaways from Macy's Q4 Results

We like that revenue and gross margin outperformed Wall Street's estimates. On the other hand, its full-year earnings forecast missed analysts' expectations and its full-year revenue guidance slightly missed Wall Street's estimates. Overall, we think this was a fine quarter, with the outlook dragging down shares. The stock is down 1.5% after reporting, trading at $19.03 per share.

Is Now The Time?

Macy's may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Macy's, we'll be cheering from the sidelines. Its revenue has declined over the last four years, and analysts expect growth to deteriorate from here. And while its popular brand makes consumers more likely to purchase its products, the downside is its relatively low ROIC suggests it has struggled to grow profits historically. On top of that, its shrinking same-store sales suggests it'll need to change its strategy to succeed.

Macy's price-to-earnings ratio based on the next 12 months is 6.9x. While we've no doubt one can find things to like about Macy's, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $18.69 per share right before these results (compared to the current share price of $19.03).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.