Fast-food chain McDonald’s (NYSE:MCD) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 2.7% year on year to $6.87 billion. Its non-GAAP profit of $3.23 per share wasalso in line with analysts’ consensus estimates.

Is now the time to buy McDonald's? Find out by accessing our full research report, it’s free.

McDonald's (MCD) Q3 CY2024 Highlights:

- Revenue: $6.87 billion vs analyst estimates of $6.82 billion (in line)

- Adjusted EPS: $3.23 vs analyst expectations of $3.20 (in line)

- EBITDA: $3.30 billion vs analyst estimates of $3.76 billion (12.3% miss)

- Gross Margin (GAAP): 56.4%, down from 57.7% in the same quarter last year

- Operating Margin: 46.4%, down from 47.9% in the same quarter last year

- EBITDA Margin: 48%, down from 55.8% in the same quarter last year

- Same-Store Sales fell 1.5% year on year (8.8% in the same quarter last year) (miss vs. expectations of down 0.8% year on year)

- Market Capitalization: $212.9 billion

"We will stay laser-focused on providing an unparalleled experience with simple, everyday value and affordability that our consumers can count on as they continue to be mindful about their spending," said Chairman and CEO Chris Kempczinski.

Company Overview

Arguably one of the most iconic brands in the world, McDonald’s (NYSE:MCD) is a fast-food behemoth known for its convenience, value, and wide assortment of menu items.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

McDonald's is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. However, its scale is a double-edged sword because it's harder to find incremental growth when you've already penetrated the market.

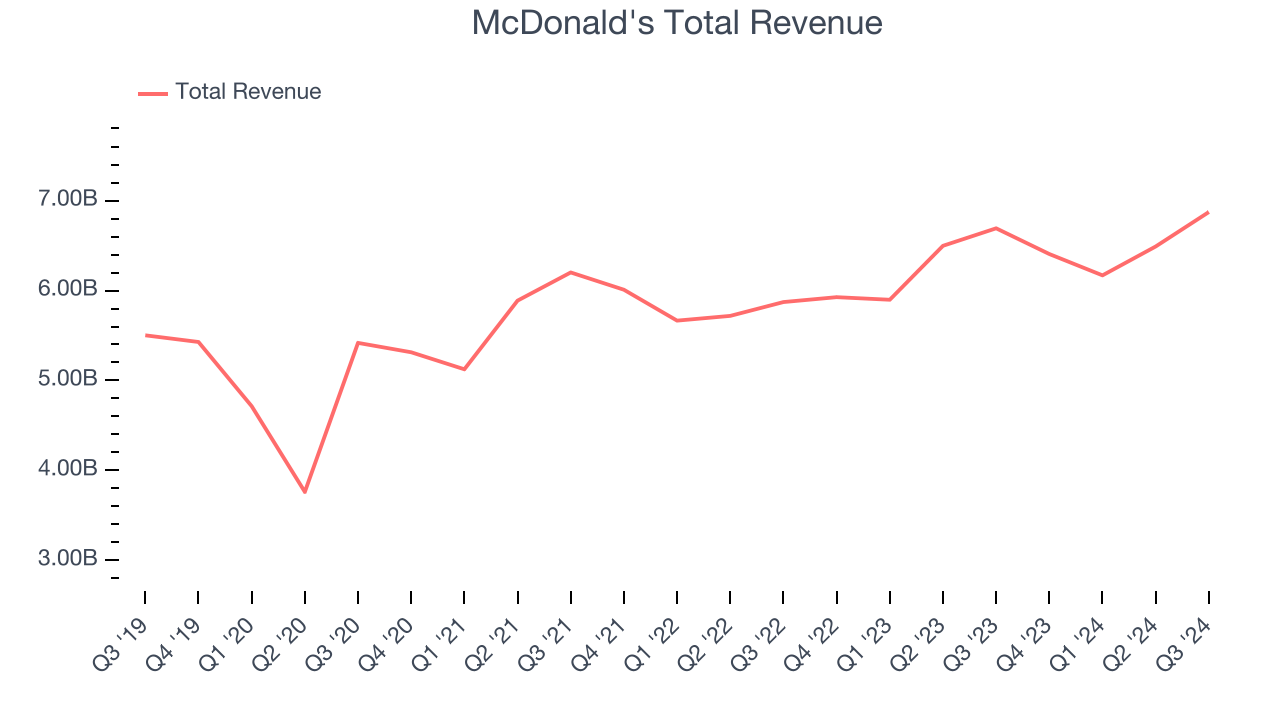

As you can see below, McDonald’s sales grew at a sluggish 4.2% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, McDonald's grew its revenue by 2.7% year on year, and its $6.87 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, similar to its five-year rate. This projection doesn't excite us and shows the market thinks its newer offerings will not lead to better top-line performance yet. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Restaurant Performance

Number of Restaurants

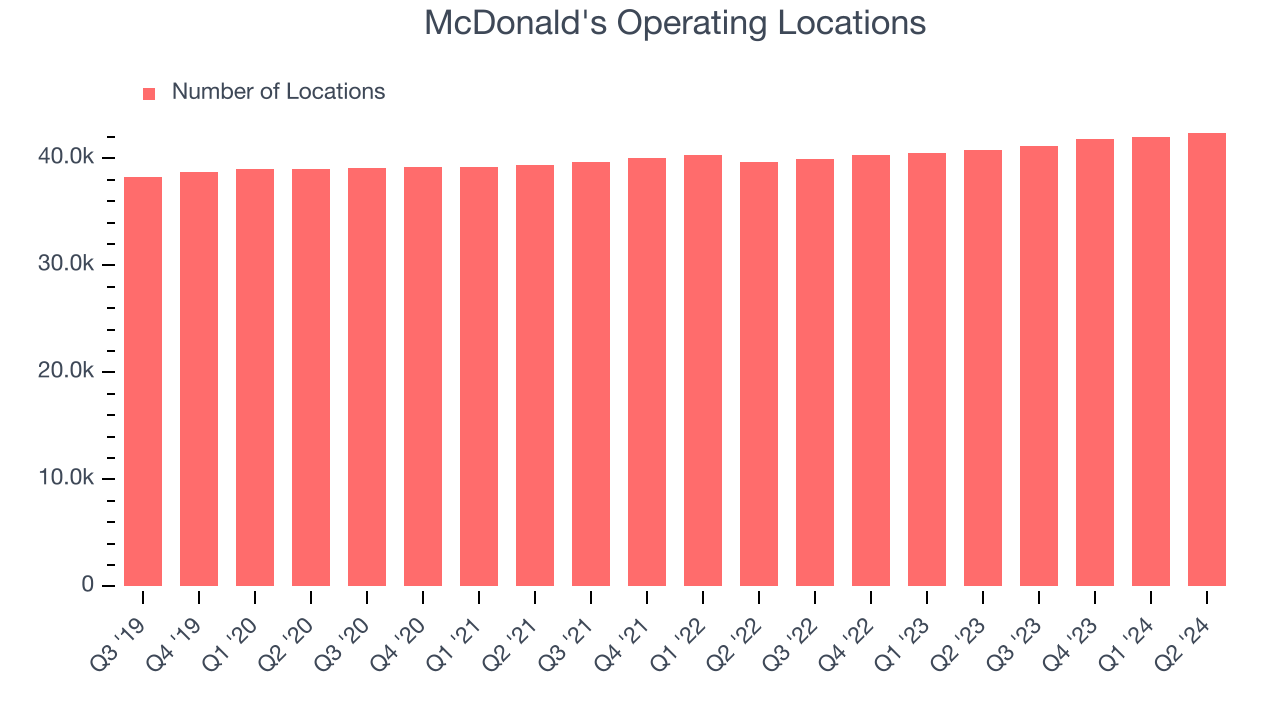

Over the last two years, McDonald's opened new restaurants quickly, averaging 2.6% annual growth. This was faster than the broader restaurant sector. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while McDonald's provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

Note that McDonald's reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

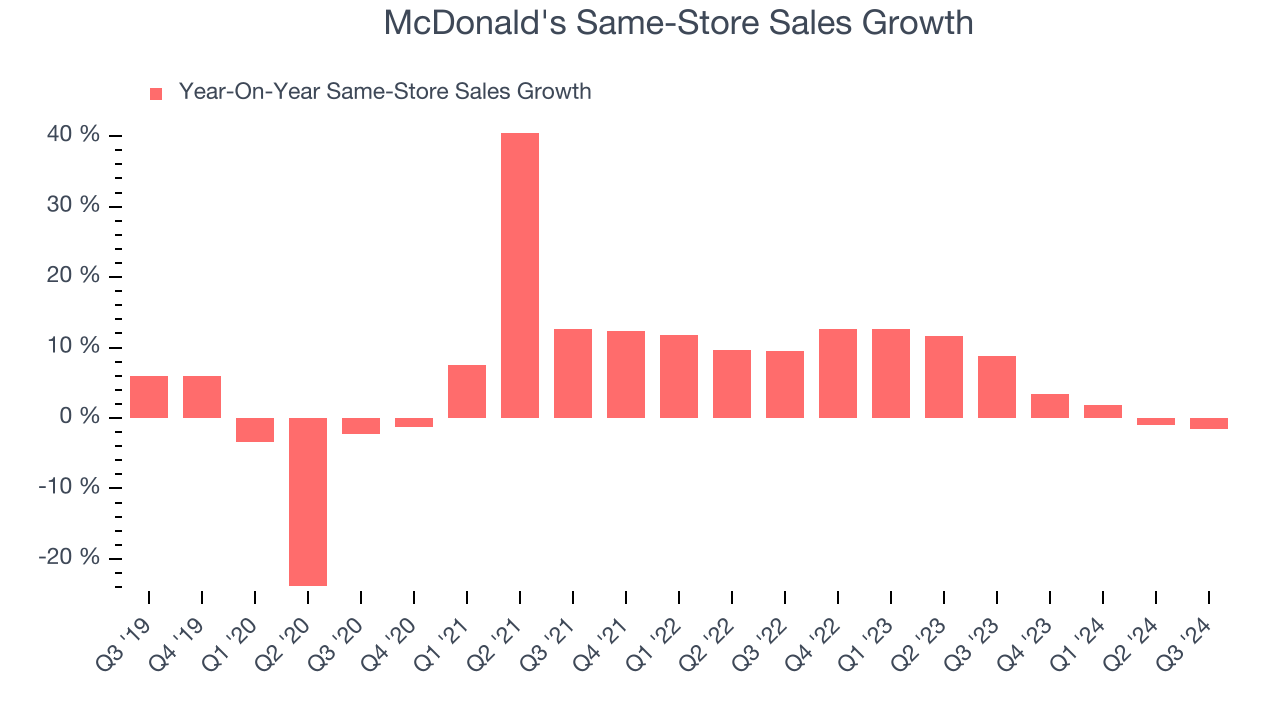

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations. Same-store sales provides a deeper understanding of this issue because it measures organic growth for restaurants open for at least a year.

McDonald's has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 6.1%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop as McDonald's has multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, McDonald’s same-store sales fell by 1.5% annually. This decline was a reversal from the 8.8% year-on-year increase it posted 12 months ago. We’ll keep a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from McDonald’s Q3 Results

It was good to see McDonald's beat analysts’ revenue expectations this quarter. On the other hand, its all-important same-store sales and EBITDA both missed. Overall, this was a mixed quarter. The stock traded down 3.2% to $287.61 immediately after reporting.

The latest quarter from McDonald’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price.When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.