Fast-food chain McDonald’s (NYSE:MCD) fell short of analysts' expectations in Q4 FY2023, with revenue up 8.1% year on year to $6.41 billion. It made a non-GAAP profit of $2.95 per share, improving from its profit of $2.59 per share in the same quarter last year.

Is now the time to buy McDonald's? Find out by accessing our full research report, it's free.

McDonald's (MCD) Q4 FY2023 Highlights:

- Revenue: $6.41 billion vs analyst estimates of $6.45 billion (0.7% miss)

- EPS (non-GAAP): $2.95 vs analyst estimates of $2.83 (4.4% beat)

- Gross Margin (GAAP): 57%, in line with the same quarter last year

- Same-Store Sales were up 3.4% year on year (miss vs. expectations of up 4.7% year on year)

- Store Locations: 40,000 at quarter end, decreasing by 275 over the last 12 months

- Market Capitalization: $215.5 billion

"Our global comparable sales growth of 9% for the year is a testament to the tremendous dedication of the entire McDonald's System," said McDonald's President and CEO Chris Kempczinski.

Arguably one of the most iconic brands in the world, McDonald’s (NYSE:MCD) is a fast-food behemoth known for its convenience, value, and wide assortment of menu items.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

McDonald's is one of the most widely recognized restaurant chains in the world and benefits from brand equity, giving it customer loyalty and more influence over purchasing decisions.

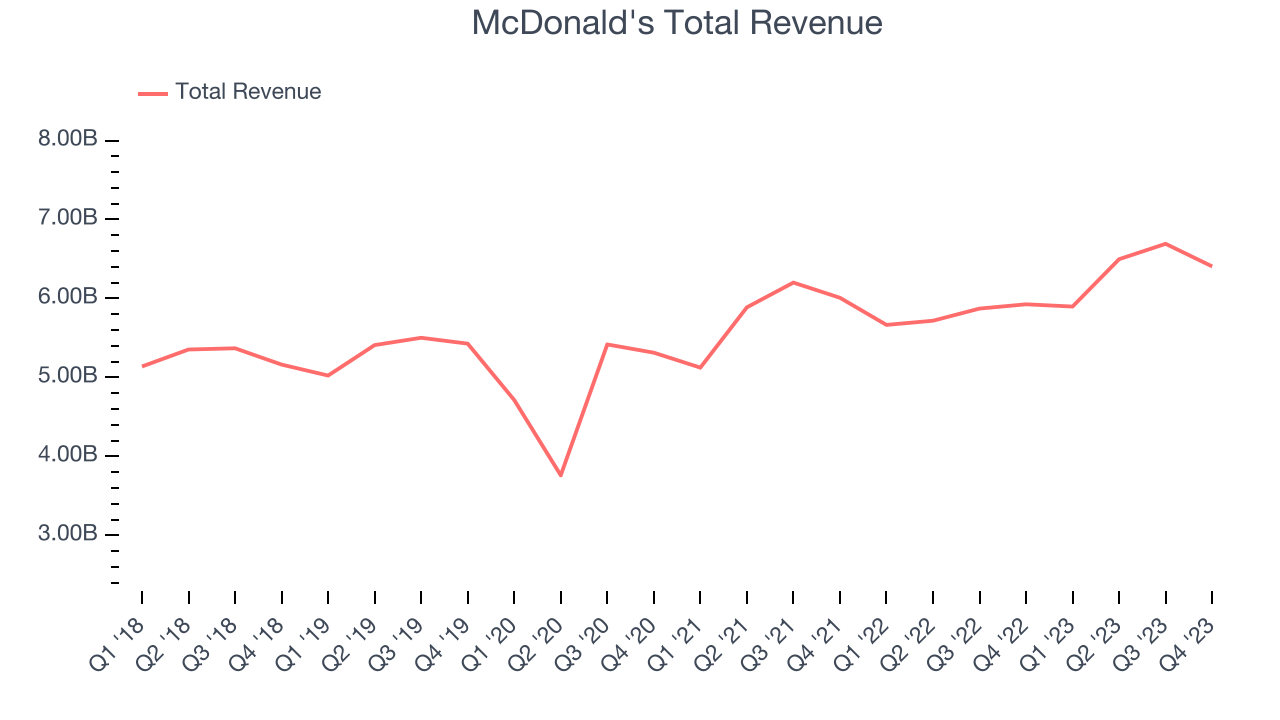

As you can see below, the company's annualized revenue growth rate of 4.5% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, McDonald's revenue grew 8.1% year on year to $6.41 billion, missing Wall Street's expectations. Looking ahead, Wall Street expects sales to grow 6.5% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Number of Stores

When a chain like McDonald's is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. As of the most recently reported quarter, McDonald's operated 40,000 total locations, in line with its restaurant count a year ago.

Taking a step back, McDonald's has generally opened new restaurants over the last eight quarters, averaging 1.3% annual increases in new locations. This growth is decent compared to other restaurant businesses but should be taken lightly as the industry is quite mature. Analyzing a restaurant's location growth is important because expansion means McDonald's has more opportunities to feed customers and generate sales.

Same-Store Sales

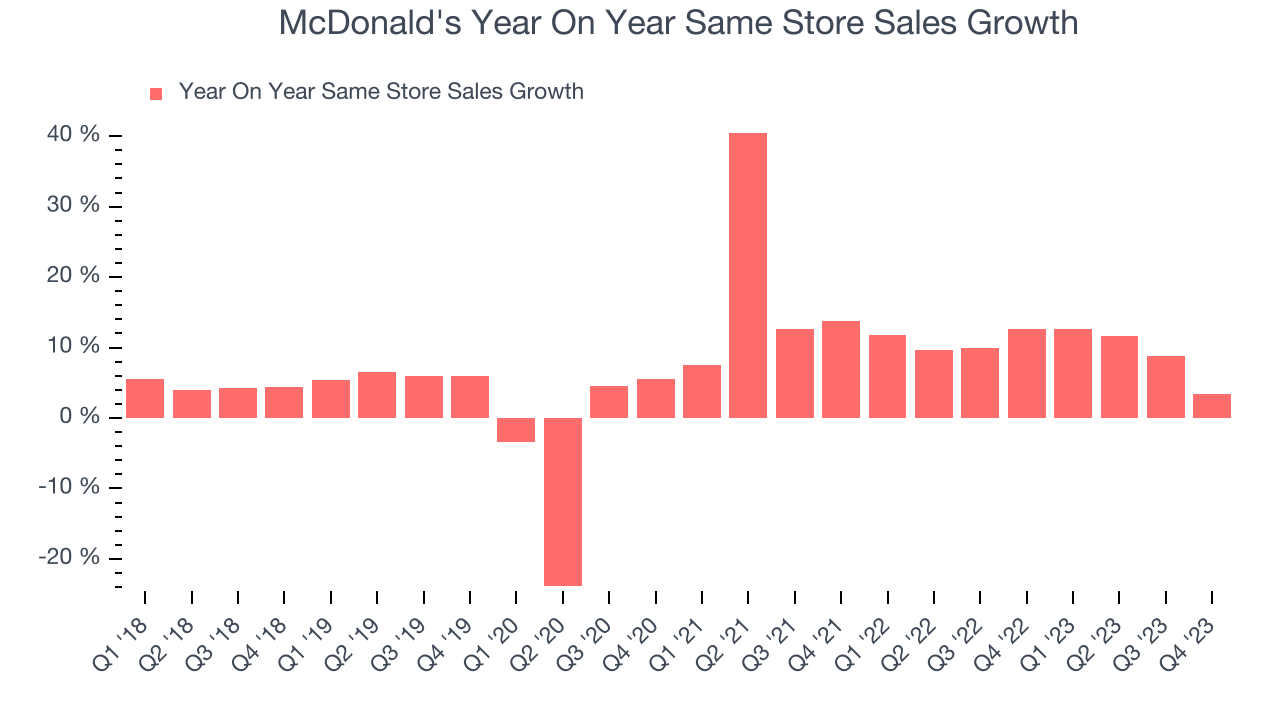

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

McDonald's demand has outpaced the broader restaurant sector over the last eight quarters. On average, the company has grown its same-store sales by a robust 10% year on year. This performance suggests its steady rollout of new restaurants could be beneficial for shareholders. When a company has strong demand, more locations should help it reach more customers seeking its meals.

In the latest quarter, McDonald's same-store sales rose 3.4% year on year. By the company's standards, this growth was a meaningful deceleration from the 12.6% year-on-year increase it posted 12 months ago. We'll be watching McDonald's closely to see if it can reaccelerate growth.

Key Takeaways from McDonald's Q4 Results

Revenue unfortunately missed analysts' expectations, driven by a same-store sales miss. With better gross margins, through, EPS beat. The stock is down 1.7% after reporting, trading at $292 per share.

So should you invest in McDonald's right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.