Conveyorized car wash service company Mister Car Wash (NYSE:MCW) missed analysts' expectations in Q1 CY2024, with revenue up 5.9% year on year to $239.2 million. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $1.00 billion at the midpoint. It made a non-GAAP profit of $0.08 per share, down from its profit of $0.08 per share in the same quarter last year.

Mister Car Wash (MCW) Q1 CY2024 Highlights:

- Revenue: $239.2 million vs analyst estimates of $242.7 million (1.5% miss)

- Adjusted EBITDA: $75.2 million vs analyst estimates of $74.3 million (1.2% beat)

- EPS (non-GAAP): $0.08 vs analyst expectations of $0.08 (in line)

- The company reconfirmed its revenue guidance for the full year of $1.00 billion at the midpoint (in line with expectations)

- The company reconfirmed its EPS (non-GAAP) guidance for the full year of $0.32 at the midpoint (in line with expectations)

- Gross Margin (GAAP): 29.6%, down from 33.8% in the same quarter last year

- Free Cash Flow was -$23.85 million compared to -$70.27 million in the previous quarter

- Same-Store Sales were up 0.9% year on year (slight miss vs. expectations of up 1.0% year on year)

- Market Capitalization: $2.13 billion

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE:MCW) offers car washes across the United States through its conveyorized service.

Mister Car Wash fulfills the demand for convenient car cleaning, operating strategically placed locations in urban and suburban areas such as highway interchanges to allow easy customer access.

The company offers external and internal car cleaning services. Exterior wash is fulfilled via the company’s conveyor-belt wash service, with the option for interior vacuuming and window cleaning via its full-service wash at an extra cost. Additional offerings include detailing services, such as waxing and polishing, and a subscription-based plan that gives customers access to unlimited service for a fixed monthly fee.

Mister Car Wash generates revenue through its single-use wash services, package wash service sales, and monthly subscription services. It primarily sells to individual vehicle owners through on-site sales and mobile apps. The company also serves commercial clients through direct negotiations with businesses.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Competitors offering conveyorized car washes and detailing services include private companies Autobell Car Wash, Zips Car Wash, and Wash Depot Holdings.Sales Growth

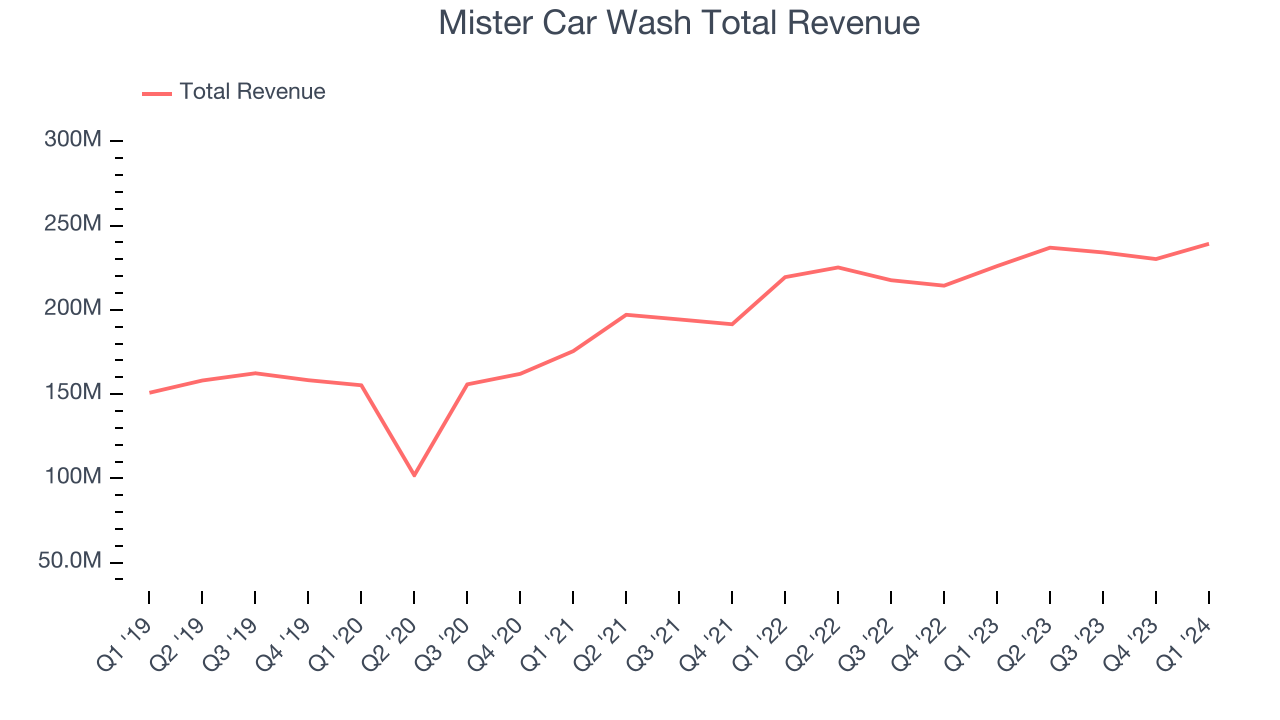

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Mister Car Wash's annualized revenue growth rate of 10.4% over the last four years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Mister Car Wash's recent history shows the business has slowed as its annualized revenue growth of 8.3% over the last two years is below its four-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Mister Car Wash's recent history shows the business has slowed as its annualized revenue growth of 8.3% over the last two years is below its four-year trend.

We can better understand the company's revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Mister Car Wash's same-store sales averaged 1.4% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company's top-line performance.

This quarter, Mister Car Wash's revenue grew 5.9% year on year to $239.2 million, missing Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 8.8% over the next 12 months, an acceleration from this quarter.

Operating Margin

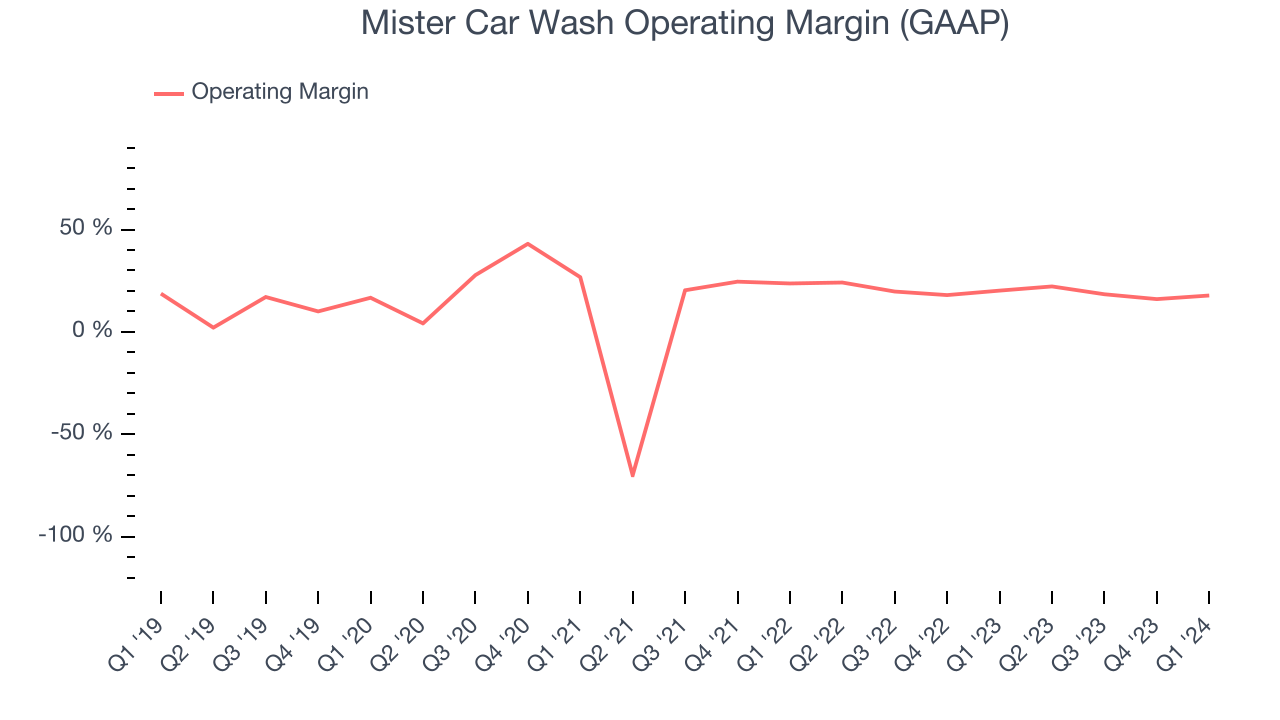

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Mister Car Wash has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 19.6%.

This quarter, Mister Car Wash generated an operating profit margin of 17.8%, down 2.4 percentage points year on year.

Over the next 12 months, Wall Street expects Mister Car Wash to become more profitable. Analysts are expecting the company’s LTM operating margin of 18.6% to rise to 22.1%.EPS

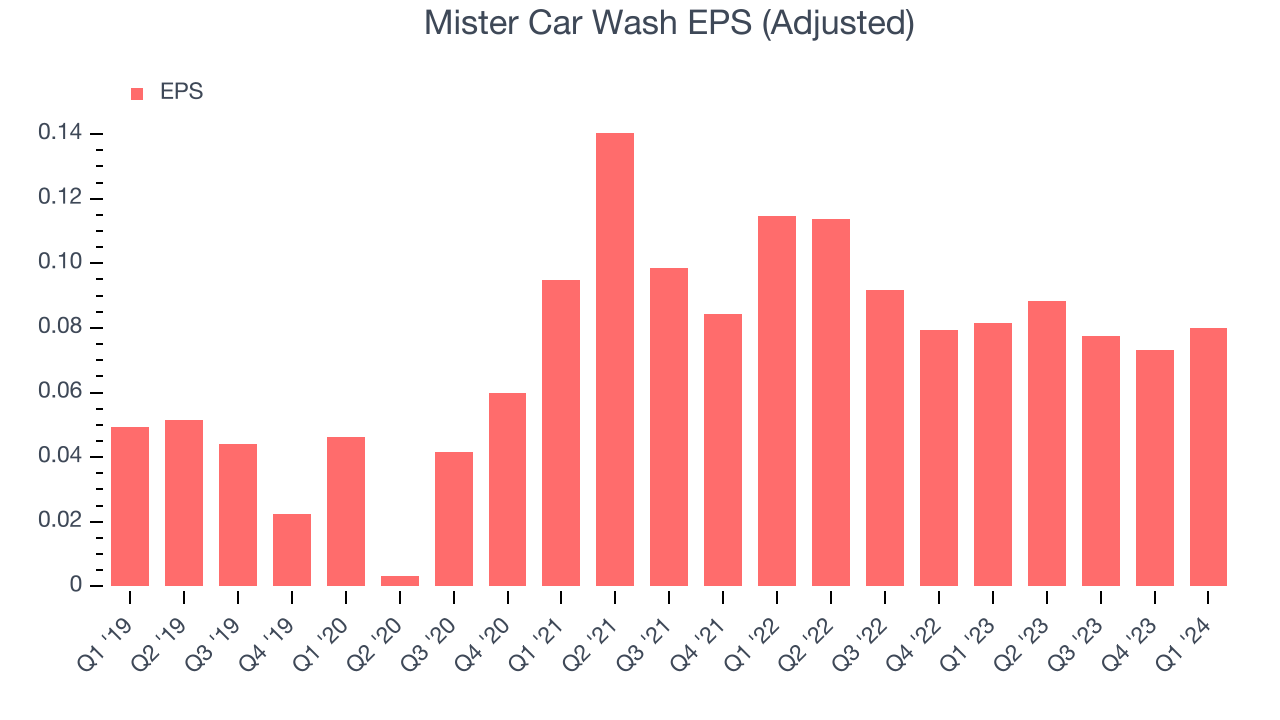

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last four years, Mister Car Wash's EPS grew 94.4%, translating into a remarkable 18.1% compounded annual growth rate. This performance is materially higher than its 10.4% annualized revenue growth over the same period. Let's dig into why.

While we mentioned earlier that Mister Car Wash's operating margin declined this quarter, a four-year view shows its margin has expanded 1.1 percentage points, leading to higher profitability and earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Mister Car Wash reported EPS at $0.08, down from $0.08 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 1.1%. Over the next 12 months, Wall Street expects Mister Car Wash to perform poorly. Analysts are projecting its LTM EPS of $0.32 to shrink to break even.

Cash Is King

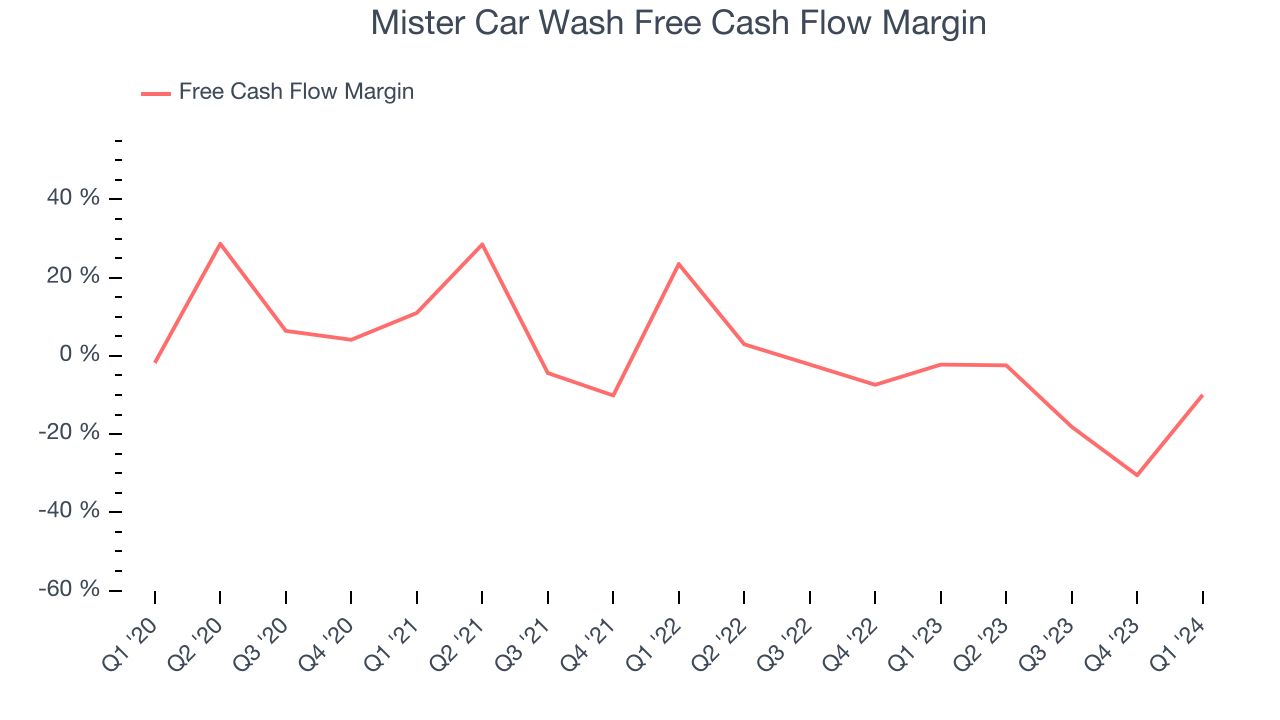

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Mister Car Wash's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 8.8%.

Mister Car Wash burned through $23.85 million of cash in Q1, equivalent to a negative 10% margin, reducing its cash burn by 373% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Mister Car Wash's five-year average return on invested capital was 12.5%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Mister Car Wash's ROIC averaged 7.5 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Mister Car Wash reported $10.7 million of cash and $920.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $290.1 million of EBITDA over the last 12 months, we view Mister Car Wash's 3.1x net-debt-to-EBITDA ratio as safe. We also see its $37.33 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Mister Car Wash's Q1 Results

This quarter pretty much met expectations across the board. Same store sales was slightly below, leading to a small revenue miss, but adjusted EBITDA was slightly ahead. The company maintained its revenue and EPS outlook for the full year, both of which are in line with current expectations. The stock is flat after reporting and currently trades at $6.69 per share.

Is Now The Time?

Mister Car Wash may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Mister Car Wash, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last four years. And while its strong operating margins show it's a well-run business, the downside is its cash burn raises the question of whether it can sustainably maintain growth. On top of that, its same-store sales performance has been disappointing.

Mister Car Wash's price-to-earnings ratio based on the next 12 months is 19.7x. While we've no doubt one can find things to like about Mister Car Wash, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $9.62 per share right before these results (compared to the current share price of $6.69).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.