Vertically integrated manufacturing solutions provider Mayville Engineering Company (NYSE:MEC) reported Q2 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 17.7% year on year to $163.6 million. The company expects the full year's revenue to be around $630 million, in line with analysts' estimates. It made a non-GAAP profit of $0.26 per share, improving from its profit of $0.20 per share in the same quarter last year.

Is now the time to buy Mayville Engineering? Find out by accessing our full research report, it's free.

Mayville Engineering (MEC) Q2 CY2024 Highlights:

- Revenue: $163.6 million vs analyst estimates of $159.1 million (2.8% beat)

- Adj EBITDA: $19.6 million vs analyst estimates of $18.5 million (5.9% beat)

- EPS (non-GAAP): $0.26 vs analyst estimates of $0.22 (18.3% beat)

- The company reconfirmed its revenue guidance for the full year of $630 million at the midpoint

- EBITDA guidance for the full year is $74 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 13.6%, up from 12.7% in the same quarter last year

- Adjusted EBITDA Margin: 12%, in line with the same quarter last year

- Free Cash Flow of $19.18 million, up 144% from the previous quarter

- Market Capitalization: $342.6 million

“We continued to demonstrate strong strategic execution during the second quarter, as net sales, margin realization, and free cash generation each increased significantly above prior-year levels,” stated Jag Reddy, President and Chief Executive Officer.

Originally founded solely on tool and die manufacturing, Mayville Engineering Company (NYSE:MEC) specializes in metal fabrication, tube bending, and welding to be used in various industries.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

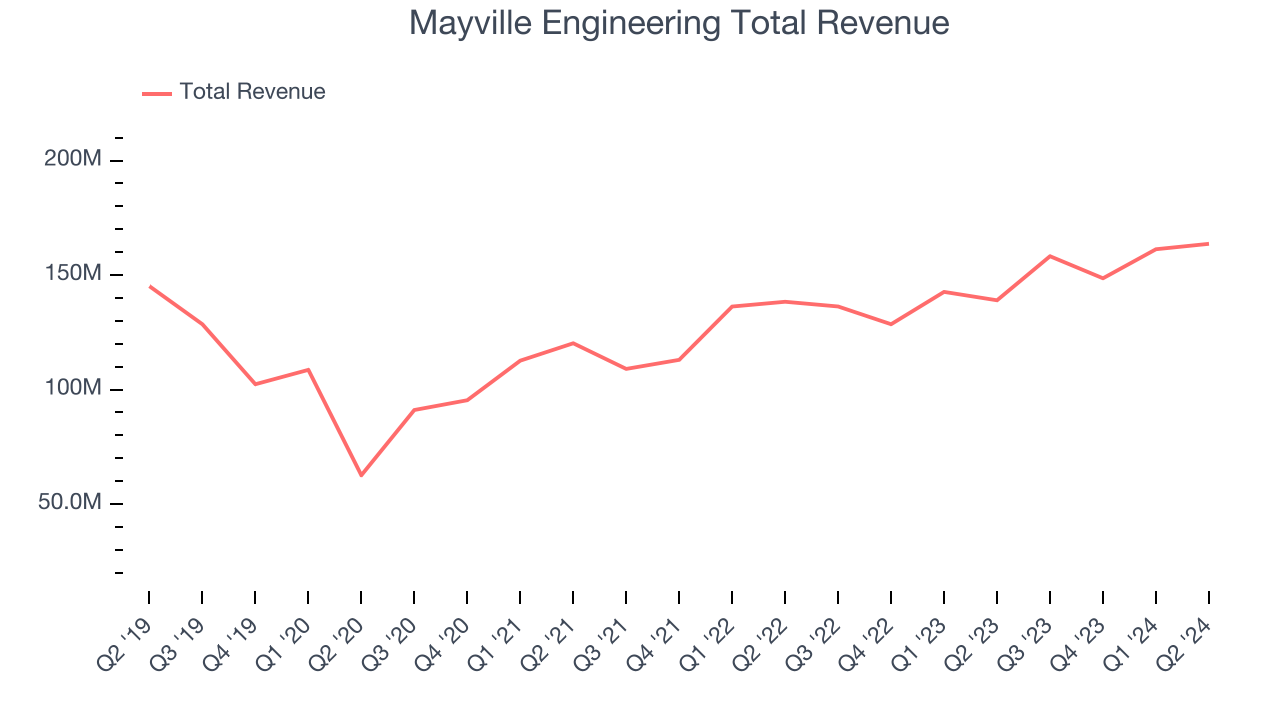

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Mayville Engineering's 6.3% annualized revenue growth over the last five years was mediocre. This shows it couldn't expand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Mayville Engineering's annualized revenue growth of 12.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company's revenue dynamics by analyzing its most important segments, Commercial Vehicle and Construction & Access, which are 38% and 16.6% of revenue. Over the last two years, Mayville Engineering's Commercial Vehicle revenue (exhaust, engine components, fuel systems) averaged 15.1% year-on-year growth while its Construction & Access revenue (fenders, hoods, frames for heavy machinery) averaged 1.5% growth.

This quarter, Mayville Engineering reported robust year-on-year revenue growth of 17.7%, and its $163.6 million of revenue exceeded Wall Street's estimates by 2.8%. Looking ahead, Wall Street expects sales to grow 2% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

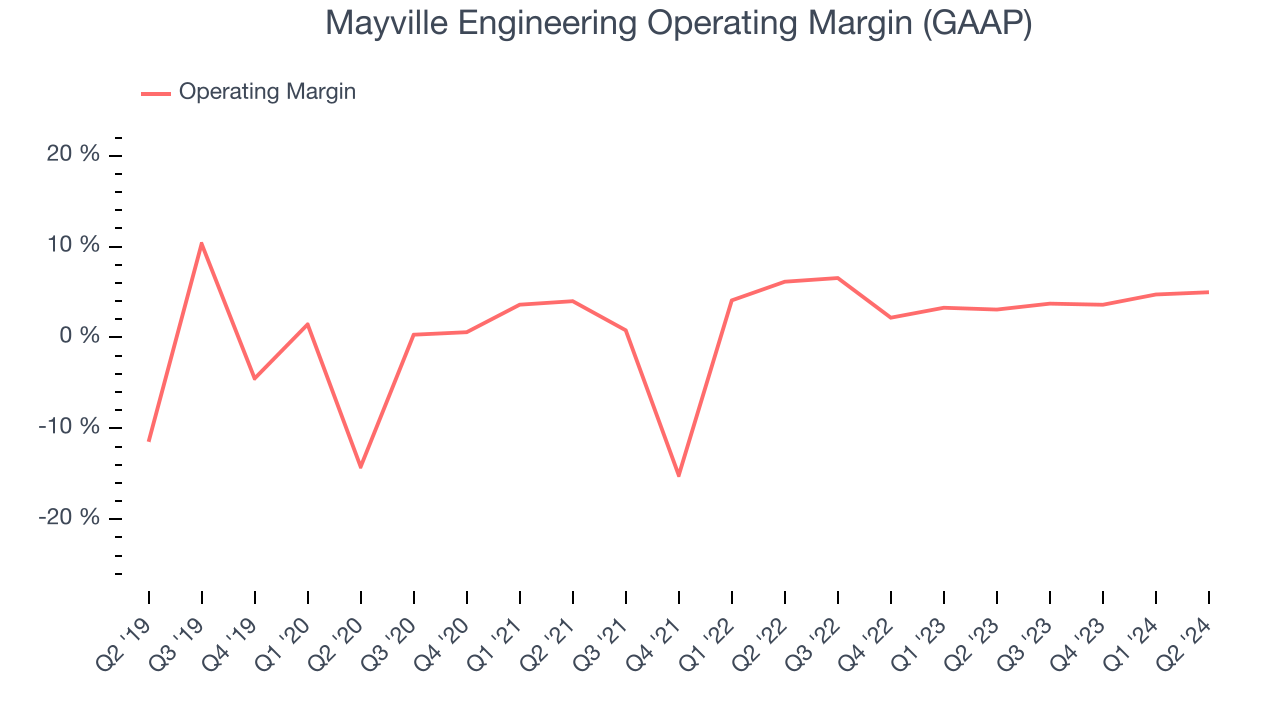

Operating Margin

Mayville Engineering was profitable over the last five years but held back by its large expense base. It demonstrated lousy profitability for an industrials business, producing an average operating margin of 2.3%. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, Mayville Engineering's annual operating margin rose by 4 percentage points over the last five years

This quarter, Mayville Engineering generated an operating profit margin of 5%, up 1.9 percentage points year on year. This increase was encouraging, and since the company's operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as sales, marketing, R&D, and administrative overhead.

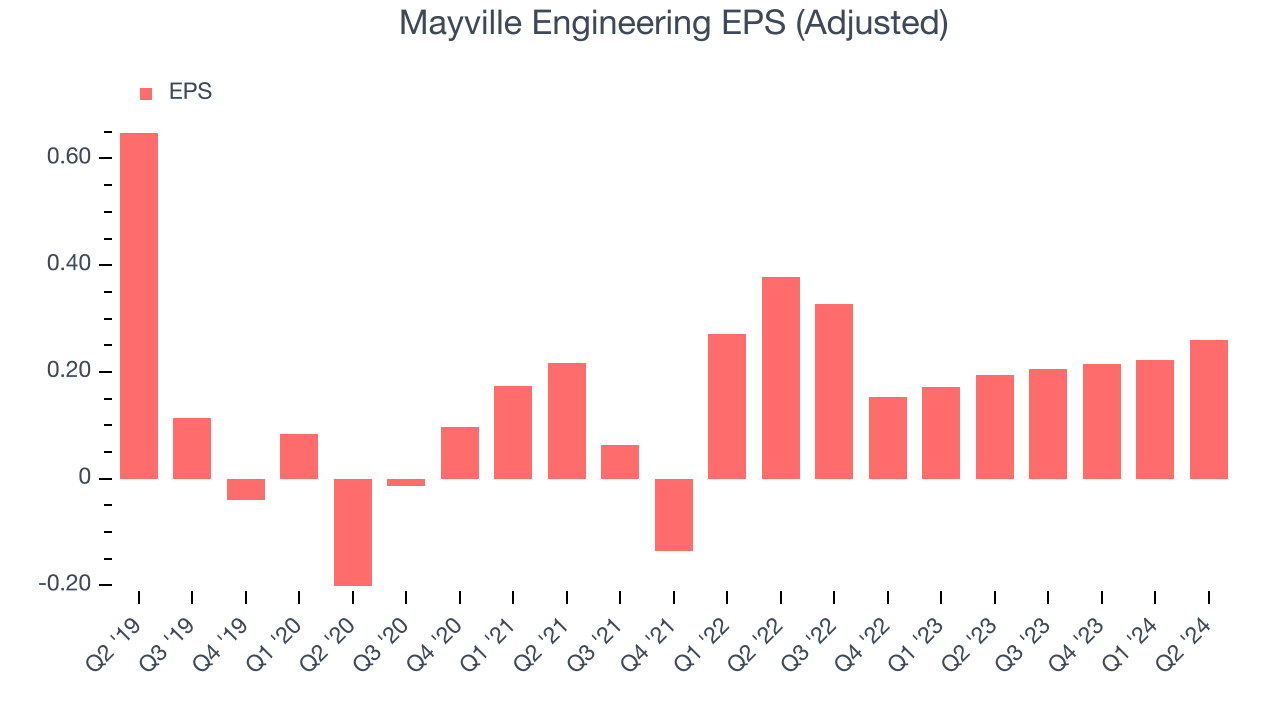

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Mayville Engineering, its EPS declined by 9% annually over the last five years while its revenue grew by 6.3%. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

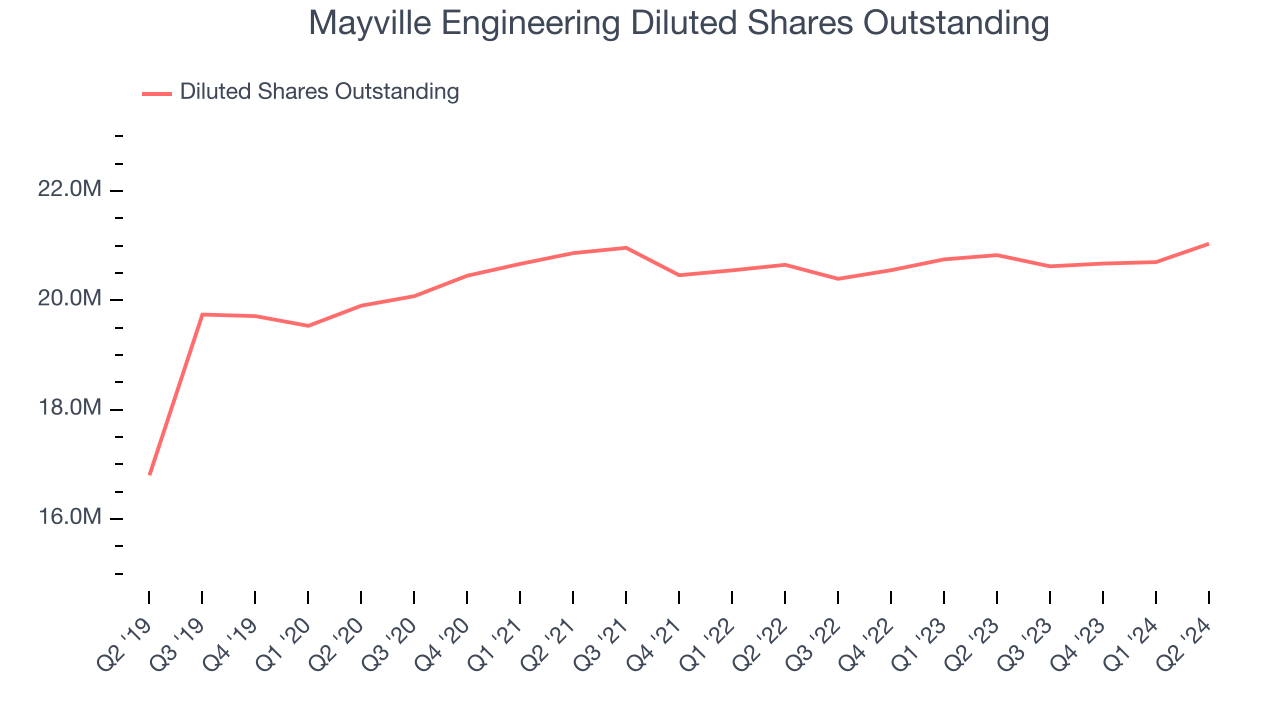

We can take a deeper look into Mayville Engineering's earnings to better understand the drivers of its performance. A five-year view shows Mayville Engineering has diluted its shareholders, growing its share count by 25.2%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For Mayville Engineering, its two-year annual EPS growth of 25.2% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q2, Mayville Engineering reported EPS at $0.26, up from $0.20 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Mayville Engineering to grow its earnings. Analysts are projecting its EPS of $0.90 in the last year to climb by 25.7% to $1.14.

Key Takeaways from Mayville Engineering's Q2 Results

We were impressed by how significantly Mayville Engineering blew past analysts' Commercial Vehicle revenue expectations this quarter. We were also excited its consolidated revenue and adjusted EBITDA both outperformed Wall Street's estimates. On the other hand, its full-year revenue guidance was underwhelming. Overall, we think this was a mixed but solid quarter nonetheless. The stock traded up 4.8% to $17.56 immediately following the results.

Mayville Engineering may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.