Environmental services provider Montrose (NYSE:MEG) reported results in line with analysts' expectations in Q2 CY2024, with revenue up 8.9% year on year to $173.3 million. The company's full-year revenue guidance of $715 million at the midpoint came in slightly above analysts' estimates. It made a non-GAAP profit of $0.20 per share, improving from its loss of $0.38 per share in the same quarter last year.

Is now the time to buy Montrose? Find out by accessing our full research report, it's free.

Montrose (MEG) Q2 CY2024 Highlights:

- Revenue: $173.3 million vs analyst estimates of $173.9 million (small miss)

- EPS (non-GAAP): $0.20 vs analyst expectations of $0.25 (18.9% miss)

- The company reconfirmed its revenue guidance for the full year of $715 million at the midpoint

- EBITDA guidance for the full year is $97.5 million at the midpoint, above analyst estimates of $96.52 million

- Gross Margin (GAAP): 39.9%, up from 38.3% in the same quarter last year

- Adjusted EBITDA Margin: 13.5%, in line with the same quarter last year

- Free Cash Flow was -$11.06 million compared to -$28 million in the previous quarter

- Market Capitalization: $919.5 million

Montrose Chief Executive Officer and Director, Vijay Manthripragada, commented, “We’re thrilled to build on our strong first quarter performance with another period of exceptional results. Broad-based strength across our business lines drove year-over-year growth in our key operating metrics. This resulted in record quarterly revenues and record Consolidated Adjusted EBITDA1, and year-over-year margin improvement across all three segments. We're especially pleased with our continued organic growth this quarter, fueled by the growing traction of our cross-selling initiatives. This strong organic growth, five highly accretive acquisitions completed so far this year, and ongoing secular tailwinds reinforce our confidence in our outlook.”

Founded to protect a tree-lined two-lane road, Montrose (NYSE:MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

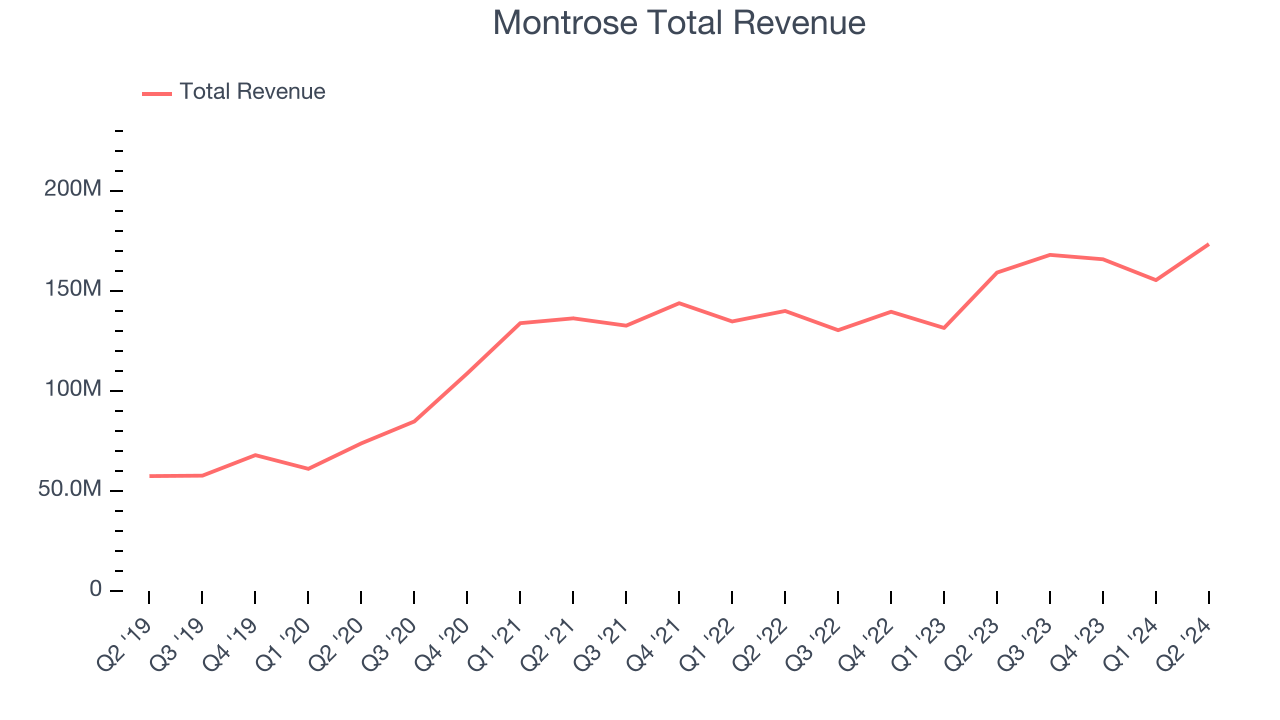

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Over the last five years, Montrose grew its sales at an incredible 26.3% compounded annual growth rate. This shows it expanded quickly, a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Montrose's annualized revenue growth of 9.6% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Montrose grew its revenue by 8.9% year on year, and its $173.3 million of revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 10.6% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

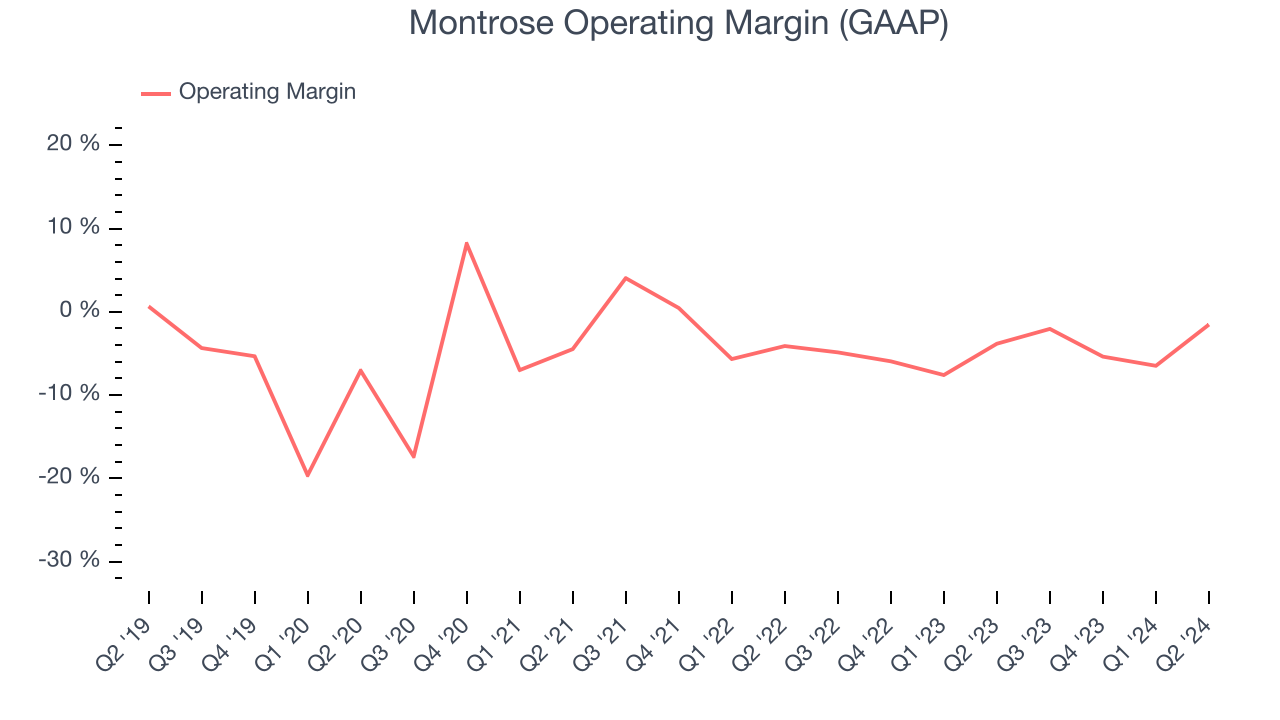

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It's also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Unprofitable industrials companies require extra attention because they could get caught swimming naked if the tide goes out. It's hard to trust that Montrose can endure a full cycle as its high expenses have contributed to an average operating margin of negative 4.3% over the last five years. This result is surprising given its high gross margin as a starting point.

On the bright side, Montrose's annual operating margin rose by 5.2 percentage points over the last five years, as its sales growth gave it immense operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q2, Montrose generated an operating profit margin of negative 1.5%, up 2.3 percentage points year on year. This increase was encouraging, and since the company's operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as sales, marketing, R&D, and administrative overhead.

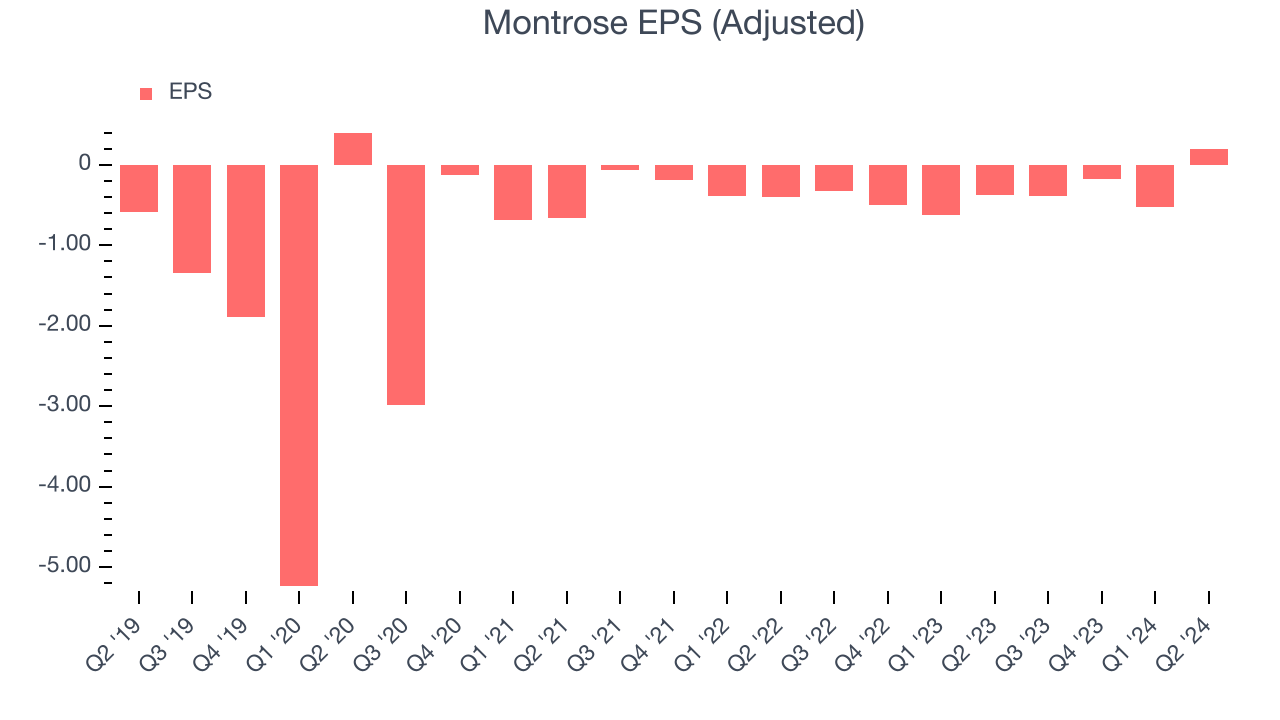

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Although Montrose's full-year earnings are still negative, it reduced its losses and improved its EPS by 21.3% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q2, Montrose reported EPS at $0.20, up from negative $0.38 in the same quarter last year. Despite growing year on year, this print missed analysts' estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Montrose's EPS of negative $0.90 in the last year to flip to positive $1.14.

Key Takeaways from Montrose's Q2 Results

It was good to see Montrose's full-year revenue and EBITDA forecast beat analysts' expectations. On the other hand, this quarter's revenue and EPS fell short of Wall Street's estimates. Overall, this was a mediocre quarter for Montrose. The stock remained flat at $29.27 immediately following the results.

So should you invest in Montrose right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.