Custom-engineered solutions manufacturer Methode Electronics (NYSE:MEI) missed analysts’ expectations in Q2 CY2024, with revenue down 10.8% year on year to $258.5 million. It made a GAAP loss of $0.52 per share, down from its profit of $0.02 per share in the same quarter last year.

Is now the time to buy Methode Electronics? Find out by accessing our full research report, it’s free.

Methode Electronics (MEI) Q2 CY2024 Highlights:

- Revenue: $258.5 million vs analyst estimates of $266.6 million (3% miss)

- EPS: -$0.52 vs analyst estimates of -$0.31 (-$0.21 miss)

- For fiscal 2025, the company affirmed its expectation for net sales to be similar to fiscal 2024 and adjusted pre-tax income to be approaching breakeven

- Gross Margin (GAAP): 17.3%, down from 18.8% in the same quarter last year

- EBITDA Margin: 3.8%

- Free Cash Flow was -$2.7 million compared to -$19.4 million in the same quarter last year

- Market Capitalization: $355.4 million

Management CommentsPresident and Chief Executive Officer Jon DeGaynor said, “Our sales in the quarter were on track with our expectations, while our adjusted pre-tax loss was better than our expectations. We continue to navigate a challenging transition from our legacy programs to the launching of a multitude of new programs. Our bookings remained solid, and our EV activity rebounded from our previous quarter.”

Founded in 1946, Methode Electronics (NYSE:MEI) is a global supplier of custom-engineered solutions for Original Equipment Manufacturers (OEMs).

Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

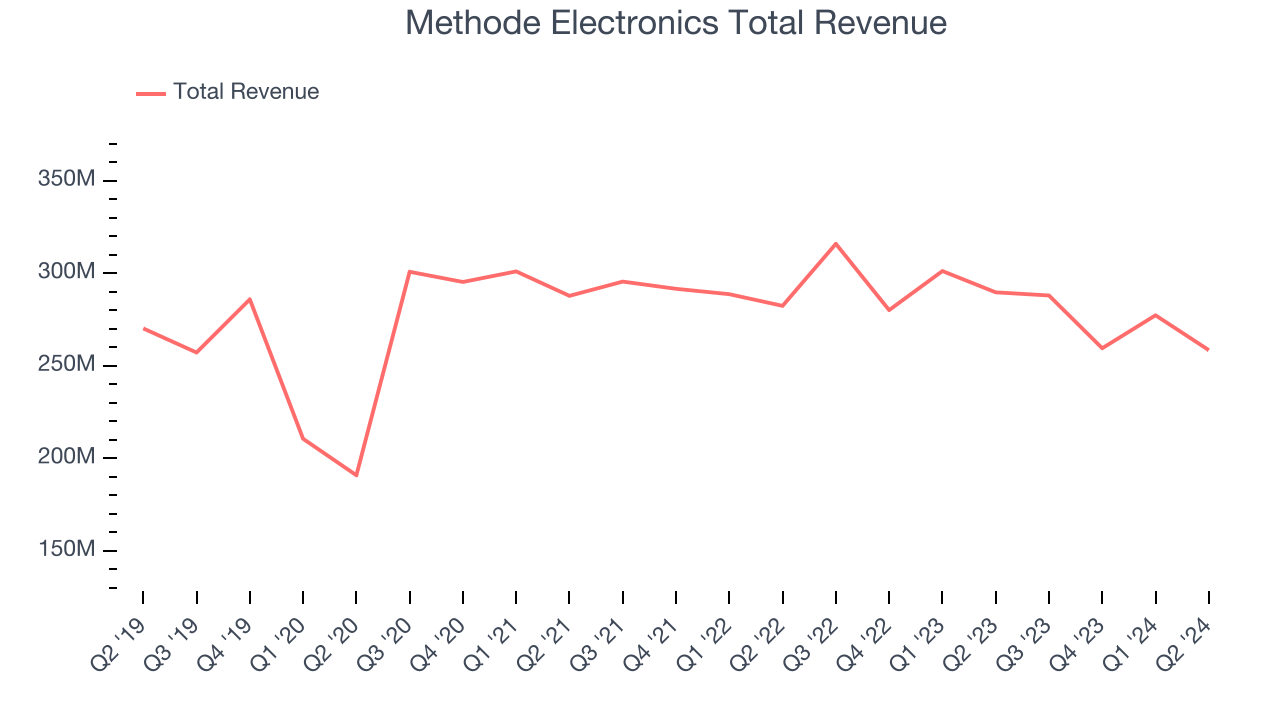

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Methode Electronics struggled to generate demand over the last five years as its sales were flat. This is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Methode Electronics’s recent history shows its demand has stayed suppressed as its revenue has declined by 3.3% annually over the last two years.

This quarter, Methode Electronics missed Wall Street’s estimates and reported a rather uninspiring 10.8% year-on-year revenue decline, generating $258.5 million of revenue. Looking ahead, Wall Street expects sales to grow 3.1% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

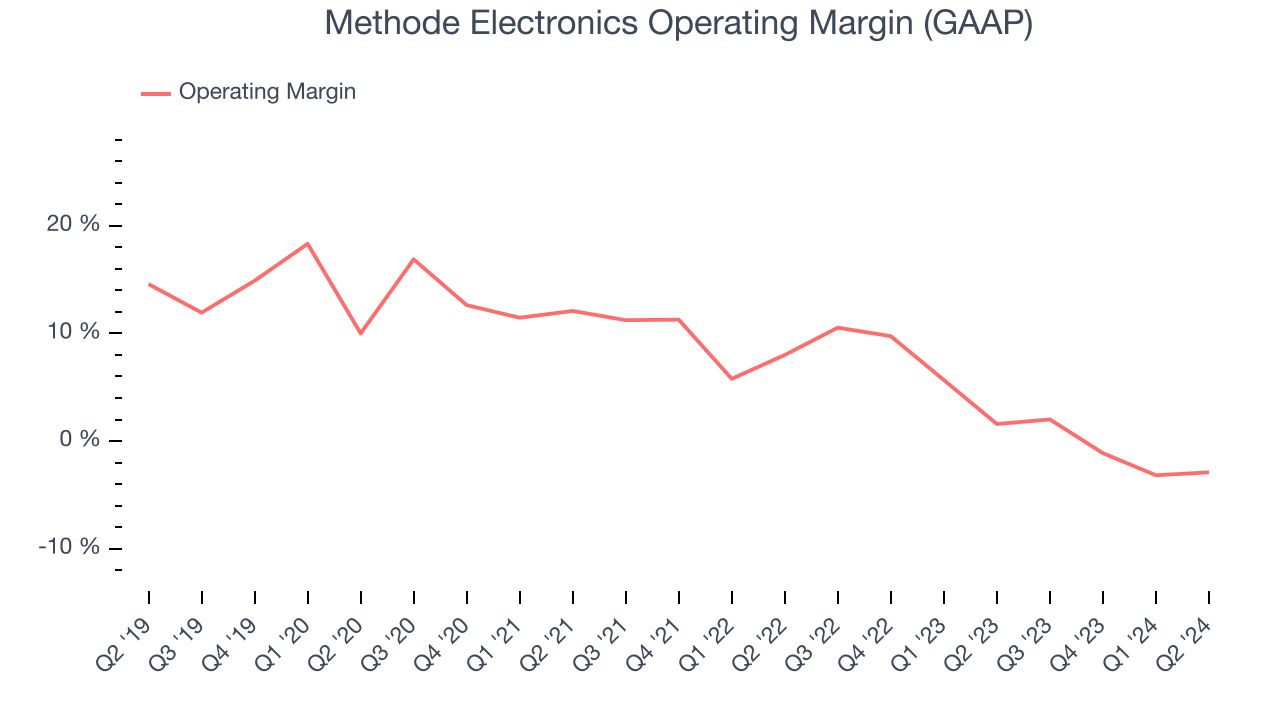

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Methode Electronics has done a decent job managing its expenses over the last five years. The company has produced an average operating margin of 8.3%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Methode Electronics’s annual operating margin decreased by 15.1 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Methode Electronics become more profitable in the future.

This quarter, Methode Electronics generated an operating profit margin of negative 2.9%, down 4.5 percentage points year on year. Since Methode Electronics’s operating margin decreased more than its gross margin, we can assume the company was recently less efficient because expenses such as sales, marketing, R&D, and administrative overhead increased.

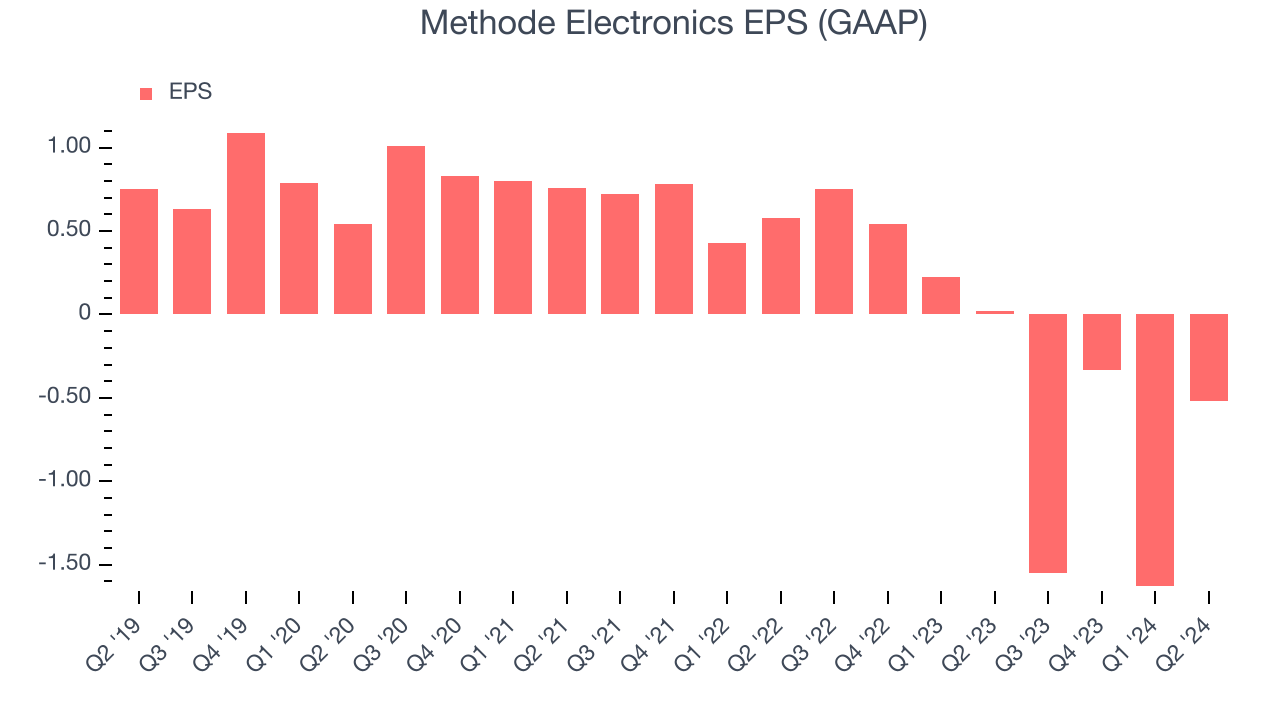

EPS

Analyzing long-term revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Methode Electronics, its EPS declined by 25.7% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Diving into the nuances of Methode Electronics’s earnings can give us a better understanding of its performance. As we mentioned earlier, Methode Electronics’s operating margin declined by 15.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For Methode Electronics, its two-year annual EPS declines of 89.9% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q2, Methode Electronics reported EPS at negative $0.52, down from $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Methode Electronics’s EPS of negative $4.03 in the last year to reach break even.

Key Takeaways from Methode Electronics’s Q2 Results

The quarter was underwhelming. Its revenue unfortunately missed and its EPS fell short of Wall Street’s estimates. However, the company affirmed its expectation for fiscal 2025 net sales to be similar to fiscal 2024 and for fiscal 2025 adjusted pre-tax income to be approaching breakeven. It's always comforting when previous guidance is maintained. The stock traded up 3.9% to $10.45 immediately after reporting.

So should you invest in Methode Electronics right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.