Food flavoring company McCormick (NYSE:MKC) met Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $1.68 billion. Its non-GAAP profit of $0.83 per share was 23.3% above analysts’ consensus estimates.

Is now the time to buy McCormick? Find out by accessing our full research report, it’s free.

McCormick (MKC) Q3 CY2024 Highlights:

- Revenue: $1.68 billion vs analyst estimates of $1.67 billion (in line)

- EPS (non-GAAP): $0.83 vs analyst estimates of $0.67 (23.3% beat)

- EPS (non-GAAP) guidance for the full year is $2.88 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 38.7%, up from 37% in the same quarter last year

- Sales Volumes were up 1% year on year

- Market Capitalization: $22.11 billion

Brendan M. Foley, President and CEO, stated, "We are pleased with our year to date performance, which was in line with our expectations and reflects the success of our prioritized investments in the areas within our portfolio that we believe will drive the greatest value. This quarter we reached a meaningful milestone by delivering total global positive volume growth, reflecting improved trends across both segments, and we expect this momentum to continue into the fourth quarter. In our Consumer segment, we delivered solid volume growth, despite a more challenging macro environment in China. In Flavor Solutions, we drove sequential volume improvement, as we delivered strong growth in Branded Foodservice.

Company Overview

The classic red Heinz ketchup bottle’s competitor, McCormick (NYSE:MKC) sells food-flavoring products like condiments, spices, and seasoning mixes.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

McCormick is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

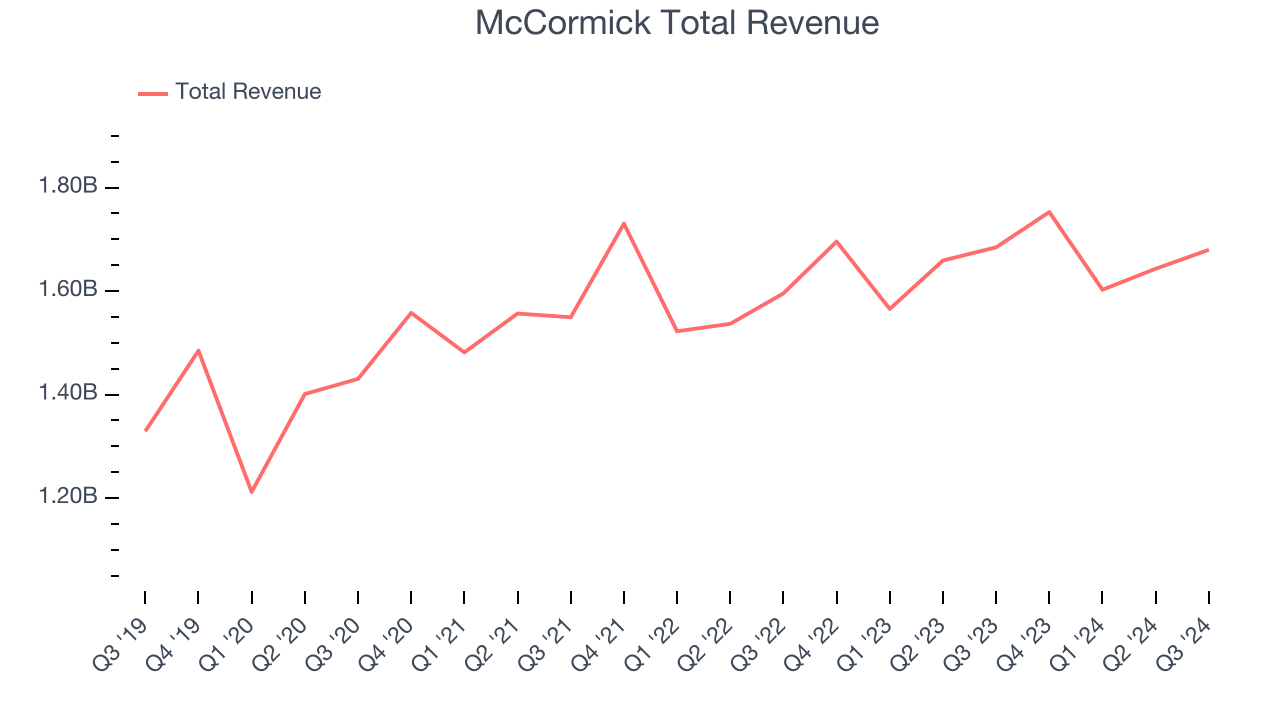

As you can see below, the company’s annualized revenue growth rate of 2.8% over the last three years was sluggish as the number of units it sold was more or less the same each year. We’ll explore what this means in the "Volume Growth" section.

This quarter, McCormick reported a rather uninspiring 0.3% year-on-year revenue decline to $1.68 billion in revenue, in line with Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 2% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

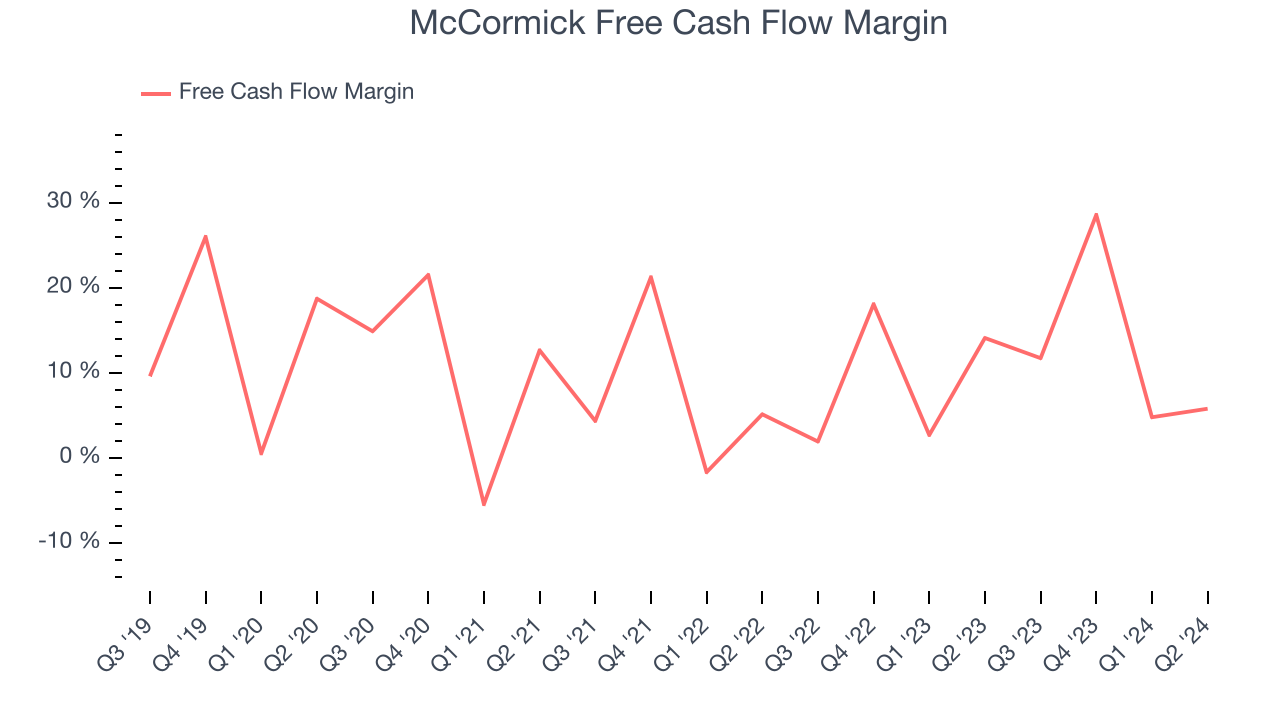

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling. Free cash flow accounts for operating and capital expenses, making it tough to manipulate. Cash is king.

McCormick has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.5% over the last two years, quite impressive for a consumer staples business.

Key Takeaways from McCormick’s Q3 Results

We enjoyed seeing McCormick exceed analysts’ gross margin and EPS expectations this quarter. Full year EPS guidance was in line with expectations, meaning the company is squarely on track. Overall, this quarter wasn't perfect, but it was quite solid and lacked major negatives. The stock traded up 3.7% to $85.32 immediately following the results.

McCormick may have had a good quarter, but does that mean you should invest right now?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.