Real estate brokerage and services firm Marcus & Millichap (NYSE:MMI) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue down 16.6% year on year to $129.1 million. It made a GAAP loss of $0.26 per share, down from its loss of $0.15 per share in the same quarter last year.

Marcus & Millichap (MMI) Q1 CY2024 Highlights:

- Revenue: $129.1 million vs analyst estimates of $127.5 million (1.3% beat)

- EPS: -$0.26 vs analyst estimates of -$0.28 (7.1% beat)

- Gross Margin (GAAP): 40.5%, up from 38.4% in the same quarter last year

- Market Capitalization: $1.29 billion

Founded in 1971, Marcus & Millichap (NYSE:MMI) specializes in commercial real estate investment sales, financing, research, and advisory services.

The foundation of Marcus & Millichap's business model is its unique investment brokerage focus. The company primarily concentrates on selling commercial real estate properties to individual and institutional investors. This specialization has allowed Marcus & Millichap to develop expertise in various property types, including multifamily, retail, office, industrial, hospitality, self-storage, and senior housing.

Marcus & Millichap's agents work across geographic boundaries and property types, leveraging the company's proprietary database to match buyers and sellers effectively. This collaborative approach has earned Marcus & Millichap a reputation for executing transactions efficiently and maximizing value for clients.

The company's services extend beyond sales and brokerage. Marcus & Millichap Capital Corporation, a subsidiary, offers clients financing services, including debt and equity financing for a range of property types. The firm also provides advisory services, including market research, property valuation, and consultation for property owners, developers, and investors, ensuring clients are well-informed to make strategic real estate decisions.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Marcus & Millichap's primary competitors include CBRE (NYSE:CBRE), Jones Lang LaSalle (NYSE:JLL), Cushman & Wakefield (NYSE:CWK), Colliers International (NASDAQ:CIGI), and Newmark (NASDAQ:NMRK).Sales Growth

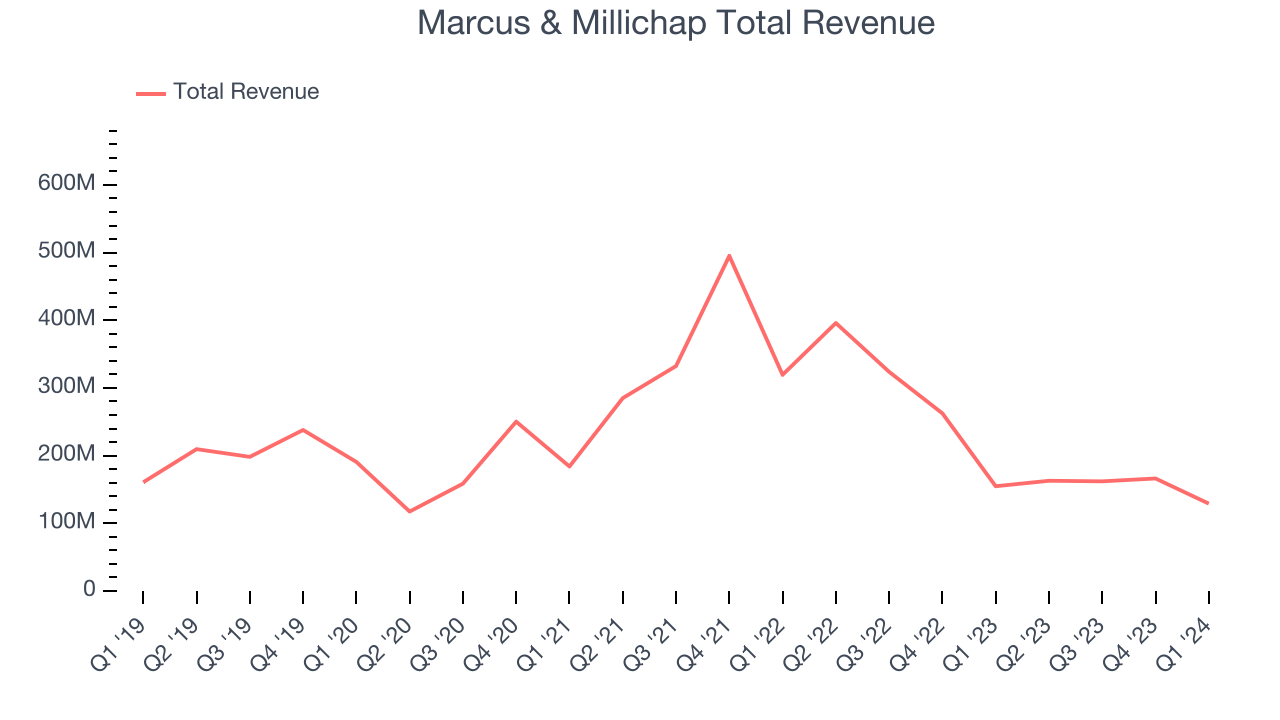

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Marcus & Millichap's revenue declined over the last five years, dropping 5.3% annually.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Marcus & Millichap's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 34.2% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Marcus & Millichap's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 34.2% over the last two years.

This quarter, Marcus & Millichap's revenue fell 16.6% year on year to $129.1 million but beat Wall Street's estimates by 1.3%. Looking ahead, Wall Street expects sales to grow 31.6% over the next 12 months, an acceleration from this quarter.

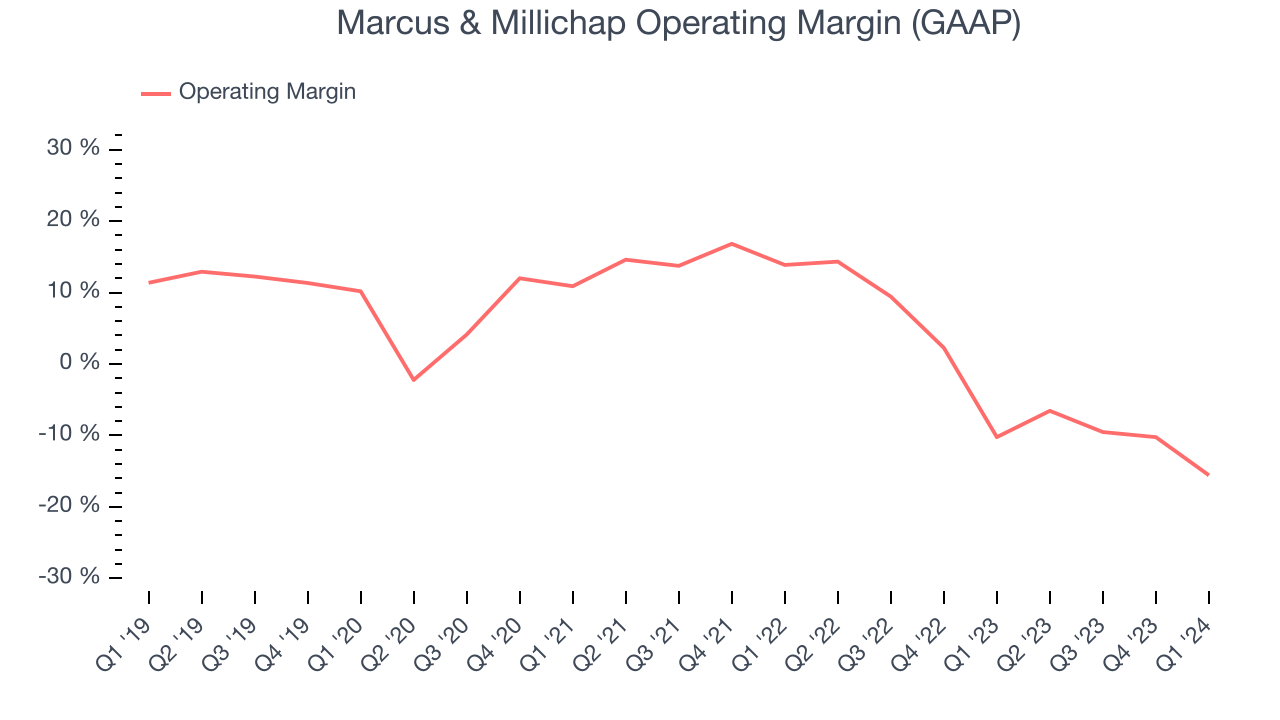

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Marcus & Millichap was roughly breakeven when averaging the last two years of quarterly operating profits, weak for a consumer discretionary business.

In Q1, Marcus & Millichap generated an operating profit margin of negative 15.6%, down 5.3 percentage points year on year.

Over the next 12 months, Wall Street expects Marcus & Millichap to break even on its operating profits. Analysts are expecting the company’s LTM operating margin of negative 10.2% to rise by 11 percentage points.EPS

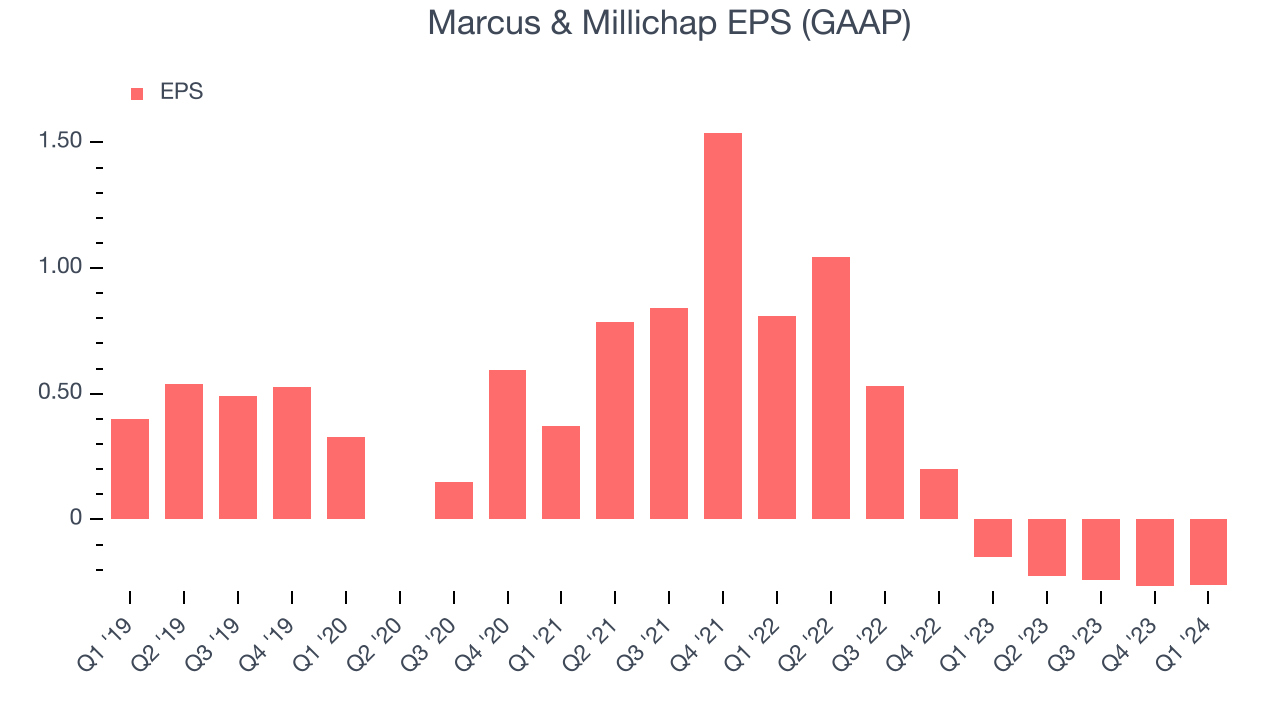

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Marcus & Millichap's EPS dropped 148%, translating into 19.9% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, Marcus & Millichap reported EPS at negative $0.26, down from negative $0.15 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 7.1%. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Marcus & Millichap's LTM EPS of negative $0.99 to reach break even.

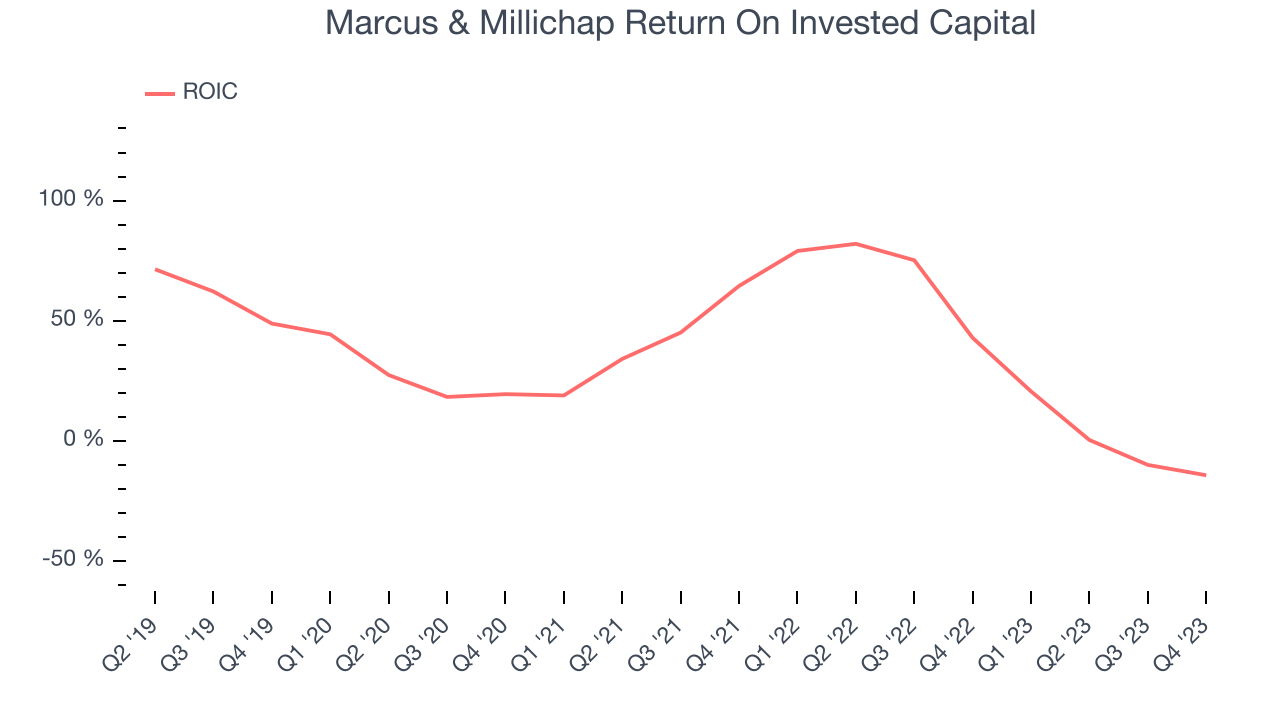

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Marcus & Millichap hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 40.7%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Marcus & Millichap's ROIC has significantly increased. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Marcus & Millichap, which has $90.56 million of cash and $91.47 million of debt on its balance sheet, was unprofitable over the last 12 months. It posted negative $31.84 million of EBITDA, and as investors in high-quality companies, we seek to avoid indebted loss-making companies.

We implore our readers to do the same because credit agencies could downgrade Marcus & Millichap if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Marcus & Millichap can improve its profitability and remain cautious until then.

Key Takeaways from Marcus & Millichap's Q1 Results

It was good to see Marcus & Millichap beat analysts' revenue and operating margin expectations this quarter, helping it top Wall Street's EPS estimates. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is flat after reporting and currently trades at $33.34 per share.

Is Now The Time?

Marcus & Millichap may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Marcus & Millichap isn't a bad business, but it probably wouldn't be one of our picks. Its revenue has declined over the last five years, but at least growth is expected to increase in the short term. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

Marcus & Millichap's price-to-earnings ratio based on the next 12 months is 75.8x. We can find things to like about Marcus & Millichap and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $20 per share right before these results (compared to the current share price of $33.34), implying they didn't see much short-term potential in Marcus & Millichap.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.