Real estate brokerage and services firm Marcus & Millichap (NYSE:MMI) fell short of analysts' expectations in Q4 FY2023, with revenue down 36.7% year on year to $166.2 million. It made a GAAP loss of $0.27 per share, down from its profit of $0.19 per share in the same quarter last year.

Marcus & Millichap (MMI) Q4 FY2023 Highlights:

- Revenue: $166.2 million vs analyst estimates of $171.2 million (2.9% miss)

- EPS: -$0.27 vs analyst estimates of -$0.28 ($0.01 beat)

- Gross Margin (GAAP): 36.6%, up from 31.1% in the same quarter last year

- Market Capitalization: $1.53 billion

Founded in 1971, Marcus & Millichap (NYSE:MMI) specializes in commercial real estate investment sales, financing, research, and advisory services.

The foundation of Marcus & Millichap's business model is its unique investment brokerage focus. The company primarily concentrates on selling commercial real estate properties to individual and institutional investors. This specialization has allowed Marcus & Millichap to develop expertise in various property types, including multifamily, retail, office, industrial, hospitality, self-storage, and senior housing.

Marcus & Millichap's agents work across geographic boundaries and property types, leveraging the company's proprietary database to match buyers and sellers effectively. This collaborative approach has earned Marcus & Millichap a reputation for executing transactions efficiently and maximizing value for clients.

The company's services extend beyond sales and brokerage. Marcus & Millichap Capital Corporation, a subsidiary, offers clients financing services, including debt and equity financing for a range of property types. The firm also provides advisory services, including market research, property valuation, and consultation for property owners, developers, and investors, ensuring clients are well-informed to make strategic real estate decisions.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Marcus & Millichap's primary competitors include CBRE (NYSE:CBRE), Jones Lang LaSalle (NYSE:JLL), Cushman & Wakefield (NYSE:CWK), Colliers International (NASDAQ:CIGI), and Newmark (NASDAQ:NMRK).Sales Growth

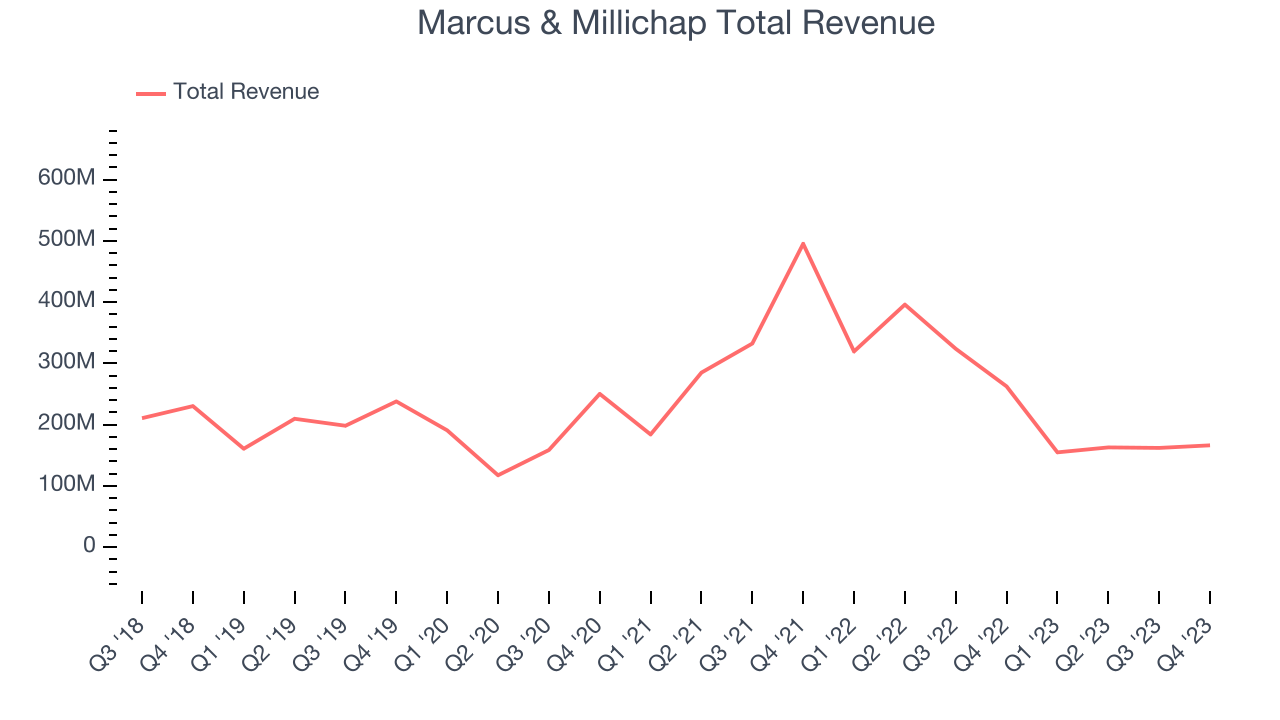

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Marcus & Millichap's revenue declined over the last five years, dropping 5.7% annually.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Marcus & Millichap's recent history shows its demand has decreased even further, as its revenue has shown annualized declines of 29.4% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Marcus & Millichap's recent history shows its demand has decreased even further, as its revenue has shown annualized declines of 29.4% over the last two years.

This quarter, Marcus & Millichap missed Wall Street's estimates and reported a rather uninspiring 36.7% year-on-year revenue decline, generating $166.2 million of revenue. Looking ahead, Wall Street expects sales to grow 33.5% over the next 12 months, an acceleration from this quarter.

Operating Margin

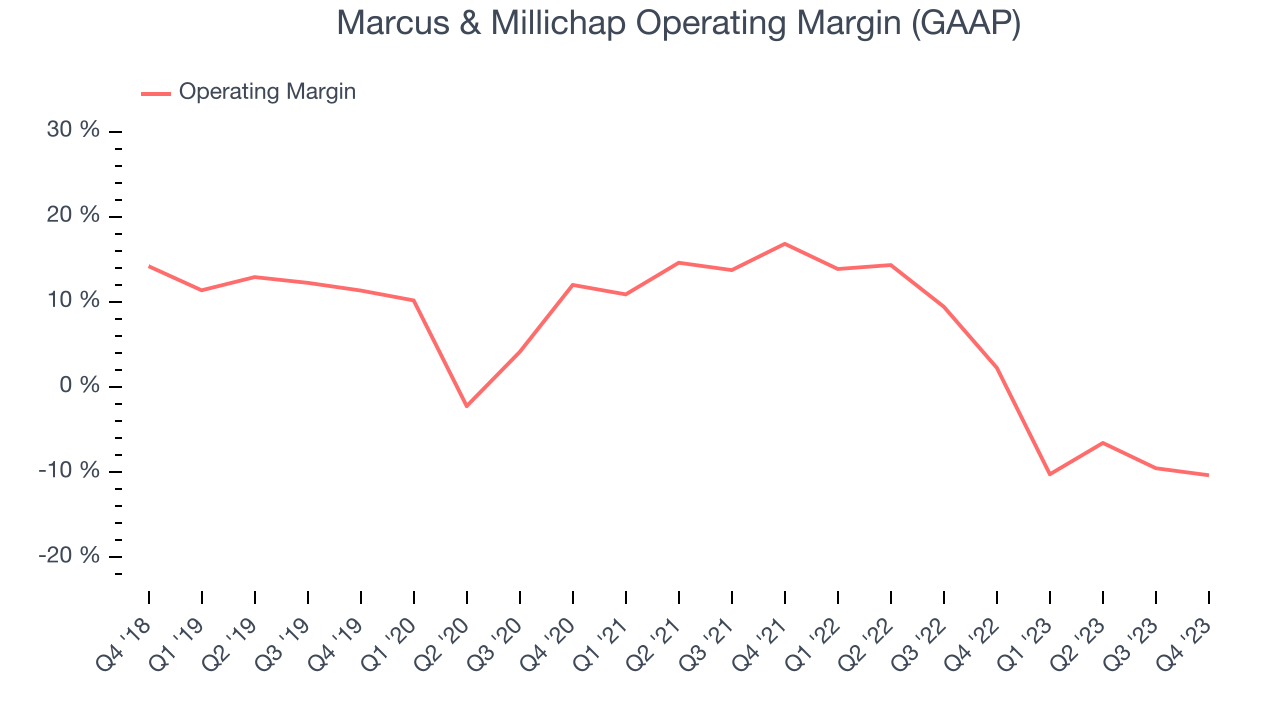

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Marcus & Millichap was profitable over the last two years but held back by its large expense base. Its average operating margin of 4% has been paltry for a consumer discretionary business.

This quarter, Marcus & Millichap generated an operating profit margin of negative 10.3%, down 12.6 percentage points year on year.

Over the next 12 months, Wall Street expects Marcus & Millichap to become profitable. Analysts are expecting the company’s LTM operating margin of negative 9.2% to rise to positive 2.6%.EPS

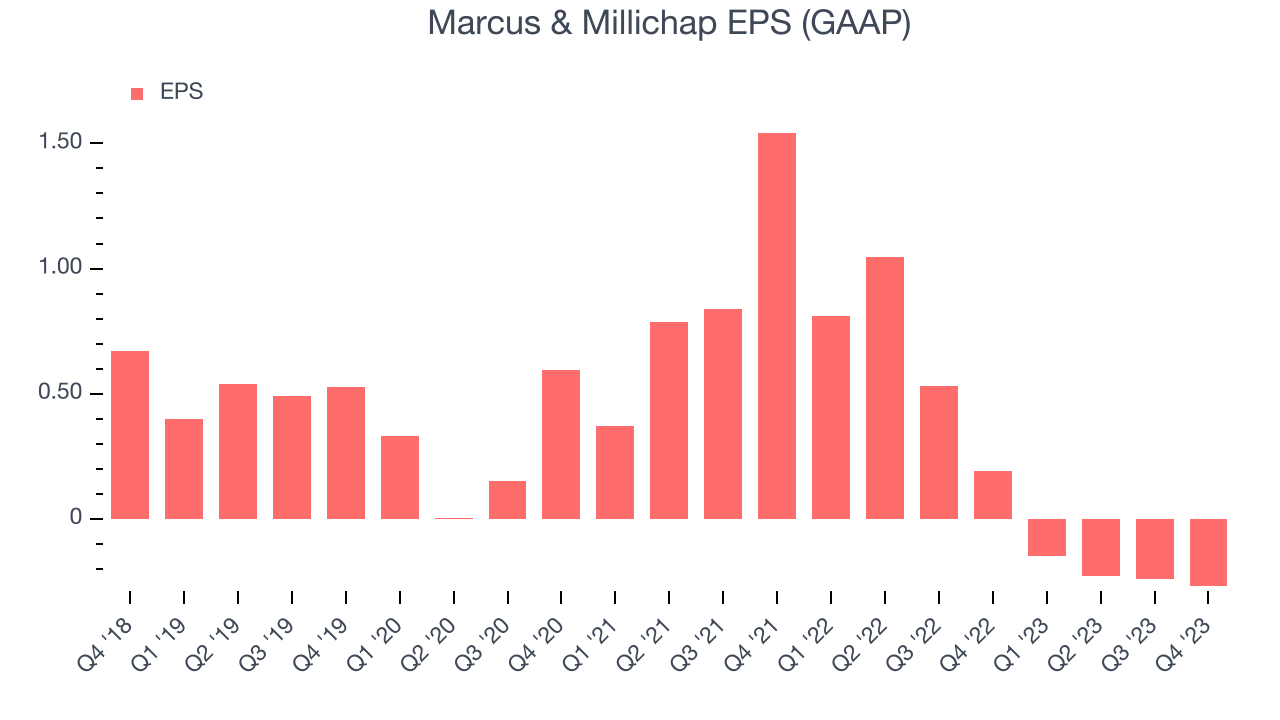

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Marcus & Millichap's EPS dropped 65.9%, translating into 19.4% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q4, Marcus & Millichap reported EPS at negative $0.27, down from $0.19 in the same quarter a year ago. This print beat analysts' estimates by 3.6%. Over the next 12 months, Wall Street expects Marcus & Millichap to perform well. Analysts are projecting its LTM EPS of negative $0.89 to flip to positive $0.74.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Marcus & Millichap hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 63.2%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Marcus & Millichap's ROIC over the last two years has averaged steep declines in returns. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Marcus & Millichap's Q4 Results

It was encouraging to see Marcus & Millichap slightly top analysts' EPS expectations this quarter. That stood out as a positive in these results. On the other hand, its revenue unfortunately missed and its operating margin fell short of Wall Street's estimates. Management added that results "reflect the ongoing market disruption created by the Fed’s fight against inflation and persistent interest rate volatility impacting real estate valuations". Overall, the results could have been better and the macro is highly uncertain for the company. The stock is flat after reporting and currently trades at $39.96 per share.

Is Now The Time?

Marcus & Millichap may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Marcus & Millichap, we'll be cheering from the sidelines. Its revenue has declined over the last five years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its falling ROIC shows its profitable business opportunities are shrinking.

Marcus & Millichap's price-to-earnings ratio based on the next 12 months is 54.0x. While we've no doubt one can find things to like about Marcus & Millichap, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $20 per share right before these results (compared to the current share price of $39.96), implying they didn't see much short-term potential in Marcus & Millichap.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.