Tobacco company Altria (NYSE:MO) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 18.6% year on year to $6.26 billion. Its non-GAAP profit of $1.38 per share was also 2.2% above analysts’ consensus estimates.

Is now the time to buy Altria? Find out by accessing our full research report, it’s free.

Altria (MO) Q3 CY2024 Highlights:

- Revenue: $6.26 billion vs analyst estimates of $5.33 billion (17.5% beat)

- Adjusted EPS: $1.38 vs analyst estimates of $1.35 (2.2% beat)

- Management reiterated its full-year Adjusted EPS guidance of $5.11 at the midpoint

- Gross Margin (GAAP): 75.5%, up from 69.8% in the same quarter last year

- Operating Margin: 50.4%, down from 58.5% in the same quarter last year

- Market Capitalization: $86.16 billion

“Altria delivered outstanding results in the third quarter,” said Billy Gifford, Altria’s Chief Executive Officer.

Company Overview

Best known for its Marlboro brand of cigarettes, Altria (NYSE:MO) offers tobacco and nicotine products.

Beverages, Alcohol and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Altria is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because it's harder to find incremental growth when you've already penetrated the market.

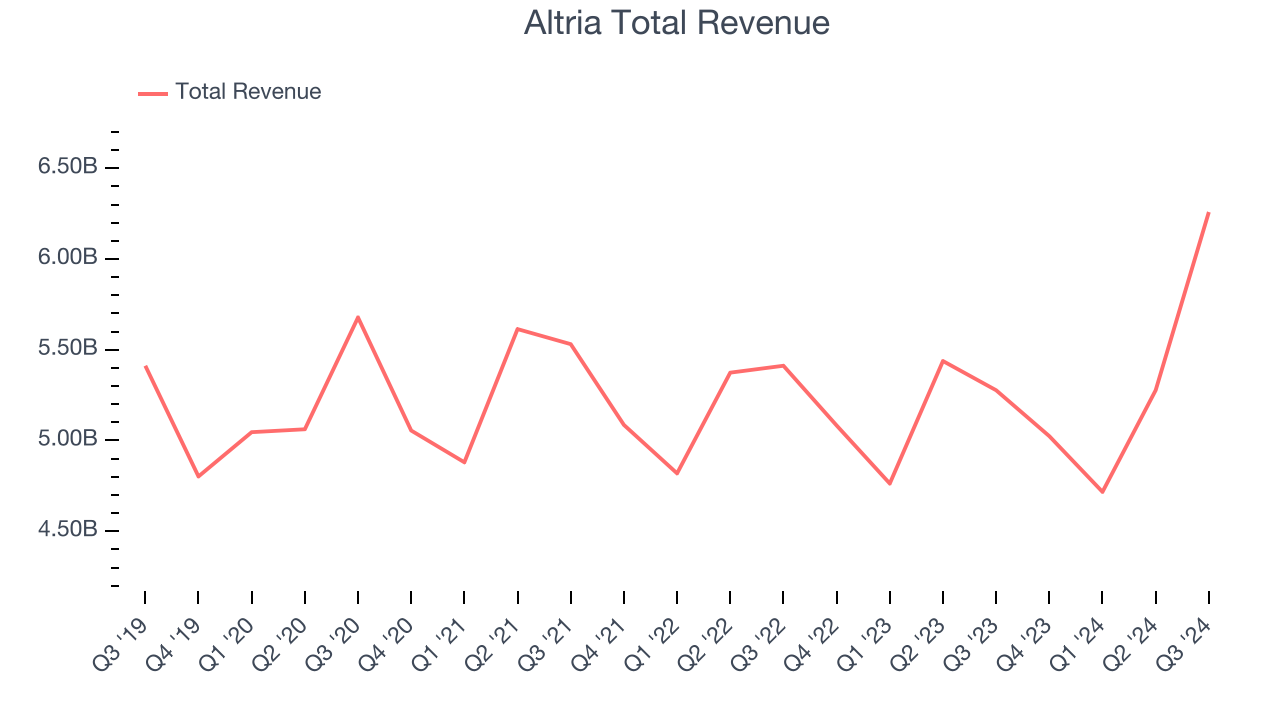

As you can see below, Altria’s sales were flat over the last three years, showing demand was soft. This is a tough starting point for our analysis.

This quarter, Altria reported year-on-year revenue growth of 18.6%, and its $6.26 billion of revenue exceeded Wall Street’s estimates by 17.5%.

Looking ahead, sell-side analysts expect revenue to decline 4.3% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and shows the market believes its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

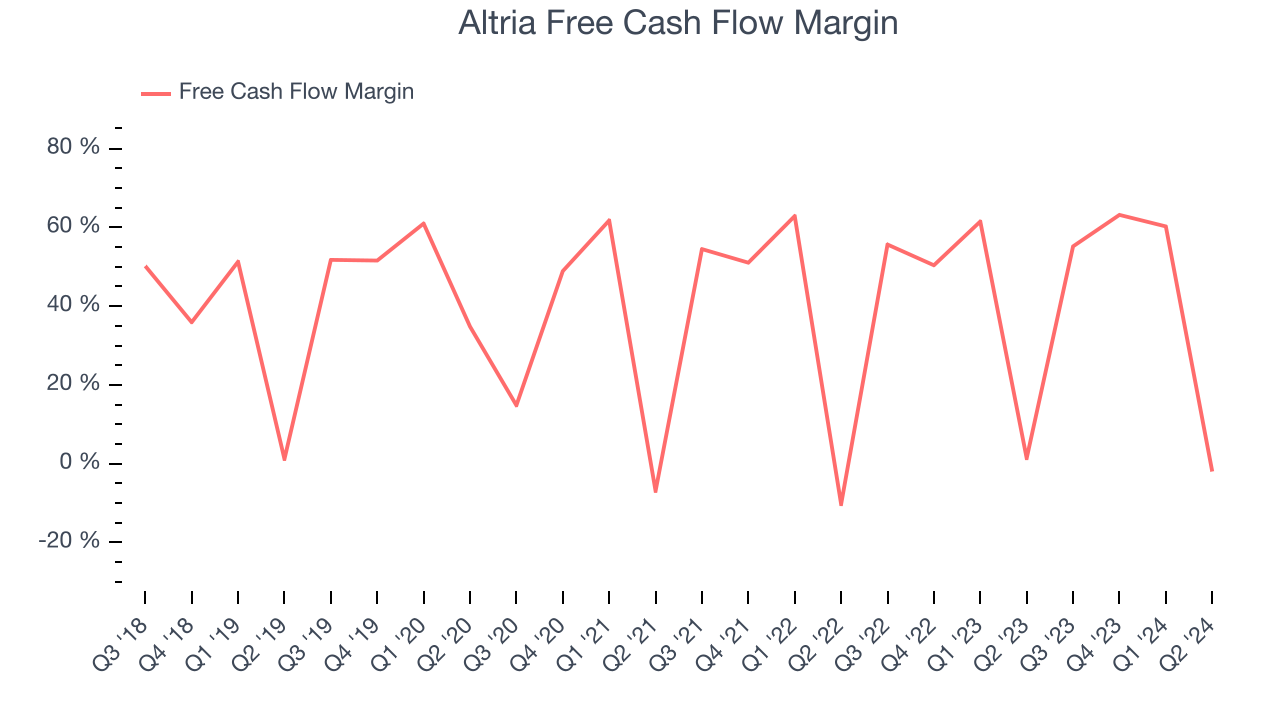

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Altria has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging an eye-popping 40.4% over the last two years.

Key Takeaways from Altria’s Q3 Results

We were impressed by how significantly Altria blew past analysts’ revenue expectations this quarter. We were also excited its gross margin outperformed Wall Street’s estimates. That management reiterated full year EPS guidance shows that the company is on track. Overall, we think this was still a solid quarter with some key areas of upside. The stock remained flat at $50.79 immediately following the results.

Altria may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.