Golf entertainment and gear company Topgolf Callaway (NYSE:MODG) fell short of analysts' expectations in Q1 CY2024, with revenue down 2% year on year to $1.14 billion. Next quarter's revenue guidance of $1.19 billion also underwhelmed, coming in 5.1% below analysts' estimates. It made a non-GAAP profit of $0.09 per share, down from its profit of $0.16 per share in the same quarter last year.

Topgolf Callaway (MODG) Q1 CY2024 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.16 billion (1.1% miss)

- EPS (non-GAAP): $0.09 vs analyst estimates of $0.01 ($0.08 beat)

- Revenue Guidance for Q2 CY2024 is $1.19 billion at the midpoint, below analyst estimates of $1.25 billion

- The company dropped its revenue guidance for the full year from $4.54 billion to $4.46 billion at the midpoint, a 1.8% decrease

- Gross Margin (GAAP): 63.9%, up from 32.2% in the same quarter last year

- Free Cash Flow was -$138.7 million, down from $43.7 million in the previous quarter

- Market Capitalization: $3.06 billion

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE:MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Callaway, known for its golf equipment, merged with Topgolf in 2021 to broaden its reach within the golf industry. The merger allowed Callaway to tap into the casual player market as Topgolf seeks to lower golf's steep learning curve and intimidating atmosphere.

Topgolf attempts to enhance traditional golf experiences by infusing technology and entertainment. Its venues' main attraction is the driving range, which features swing-tracking technology and mini-games suited for players of all levels. There are also spaces for dining and socializing where customers can purchase food and beverages.

By integrating Callaway's product line and Topgolf Callaway's apparel segment, which includes brands such as TravisMatthew, Topgolf has expanded its revenue streams to include sales of golf gear and equipment, complementing its income from gameplay reservations, event hosting, and dining services. The company also sells its swing-tracking technology, Top Tracer, to third-party driving ranges. This strategy positions Topgolf Callaway to provide a comprehensive golf experience.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Competitors of Topgolf Callaway (NYSE:MODG) include TaylorMade Golf, Acushnet (NASDAQ:GOLF), and Johnson Outdoors (NASDAQ:JOUT).Sales Growth

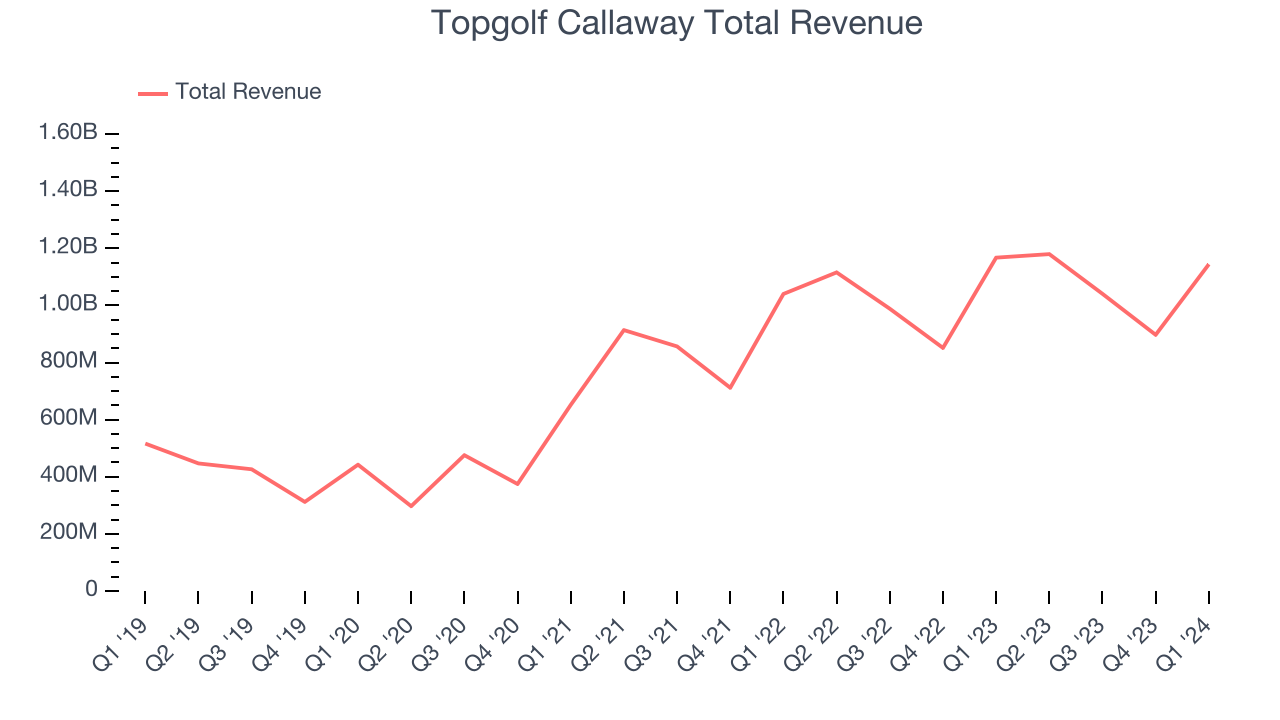

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Topgolf Callaway's annualized revenue growth rate of 25.7% over the last five years was excellent for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow more recent performance. Topgolf Callaway's recent history shows its demand slowed significantly as its annualized revenue growth of 10% over the last two years is well below its five-year trend. Note that COVID hurt Topgolf Callaway's business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Topgolf Callaway also breaks out the revenue for its three most important segments: Topgolf, Golf Equipment, and Active Lifestyle, which are 37%, 39.3%, and 23.7% of revenue. Over the last two years, Topgolf Callaway's revenues in all three segments increased. Its Topgolf revenue (venue reservations, dining) averaged year-on-year growth of 16.5% while its Golf Equipment (Callaway) and Active Lifestyle (apparel) revenues averaged 4.1% and 12.3%.

This quarter, Topgolf Callaway missed Wall Street's estimates and reported a rather uninspiring 2% year-on-year revenue decline, generating $1.14 billion of revenue. For next quarter, the company is guiding for flat year on year revenue of $1.19 billion, slowing from the 5.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 8.1% over the next 12 months, an acceleration from this quarter.

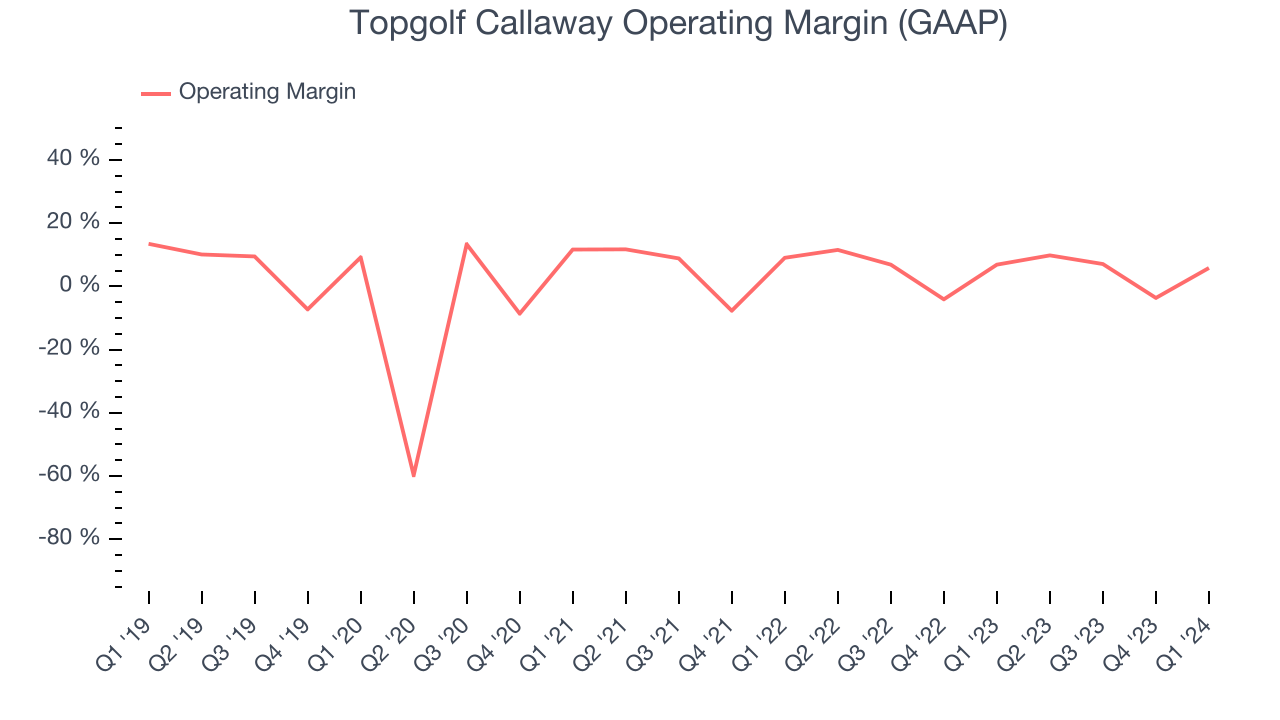

Operating Margin

Topgolf Callaway was profitable over the last eight quarters but held back by its large expense base. It's demonstrated weak profitability for a consumer discretionary business, producing an average operating margin of 5.6%.

This quarter, Topgolf Callaway generated an operating profit margin of 5.8%, down 1 percentage points year on year. Looking ahead, Wall Street expects Topgolf Callaway to become more profitable. Analysts are expecting the company’s trailing 12 month operating margin of 5.3% to rise to 7% in the coming year.

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Sadly for Topgolf Callaway, its EPS declined by 19.2% annually over the last five years while its revenue grew by 25.7%. All else equal, this tells us its incremental sales were unprofitable.

We can delve even further into Topgolf Callaway's earnings performance. Topgolf Callaway's operating margin has declined 7.6 percentage points over the last five years, leading to lower profitability and earnings. Taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

In Q1, Topgolf Callaway reported EPS at $0.09, down from $0.16 in the same quarter last year. Despite falling year on year, this print easily cleared analysts' estimates. Over the next 12 months, Wall Street expects Topgolf Callaway to perform poorly. Analysts are projecting its EPS of $0.36 in the last year to hit $0.34.

Cash Is King

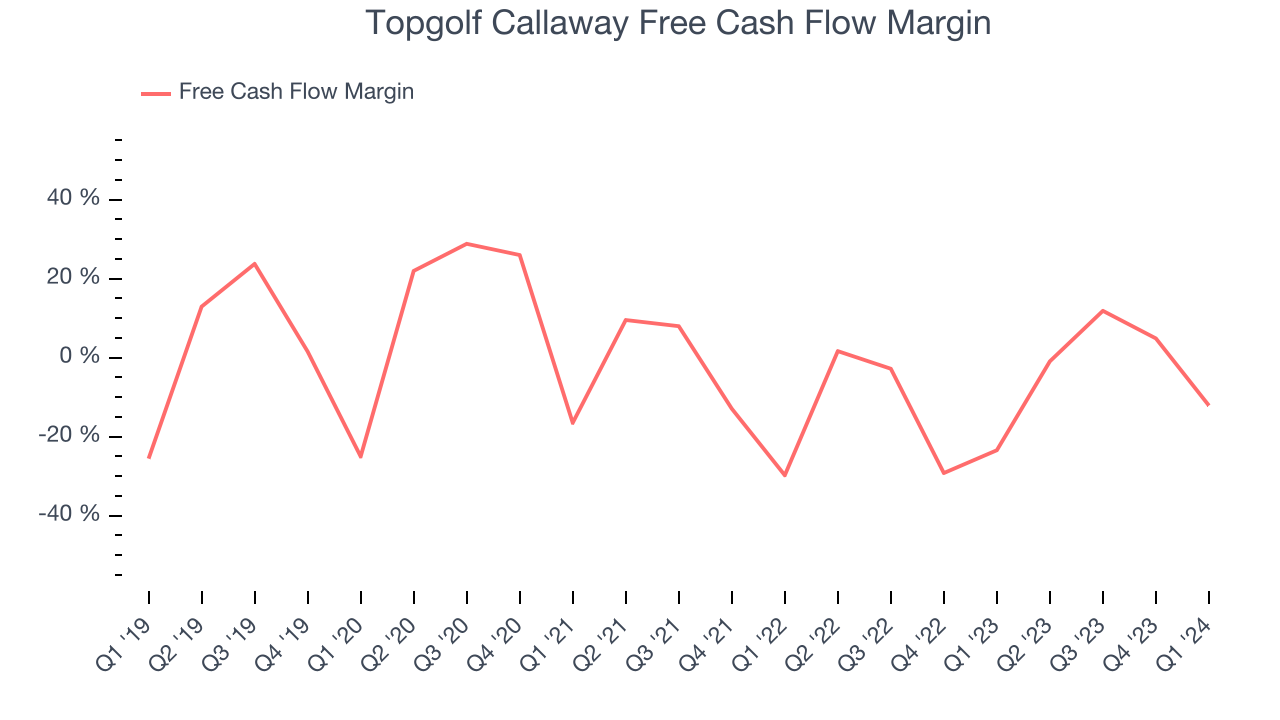

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Topgolf Callaway's demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 6.1%.

Topgolf Callaway burned through $138.7 million of cash in Q1, equivalent to a negative 12.1% margin. The company's cash burn increased by 49.3% year on year. We also like to analyze expected free cash flow for the next year based on Wall Street's consensus estimates, but there is insufficient data.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money it has raised (debt and equity).

Topgolf Callaway's five-year average ROIC was 3.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+. Its returns suggest it was mediocre at investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Topgolf Callaway's ROIC averaged 4.2 percentage point increases. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Topgolf Callaway reported $233.9 million of cash and $3.04 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $571.6 million of EBITDA over the last 12 months, we view Topgolf Callaway's 4.9x net-debt-to-EBITDA ratio as safe. We also see its $219.4 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Topgolf Callaway's Q1 Results

We were impressed by how significantly Topgolf Callaway blew past analysts' EPS and operating margin expectations this quarter. On the other hand, its full-year revenue guidance fell short of Wall Street's estimates. Overall, the results could have been better. The company is down 5.4% on the results and currently trades at $15.46 per share.

Is Now The Time?

Topgolf Callaway may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for companies serving consumers, but in the case of Topgolf Callaway, we'll be cheering from the sidelines. Although its revenue growth has been impressive over the last five years, its declining EPS over the last five years makes it hard to trust over the long term. On top of that, its projected EPS for the next year is lacking.

Topgolf Callaway's price-to-earnings ratio based on the next 12 months is 48x. While one can find things to like about Topgolf Callaway, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $20.02 per share right before these results (compared to the current share price of $15.40). Despite the bullish target, readers should remember that Wall Street analysts tend to be overly optimistic. The firms they work for, many of which are big banks, have relationships with companies that extend into fundraising, M&A advisory, and other lucrative business lines. In other words, Wall Street is typically hesitant to say bad things about a company out of fear they will lose out on business in other areas. We at StockStory do not suffer from such conflicts of interest.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.

Is Now The Time?

Topgolf Callaway may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Topgolf Callaway, we'll be cheering from the sidelines. Although its revenue growth has been impressive over the last five years, its declining EPS over the last five years makes it hard to trust over the long term. On top of that, its projected EPS for the next year is lacking.

Topgolf Callaway's price-to-earnings ratio based on the next 12 months is 48.0x. While we've no doubt one can find things to like about Topgolf Callaway, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $20.02 per share right before these results (compared to the current share price of $15.40).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.