Luxury watch company Movado (NYSE:MOV) reported Q4 CY2023 results beating Wall Street analysts' expectations, with revenue down 7.5% year on year to $179.6 million. The company's full-year revenue guidance of $705 million at the midpoint also came in 2.2% above analysts' estimates. It made a GAAP profit of $0.53 per share, down from its profit of $1.00 per share in the same quarter last year.

Movado (MOV) Q4 CY2023 Highlights:

- Revenue: $179.6 million vs analyst estimates of $174.8 million (2.8% beat)

- EPS: $0.53 vs analyst estimates of $0.39 (35.9% beat)

- Management's revenue guidance for the upcoming financial year 2025 is $705 million at the midpoint, beating analyst estimates by 2.2% and implying 4.8% growth (vs -10.6% in FY2024)

- However, Management's EPS guidance for the upcoming financial year 2025 is $1.25 missed analyst estimates of $2.06 due to lower anticipated profitability

- Gross Margin (GAAP): 53.9%, down from 56.2% in the same quarter last year

- Free Cash Flow of $67.81 million is up from -$3.87 million in the previous quarter

- Market Capitalization: $585.6 million

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado’s signature Museum Watch is characterized by a singular dot at 12 o'clock, symbolizing the sun at high noon. This iconic design has gained mainstream popularity and is displayed in the Museum of Modern Art’s permanent collection in New York.

Movado’s portfolio extends beyond its flagship brand with labels including Ebel, Concord, Olivia Burton, and MVMT. This multi-brand strategy allows Movado to offer a broad spectrum of watch designs, from classic and luxury timepieces to contemporary and fashion-forward styles. This product breadth captures a wide customer base, from watch enthusiasts to casual wearers. Additionally, the company designs and distributes jewelry, eyewear, and other accessories, broadening its category offerings.

Movado's growth is dependent on the development of new watch designs and its approach to sales and marketing. The brand leverages digital platforms and e-commerce to adapt to changing consumer purchasing behaviors and the evolving retail landscape.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Movado’s primary competitors include Omega (owned by Swatch SWX:UHR), Fossil Group (NASDAQ:FOSL), Citizen Watch (TYO:7762), TAG Heuer (owned by LVMH Moët Hennessy Louis Vuitton Euronext:MC), and private company Rolex.Sales Growth

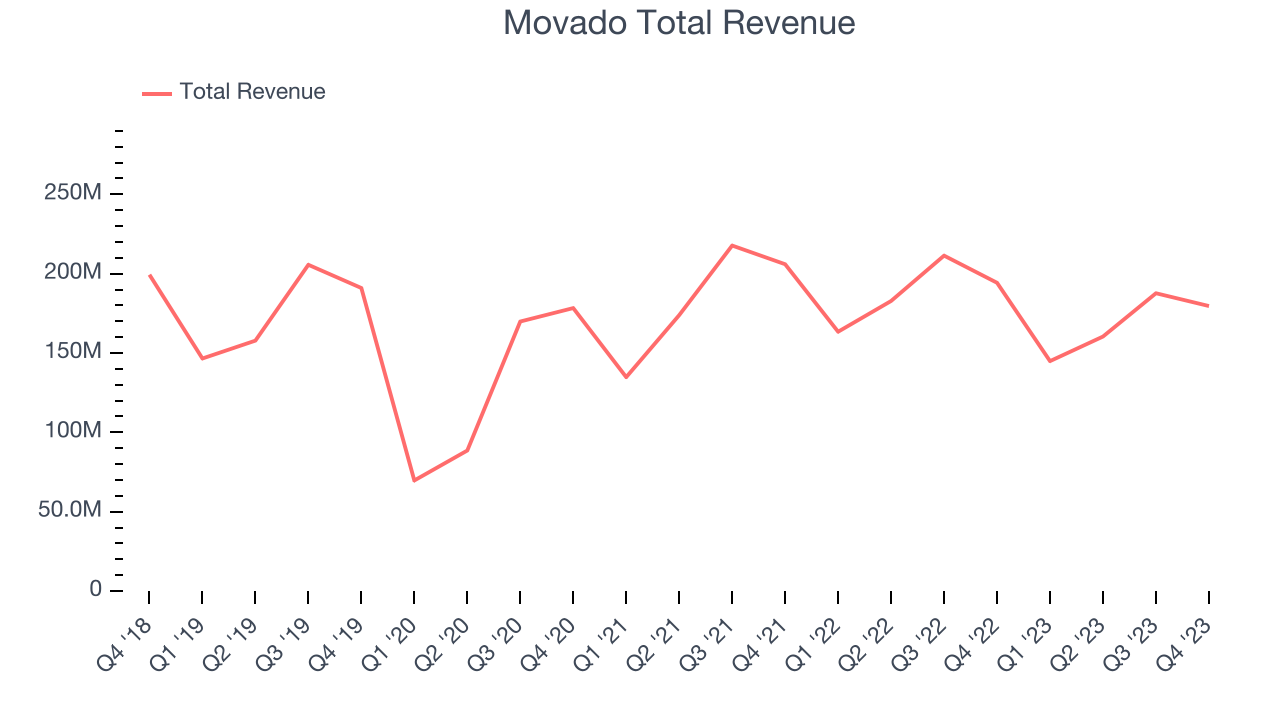

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Movado's revenue declined over the last five years, dropping 2.1% annually.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Movado's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 4.2% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Movado's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 4.2% over the last two years.

This quarter, Movado's revenue fell 7.5% year on year to $179.6 million but beat Wall Street's estimates by 2.8%. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

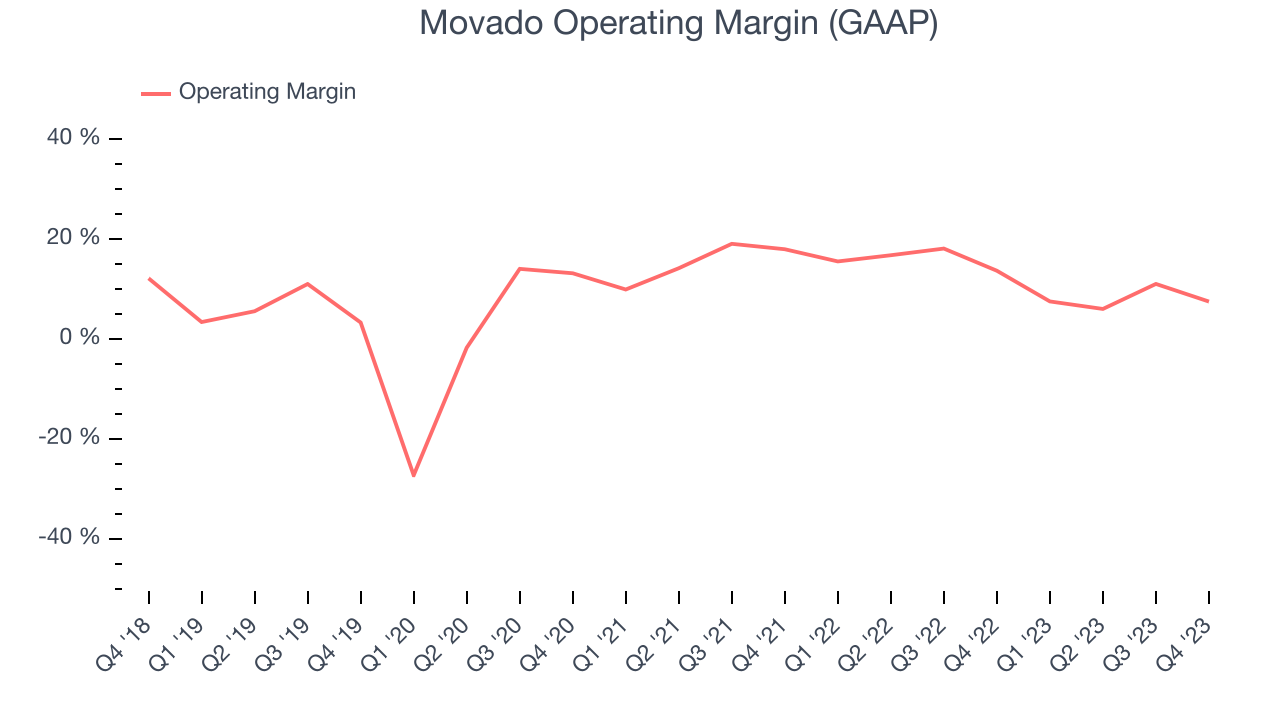

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Movado has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 12.3%, higher than the broader consumer discretionary sector.

This quarter, Movado generated an operating profit margin of 7.5%, down 6.2 percentage points year on year.

Over the next 12 months, Wall Street expects Movado to become more profitable. Analysts are expecting the company’s LTM operating margin of 8.1% to rise to 9.2%.EPS

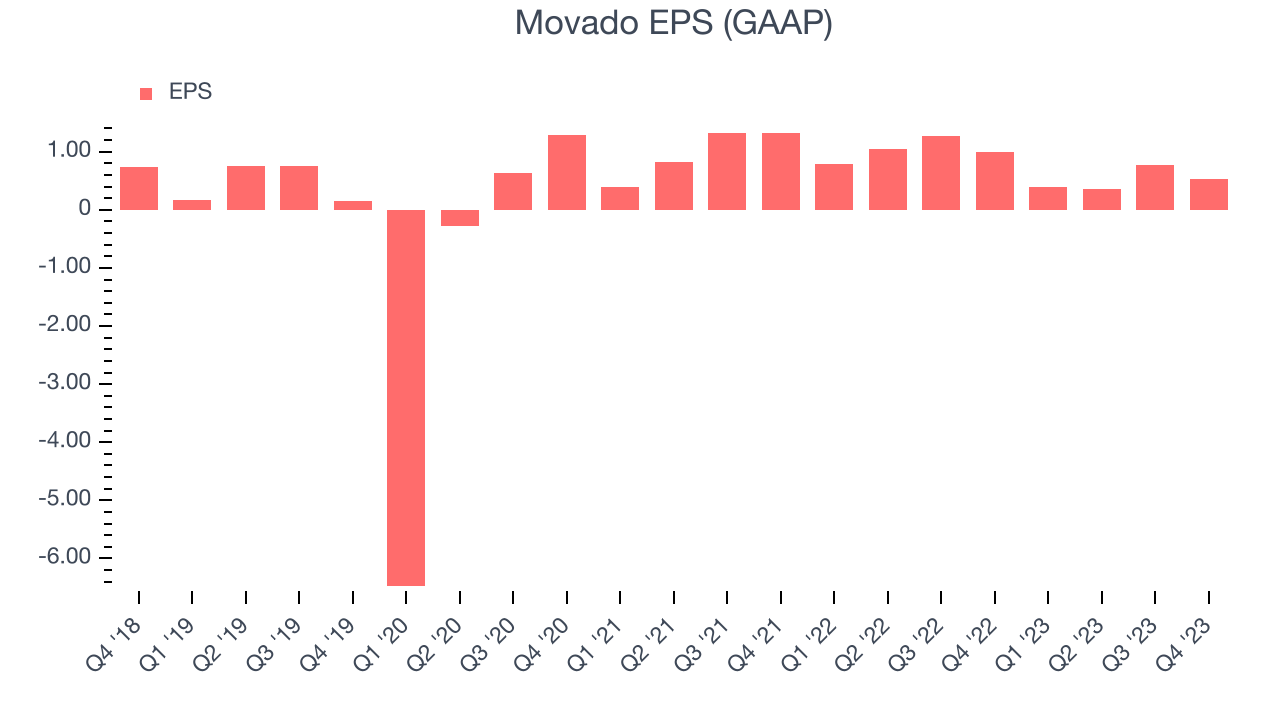

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Movado's EPS dropped 41%, translating into 7.1% annualized declines. Thankfully, Movado has bucked its trend as of late, growing its EPS over the last three years. We'll see if the company's growth is sustainable.

In Q4, Movado reported EPS at $0.53, down from $1.00 in the same quarter a year ago. This print beat analysts' estimates by 35.9%. Over the next 12 months, Wall Street expects Movado's LTM EPS of $2.06 to stay about the same.

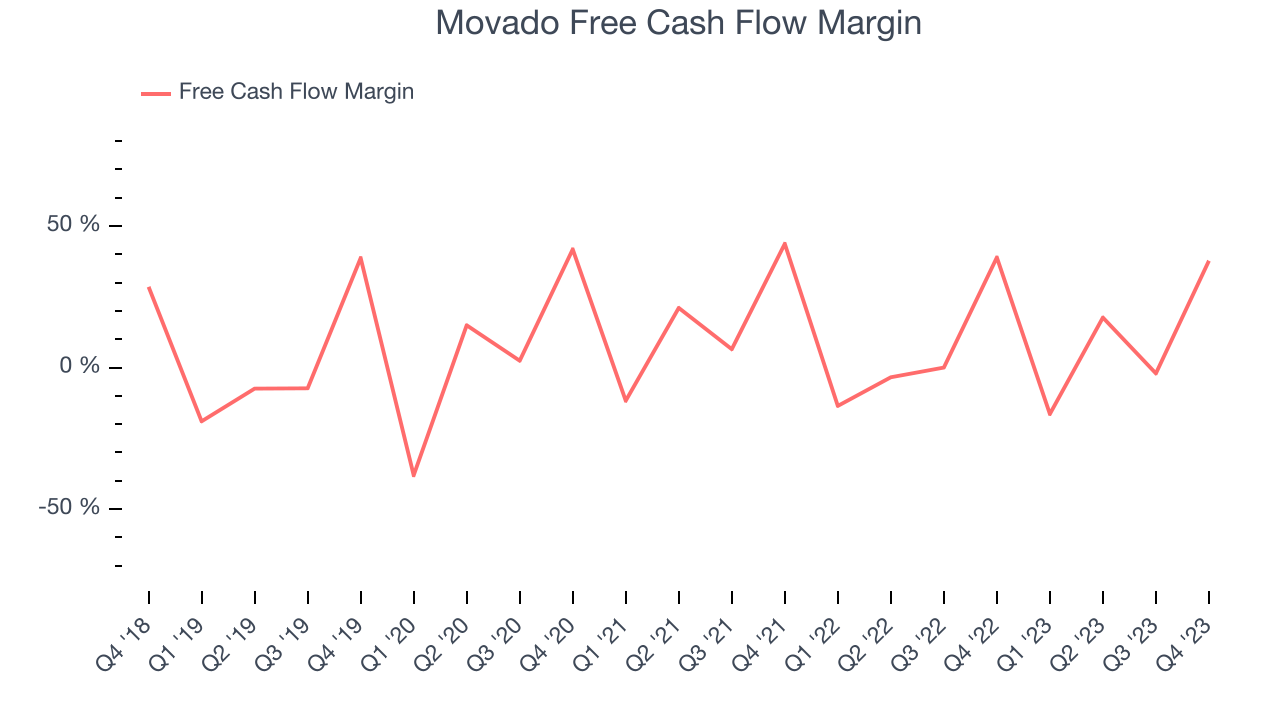

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Movado has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.1%, subpar for a consumer discretionary business.

Movado's free cash flow came in at $67.81 million in Q4, equivalent to a 37.8% margin and down 10.3% year on year. Over the next year, analysts predict Movado's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 10.2% will decrease to 9%.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Movado hasn't been the highest-quality company lately because of its poor top-line performance, it historically did an excellent job investing in profitable business initiatives. Its five-year average return on invested capital was 22.4%, impressive for a consumer discretionary company.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last five years, Movado's ROIC has averaged meaningful increases. This is a good sign and we hope the company can continue improving.

Key Takeaways from Movado's Q4 Results

We liked that both revenue and EPS beat this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. On the other hand, its full-year earnings forecast missed by a wide margin due to lower-than-expected profitability. Overall, this quarter's results were mixed. The stock is flat after reporting and currently trades at $26.52 per share.

Is Now The Time?

Movado may have had a favorable mixed quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Movado, we'll be cheering from the sidelines. Its revenue has declined over the last five years, but at least growth is expected to increase in the short term. And while its market-beating ROIC suggests it has been a well-managed company historically, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its projected EPS for the next year is lacking.

While the price is reasonable and there are some things to like about Movado, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $41 per share right before these results (compared to the current share price of $26.52).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.