Fluid and gas handling company MRC (NYSE:MRC) reported results in line with analysts' expectations in Q2 CY2024, with revenue down 4.5% year on year to $832 million. It made a non-GAAP profit of $0.31 per share, improving from its profit of $0.26 per share in the same quarter last year.

Is now the time to buy MRC Global? Find out by accessing our full research report, it's free.

MRC Global (MRC) Q2 CY2024 Highlights:

- Revenue: $832 million vs analyst estimates of $831.3 million (small beat)

- EPS (non-GAAP): $0.31 vs analyst estimates of $0.25 (22.8% beat)

- Gross Margin (GAAP): 20.8%, up from 20.1% in the same quarter last year

- Adjusted EBITDA Margin: 7.8%, in line with the same quarter last year

- Free Cash Flow of $56.5 million, up 85.2% from the previous quarter

- Market Capitalization: $1.11 billion

Rob Saltiel, MRC Global’s President and CEO stated, “We achieved sequential growth in revenue, adjusted EBITDA and cash flow from operations in the second quarter, despite slowing activity in the US oilfield and project delays in our DIET sector. We have generated $101 million in operating cash flow through the first half of 2024, and we are tracking well to meet or exceed our annual operating cash flow target of $200 million.

Producing bomb casings and tracks for vehicles during WWII, MRC (NYSE:MRC) offers pipes, valves, and fitting products for various industries.

Infrastructure Distributors

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

Sales Growth

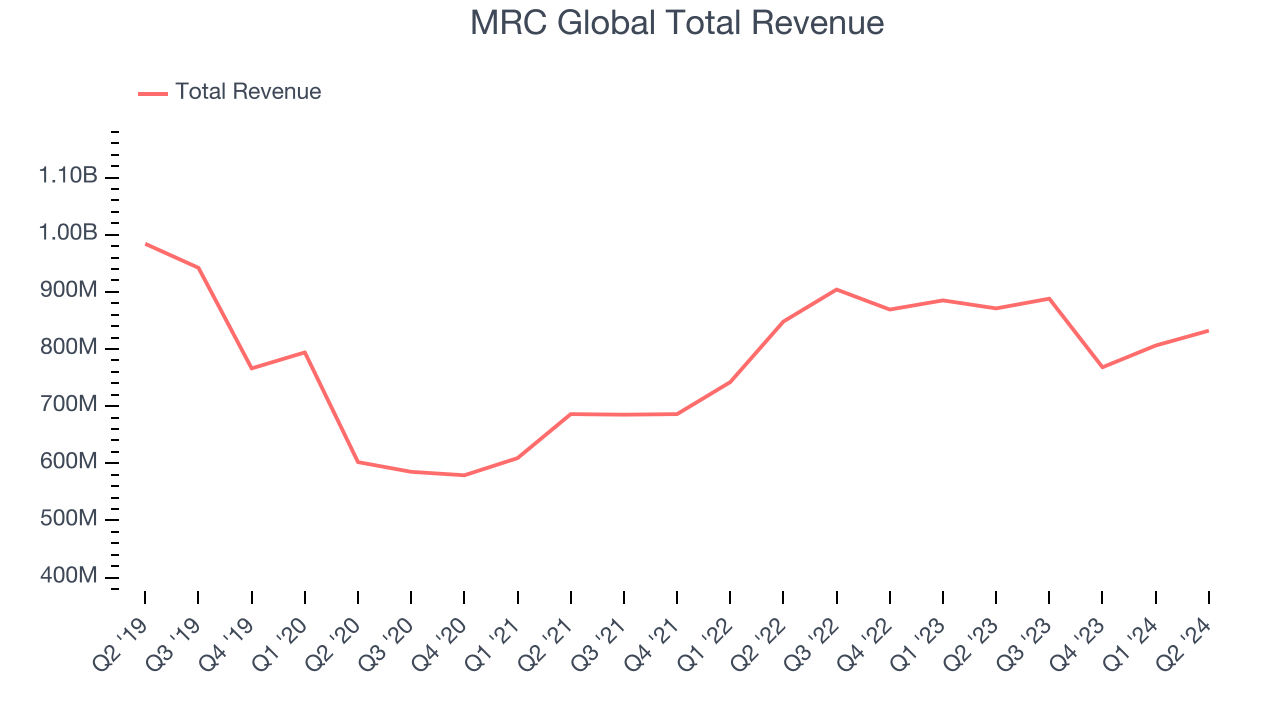

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. MRC Global's demand was weak over the last five years as its sales fell by 4% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. MRC Global's annualized revenue growth of 5.5% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can dig further into the company's revenue dynamics by analyzing its most important segments, Valves and Fittings, which are 36.3% and 28.2% of revenue. Over the last two years, MRC Global's Valves revenue (fluid control) averaged 9.4% year-on-year growth while its Fittings revenue (pipe connectors) averaged 9.3% growth.

This quarter, MRC Global reported a rather uninspiring 4.5% year-on-year revenue decline to $832 million of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 5.4% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

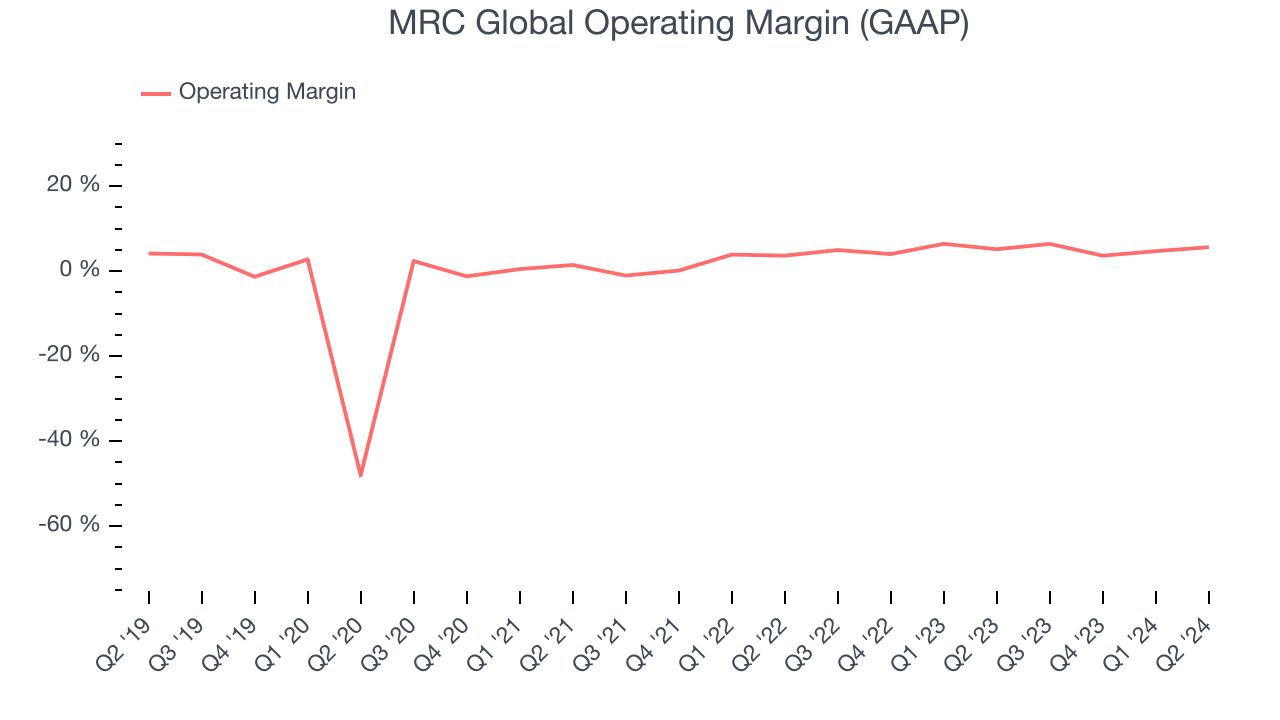

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

MRC Global was profitable over the last five years but held back by its large expense base. It demonstrated inadequate profitability for an industrials business, producing an average operating margin of 1.2%. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, MRC Global's annual operating margin rose by 12.9 percentage points over the last five years

In Q2, MRC Global generated an operating profit margin of 5.6%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

EPS

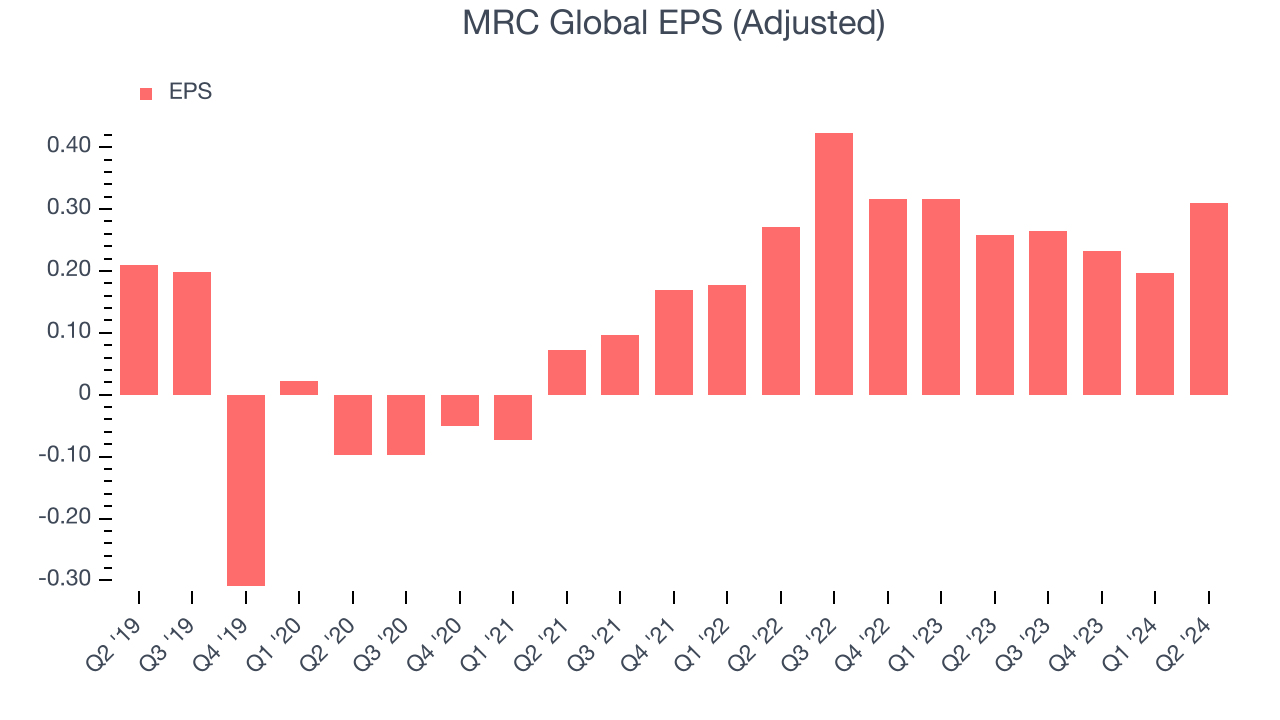

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

MRC Global's EPS grew at an unimpressive 5.5% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 4% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

We can take a deeper look into MRC Global's earnings to better understand the drivers of its performance. As we mentioned earlier, MRC Global's operating margin was flat this quarter but expanded by 12.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For MRC Global, its two-year annual EPS growth of 18.5% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q2, MRC Global reported EPS at $0.31, up from $0.26 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects MRC Global to grow its earnings. Analysts are projecting its EPS of $1.00 in the last year to climb by 29.1% to $1.30.

Key Takeaways from MRC Global's Q2 Results

We were impressed by how significantly MRC Global blew past analysts' EPS expectations this quarter. Overall, this quarter seemed fairly positive and shareholders should feel optimistic. The stock remained flat at $13.18 immediately after reporting.

MRC Global may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.